18+ 3 types of sanctions money laundering info

Home » about money loundering Info » 18+ 3 types of sanctions money laundering infoYour 3 types of sanctions money laundering images are ready in this website. 3 types of sanctions money laundering are a topic that is being searched for and liked by netizens today. You can Get the 3 types of sanctions money laundering files here. Download all free photos and vectors.

If you’re looking for 3 types of sanctions money laundering images information connected with to the 3 types of sanctions money laundering topic, you have come to the ideal site. Our site always provides you with hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

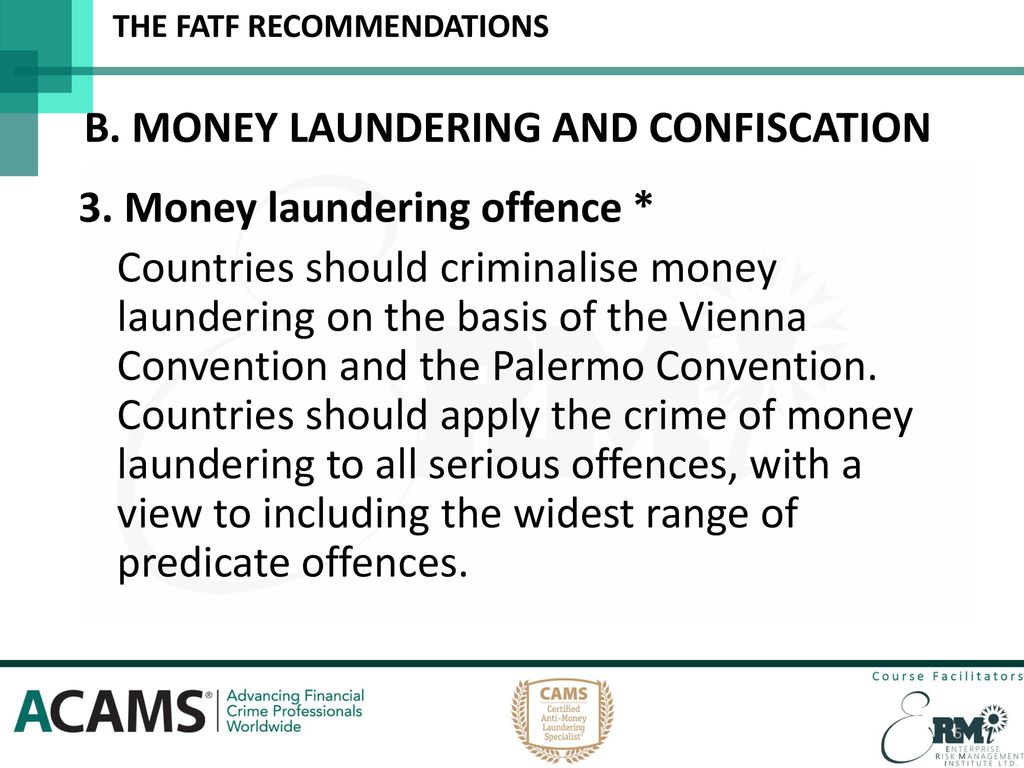

3 Types Of Sanctions Money Laundering. B impose immigration sanctions see section 3. C impose trade sanctions see section 4 and Schedule 1. The Sanctions and Anti-Money Laundering Act received Royal Assent on 23 May 2018. Types of sanctions Sanctions imposed by Canada on specific countries organizations or individuals vary and can encompass a variety of measures including restricting or prohibiting trade financial transactions or other economic activity between Canada and the target state.

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn From ppt-online.org

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn From ppt-online.org

Financial sanctions laws can affect reinsurers including coverholders either by directly prohibiting the provision of insurance or reinsurance to designated entities or individuals or in. CIBC is committed to protect the safety soundness and reputation of CIBC by reducing the likelihood that CIBC will be used as a vehicle for or become a victim of Money Laundering or Terrorist Financing MLTF activities. ANTI-MONEY LAUNDERING ECONOMIC SANCTIONS RECENT DEVELOPMENTS. And ii Trade Sanctions. This table is for guidance purposes only. F impose sanctions within section 7 other sanctions for purposes of UN obligations.

Sanctions can take a number of forms but the most relevant types of sanctions are i Financial Sanctions.

Anti-Money Laundering and Sanctions Rules and Guidance AML AML VER04030220. Anti-Money Laundering and Sanctions Enforcement and Compliance in 2020 and Beyond December 10 2020. There existed growing concerns that without a new domestic sanctions framework the UK will not have the powers to impose amend or lift sanctions independently from the UN or EU after Brexit. 3 in force at 22112018 by SI. Sanctions can take a number of forms but the most relevant types of sanctions are i Financial Sanctions. 2a 4 Immigration sanctions.

Source: pinterest.com

Source: pinterest.com

Financial sanctions clause 2 can among other things freeze funds and economic resources and prevent the provision of financial services. IMPLICATIONS FOR THE US. Sanctions are used for a number of purposes including pressurising a particular country or regime to change their behaviour or to prevent terrorist financing. F impose sanctions within section 7 other sanctions for purposes of UN obligations. Sanctions can take a number of forms but the most relevant types of sanctions are i Financial Sanctions.

Source: ppt-online.org

Source: ppt-online.org

AML Rulebook to each of the different types of Relevant Persons specified in Rule 1211. Korea implemented Global Magnitsky Act sanctions targeting human rights abuses and corruption worldwide and established new sanctions programs targeting the Nicaraguan regime and non-US. Enforcement of the Bank Secrecy Actanti-money laundering BSAAML lawsor their state. CIBCs AMLATF and Sanctions Regime. There are currently no known outstanding effects for the Sanctions and Anti-Money Laundering Act 2018 Cross Heading.

Source: ec.europa.eu

Source: ec.europa.eu

A number of different types of sanctions regulations can be made under clause 1. C impose trade sanctions see section 4 and Schedule 1. And ii Trade Sanctions. E impose shipping sanctions see section 6. 2a 4 Immigration sanctions.

Source: acamstoday.org

Source: acamstoday.org

B impose immigration sanctions see section 3. Enforcement of the Bank Secrecy Actanti-money laundering BSAAML lawsor their state. The UK may impose the following types of sanctions measures. 3 Risk-appropriate controls sufficient customer due diligence and suspicious activity identification and monitoring. Weak oversight and dormant systems leave countries doors open to money laundering.

Source: amlcompliance.ie

Source: amlcompliance.ie

Although the UK will incorporate the existing EU sanctions and AML regime via the European Union Withdrawal Bill the regime will be frozen at the date of withdrawal. IMPLICATIONS FOR THE US. There are many different types of sanctions including travel bans asset freezes trade embargoes and other restrictions. INSURANCE INDUSTRY August 11 2006. Anti-Money Laundering and Sanctions Rules and Guidance AML AML VER04030220.

Source: mdpi.com

Source: mdpi.com

IMPLICATIONS FOR THE US. There are many different types of sanctions including travel bans asset freezes trade embargoes and other restrictions. CIBC is committed to protect the safety soundness and reputation of CIBC by reducing the likelihood that CIBC will be used as a vehicle for or become a victim of Money Laundering or Terrorist Financing MLTF activities. 2a 4 Immigration sanctions. Basel AML Index 2020.

Source:

There existed growing concerns that without a new domestic sanctions framework the UK will not have the powers to impose amend or lift sanctions independently from the UN or EU after Brexit. An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or for the purposes of national security or international peace and security or for the purposes of furthering foreign policy objectives. SANCTIONS AND ANTI-MONEy LAUNDERING BILL HL 3 8. There are many different types of sanctions including travel bans asset freezes trade embargoes and other restrictions. Weak oversight and dormant systems leave countries doors open to money laundering.

Source: shuftipro.com

Source: shuftipro.com

Although the sanctions-related provisions of the Act are not yet in force they will give the government wider powers to implement sanctions - including financial sanctions trade. CIBC is committed to protect the safety soundness and reputation of CIBC by reducing the likelihood that CIBC will be used as a vehicle for or become a victim of Money Laundering or Terrorist Financing MLTF activities. IMPLICATIONS FOR THE US. They are enumerated in clauses 27. There are many different types of sanctions including travel bans asset freezes trade embargoes and other restrictions.

Source: slideplayer.com

Source: slideplayer.com

Sanctions can take a number of forms but the most relevant types of sanctions are i Financial Sanctions. There existed growing concerns that without a new domestic sanctions framework the UK will not have the powers to impose amend or lift sanctions independently from the UN or EU after Brexit. ANTI-MONEY LAUNDERING ECONOMIC SANCTIONS RECENT DEVELOPMENTS. Sanctions are used for a number of purposes including pressurising a particular country or regime to change their behaviour or to prevent terrorist financing. Anti-Money Laundering and Sanctions Enforcement and Compliance in 2020 and Beyond December 10 2020.

Source: amlc.eu

Source: amlc.eu

O FinCEN clarified the types of actions it might take when an actual or potential. Sanctions are used for a number of purposes including pressurising a particular country or regime to change their behaviour or to prevent terrorist financing. A number of different types of sanctions regulations can be made under clause 1. B impose immigration sanctions see section 3. F impose sanctions within section 7 other sanctions for purposes of UN obligations.

Source: ppt-online.org

Source: ppt-online.org

There existed growing concerns that without a new domestic sanctions framework the UK will not have the powers to impose amend or lift sanctions independently from the UN or EU after Brexit. Furthermore CIBC is also committed to comply with applicable Economic Sanctions laws. CIBC is committed to protect the safety soundness and reputation of CIBC by reducing the likelihood that CIBC will be used as a vehicle for or become a victim of Money Laundering or Terrorist Financing MLTF activities. The average money laundering risk increased compared to last year as the Basel Institute of Management published the 2020 anti-money laundering index which assesses the risks of money laundering terrorist financing of 141 countries. Financial sanctions laws can affect reinsurers including coverholders either by directly prohibiting the provision of insurance or reinsurance to designated entities or individuals or in.

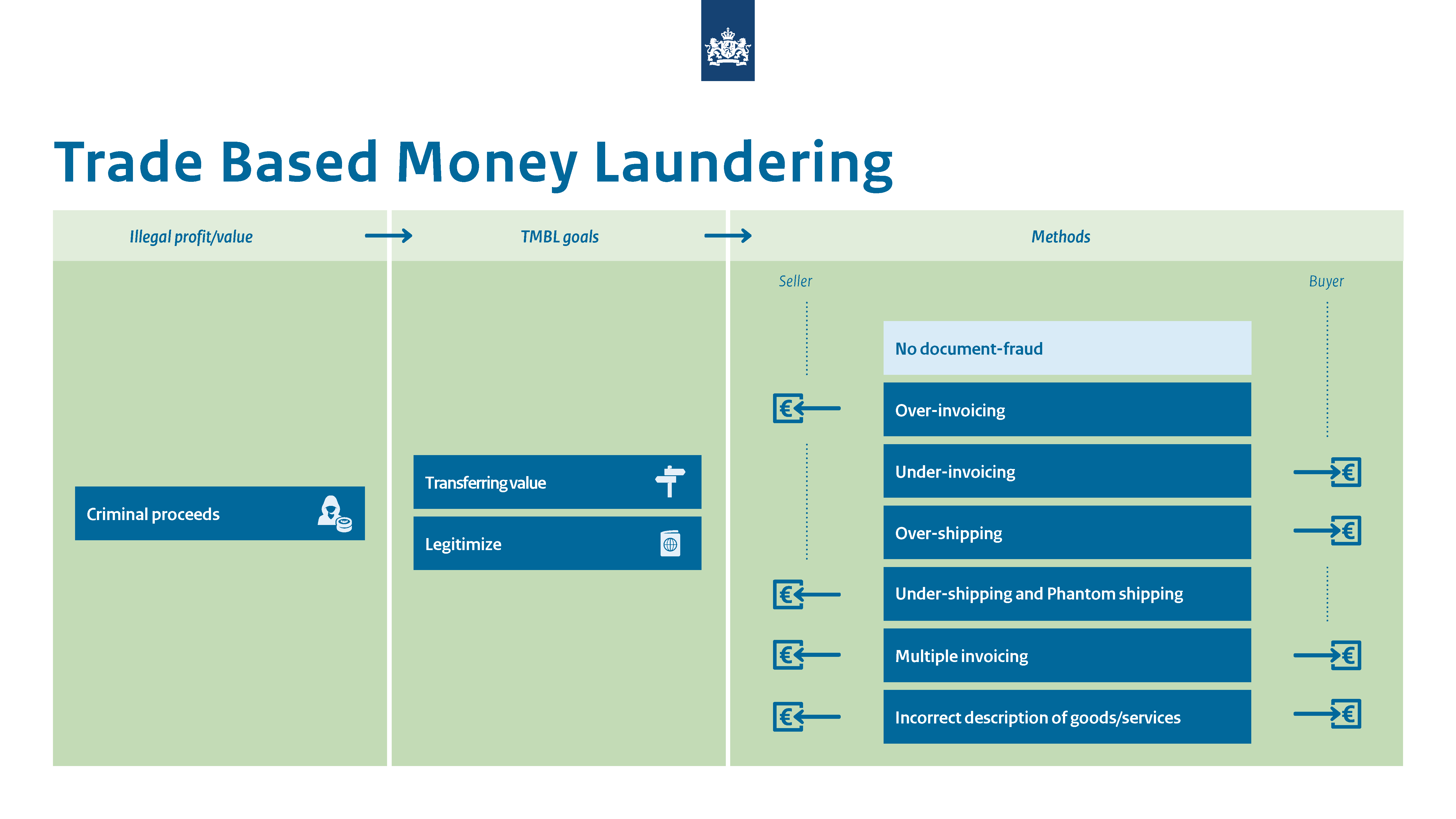

Source: businessforensics.nl

Source: businessforensics.nl

4 Aspects of bank BSAAML strategies that may lead to de-risking. E impose shipping sanctions see section 6. Furthermore CIBC is also committed to comply with applicable Economic Sanctions laws. The Sanctions and Anti-Money Laundering Act received Royal Assent on 23 May 2018. SANCTIONS AND ANTI-MONEy LAUNDERING BILL HL 3 8.

Source: ppt-online.org

Source: ppt-online.org

O FinCEN clarified the types of actions it might take when an actual or potential. 3 Risk-appropriate controls sufficient customer due diligence and suspicious activity identification and monitoring. F impose sanctions within section 7 other sanctions for purposes of UN obligations. The UK may impose the following types of sanctions measures. An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or for the purposes of national security or international peace and security or for the purposes of furthering foreign policy objectives.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 3 types of sanctions money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas