20+ 4th eu money laundering directive summary information

Home » about money loundering idea » 20+ 4th eu money laundering directive summary informationYour 4th eu money laundering directive summary images are available in this site. 4th eu money laundering directive summary are a topic that is being searched for and liked by netizens today. You can Find and Download the 4th eu money laundering directive summary files here. Get all free vectors.

If you’re looking for 4th eu money laundering directive summary images information related to the 4th eu money laundering directive summary topic, you have come to the ideal blog. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

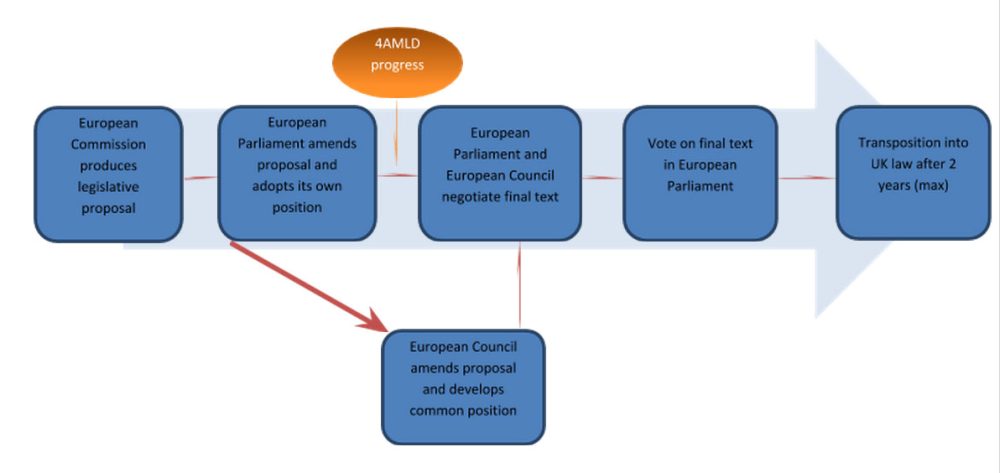

4th Eu Money Laundering Directive Summary. The European Parliament finally approved the Fourth Money Laundering Directive on 20th May 2015. While Member States have two years to adopt the Fourth Directives amendments into national legislation financial institutions can assess and update their AML frameworks in preparation for the implementation of the. On 26 June 2015 the 4th Anti-Money Laundering Directive EU No. It replaces the Third EU Money Laundering Directive and its purpose is to strengthen and improve existing anti-money laundering and counter-terrorist financing laws.

The Eu S Latest Agreement On Amending The Anti Money Laundering Directive At The Vanguard Of Trust Transparency But Still Further To Go Tax Justice Network From taxjustice.net

The Eu S Latest Agreement On Amending The Anti Money Laundering Directive At The Vanguard Of Trust Transparency But Still Further To Go Tax Justice Network From taxjustice.net

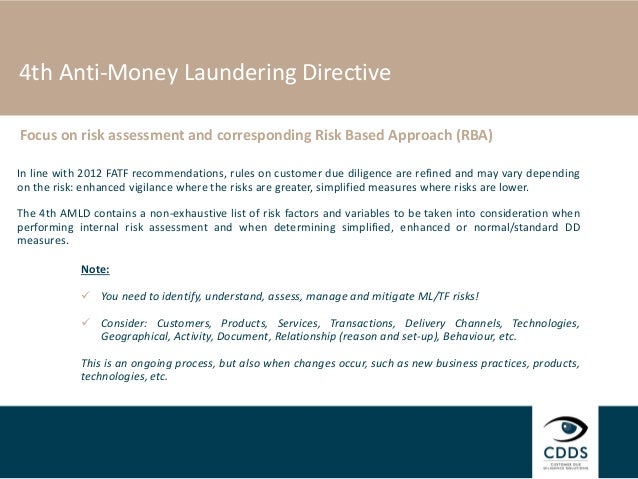

AMLD4 incorporates recommendations from the Financial Action Task Force FATF which it first released in February 2012. The Fourth Money Laundering Directive Implementation date. On 26 June 2015 the 4th Anti-Money Laundering Directive EU No. As most EU member states have completed the transposition of the Fourth Money Laundering Directive 4MLD into their national law there are some key differences to be aware of. The European Union Fourth Money Laundering Directive 4AMLD was ratified by the European Parliament in 2015 and was implemented in all EU states on the 26th June 2017. Below follows a summary of the key aspects of the Directive.

It was the most sweeping AML legislation in Europe in several years as it attempted to improve the EUs efforts in combating the laundering of money from.

The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. Te n years on since the passing of the Third Money Laundering Directive the EU 4 th Money Laundering Directive 4MLD was finally approved in May 2015 by the European Parliament. The challenge for this framework is to keep pace with technological innovation in financial services. EU Member States have to implement the 4th AMLD by 26 June 2017 into national law. Directive EU 2015849 on preventing the use of the financial system for money laundering or terrorist financing 4 th anti-money laundering Directive.

Source: hedgethink.com

Source: hedgethink.com

The EU 4th Money Laundering Directive will lead to new Money Laundering Regulations being introduced in the UK within two years. 4MLD looks to give effect to the updated standards that have been set by the Financial Action Task Force FATF. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC. During those ten years the financial industry has faced many challenges and changes which have put more pressure on the regulators to monitor. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015.

Source: coe.int

Source: coe.int

Financial crime is composed of Directive EU 2015849 the Fourth Anti-Money-Laundering Directive and Regulation EU 2015847 on information accompanying transfers of funds. The Fourth European Union Anti-Money Laundering Directive is intended to update and improve the EUs AML and CTF laws. Financial crime is composed of Directive EU 2015849 the Fourth Anti-Money-Laundering Directive and Regulation EU 2015847 on information accompanying transfers of funds. The Fourth Money Laundering Directive Implementation date. As most EU member states have completed the transposition of the Fourth Money Laundering Directive 4MLD into their national law there are some key differences to be aware of.

Source: eklawyers.com

Source: eklawyers.com

In 2013 the European Commission released its proposal for the 4 th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. By Nina Kerkez Senior Product Manager KYC Solutions Accuity. Fourth Money Laundering Directive Summary of Changes August 2015. The Fourth EU Money Laundering Directive AMLD4 came into force on 26 June 2015. The 4thAML Directive took into consideration the 40 new recommendations introduced by the Financial Task Force FATF which each Member State of the European Union must ensure compliance.

Source: taxjustice.net

Source: taxjustice.net

Below follows a summary of the key aspects of the Directive. It will also ensure consistency in the application of such laws across all EU Member States. AMLD4 incorporates recommendations from the Financial Action Task Force FATF which it first released in February 2012. The EU 4th Money Laundering Directive will lead to new Money Laundering Regulations being introduced in the UK within two years. The proposals were based in response to the Financial Action Task Force FATF 2012 recommendations to help improve customer due diligence programs globally.

Source: bankinghub.eu

Source: bankinghub.eu

Fourth Money Laundering Directive Summary of Changes August 2015. The proposals were based in response to the Financial Action Task Force FATF 2012 recommendations to help improve customer due diligence programs globally. It will also ensure consistency in the application of such laws across all EU Member States. During those ten years the financial industry has faced many challenges and changes which have put more pressure on the regulators to monitor. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals.

Source: complyadvantage.com

Source: complyadvantage.com

EU Member States have to implement the 4th AMLD by 26 June 2017 into national law. The European Parliament finally approved the Fourth Money Laundering Directive on 20th May 2015. The Fourth Money Laundering Directive Implementation date. It was the most sweeping AML legislation in Europe in several years as it attempted to improve the EUs efforts in combating the laundering of money from. Financial crime is composed of Directive EU 2015849 the Fourth Anti-Money-Laundering Directive and Regulation EU 2015847 on information accompanying transfers of funds.

Source: bankinghub.eu

Source: bankinghub.eu

Directive EU 2015849 on preventing the use of the financial system for money laundering or terrorist financing 4 th anti-money laundering Directive. The Fourth European Union Anti-Money Laundering Directive is intended to update and improve the EUs AML and CTF laws. This Directive is the fourth directive to address the threat of money laundering. Directive EU 2015849 on preventing the use of the financial system for money laundering or terrorist financing 4 th anti-money laundering Directive. It will also ensure consistency in the application of such laws across all EU Member States.

Source:

Summary of the Fourth Money Laundering Directive 4MLD Last summer on 5th June 2015 the Fourth Money Laundering Directive also referred to as 4MLD or MLD4 was published in the EU Official Journal. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development. As most EU member states have completed the transposition of the Fourth Money Laundering Directive 4MLD into their national law there are some key differences to be aware of. On 26 June 2015 the 4th Anti-Money Laundering Directive EU No. The EU Regulation 2015849 entered into force on 26th of June 2017.

Source: bankinghub.eu

Source: bankinghub.eu

The proposals were based in response to the Financial Action Task Force FATF 2012 recommendations to help improve customer due diligence programs globally. The Fourth Money Laundering Directive Implementation date. By Nina Kerkez Senior Product Manager KYC Solutions Accuity. While Member States have two years to adopt the Fourth Directives amendments into national legislation financial institutions can assess and update their AML frameworks in preparation for the implementation of the. The 4th AMLD recasts the existing 3rd Anti-Money Laundering Directive Directive 200560EU and the corresponding Implementing Directive Commission Directive 200670EC.

Source: globalbankingandfinance.com

Source: globalbankingandfinance.com

DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development. Te n years on since the passing of the Third Money Laundering Directive the EU 4 th Money Laundering Directive 4MLD was finally approved in May 2015 by the European Parliament. It will also ensure consistency in the application of such laws across all EU Member States. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals.

Source:

By Nina Kerkez Senior Product Manager KYC Solutions Accuity. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals. AMLD4 incorporates recommendations from the Financial Action Task Force FATF which it first released in February 2012. The 4thAML Directive took into consideration the 40 new recommendations introduced by the Financial Task Force FATF which each Member State of the European Union must ensure compliance. DIRECTIVE EU 2015849 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing is pointing that flows of illicit money can damage the integrity stability and reputation of the financial sector and threaten the internal market of the Union as well as international development.

Source: tookitaki.ai

Source: tookitaki.ai

The 4thAML Directive took into consideration the 40 new recommendations introduced by the Financial Task Force FATF which each Member State of the European Union must ensure compliance. The proposals were based in response to the Financial Action Task Force FATF 2012 recommendations to help improve customer due diligence programs globally. The European Union Fourth Money Laundering Directive 4AMLD was ratified by the European Parliament in 2015 and was implemented in all EU states on the 26th June 2017. EU Member States have to implement the 4th AMLD by 26 June 2017 into national law. As most EU member states have completed the transposition of the Fourth Money Laundering Directive 4MLD into their national law there are some key differences to be aware of.

Source: slideshare.net

Source: slideshare.net

Risk based approach The AMLCTF rules of the Crown Dependencies have mandated a risk based approach to due diligence for a number of years. As most EU member states have completed the transposition of the Fourth Money Laundering Directive 4MLD into their national law there are some key differences to be aware of. Te n years on since the passing of the Third Money Laundering Directive the EU 4 th Money Laundering Directive 4MLD was finally approved in May 2015 by the European Parliament. While Member States have two years to adopt the Fourth Directives amendments into national legislation financial institutions can assess and update their AML frameworks in preparation for the implementation of the. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 4th eu money laundering directive summary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information