16+ 5th aml directive central bank ideas

Home » about money loundering Info » 16+ 5th aml directive central bank ideasYour 5th aml directive central bank images are ready in this website. 5th aml directive central bank are a topic that is being searched for and liked by netizens today. You can Find and Download the 5th aml directive central bank files here. Find and Download all free photos.

If you’re searching for 5th aml directive central bank pictures information linked to the 5th aml directive central bank interest, you have come to the ideal site. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

5th Aml Directive Central Bank. First of all the 5th Anti-Money Laundering Directive contains the legal definition of virtual currencies as a digital representation of value that is not issued or guaranteed by a central bank or a public authority is not necessarily attached to a legally established currency and does not possess a legal status of currency or money but is accepted by natural or legal persons as a means of exchange. Information available in the central registers and the beneficial ownership information. The CBC has issued the 5th Edition of the Directive on the Prevention of Money Laundering and Terrorist Financing the CBC AMLCFT Directive which replaced the previous 4th Edition of December 2013 as well as the amendments to the 4th Edition of April 2016 and July 2017. The Member States had to transpose this Directive by 10 January 2020.

Pin On Best Sites From pinterest.com

Pin On Best Sites From pinterest.com

The Directive also obliges all EU member states to create maintain central bank and payment account registers or central retrieval systems. Establishment of centralized bank account registers or retrieval systems. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. The central bank in any nation gives complete guides to AML and CFT to fight such actions. A digital representation of value that is not issued or guaranteed by a central bank or a. Improve the cooperation and enhance of information between anti-money laundering supervisors between them and between them and prudential supervisors and the European Central Bank.

The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law.

5th-CBC-DIRECTIVE-FEB 2019-ENGpdf The Central Bank of Cyprus CBC was established in 1963 shortly after Cyprus gained its independence in accordance with the Central Bank of Cyprus Law 1963 and the relevant articles of the Constitution. 5th-CBC-DIRECTIVE-FEB 2019-ENGpdf The Central Bank of Cyprus CBC was established in 1963 shortly after Cyprus gained its independence in accordance with the Central Bank of Cyprus Law 1963 and the relevant articles of the Constitution. The new AML Directive by the Central Bank and shell companies-February 2019 The Central Bank of Cyprus CBC has issued last February 2019 the 5th edition of the Directive on the Prevention of Money Laundering and Terrorist Financing the CBC AMLCFT Directive which replaced the previous 4th edition of December 2013 as well as the amendments to the fourth edition of April. The Directive also obliges all EU member states to create maintain central bank and payment account registers or central retrieval systems. Proposed in July 2016 as part of the EUs plans to combat terrorism the 5th EU Anti-Money Laundering Directive AMLD 5 entered into force on the 9th of July 2018. Information available in the central registers and the beneficial ownership information.

Source: moderndiplomacy.eu

Source: moderndiplomacy.eu

These polices when adopted and exercised by banks religiously present sufficient security to the banks to discourage such conditions. For more information read the European Commissions Fact Sheet on the 5th Anti Money laundering Directive. FIFTH ANTI-MONEY LAUNDERING DIRECTIVE AMLD 5 Coverage of the crypto market. 5th-CBC-DIRECTIVE-FEB 2019-ENGpdf The Central Bank of Cyprus CBC was established in 1963 shortly after Cyprus gained its independence in accordance with the Central Bank of Cyprus Law 1963 and the relevant articles of the Constitution. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union.

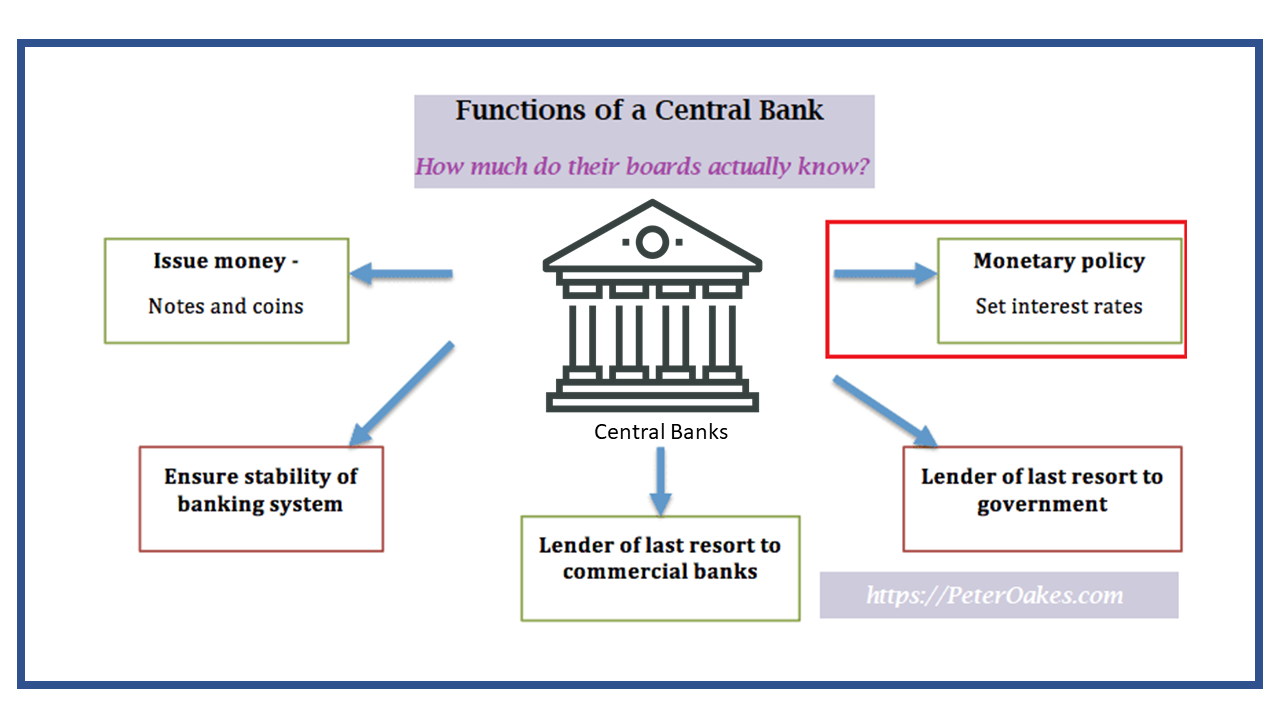

Source: peteroakes.com

Source: peteroakes.com

The central bank in any nation gives complete guides to AML and CFT to fight such actions. Information available in the central registers and the beneficial ownership information. The main areas addressed by the 5th Directive include beneficial ownership transparency Financial Intelligence Units FIUs access to information cryptocurrencies and pre-paid instruments communication between AML supervisors and the European Central Bank high-risk third countries and politically exposed persons. The 5th AML Directive provides for the requirement for Member States to establish centralized automated mechanisms such as registers or data retrieval systems so as to allow for identification in a timely manner of the holders of bank and payment accounts and safe-deposit boxes 10 as well as their proxy holders and their BOs. 5th-CBC-DIRECTIVE-FEB 2019-ENGpdf The Central Bank of Cyprus CBC was established in 1963 shortly after Cyprus gained its independence in accordance with the Central Bank of Cyprus Law 1963 and the relevant articles of the Constitution.

Source: id.pinterest.com

Source: id.pinterest.com

Set up central bank account registries or retrieval systems in all Member States. The CBC has issued the 5th Edition of the Directive on the Prevention of Money Laundering and Terrorist Financing the CBC AMLCFT Directive which replaced the previous 4th Edition of December 2013 as well as the amendments to the 4th Edition of April 2016 and July 2017. The central bank in any country offers full guides to AML and CFT to fight such actions. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. A digital representation of value that is not issued or guaranteed by a central bank or a.

Source: researchgate.net

Source: researchgate.net

The 5th AML Directive provides for the requirement for Member States to establish centralized automated mechanisms such as registers or data retrieval systems so as to allow for identification in a timely manner of the holders of bank and payment accounts and safe-deposit boxes 10 as well as their proxy holders and their BOs. Establishment of centralized bank account registers or retrieval systems. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. Member States shall put in place centralised automated mechanisms such as central registries or central electronic data retrieval systems which allow the identification in a timely manner of any natural or legal persons holding or controlling payment accounts and bank accounts identified by IBAN as defined by Regulation EU No 2602012 of the European Parliament and of the Council 7 and safe. The central bank in any nation gives complete guides to AML and CFT to fight such actions.

Source: centralbankmalta.org

A digital representation of value that is not issued or guaranteed by a central bank or a. By design the AMLD5 is meant to become an inherent part of the laws of Member States MS whilst leaving some leeway when it. These polices when adopted and exercised by banks religiously present sufficient security to the banks to discourage such conditions. For more information read the European Commissions Fact Sheet on the 5th Anti Money laundering Directive. The 5th AML Directive provides for the requirement for Member States to establish centralized automated mechanisms such as registers or data retrieval systems so as to allow for identification in a timely manner of the holders of bank and payment accounts and safe-deposit boxes 10 as well as their proxy holders and their BOs.

Source: pinterest.com

Source: pinterest.com

The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. Information available in the central registers and the beneficial ownership information. A digital representation of value that is not issued or guaranteed by a central bank or a. 5th-CBC-DIRECTIVE-FEB 2019-ENGpdf The Central Bank of Cyprus CBC was established in 1963 shortly after Cyprus gained its independence in accordance with the Central Bank of Cyprus Law 1963 and the relevant articles of the Constitution. By design the AMLD5 is meant to become an inherent part of the laws of Member States MS whilst leaving some leeway when it.

Source: researchgate.net

Source: researchgate.net

Improve the cooperation and enhance of information between anti-money laundering supervisors between them and between them and prudential supervisors and the European Central Bank. The main areas addressed by the 5th Directive include beneficial ownership transparency Financial Intelligence Units FIUs access to information cryptocurrencies and pre-paid instruments communication between AML supervisors and the European Central Bank high-risk third countries and politically exposed persons. Information available in the central registers and the beneficial ownership information. The Guidelines set out the expectations of the Central Bank in respect of credit and financial institutions compliance with their AMLCFT obligations as set out in the Criminal Justice Money Laundering and Terrorist Financing Act 2010 the CJA 2010 following the transposition of the EUs Fourth Anti-Money Laundering Directive 4AMLD into Irish Law. A digital representation of value that is not issued or guaranteed by a central bank or a.

Source: academia.edu

Source: academia.edu

With the purpose of more transparent identification of the bank account and payment holders the 5th AML Directive requires Member States to set up centralized bank account registers or retrieval systems. Proposed in July 2016 as part of the EUs plans to combat terrorism the 5th EU Anti-Money Laundering Directive AMLD 5 entered into force on the 9th of July 2018. Establishment of centralized bank account registers or retrieval systems. The central bank in any nation gives complete guides to AML and CFT to fight such actions. The main areas addressed by the 5th Directive include beneficial ownership transparency Financial Intelligence Units FIUs access to information cryptocurrencies and pre-paid instruments communication between AML supervisors and the European Central Bank high-risk third countries and politically exposed persons.

Source: slideshare.net

Source: slideshare.net

For more information read the European Commissions Fact Sheet on the 5th Anti Money laundering Directive. The central bank in any country offers full guides to AML and CFT to fight such actions. Improve the cooperation and enhance of information between anti-money laundering supervisors between them and between them and prudential supervisors and the European Central Bank. The 5th AML Directive was signed into law on the 30th of May 2018 giving the Member States 18. 5th-CBC-DIRECTIVE-FEB 2019-ENGpdf The Central Bank of Cyprus CBC was established in 1963 shortly after Cyprus gained its independence in accordance with the Central Bank of Cyprus Law 1963 and the relevant articles of the Constitution.

Source: twitter.com

Source: twitter.com

The new AML Directive by the Central Bank and shell companies-February 2019 The Central Bank of Cyprus CBC has issued last February 2019 the 5th edition of the Directive on the Prevention of Money Laundering and Terrorist Financing the CBC AMLCFT Directive which replaced the previous 4th edition of December 2013 as well as the amendments to the fourth edition of April. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such conditions. Improve the cooperation and enhance of information between anti-money laundering supervisors between them and between them and prudential supervisors and the European Central Bank. 5 th anti-money laundering Directive. On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union.

Source: blog.scorechain.com

Source: blog.scorechain.com

On 19 June 2018 the 5 th anti-money laundering Directive Directive EU 2018843 which amended the 4 th anti-money laundering Directive was published in the Official Journal of the European Union. The central bank in any nation gives complete guides to AML and CFT to fight such actions. Proposed in July 2016 as part of the EUs plans to combat terrorism the 5th EU Anti-Money Laundering Directive AMLD 5 entered into force on the 9th of July 2018. FIFTH ANTI-MONEY LAUNDERING DIRECTIVE AMLD 5 Coverage of the crypto market. By design the AMLD5 is meant to become an inherent part of the laws of Member States MS whilst leaving some leeway when it.

Source:

Source:

Set up central bank account registries or retrieval systems in all Member States. The new AML Directive by the Central Bank and shell companies-February 2019 The Central Bank of Cyprus CBC has issued last February 2019 the 5th edition of the Directive on the Prevention of Money Laundering and Terrorist Financing the CBC AMLCFT Directive which replaced the previous 4th edition of December 2013 as well as the amendments to the fourth edition of April. The Directive also obliges all EU member states to create maintain central bank and payment account registers or central retrieval systems. Proposed in July 2016 as part of the EUs plans to combat terrorism the 5th EU Anti-Money Laundering Directive AMLD 5 entered into force on the 9th of July 2018. Information available in the central registers and the beneficial ownership information.

Source: pinterest.com

Source: pinterest.com

The 5th AML Directive provides for the requirement for Member States to establish centralized automated mechanisms such as registers or data retrieval systems so as to allow for identification in a timely manner of the holders of bank and payment accounts and safe-deposit boxes 10 as well as their proxy holders and their BOs. Establishment of centralized bank account registers or retrieval systems. Improve the cooperation and enhance of information between anti-money laundering supervisors between them and between them and prudential supervisors and the European Central Bank. With the purpose of more transparent identification of the bank account and payment holders the 5th AML Directive requires Member States to set up centralized bank account registers or retrieval systems. 5 th anti-money laundering Directive.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 5th aml directive central bank by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas