11+ 4 elements of anti money laundering info

Home » about money loundering Info » 11+ 4 elements of anti money laundering infoYour 4 elements of anti money laundering images are ready. 4 elements of anti money laundering are a topic that is being searched for and liked by netizens today. You can Download the 4 elements of anti money laundering files here. Get all free vectors.

If you’re searching for 4 elements of anti money laundering pictures information linked to the 4 elements of anti money laundering keyword, you have pay a visit to the ideal site. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

4 Elements Of Anti Money Laundering. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. The procedures must enable the bank to form a reasonable belief that it knows the true identity of each customer. Their current partial address is Dublin and the company status is Normal. Money laundering is a means of storing or transporting.

Layering Aml Anti Money Laundering From amlbot.com

Layering Aml Anti Money Laundering From amlbot.com

4 Elements of an Effective Anti-Money Laundering Program I. The CIP must include risk-based procedures for verifying the identity of each customer to the extent reasonable and practicable. International money laundering transactions 1956 a 2. Investigating and Prosecuting International Corruption and Money Laundering Cases Page 4 2. Under the 4th AMLD a key role is accorded to the principle of risk analysis and the corresponding adequate safeguards. Key elements with a potential impact on AML compliance.

The 4 Elements of Beauty Limited was set up on Monday the 8th of January 2018.

OTS - office of thrift supervision. The CIP must be a part of the anti-money laundering compliance program. 2 Identity verification procedures. Graphic illustration of investigative file inventory 33 4. In designing a solid KYCCDD programme there are key elements that need to be incorporated. Under the 4th AMLD a key role is accorded to the principle of risk analysis and the corresponding adequate safeguards.

Source: bankinghub.eu

Source: bankinghub.eu

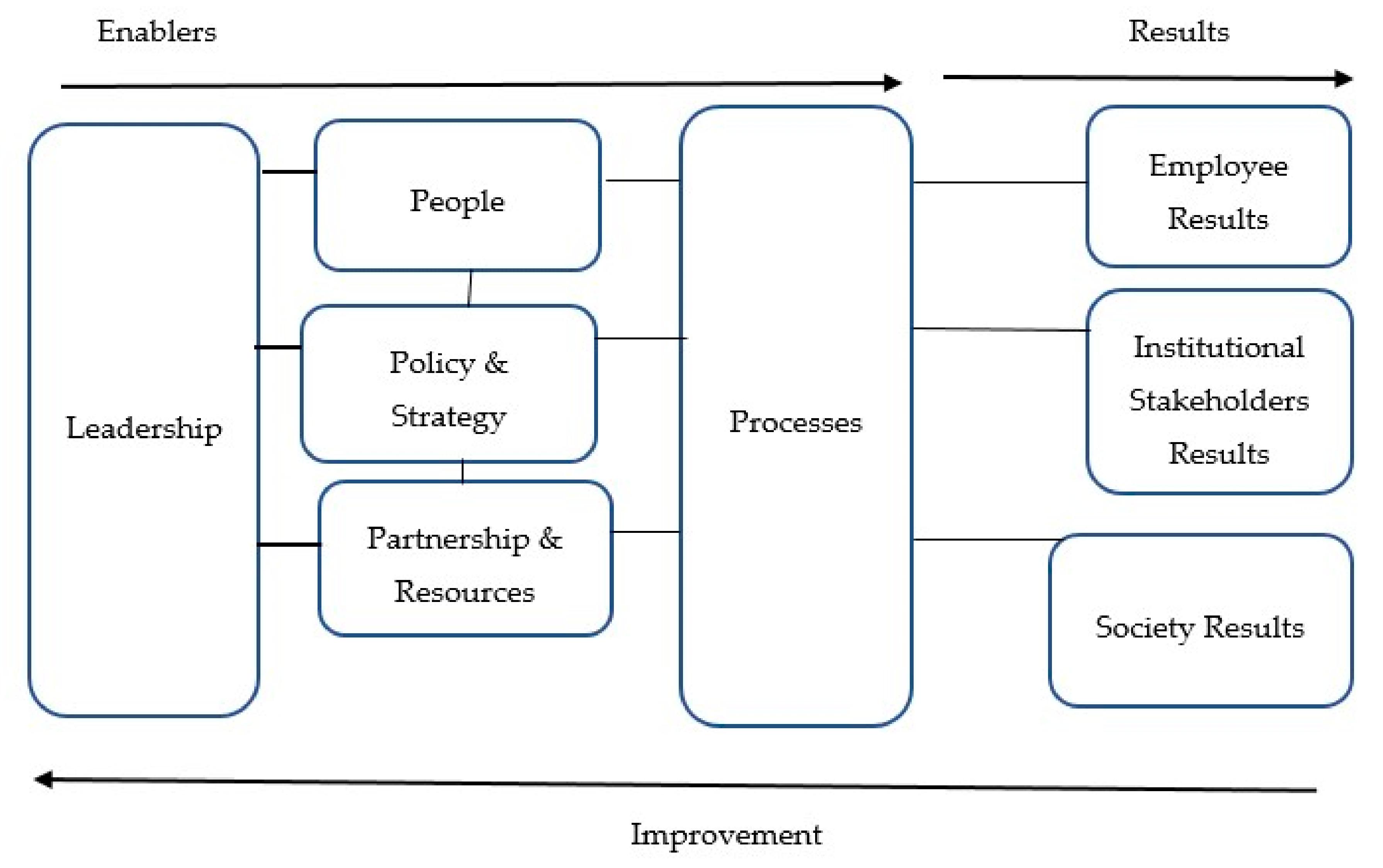

FDIC- federal deposit insurance corporation. Namely the key four elements as outlined in the relevant figure below for an effective KYC Programme are the following. 4 Elements of an Effective Anti-Money Laundering Program I. See this Manual at 2182. 2 Identity verification procedures.

Source: amlbot.com

Source: amlbot.com

ELECTRONIC EVIDENCE ORGANISATION 33 31 Investigative file inventory IFI 33 32. There are four pillars to an effective BSAAML program. Investigating and Prosecuting International Corruption and Money Laundering Cases Page 4 2. In designing a solid KYCCDD programme there are key elements that need to be incorporated. The CIP must be a part of the anti-money laundering compliance program.

Source: amlbot.com

Source: amlbot.com

The FATF Recommendations are recognised as the global anti-money. International money laundering transactions 1956 a 2. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. Four key elements of an effective KYC programme. Its a process by which soiled money is transformed into clear cash.

Source: tookitaki.ai

Source: tookitaki.ai

Their current partial address is Dublin and the company status is Normal. The Second Money Laundering Directive 2000 2MLD The Third Money Laundering Directive EU Directive 200560 3MLD Beneficial Owner. 1 development of internal policies procedures and related controls 2 designation of a compliance officer 3 a thorough and ongoing. ELECTRONIC EVIDENCE ORGANISATION 33 31 Investigative file inventory IFI 33 32. There are four pillars to an effective BSAAML program.

Source: pinterest.com

Source: pinterest.com

The sources of the money in actual are felony and the cash is invested in a method that makes it appear like clean cash and hide the identity of the legal part of the. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Four key elements of an effective KYC programme. FRB- federal reserve board.

Source: es.pinterest.com

Source: es.pinterest.com

Section 1956 a defines three types of criminal conduct. The First Money Laundering Directive of 1991 1MLD Extension of 1MLD. The idea of cash laundering is very important to be understood for those working within the financial sector. The Fourth Money Laundering Directive EU Directive 4MLD Additional EU Initiatives. Namely the key four elements as outlined in the relevant figure below for an effective KYC Programme are the following.

Source: pinterest.com

Source: pinterest.com

Know Your Customer Most companies already have effective know your customer policies in relation to compliance with the Foreign Corrupt Practices Act and similar regulations. FRB- federal reserve board. In designing a solid KYCCDD programme there are key elements that need to be incorporated. Minimum set of documents shall be obtained from various types of customers at the time of opening account as prescribed in updated Anti-Money Laundering. The idea of cash laundering is very important to be understood for those working within the financial sector.

Source: pinterest.com

Source: pinterest.com

ELECTRONIC EVIDENCE ORGANISATION 33 31 Investigative file inventory IFI 33 32. Our Anti Money Laundering Solution empowers banks and financial institutes to proactively manage AML risks and compliance. In designing a solid KYCCDD programme there are key elements that need to be incorporated. Investigating and Prosecuting International Corruption and Money Laundering Cases Page 4 2. Minimum set of documents shall be obtained from various types of customers at the time of opening account as prescribed in updated Anti-Money Laundering.

Source: yumpu.com

Source: yumpu.com

OTS - office of thrift supervision. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. See this Manual at 2182. The FATF Recommendations are recognised as the global anti-money. ELEMENTS OF CDD 41.

Source: pinterest.com

Source: pinterest.com

Section 1956 a defines three types of criminal conduct. International money laundering transactions 1956 a 2. The Fourth Money Laundering Directive EU Directive 4MLD Additional EU Initiatives. The idea of cash laundering is very important to be understood for those working within the financial sector. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. CUSTOMER IDENTIFICATION MCB Bank will serve only the genuine persons and all out efforts would be made to determine true identity of every customer. Money laundering is a means of storing or transporting. The 4 Elements of Beauty Limited was set up on Monday the 8th of January 2018. Know Your Customer Most companies already have effective know your customer policies in relation to compliance with the Foreign Corrupt Practices Act and similar regulations.

Source: shuftipro.com

Source: shuftipro.com

Its a process by which soiled money is transformed into clear cash. The Second Money Laundering Directive 2000 2MLD The Third Money Laundering Directive EU Directive 200560 3MLD Beneficial Owner. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. OCC- office of the comptroller of the currency. Graphic illustration of investigative file inventory 33 4.

Source: mdpi.com

Source: mdpi.com

Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. FDIC- federal deposit insurance corporation. 1 development of internal policies procedures and related controls 2 designation of a compliance officer 3 a thorough and ongoing. The 4 Elements of Beauty Limited was set up on Monday the 8th of January 2018. OCC- office of the comptroller of the currency.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 4 elements of anti money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas