14+ 5th aml directive countries information

Home » about money loundering Info » 14+ 5th aml directive countries informationYour 5th aml directive countries images are ready. 5th aml directive countries are a topic that is being searched for and liked by netizens today. You can Download the 5th aml directive countries files here. Get all free photos and vectors.

If you’re searching for 5th aml directive countries pictures information related to the 5th aml directive countries topic, you have come to the right site. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

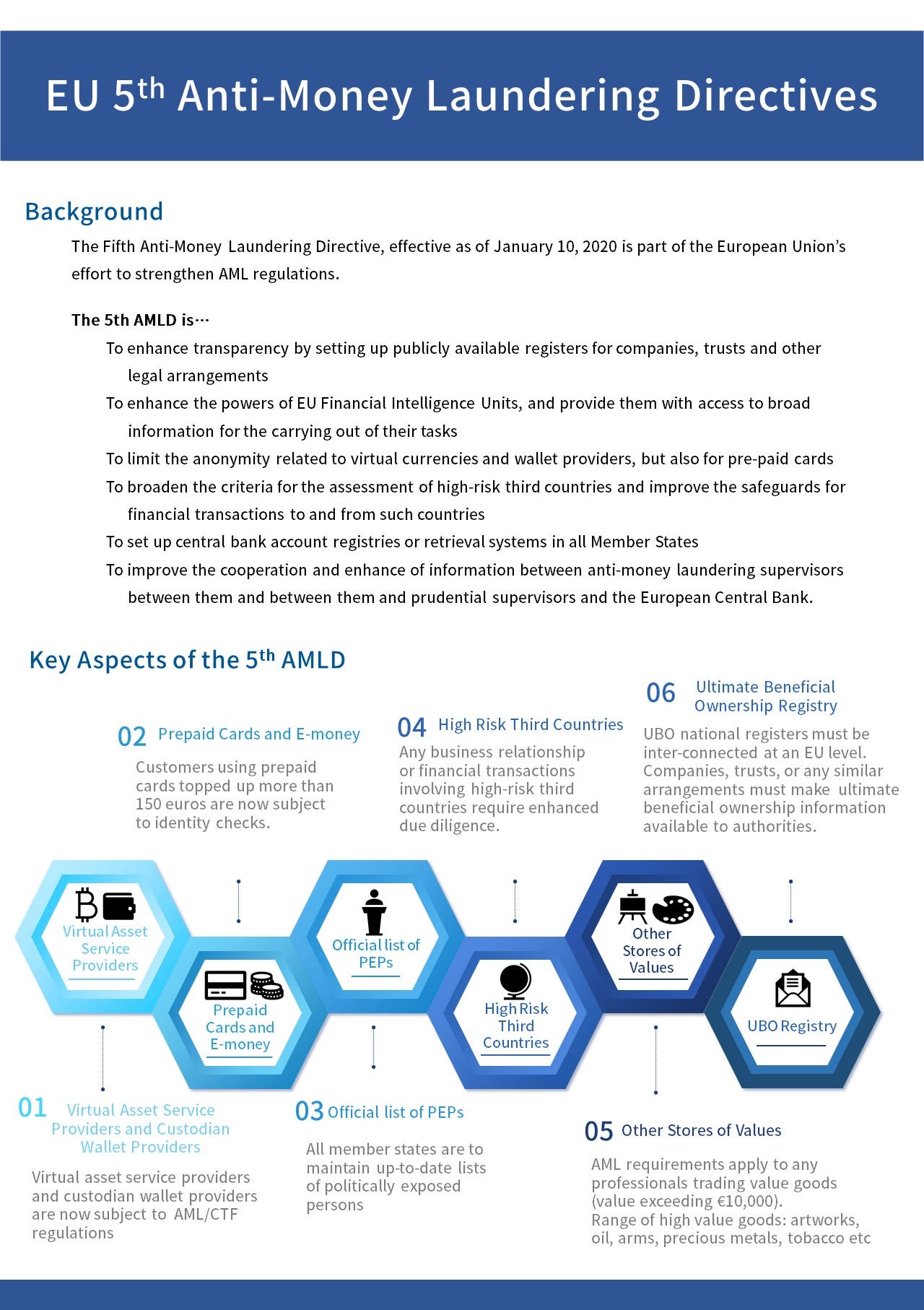

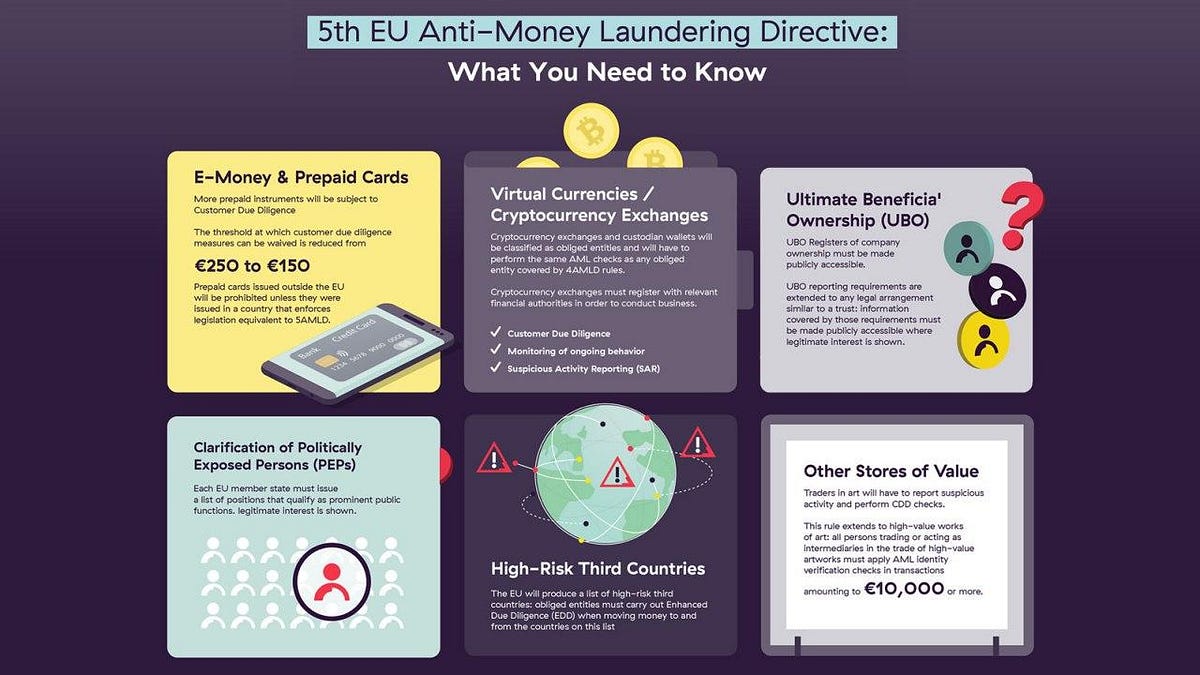

5th Aml Directive Countries. The 5th anti-money laundering directive. Significant change to the nature of terrorist attacks from organised groups to lone operators. EU Member States will then have 18 months to implement the Fifth AML Directive into national law 10 January 2020 deadline. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive.

European Commission Recommendations For Strengthening The Anti Money Laundering Framework From amleurope.com

European Commission Recommendations For Strengthening The Anti Money Laundering Framework From amleurope.com

EU Member States will then have 18 months to implement the Fifth AML Directive into national law 10 January 2020 deadline. The fourth directive caused some confusion in the general insurance sector as it was unclear if any of it applied. On May 14 after nearly two years of negotiations and counterproposals the European Parliament and Council adopted the fifth and latest update to the European Unions Anti-Money Laundering Directive 5AMLD. Afghanistan Bosnia and Herzegovina Guyana Iraq the Lao Peoples Democratic Republic Syria Uganda Vanuatu Yemen Ethiopia Sri Lanka Trinidad and Tobago Tunisia Iran and the Democratic Peoples Republic of Korea DPRK. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the largescale obfuscation of funds. The UK and EU member states began integrating 5MLD into individual country AML and CFT regulations from January 2020.

Obtaining information on.

Czechia Spain Cyprus Hungary Malta The Netherlands Portugal Romania Slovenia and Slovakia FIFTH. EU Member States will then have 18 months to implement the Fifth AML Directive into national law 10 January 2020 deadline. The impact of 5AMLD is far-reaching. Countries not yet having implemented AMLD 5. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. According to the delegated COM Regulations 20161675 2018105 and 2018212 these currently include the following third countries.

Source: shuftipro.com

Source: shuftipro.com

The directive notes that this new legislation is in part a response to the terror attacks that have happened within EU member states over the past few years namely in Britain France and Belgium. Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections. On May 14 after nearly two years of negotiations and counterproposals the European Parliament and Council adopted the fifth and latest update to the European Unions Anti-Money Laundering Directive 5AMLD. Significant change to the nature of terrorist attacks from organised groups to lone operators. The 5th anti-money laundering directive.

Source: idmerit.com

Source: idmerit.com

EU Member States will then have 18 months to implement the Fifth AML Directive into national law 10 January 2020 deadline. The additional requirements in 5MLD have been in part driven by recent events. The directive notes that this new legislation is in part a response to the terror attacks that have happened within EU member states over the past few years namely in Britain France and Belgium. On 20 February 2020 the European Commission issued letters of formal notice that urge 8 EU Member States to transpose the 5 th Anti-Money Laundering Directive. The Fifth AML Directive will enter into force on 9 July 2018.

Source: newbanking.com

Source: newbanking.com

The 5th Anti-Money laundering directive has been adopted and entered into force on 9 July 2018. According to the delegated COM Regulations 20161675 2018105 and 2018212 these currently include the following third countries. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. Parliament and the member states reached an initial agreement on the amendments in the 5AMLD in December 2017. The 5th Anti-Money laundering directive has been adopted and entered into force on 9 July 2018.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

2 As of January 10 2019 only eleven countries Belgium Bulgaria Ireland Greece Croatia Italy Latvia Luxemburg Austria Finland and Sweden have indicated on the EU portal updated weekly that they have implemented AML 5 into their legislation available at httpseur-lexeuropaeulegal-contentENNIMuriCELEX3A32018L0843. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the largescale obfuscation of funds. The EU continues to tighten its grip on money laundering. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive.

Source: medium.com

Source: medium.com

On 20 February 2020 the European Commission issued letters of formal notice that urge 8 EU Member States to transpose the 5 th Anti-Money Laundering Directive. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections. The fifth directive must be transposed into UK law by 20th January 2020 as always subject to any issues surrounding Brexit. TIGHTER AML CONTROLS IN FIFTH ANTI-MONEY LAUNDERING DIRECTIVE.

Source: camsafroza.com

Source: camsafroza.com

Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives. Countries not yet having implemented AMLD 5. The fourth directive caused some confusion in the general insurance sector as it was unclear if any of it applied. The fifth directive must be transposed into UK law by 20th January 2020 as always subject to any issues surrounding Brexit. The directive notes that this new legislation is in part a response to the terror attacks that have happened within EU member states over the past few years namely in Britain France and Belgium.

Source: mooncatchermeme.com

Source: mooncatchermeme.com

On May 14 after nearly two years of negotiations and counterproposals the European Parliament and Council adopted the fifth and latest update to the European Unions Anti-Money Laundering Directive 5AMLD. The impact of 5AMLD is far-reaching. Parliament and the member states reached an initial agreement on the amendments in the 5AMLD in December 2017. 5AMLD 5th Anti-Money Laundering Directive. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues.

Source: ec.europa.eu

Source: ec.europa.eu

Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. Obtaining information on. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the largescale obfuscation of funds. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. EU Member States will then have 18 months to implement the Fifth AML Directive into national law 10 January 2020 deadline.

Source: fineksus.com

Source: fineksus.com

On May 14 after nearly two years of negotiations and counterproposals the European Parliament and Council adopted the fifth and latest update to the European Unions Anti-Money Laundering Directive 5AMLD. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive. The EU continues to tighten its grip on money laundering. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Due to the lack or delay of the notification of national transposition measures or their incompleteness an infringement proceeding for non-communication of the national transposition measures is pending against.

Source: amleurope.com

Source: amleurope.com

On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive. The fourth directive caused some confusion in the general insurance sector as it was unclear if any of it applied. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives. Significant change to the nature of terrorist attacks from organised groups to lone operators. Czechia Spain Cyprus Hungary Malta The Netherlands Portugal Romania Slovenia and Slovakia FIFTH.

Source: elsavco.com

Source: elsavco.com

Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. The fifth directive must be transposed into UK law by 20th January 2020 as always subject to any issues surrounding Brexit. In Belgium amendments to the law of 18 September 2017 and the implementing decrees are expected. The EU continues to tighten its grip on money laundering. The impact of 5AMLD is far-reaching.

Source: idenfy.com

Source: idenfy.com

According to the delegated COM Regulations 20161675 2018105 and 2018212 these currently include the following third countries. The EU continues to tighten its grip on money laundering. Obtaining information on. On 20 February 2020 the European Commission issued letters of formal notice that urge 8 EU Member States to transpose the 5 th Anti-Money Laundering Directive. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive.

Source: branddocs.com

Source: branddocs.com

On May 14 after nearly two years of negotiations and counterproposals the European Parliament and Council adopted the fifth and latest update to the European Unions Anti-Money Laundering Directive 5AMLD. The Euro The Euro Letters were sent to the Netherlands Portugal Romania Cyprus Hungary Slovakia Slovenia and Spain for not having notified the EC of any implementation measures for the 5 th Anti-Money Laundering Directive. Czechia Spain Cyprus Hungary Malta The Netherlands Portugal Romania Slovenia and Slovakia FIFTH. Due to the lack or delay of the notification of national transposition measures or their incompleteness an infringement proceeding for non-communication of the national transposition measures is pending against. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 5th aml directive countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas