18+ 5th anti money laundering directive uk trusts information

Home » about money loundering idea » 18+ 5th anti money laundering directive uk trusts informationYour 5th anti money laundering directive uk trusts images are ready. 5th anti money laundering directive uk trusts are a topic that is being searched for and liked by netizens today. You can Get the 5th anti money laundering directive uk trusts files here. Download all royalty-free images.

If you’re searching for 5th anti money laundering directive uk trusts pictures information linked to the 5th anti money laundering directive uk trusts keyword, you have come to the right site. Our website always gives you hints for seeking the highest quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

5th Anti Money Laundering Directive Uk Trusts. Fifth Money Laundering Directive Although the UK is currently on path to leave the EU on 31 January 2020 the EUs Fifth Money Laundering Directive 5MLD was implemented in the UK on 10 January 2020 when the 2019 Regulation was passed. Notwithstanding Brexit the EU 5th Anti Money Laundering Directive 5MLD must now be implemented by the UK Government and has a significant impact on trusts. UKs anti-money laundering and counter terrorist financing regime is up-to-date effective and proportionate. UK implementation of the Fifth Money Laundering Directive.

Time To Act The Uk Trust Register And The Fifth Money Laundering Directive Wilberforce Chambers From wilberforce.co.uk

Time To Act The Uk Trust Register And The Fifth Money Laundering Directive Wilberforce Chambers From wilberforce.co.uk

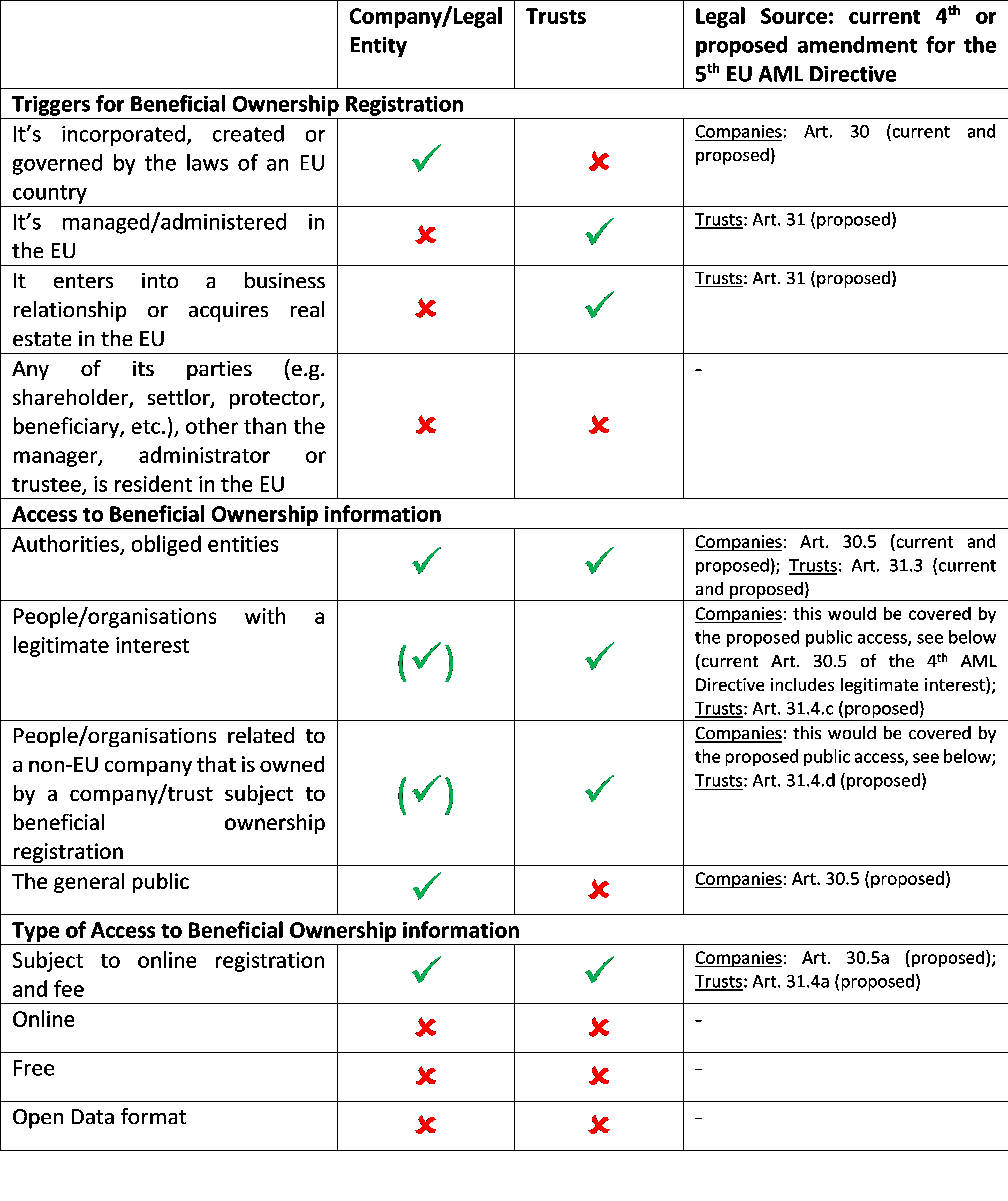

The legislation came into force on 6 October 2020 and has wide-ranging. Changes include an extension to the range of trusts that must be registered and a requirement for trusts to share certain information on publicly accessible registers. New rules were introduced on 6 October 2020 which extend the scope of the trust register to all UK express trusts and some non-UK trusts regardless of whether the trust has to pay any tax but with some specific exclusions. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of. 5MLD contains amendments to 4MLD which will improve transparency and the existing. The Fifth EU Money Laundering Directive 5MLD is to be implemented into UK law by January 2020.

The Fourth EU Money Laundering Directive 4MLD was the reason that HMRC introduced the Trust Registration Service which broadly requires all trusts with tax liabilities to register with HMRC.

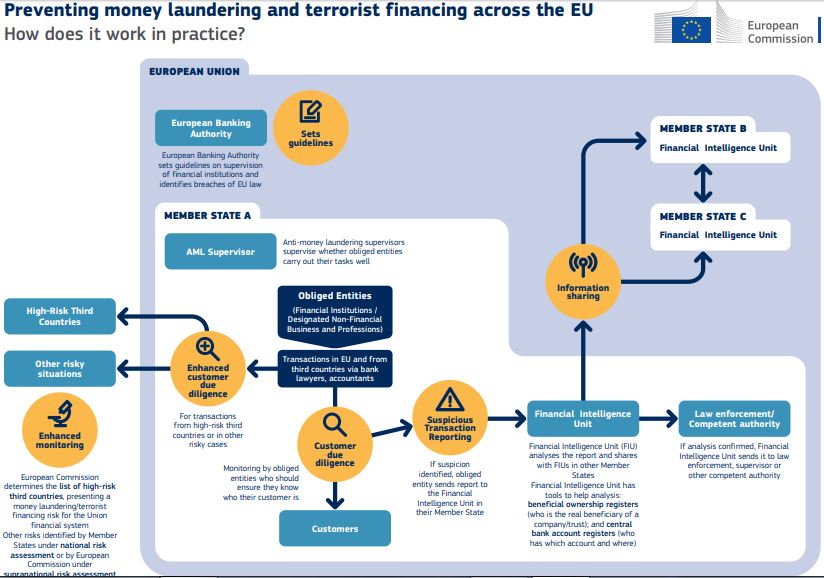

The 5 th AMLD is the latest EU directive intended to strengthen the preventative framework designed to counter money laundering and the financing of terrorist activity across the EU. Changes include an extension to the range of trusts that must be registered and a requirement for trusts to share certain information on publicly accessible registers. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law. UK implementation of the Fifth Money Laundering Directive. The Government has introduced new legislation which increases reporting obligations for trusts following its implementation of the European Unions Fifth Money Laundering Directive 5MLD.

Source: researchgate.net

Source: researchgate.net

Read our response to the original consultation The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. The Fourth EU Money Laundering Directive 4MLD was the reason that HMRC introduced the Trust Registration Service which broadly requires all trusts with tax liabilities to register with HMRC. Read our response to the original consultation The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. Fifth Money Laundering Directive Although the UK is currently on path to leave the EU on 31 January 2020 the EUs Fifth Money Laundering Directive 5MLD was implemented in the UK on 10 January 2020 when the 2019 Regulation was passed. The Government has introduced new legislation which increases reporting obligations for trusts following its implementation of the European Unions Fifth Money Laundering Directive 5MLD.

Source: vinciworks.com

Source: vinciworks.com

New rules were introduced on 6 October 2020 which extend the scope of the trust register to all UK express trusts and some non-UK trusts regardless of whether the trust has to pay any tax but with some specific exclusions. The legislation came into force on 6 October 2020 and has wide-ranging. The consultation outlined how the government intended to implement changes to the Trust Registration Service TRS as required by the Fifth Money Laundering Directive the Directive. Read our response to the original consultation The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. New rules were introduced on 6 October 2020 as part of the UKs implementation of the Fifth Money Laundering Directive 5MLD which extend the scope of.

Source: lawscot.org.uk

Source: lawscot.org.uk

Read our response to the original consultation The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. Fifth Money Laundering Directive and Trust Registration Service. Following a consultation held earlier this year on the changing requirements for trusts to register beneficial ownership information following the implementation of the EUs fifth anti-money laundering directive 5MLD in January 2020 the government has published a summary of responses 18 page 291KB PDF and clarified the new requirements. Notwithstanding Brexit the EU 5th Anti Money Laundering Directive 5MLD must now be implemented by the UK Government and has a significant impact on trusts.

Source: farrer.co.uk

Source: farrer.co.uk

5MLD contains amendments to 4MLD which will improve transparency and the existing. The regulations did not cover trust registration. Changes include an extension to the range of trusts that must be registered and a requirement for trusts to share certain information on publicly accessible registers. On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. Although the UK has committed to leaving the EU it still intends to implement the directive.

Source: vinciworks.com

Source: vinciworks.com

New sweeping blanket requirement to register nearly all UK connected trusts under Fifth Anti-Money Laundering Directive News 14-07-2021 London Whilst the Fifth EU Anti-Money Laundering Directive 5MLD came into force on 6 October 2020 with little fanfare the impact it will have on trusts with a UK connection could well be dramatic. Fifth Money Laundering Directive and Trust Registration Service. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law. New sweeping blanket requirement to register nearly all UK connected trusts under Fifth Anti-Money Laundering Directive News 14-07-2021 London Whilst the Fifth EU Anti-Money Laundering Directive 5MLD came into force on 6 October 2020 with little fanfare the impact it will have on trusts with a UK connection could well be dramatic. UK implementation of the Fifth Money Laundering Directive.

Source: willsworldwide.com

Source: willsworldwide.com

Notwithstanding Brexit the EU 5th Anti Money Laundering Directive 5MLD must now be implemented by the UK Government and has a significant impact on trusts. In April 2019 the government sought views on transposing the Fifth Money Laundering Directive into national law. The consultation outlined how the government intended to implement changes to the Trust Registration Service TRS as required by the Fifth Money Laundering Directive the Directive. The Government has introduced new legislation which increases reporting obligations for trusts following its implementation of the European Unions Fifth Money Laundering Directive 5MLD. UKs anti-money laundering and counter terrorist financing regime is up-to-date effective and proportionate.

The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of. The consultation outlined how the government intended to implement changes to the Trust Registration Service TRS as required by the Fifth Money Laundering Directive the Directive. Read our response to the original consultation The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. New rules were introduced on 6 October 2020 as part of the UKs implementation of the Fifth Money Laundering Directive 5MLD which extend the scope of. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of.

Source: taxjustice.net

Source: taxjustice.net

The regulations did not cover trust registration. On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. Read our response to the original consultation The government then issued regulations that came into force on 10 January 2020 relating to most aspects of transposition. Notwithstanding Brexit the EU 5th Anti Money Laundering Directive 5MLD must now be implemented by the UK Government and has a significant impact on trusts. New rules were introduced on 6 October 2020 which extend the scope of the trust register to all UK express trusts and some non-UK trusts regardless of whether the trust has to pay any tax but with some specific exclusions.

Source: mortgagefinancegazette.com

Source: mortgagefinancegazette.com

The regulations did not cover trust registration. This change has been driven by the EUs Fifth Money Laundering Directive the effect of which has despite Brexit been brought into English law by the Money Laundering and Terrorist Financing Amendment EU Exit Regulations 2020 most of which came into force on 6 October 2020 2020 Regulations. New rules were introduced on 6 October 2020 as part of the UKs implementation of the Fifth Money Laundering Directive 5MLD which extend the scope of. The UK was obliged to implement the directive as we remained a member of the EU on 10 January 2020 the date by which the 5 th AMLD had to be incorporated into member. The Fourth EU Money Laundering Directive 4MLD was the reason that HMRC introduced the Trust Registration Service which broadly requires all trusts with tax liabilities to register with HMRC.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The Fifth EU Money Laundering Directive 5MLD is to be implemented into UK law by January 2020. On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. The Government has introduced new legislation which increases reporting obligations for trusts following its implementation of the European Unions Fifth Money Laundering Directive 5MLD. The consultation outlined how the government intended to implement changes to the Trust Registration Service TRS as required by the Fifth Money Laundering Directive the Directive. Notwithstanding Brexit the EU 5th Anti Money Laundering Directive 5MLD must now be implemented by the UK Government and has a significant impact on trusts.

Source: wilberforce.co.uk

Source: wilberforce.co.uk

The UK was obliged to implement the directive as we remained a member of the EU on 10 January 2020 the date by which the 5 th AMLD had to be incorporated into member. The Government has introduced new legislation which increases reporting obligations for trusts following its implementation of the European Unions Fifth Money Laundering Directive 5MLD. On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. The regulations did not cover trust registration. Although the UK has committed to leaving the EU it still intends to implement the directive.

Source: ekothinking.wordpress.com

Source: ekothinking.wordpress.com

Fifth Money Laundering Directive Although the UK is currently on path to leave the EU on 31 January 2020 the EUs Fifth Money Laundering Directive 5MLD was implemented in the UK on 10 January 2020 when the 2019 Regulation was passed. On 24 January 2020 HM Revenue Customs HMRC and HM Treasury published a technical consultation Fifth Money Laundering Directive and Trust Registration Service. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of. Although the UK has committed to leaving the EU it still intends to implement the directive. Following a consultation held earlier this year on the changing requirements for trusts to register beneficial ownership information following the implementation of the EUs fifth anti-money laundering directive 5MLD in January 2020 the government has published a summary of responses 18 page 291KB PDF and clarified the new requirements.

Source: researchgate.net

UKs anti-money laundering and counter terrorist financing regime is up-to-date effective and proportionate. New sweeping blanket requirement to register nearly all UK connected trusts under Fifth Anti-Money Laundering Directive News 14-07-2021 London Whilst the Fifth EU Anti-Money Laundering Directive 5MLD came into force on 6 October 2020 with little fanfare the impact it will have on trusts with a UK connection could well be dramatic. New rules were introduced on 6 October 2020 as part of the UKs implementation of the Fifth Money Laundering Directive 5MLD which extend the scope of. The consultation outlined how the government intended to implement changes to the Trust Registration Service TRS as required by the Fifth Money Laundering Directive the Directive. 5MLD contains amendments to 4MLD which will improve transparency and the existing.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5th anti money laundering directive uk trusts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information