17++ 5 directive aml info

Home » about money loundering Info » 17++ 5 directive aml infoYour 5 directive aml images are available. 5 directive aml are a topic that is being searched for and liked by netizens today. You can Download the 5 directive aml files here. Download all free images.

If you’re looking for 5 directive aml pictures information related to the 5 directive aml topic, you have visit the ideal site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

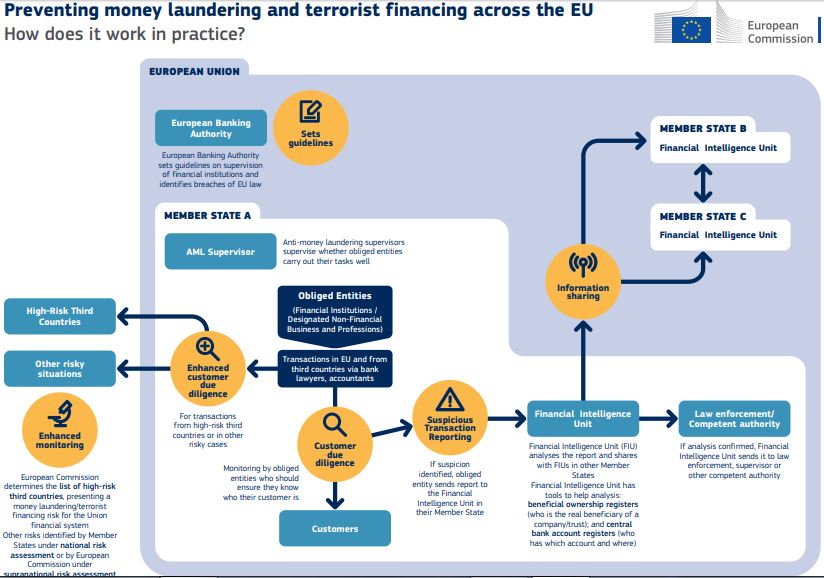

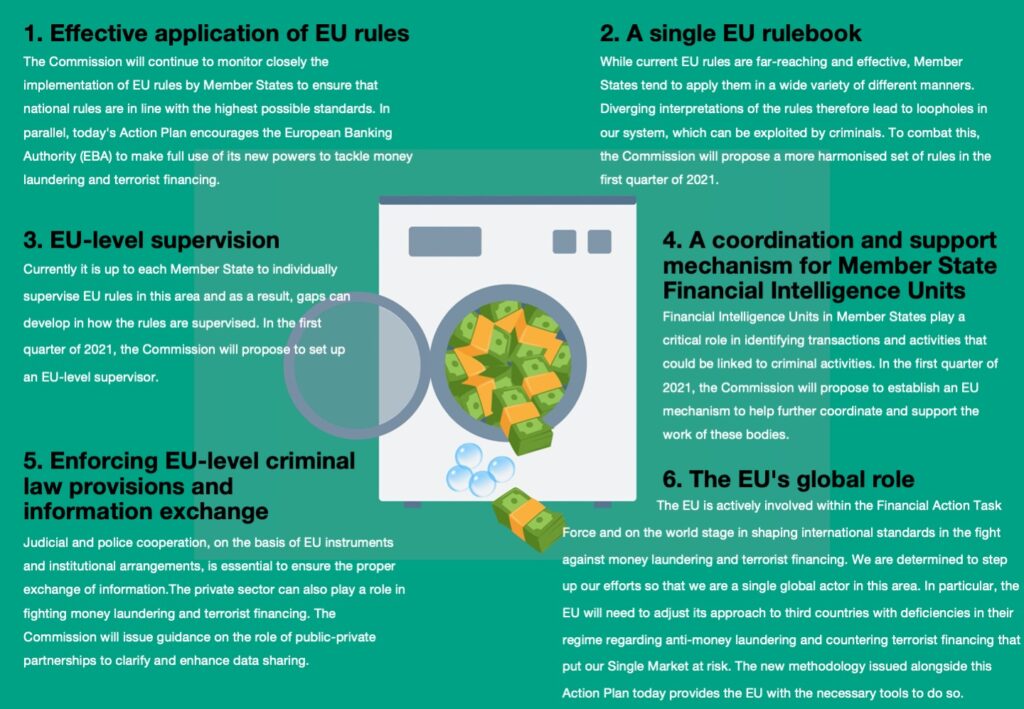

5 Directive Aml. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. Latest news reports from the medical literature videos from the experts and more. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. 5thAnti-Money Laundering Directive 5AMLD.

A Brief Summary On 5th Aml Directive Of Eu From fineksus.com

A Brief Summary On 5th Aml Directive Of Eu From fineksus.com

Latest news reports from the medical literature videos from the experts and more. UBO lists drawn up under 4MLD are to be made publicly accessible. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. Ad AML coverage from every angle. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. 5th Anti-Money Laundering Directive 5th Anti-Money Laundering Directive Contemporary global finance is increasingly focused on the need for transparency and accountability in relation to business transactions tax requirements and ownership matters.

Latest news reports from the medical literature videos from the experts and more.

What is the Fifth Anti Money laundering Directive 5AMLD. Banking and financial services. 5 May 2021 Author. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. The new directive Directive EU 2018843 on the prevention of the use of the financial system for the purposes of money laundering or terrorism financing the 5th AML Directive amending the 4th AML Directive was published in the Official Journal of the European Union on 19 June 2018 and will enter into force 20 days thereafter. The Money Laundering and Terrorist Financing Amendment Regulations 2019.

Source: fineksus.com

Source: fineksus.com

The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. In 2017 4MLD introduced a focus on ultimate beneficial ownership UBO for the purposes of risk mitigation and money laundering prevention. A STEP FORWARD TO TAX TRANSPARENCY AND ACCOUNTABILITY Contemporary global finance is increasingly focused on the need for transparency accountability in relation to business transactions tax requirements and ownership matters. 5thAnti-Money Laundering Directive 5AMLD. UBO lists drawn up under 4MLD are to be made publicly accessible.

Source: camsafroza.com

Source: camsafroza.com

This Directive dramatically changes this concept creating a unique digital space for client identification. Anti-money laundering directive V AMLD V - transposition status. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. The Member States had to transpose this Directive by 10 January 2020. The AMLD5 came into effect on January 10th 2020 and is enriched with regulations concerning cryptocurrency businesses.

Source: pideeco.be

Source: pideeco.be

The latest EU anti money laundering directive aims to improve transparency in identifying the beneficial ownership of trusts and companies disrupt criminal abuse of the virtual currencies and prepaid cards apply enhanced due diligence on transactions to and from high-risk countries. The Money Laundering and Terrorist Financing Amendment Regulations 2019. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. The 5th Anti-Money Laundering Directive which amends the 4th Anti-Money Laundering Directive was published on June 19th 2018 as a result of the constantly changing financial situation of the market. The 5 th Anti-Money Laundering directive will.

Source: shuftipro.com

Source: shuftipro.com

The latest EU anti money laundering directive aims to improve transparency in identifying the beneficial ownership of trusts and companies disrupt criminal abuse of the virtual currencies and prepaid cards apply enhanced due diligence on transactions to and from high-risk countries. 5MLD builds on those steps introducing the following measures. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. 02 June 2020 last update on. Banking and financial services.

Source: newbanking.com

Source: newbanking.com

5thAnti-Money Laundering Directive 5AMLD. This Directive dramatically changes this concept creating a unique digital space for client identification. 02 June 2020 last update on. Entered into force on July 9 2018 at community level with effective application at national level on January 10 2020. UBO lists drawn up under 4MLD are to be made publicly accessible.

Source: ec.europa.eu

Source: ec.europa.eu

The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. UBO lists drawn up under 4MLD are to be made publicly accessible. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. Entered into force on July 9 2018 at community level with effective application at national level on January 10 2020. The new directive Directive EU 2018843 on the prevention of the use of the financial system for the purposes of money laundering or terrorism financing the 5th AML Directive amending the 4th AML Directive was published in the Official Journal of the European Union on 19 June 2018 and will enter into force 20 days thereafter.

Source: ekothinking.wordpress.com

Source: ekothinking.wordpress.com

The 5 th Anti-Money Laundering directive will. 5 May 2021 Author. Banking and financial services. UBO lists drawn up under 4MLD are to be made publicly accessible. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020.

This Directive dramatically changes this concept creating a unique digital space for client identification. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. A STEP FORWARD TO TAX TRANSPARENCY AND ACCOUNTABILITY Contemporary global finance is increasingly focused on the need for transparency accountability in relation to business transactions tax requirements and ownership matters. Ad AML coverage from every angle. AML5 is the new community rule standard for the prevention of money laundering and terrorist financing.

Source: planetcompliance.com

Source: planetcompliance.com

What is the Fifth Anti Money laundering Directive 5AMLD. 5thAnti-Money Laundering Directive 5AMLD. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. 5th Anti-Money Laundering Directive 5th Anti-Money Laundering Directive Contemporary global finance is increasingly focused on the need for transparency and accountability in relation to business transactions tax requirements and ownership matters. 5 While the aims of Directive EU 2015849 should be pursued and any amendments to it should be consistent with the Unions ongoing action in the field of countering terrorism and terrorist financing such amendments should be made having due regard to the fundamental right to the protection of personal data as well as the observance and application of the proportionality principle.

Source: idmerit.com

Source: idmerit.com

5AMLD 5th Anti-Money Laundering Directive. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Anti-money laundering directive V AMLD V - transposition status. Ad AML coverage from every angle. 5AMLD 5th Anti-Money Laundering Directive.

Source: pinterest.com

Source: pinterest.com

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. This Directive dramatically changes this concept creating a unique digital space for client identification. Ad AML coverage from every angle. 02 June 2020 last update on.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Entered into force on July 9 2018 at community level with effective application at national level on January 10 2020. The Member States had to transpose this Directive by 10 January 2020. The latest EU anti money laundering directive aims to improve transparency in identifying the beneficial ownership of trusts and companies disrupt criminal abuse of the virtual currencies and prepaid cards apply enhanced due diligence on transactions to and from high-risk countries. 5MLD builds on those steps introducing the following measures.

Source: elsavco.com

Source: elsavco.com

What is the Fifth Anti Money laundering Directive 5AMLD. AML5 is the new community rule standard for the prevention of money laundering and terrorist financing. Financial Stability Financial Services and Capital Markets Union. This Directive dramatically changes this concept creating a unique digital space for client identification. Latest news reports from the medical literature videos from the experts and more.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 5 directive aml by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas