16+ 5th aml high risk countries ideas in 2021

Home » about money loundering Info » 16+ 5th aml high risk countries ideas in 2021Your 5th aml high risk countries images are ready in this website. 5th aml high risk countries are a topic that is being searched for and liked by netizens today. You can Find and Download the 5th aml high risk countries files here. Download all royalty-free vectors.

If you’re looking for 5th aml high risk countries pictures information related to the 5th aml high risk countries topic, you have pay a visit to the right site. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

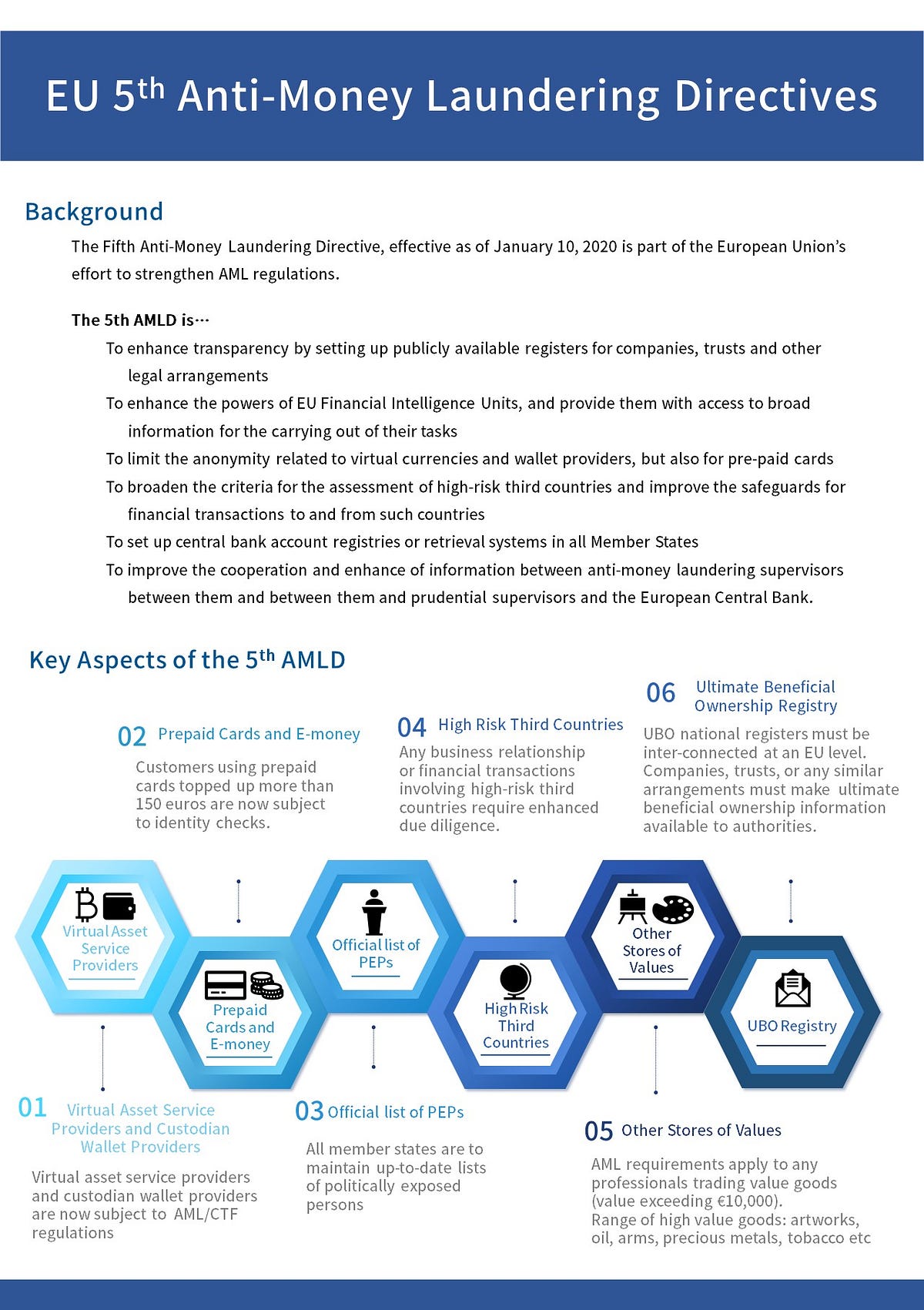

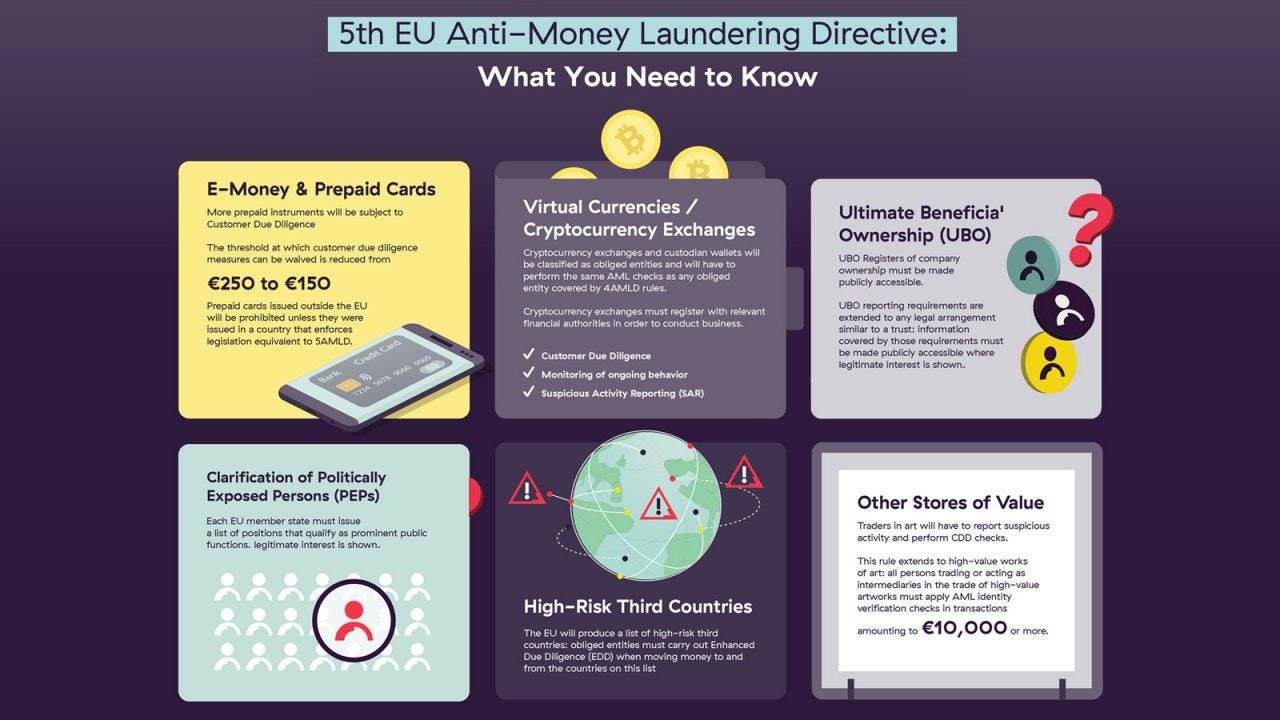

5th Aml High Risk Countries. The Fifth Money-Laundering Directive also looks set to amend the reliable and independent source requirement for verification of customer information. Hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which Member States had to implement by June last year we now have the next instalment the Fifth Anti-Money Laundering Directive 5MLD which comes into force today and. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. The EU continues to tighten its grip on money laundering.

5amld 5th Anti Money Laundering Directive High Risk Third Countries From complyadvantage.com

5amld 5th Anti Money Laundering Directive High Risk Third Countries From complyadvantage.com

5AMLD 5th Anti-Money Laundering Directive. Ad AML coverage from every angle. This amendment will probably mean that the source will have to be provided and stored electronically. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk score. Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries.

The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris.

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The 24 high-risk third countries are. TIGHTER AML CONTROLS IN FIFTH ANTI-MONEY LAUNDERING DIRECTIVE. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. 2 As of January 10 2019 only eleven countries Belgium Bulgaria Ireland Greece Croatia Italy Latvia Luxemburg Austria Finland and Sweden have indicated on the EU portal updated weekly that they have implemented AML 5 into their legislation available at httpseur-lexeuropaeulegal-contentENNIMuriCELEX3A32018L0843.

Source: ec.europa.eu

Source: ec.europa.eu

Latest news reports from the medical literature videos from the experts and more. Amending Delegated Regulation EU 20161675 supplementing Directive EU 2015849 of the European Parliament and of the Council as regards adding the Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia MyanmarBurma Nicaragua Panama and Zimbabwe to the table in point I. Latest news reports from the medical literature videos from the experts and more. The 24 high-risk third countries are. With these sectors now formally classified as higher risk under 5MLD existing obliged entities will need to carry out a risk assessment to understand whether they are transacting in these areas and ensure they are able to conduct appropriate Customer Due Diligence checks in the case of virtual assets this will require screening of both the sender and the beneficiary.

Source: complyadvantage.com

Source: complyadvantage.com

TIGHTER AML CONTROLS IN FIFTH ANTI-MONEY LAUNDERING DIRECTIVE. However other countries may have partially or fully. Ad AML coverage from every angle. The EU continues to tighten its grip on money laundering. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: pinterest.com

Source: pinterest.com

The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The types of enhanced vigilance requirements are basically extra checks and control measures which are defined in article 18a of the Directive. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. Ad AML coverage from every angle. 2 As of January 10 2019 only eleven countries Belgium Bulgaria Ireland Greece Croatia Italy Latvia Luxemburg Austria Finland and Sweden have indicated on the EU portal updated weekly that they have implemented AML 5 into their legislation available at httpseur-lexeuropaeulegal-contentENNIMuriCELEX3A32018L0843.

Source: ec.europa.eu

Source: ec.europa.eu

TIGHTER AML CONTROLS IN FIFTH ANTI-MONEY LAUNDERING DIRECTIVE. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Companies dealing with customers from high-risk third countries will be required to perform enhanced due diligence measures specifically focused on addressing the risk posed by deficiencies in those countries AML protections. 5AMLD 5th Anti-Money Laundering Directive. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries.

Source: in.pinterest.com

Source: in.pinterest.com

The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. This amendment will probably mean that the source will have to be provided and stored electronically. Hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which Member States had to implement by June last year we now have the next instalment the Fifth Anti-Money Laundering Directive 5MLD which comes into force today and. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. With these sectors now formally classified as higher risk under 5MLD existing obliged entities will need to carry out a risk assessment to understand whether they are transacting in these areas and ensure they are able to conduct appropriate Customer Due Diligence checks in the case of virtual assets this will require screening of both the sender and the beneficiary.

Source: researchgate.net

The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk score. New delegated act on high-risk third countries. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. Latest news reports from the medical literature videos from the experts and more.

Source: dpnsee.org

Source: dpnsee.org

TIGHTER AML CONTROLS IN FIFTH ANTI-MONEY LAUNDERING DIRECTIVE. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. Ad AML coverage from every angle. High-Risk Third Countries Companies that do business with customers from high-risk third countries are under 5AMLD required to perform enhanced due diligence measures specifically focused on addressing the deficiencies in those countries AML. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries.

Source: argoskyc.medium.com

Source: argoskyc.medium.com

Amending Delegated Regulation EU 20161675 supplementing Directive EU 2015849 of the European Parliament and of the Council as regards adding the Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia MyanmarBurma Nicaragua Panama and Zimbabwe to the table in point I. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU. High-Risk Third Countries Companies that do business with customers from high-risk third countries are under 5AMLD required to perform enhanced due diligence measures specifically focused on addressing the deficiencies in those countries AML. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime.

Source: medium.com

Source: medium.com

The 24 high-risk third countries are. Latest news reports from the medical literature videos from the experts and more. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. Ad AML coverage from every angle. The types of enhanced vigilance requirements are basically extra checks and control measures which are defined in article 18a of the Directive.

Source: ec.europa.eu

Source: ec.europa.eu

Amending Delegated Regulation EU 20161675 supplementing Directive EU 2015849 of the European Parliament and of the Council as regards adding the Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia MyanmarBurma Nicaragua Panama and Zimbabwe to the table in point I. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. Ad AML coverage from every angle. The EU may also designate a blacklist of high-risk countries for money laundering.

Source: pinterest.com

Source: pinterest.com

New delegated act on high-risk third countries. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. TIGHTER AML CONTROLS IN FIFTH ANTI-MONEY LAUNDERING DIRECTIVE. However other countries may have partially or fully. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources.

Source: pinterest.com

Source: pinterest.com

It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. Hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which Member States had to implement by June last year we now have the next instalment the Fifth Anti-Money Laundering Directive 5MLD which comes into force today and. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Latest news reports from the medical literature videos from the experts and more.

Source: pinterest.com

Source: pinterest.com

Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. Amending Delegated Regulation EU 20161675 supplementing Directive EU 2015849 of the European Parliament and of the Council as regards adding the Bahamas Barbados Botswana Cambodia Ghana Jamaica Mauritius Mongolia MyanmarBurma Nicaragua Panama and Zimbabwe to the table in point I. Hot on the heels of the Fourth Anti-Money Laundering Directive 4MLD which Member States had to implement by June last year we now have the next instalment the Fifth Anti-Money Laundering Directive 5MLD which comes into force today and. Ad AML coverage from every angle. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk score.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5th aml high risk countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas