19++ 4th money laundering directive beneficial ownership information

Home » about money loundering Info » 19++ 4th money laundering directive beneficial ownership informationYour 4th money laundering directive beneficial ownership images are available. 4th money laundering directive beneficial ownership are a topic that is being searched for and liked by netizens now. You can Get the 4th money laundering directive beneficial ownership files here. Get all royalty-free photos.

If you’re searching for 4th money laundering directive beneficial ownership images information linked to the 4th money laundering directive beneficial ownership topic, you have pay a visit to the ideal blog. Our website always gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

4th Money Laundering Directive Beneficial Ownership. When money is being laundered corruption is being facilitated allowing many standards to be undermined. In that context we are pleased that increasing corporate transparency is a key objective of the European Unions EU Fourth Money Laundering Directive the Directive. The Beneficial Ownership Register UBO Register. Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector.

Register Of Beneficial Ownership Mc2 From mc2accountants.ie

Register Of Beneficial Ownership Mc2 From mc2accountants.ie

Consultation description This discussion paper outlines possible approaches to the transposition of section 30 of the Fourth Money Laundering Directive. On a central register of beneficial ownership. The ultimate beneficial owner of a corporate client will need to be determined and due diligence checks performed. The Directive aimed at increasing transparency in the identification of beneficial owners requiring all Member States to hold information on beneficial owner of several legal entities in a. 3 This Directive is the four th directive to address the threat of money launder ing. While the Fourth Directive set out requirements for its members regarding ultimate beneficial ownership UBO including that companies must obtain and hold adequate accurate and current information about their beneficial owners the Fifth Directive places greater emphasis on transparency around ultimate beneficial ownership.

Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector.

While the Fourth Directive set out requirements for its members regarding ultimate beneficial ownership UBO including that companies must obtain and hold adequate accurate and current information about their beneficial owners the Fifth Directive places greater emphasis on transparency around ultimate beneficial ownership. Beneficial ownership is defined as any natural person who ultimately owns or controls a corporate or legal entity andor on whose behalf. Member States shall ensure that money laundering and terrorist financing are prohibited. For the purposes of the Fourth Anti -Money Laundering Directive a beneficial owner is an individual or legal entity which ultimately owns or controls more than 25 of a companys shares or voting rights or exercises control over the management of the company. Some of the key changes that the Fourth Money Laundering Directive present are. The Beneficial Ownership Register UBO Register.

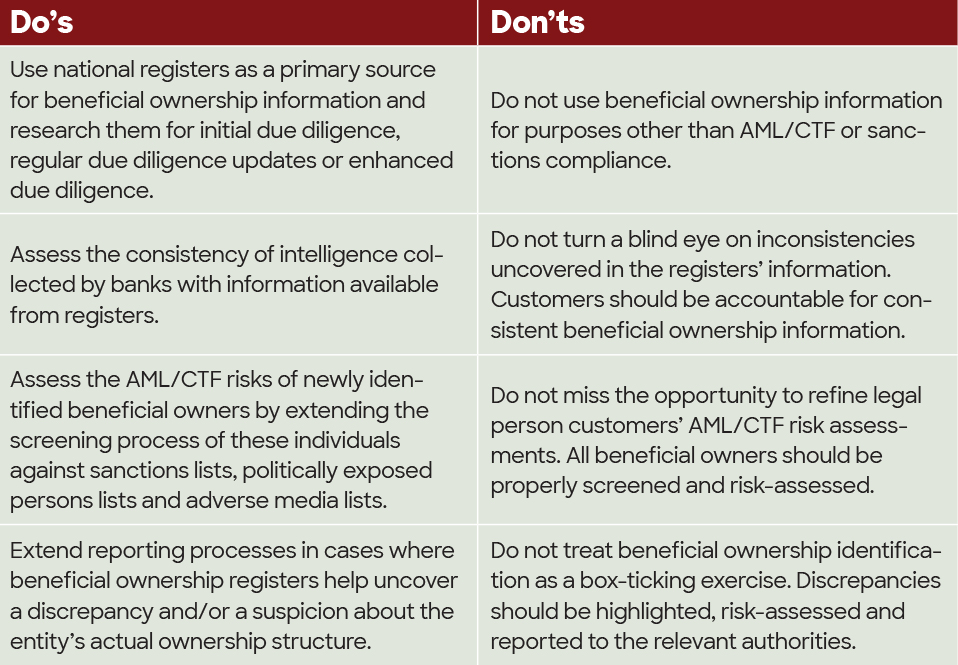

Source: acamstoday.org

Source: acamstoday.org

While the Fourth Directive set out requirements for its members regarding ultimate beneficial ownership UBO including that companies must obtain and hold adequate accurate and current information about their beneficial owners the Fifth Directive places greater emphasis on transparency around ultimate beneficial ownership. Under Article 83 and Article 84 of the Fourth Money Laundering Directive the regulated sector are required to establish and maintain policies controls and procedures to mitigate and manage. Directive EU 2015849 4th Anti-Money Laundering Directive 4AMLD aims to combat money laundering and the financing of terrorism by preventing the financial market from being misused for these purposes. Beneficial Ownership April 2019. Some of the key changes that the Fourth Money Laundering Directive present are.

Source: complyadvantage.com

Source: complyadvantage.com

The 4th Anti-Money Laundering Directive 4AMLD aims to boost tax transparency fight tax evasion prevent money laundering and the financing of terrorism by identifying any natural person who exercises ownership and control over a legal entity as defined in the 4AMLD. This is known as the register of people with significant control or PSC register. In that context we are pleased that increasing corporate transparency is a key objective of the European Unions EU Fourth Money Laundering Directive the Directive. Some of the key changes that the Fourth Money Laundering Directive present are. Beneficial ownership is defined as any natural person who ultimately owns or controls a corporate or legal entity andor on whose behalf.

Source: ciat.org

Source: ciat.org

It was left up to individual member states to determine how to implement the Directive and in doing so. This is known as the register of people with significant control or PSC register. 3 This Directive is the four th directive to address the threat of money launder ing. Member States shall ensure that money laundering and terrorist financing are prohibited. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector.

Source: hlb-poland.global

Source: hlb-poland.global

Beneficial Ownership Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. Consultation description This discussion paper outlines possible approaches to the transposition of section 30 of the Fourth Money Laundering Directive. On a central register of beneficial ownership. Council Directive 91308EEC 4 defined money launder ing in terms of dr ugs offences and imposed obligations solely on the financial sector. 562015 EN Official Jour nal of the European Union L 14173.

Source: researchgate.net

Source: researchgate.net

Beneficial Ownership Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing. 3 This Directive is the four th directive to address the threat of money launder ing. Under AMLD4 in order to address perceived deficiencies in transparency around beneficial ownership corporate and legal entities trusts and similar structures will be required to hold adequate accurate and current information on their beneficial ownership. However the rules for using a third party are strict.

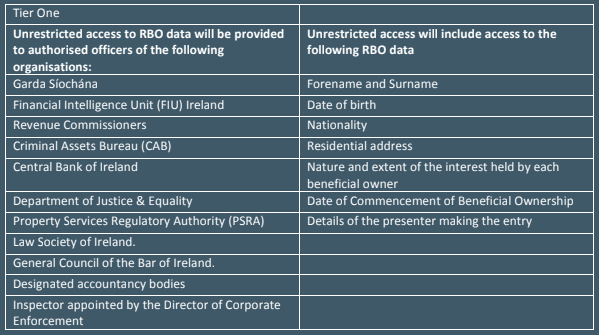

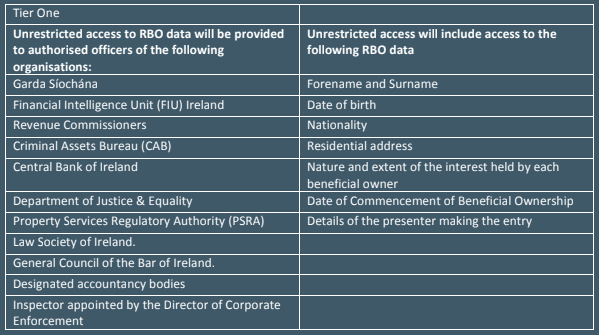

Source: mc2accountants.ie

Source: mc2accountants.ie

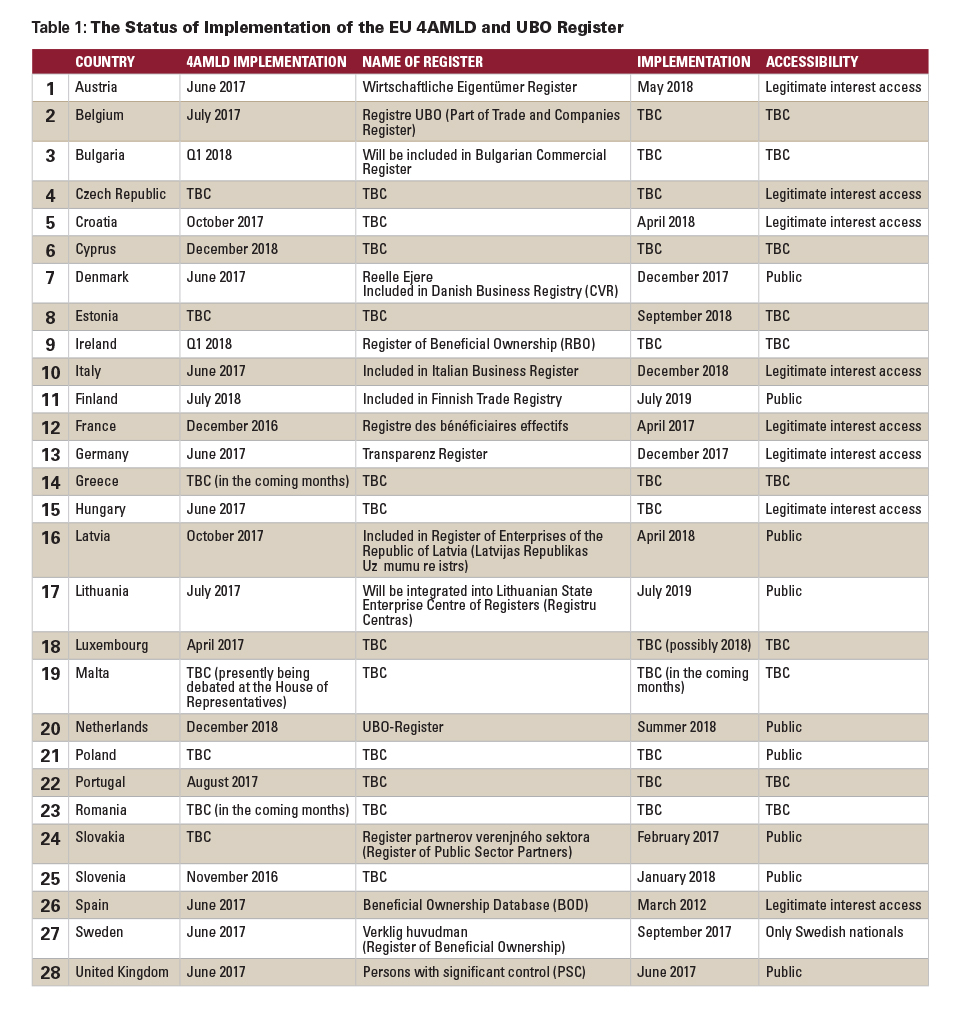

Beneficial Ownership April 2019. The Fourth Directive was transposed into UK as the Money Laundering Regulations 2017. In Denmark it is already mandatory to report owners with. Beneficial Ownership Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. Beneficial ownership is defined as any natural person who ultimately owns or controls a corporate or legal entity andor on whose behalf.

Source:

In 2013 the European Commission released its proposal for the 4th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership. The Beneficial Ownership Register UBO Register. However the rules for using a third party are strict. It was left up to individual member states to determine how to implement the Directive and in doing so.

Source: acamstoday.org

Source: acamstoday.org

The 4th Anti-Money Laundering Directive 4AMLD aims to boost tax transparency fight tax evasion prevent money laundering and the financing of terrorism by identifying any natural person who exercises ownership and control over a legal entity as defined in the 4AMLD. 3 This Directive is the four th directive to address the threat of money launder ing. Under AMLD4 in order to address perceived deficiencies in transparency around beneficial ownership corporate and legal entities trusts and similar structures will be required to hold adequate accurate and current information on their beneficial ownership. Beneficial ownership is defined as any natural person who ultimately owns or controls a corporate or legal entity andor on whose behalf. This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing.

Source: internationalsales.lexisnexis.com

Source: internationalsales.lexisnexis.com

Member States shall ensure that money laundering and terrorist financing are prohibited. The ultimate beneficial owner of a corporate client will need to be determined and due diligence checks performed. The Directive aimed at increasing transparency in the identification of beneficial owners requiring all Member States to hold information on beneficial owner of several legal entities in a. In 2013 the European Commission released its proposal for the 4th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. However the rules for using a third party are strict.

Source: medium.com

Source: medium.com

Beneficial Ownership Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. In that context we are pleased that increasing corporate transparency is a key objective of the European Unions EU Fourth Money Laundering Directive the Directive. Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership. This Directive is the fourth directive to address the threat of money laundering. Council Directive 91308EEC 4 defined money laundering in terms of drugs offences and imposed obligations solely on the financial sector.

Source: acamstoday.org

Source: acamstoday.org

Beneficial ownership is defined as any natural person who ultimately owns or controls a corporate or legal entity andor on whose behalf. Beneficial Ownership Article 30 1 of the EUs Fourth Anti-Money Laundering Directive 4AMLD requires all EU Member States to put into national law provisions requiring corporate and legal entities to obtain and hold adequate accurate and current information on their beneficial owner s in their own internal beneficial ownership register. For the purposes of the Fourth Anti -Money Laundering Directive a beneficial owner is an individual or legal entity which ultimately owns or controls more than 25 of a companys shares or voting rights or exercises control over the management of the company. In 2013 the European Commission released its proposal for the 4th EU Money Laundering Directive Directive which is to strengthen screening processes to disable dirty money to be laundered. The 4th Anti-Money Laundering Directive 4AMLD aims to boost tax transparency fight tax evasion prevent money laundering and the financing of terrorism by identifying any natural person who exercises ownership and control over a legal entity as defined in the 4AMLD.

Source: credas.co.uk

Source: credas.co.uk

When money is being laundered corruption is being facilitated allowing many standards to be undermined. 3 This Directive is the four th directive to address the threat of money launder ing. In Denmark it is already mandatory to report owners with. The Directive aimed at increasing transparency in the identification of beneficial owners requiring all Member States to hold information on beneficial owner of several legal entities in a. Under Article 83 and Article 84 of the Fourth Money Laundering Directive the regulated sector are required to establish and maintain policies controls and procedures to mitigate and manage.

Source: medium.com

Source: medium.com

As well as being covered by AML 4 the third party must also hand over all information and confirm in writing that they have undertaken appropriate levels of due diligence. Under AMLD4 in order to address perceived deficiencies in transparency around beneficial ownership corporate and legal entities trusts and similar structures will be required to hold adequate accurate and current information on their beneficial ownership. Beneficial Ownership April 2019. It was left up to individual member states to determine how to implement the Directive and in doing so. This is known as the register of people with significant control or PSC register.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 4th money laundering directive beneficial ownership by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas