11+ 5amld high risk third countries info

Home » about money loundering idea » 11+ 5amld high risk third countries infoYour 5amld high risk third countries images are ready in this website. 5amld high risk third countries are a topic that is being searched for and liked by netizens today. You can Get the 5amld high risk third countries files here. Find and Download all royalty-free vectors.

If you’re searching for 5amld high risk third countries images information related to the 5amld high risk third countries keyword, you have visit the ideal blog. Our website frequently provides you with hints for seeing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

5amld High Risk Third Countries. New delegated act on high-risk third countries. 5AMLD is an amendment to. 5AMLD is an amendment to 4AMLD which came into effect on 26 June 2017. It was adopted on May 30 2018.

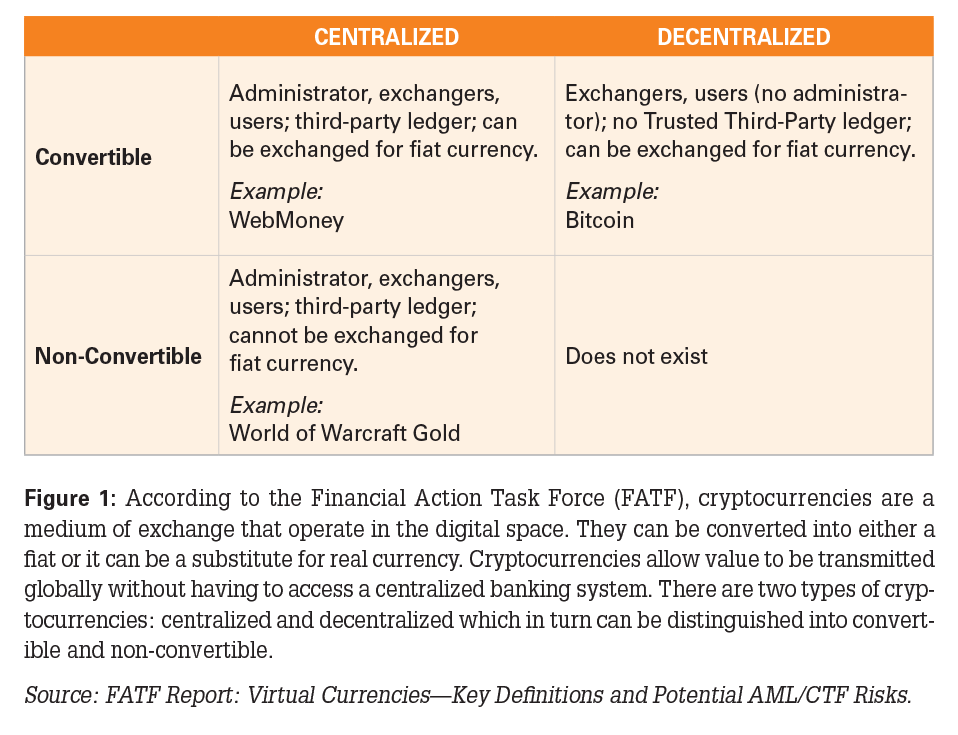

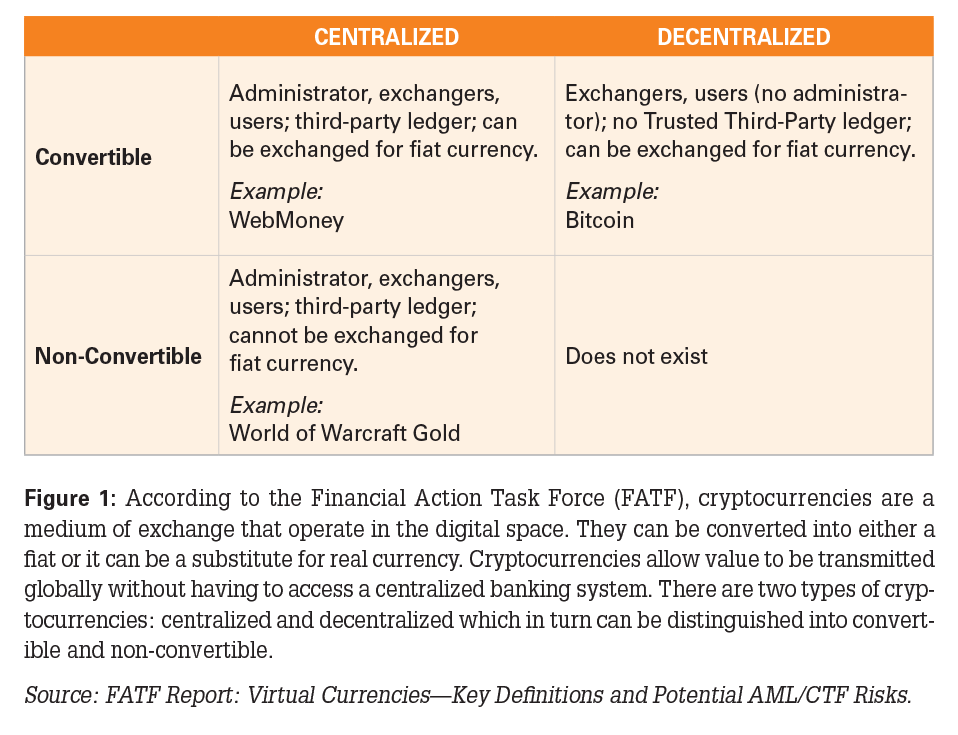

Regulating A Game Changer Europe S Approach To Cryptocurrencies Acams Today From acamstoday.org

Regulating A Game Changer Europe S Approach To Cryptocurrencies Acams Today From acamstoday.org

The 5AMLD aims to harmonise the manner in which risks imposed by high-risk third countries are addressed primarily by focusing on enhancing customer due diligence measures and alignment of national continuous customer due diligence with recordkeeping and reporting EDD measures with FATF regulatory requirements. This is specifically focused on addressing the deficiencies in those countries AML procedures and the risks they present. 5AMLD is an amendment to. Anonymous accounts passbooks or safe deposit boxes were prohibited by the 5AMLD. The types of enhanced vigilance requirements are basically extra checks and control measures which are defined in article 18a of the Directive. High-Risk Third Countries Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections.

All EU member states now require firms to apply enhanced due diligence to business relationships or transactions involving high-risk third countries.

Identification of such countries is a legal requirement stemming from Article 9 of Directive EU. The types of enhanced vigilance requirements are basically extra checks and control measures which are defined in article 18a of the Directive. 5AMLD is an amendment to 4AMLD which came into effect on 26 June 2017. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions. This follows a rejection by the Council of the EU earlier this year of a draft list of.

Source:

A list of high-risk countries can be found here. Anonymous accounts passbooks or safe deposit boxes were prohibited by the 5AMLD. All EU member states now require firms to apply enhanced due diligence to business relationships or transactions involving high-risk third countries. 5AMLD 5th Anti-Money Laundering Directive. Consistent Approach Toward High-Risk Third Countries The 5AMLD puts an impetus on member states to apply a specific list of Enhanced Due Diligence EDD measures for transactions involving entities recorded on a list of so-called high-risk third countries and sectors as.

Source: shuftipro.com

Source: shuftipro.com

Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions. The 24 high-risk third countries are. 5AMLD has also expanded the triggers for EDD to include transactions relating to oil. Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions. This is specifically focused on addressing the deficiencies in those countries AML procedures and the risks they present.

Source: companyformations.ie

Source: companyformations.ie

This is specifically focused on addressing the deficiencies in those countries AML procedures and the risks they present. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions. 5AMLD is an amendment to 4AMLD which came into effect on 26 June 2017. New Methodology Considered for identifying high-risk third countries.

Source: medium.com

Source: medium.com

According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. The 5AMLD outlines new requirements for member states to restrict the use of prepaid cards issued by third countries only to those third countries deemed to be sufficiently compliant with requirements set out in current EU AML legislation. Have all become. Recently on January 10 2020 The Fifth Anti Money Laundering Directive 5AMLD came into force. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU.

Source: shuftipro.com

Source: shuftipro.com

Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions. High-Risk Third Countries Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections. The 5AMLD outlines new requirements for member states to restrict the use of prepaid cards issued by third countries only to those third countries deemed to be sufficiently compliant with requirements set out in current EU AML legislation. 5AMLD 5th Anti-Money Laundering Directive. 5AMLD has also expanded the triggers for EDD to include transactions relating to oil.

Source: refinitiv.com

Source: refinitiv.com

5AMLD prescribes enhanced due diligence measures for business relationships or transactions involving high-risk third countries and also allows Member States to restrict obliged entities from opening branchessubsidiaries in high-risk third countries and to restrict the opening of branches in a Member State of an obliged entity based in a high-risk third country. All EU member states now require firms to apply enhanced due diligence to business relationships or transactions involving high-risk third countries. The 5AMLD outlines new requirements for member states to restrict the use of prepaid cards issued by third countries only to those third countries deemed to be sufficiently compliant with requirements set out in current EU AML legislation. New delegated act on high-risk third countries. It was adopted on May 30 2018.

Source: globalriskaffairs.com

Source: globalriskaffairs.com

The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. In its explanatory section 5AMLD states that business relationships or transactions involving high-risk third countries should be limited when significant weaknesses in the AMLCTF regime of the third countries of concern are identified unless adequate additional mitigation measures or countermeasures are applied. It was adopted on May 30 2018. The 5AMLD aims to harmonise the manner in which risks imposed by high-risk third countries are addressed primarily by focusing on enhancing customer due diligence measures and alignment of national continuous customer due diligence with recordkeeping and reporting EDD measures with FATF regulatory requirements. Consistent Approach Toward High-Risk Third Countries The 5AMLD puts an impetus on member states to apply a specific list of Enhanced Due Diligence EDD measures for transactions involving entities recorded on a list of so-called high-risk third countries and sectors as.

Source: shuftipro.com

Source: shuftipro.com

All EU member states now require firms to apply enhanced due diligence to business relationships or transactions involving high-risk third countries. The 5AMLD aims to harmonise the manner in which risks imposed by high-risk third countries are addressed primarily by focusing on enhancing customer due diligence measures and alignment of national continuous customer due diligence with recordkeeping and reporting EDD measures with FATF regulatory requirements. Recently on January 10 2020 The Fifth Anti Money Laundering Directive 5AMLD came into force. During a meeting in Brussels on 5th June 2019 a revised approach for the methodology used to identify high-risk third countries was proposed by the European Commission. Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions.

Source: fineksus.com

Source: fineksus.com

It was adopted on May 30 2018. Consistent Approach Toward High-Risk Third Countries The 5AMLD puts an impetus on member states to apply a specific list of Enhanced Due Diligence EDD measures for transactions involving entities recorded on a list of so-called high-risk third countries and sectors as. The 5AMLD outlines new requirements for member states to restrict the use of prepaid cards issued by third countries only to those third countries deemed to be sufficiently compliant with requirements set out in current EU AML legislation. During a meeting in Brussels on 5th June 2019 a revised approach for the methodology used to identify high-risk third countries was proposed by the European Commission. In addition a provision has been made for anonymous prepaid cards issued outside the EU in third countries.

Source: northrow.com

Source: northrow.com

Under 5AMLD respondents in high-risk third countries became subject to EDD review by their correspondents in the EU with the expectation that relationships should be amended or terminated if risks could not be mitigated. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. This is specifically focused on addressing the deficiencies in those countries AML procedures and the risks they present. Have all become. New delegated act on high-risk third countries.

Source: globalriskaffairs.com

Source: globalriskaffairs.com

According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. 5AMLD 5th Anti-Money Laundering Directive. Have all become. Recently on January 10 2020 The Fifth Anti Money Laundering Directive 5AMLD came into force. The 5AMLD outlines new requirements for member states to restrict the use of prepaid cards issued by third countries only to those third countries deemed to be sufficiently compliant with requirements set out in current EU AML legislation.

Source: acamstoday.org

Source: acamstoday.org

5AMLD tries to address weaknesses in the European Unions Anti-Money Laundering AML and Counter Terrorism Financing CFT regime. Have all become. 5AMLD prescribes enhanced due diligence measures for business relationships or transactions involving high-risk third countries and also allows Member States to restrict obliged entities from opening branchessubsidiaries in high-risk third countries and to restrict the opening of branches in a Member State of an obliged entity based in a high-risk third country. Anonymous accounts passbooks or safe deposit boxes were prohibited by the 5AMLD. The EU currently maintains a list of High-Risk third countries and when doing business with clients within these countries parties are required to undertake enhanced due diligence measures.

Source: northrow.com

Source: northrow.com

During a meeting in Brussels on 5th June 2019 a revised approach for the methodology used to identify high-risk third countries was proposed by the European Commission. 5AMLD has also expanded the triggers for EDD to include transactions relating to oil. This is specifically focused on addressing the deficiencies in those countries AML procedures and the risks they present. 5AMLD tries to address weaknesses in the European Unions Anti-Money Laundering AML and Counter Terrorism Financing CFT regime. Harmonised Treatment of High-Risk Third Countries Traditionally Member States each determined the type of due diligence measures to be adopted when high risk third countries are dealt with in financial transactions.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5amld high risk third countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information