18+ 5th money laundering directive cdd ideas in 2021

Home » about money loundering idea » 18+ 5th money laundering directive cdd ideas in 2021Your 5th money laundering directive cdd images are available. 5th money laundering directive cdd are a topic that is being searched for and liked by netizens now. You can Download the 5th money laundering directive cdd files here. Download all royalty-free vectors.

If you’re looking for 5th money laundering directive cdd images information connected with to the 5th money laundering directive cdd keyword, you have visit the ideal blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly search and find more informative video content and images that match your interests.

5th Money Laundering Directive Cdd. The FCAs latest pronouncement 23 December 2019 on 5MLD stated. Welcome to our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law.

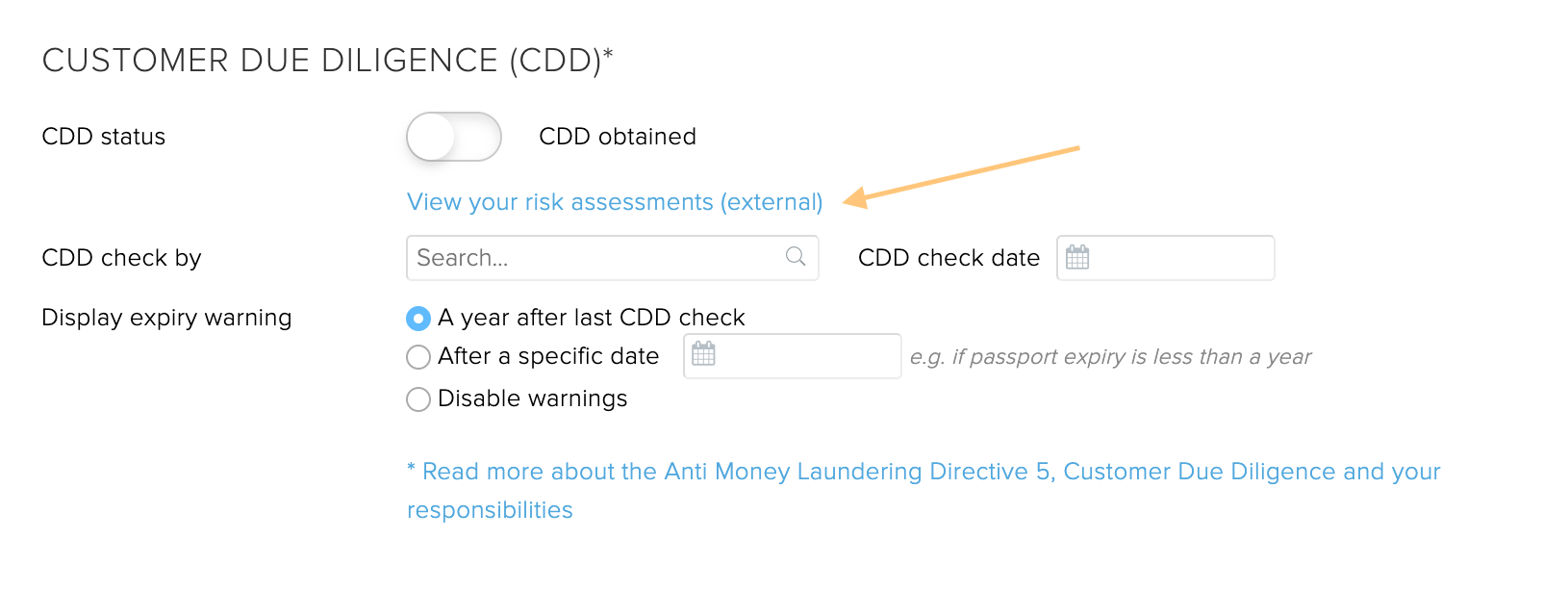

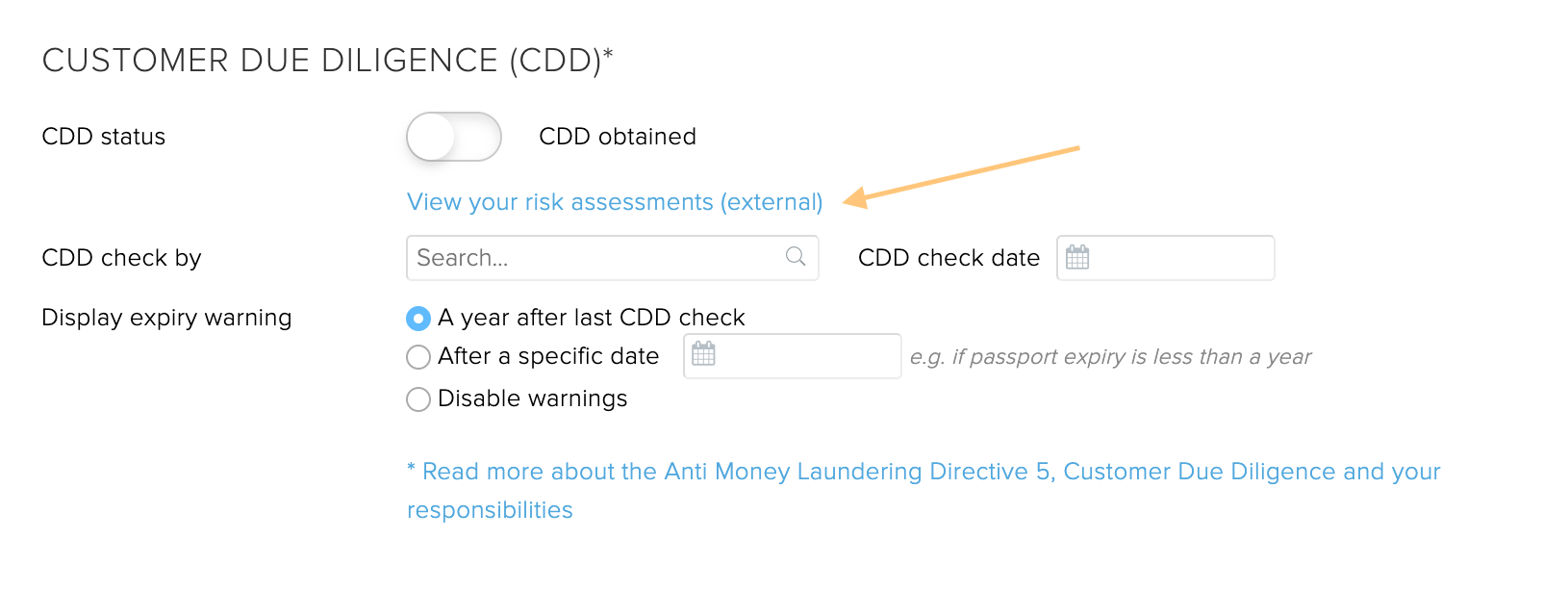

The Eu Anti Money Laundering Directive 5 Amld5 Customer Due Diligence Cdd Artlogic Artlogic Support From support.artlogic.net

The Eu Anti Money Laundering Directive 5 Amld5 Customer Due Diligence Cdd Artlogic Artlogic Support From support.artlogic.net

Transposition of the EUs Fifth Money Laundering Directive 5MLD into UK Law 1 January 2019 HM Treasury the UK Governments economic and finance ministry issued on 15 April 2019 a consultation on the introduction of the EUs 5MLD into UK law. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. 5MLD will lower the existing EUR 250 threshold for identification to EUR 150 in respect of non-reloadable prepaid payment instruments to which CDD measures apply when used face-to-face. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues.

The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework.

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Transposition of the EUs Fifth Money Laundering Directive 5MLD into UK Law 1 January 2019 HM Treasury the UK Governments economic and finance ministry issued on 15 April 2019 a consultation on the introduction of the EUs 5MLD into UK law. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. The Bill will transpose the Fifth EU Money Laundering Directive the Directive. This directive mainly concerns Crypto service providers. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: coinfirm.com

Source: coinfirm.com

The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. In this article well discuss its key changes and hear from industry experts. The Bill will transpose the Fifth EU Money Laundering Directive the Directive. The consultation closes on 10 June 2019. The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris.

Source: complyadvantage.com

Source: complyadvantage.com

More stringent provisions will also apply for prepaid cards used on the internet so that anonymous use will not be possible online. On 10 January 2020 changes to the Governments Money Laundering Regulations are coming into force And now literally as this article was being prepared we have seen the first official Government confirmation that the changes do indeed take effect from today. This month were exploring - Customer Due Diligence CDD. Transposition of the EUs Fifth Money Laundering Directive 5MLD into UK Law 1 January 2019 HM Treasury the UK Governments economic and finance ministry issued on 15 April 2019 a consultation on the introduction of the EUs 5MLD into UK law. The fifth Anti-Money Laundering Directive AMLD5 The fifth Anti-Money Laundering Directive entered into force in January 2020.

Source: coinfirm.com

Source: coinfirm.com

The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Welcome to our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. The Bill will transpose the Fifth EU Money Laundering Directive the Directive.

Source: guidehouse.com

Source: guidehouse.com

In this article well discuss its key changes and hear from industry experts. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law.

Source: idenfy.com

Source: idenfy.com

The consultation closes on 10 June 2019. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. 5 th anti-money laundering Directive. The impact of 5AMLD is far-reaching. The consultation closes on 10 June 2019.

Source: globaldataconsortium.com

Source: globaldataconsortium.com

The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law. January 10 2020 saw the implementation of increased efforts from the UK and the European Union to increase anti-money laundering regulations. This month were exploring - Customer Due Diligence CDD. 5MLD will lower the existing EUR 250 threshold for identification to EUR 150 in respect of non-reloadable prepaid payment instruments to which CDD measures apply when used face-to-face.

Source: support.artlogic.net

Source: support.artlogic.net

On 10 January 2020 changes to the Governments Money Laundering Regulations are coming into force And now literally as this article was being prepared we have seen the first official Government confirmation that the changes do indeed take effect from today. The revised FATF Recommendations demonstrate that in order to be able to cooperate fully and comply swiftly with information requests from competent authorities for the purposes of the prevention detection or investigation of money laundering and terrorist financing obliged entities should maintain for at least five years the necessary information obtained through customer due diligence. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law. 5MLD will lower the existing EUR 250 threshold for identification to EUR 150 in respect of non-reloadable prepaid payment instruments to which CDD measures apply when used face-to-face. Welcome to our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do.

Source: fineksus.com

Source: fineksus.com

The new rules are part of the European Commissions Commission wider action plan for strengthening the fight against terrorist financing which is a direct result of the 2015 terrorist attacks in Paris. The fifth Anti-Money Laundering Directive AMLD5 The fifth Anti-Money Laundering Directive entered into force in January 2020. In this article well discuss its key changes and hear from industry experts. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law. The Member States had to transpose this Directive by 10 January 2020.

Source: sygna.io

Source: sygna.io

The Member States had to transpose this Directive by 10 January 2020. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. On 10 January 2020 changes to the Governments Money Laundering Regulations are coming into force And now literally as this article was being prepared we have seen the first official Government confirmation that the changes do indeed take effect from today. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. This will bring Ireland in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework.

Source: softelligence.net

Source: softelligence.net

January 10 2020 saw the implementation of increased efforts from the UK and the European Union to increase anti-money laundering regulations. The Fifth Money Laundering Directive 5MLD the latest in the EUs arsenal in combating financial crime introduces key changes to the current anti-money laundering AML regime. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. The impact of 5AMLD is far-reaching. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: sygna.io

More stringent provisions will also apply for prepaid cards used on the internet so that anonymous use will not be possible online. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. 5 th anti-money laundering Directive. This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020.

Source: integress.co.uk

Source: integress.co.uk

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The Bill will transpose the Fifth EU Money Laundering Directive the Directive. This directive mainly concerns Crypto service providers. This will bring Ireland in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework.

Source: medium.com

Source: medium.com

This will bring Ireland in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. The impact of 5AMLD is far-reaching. 5MLD will lower the existing EUR 250 threshold for identification to EUR 150 in respect of non-reloadable prepaid payment instruments to which CDD measures apply when used face-to-face. This is known as the Fifth Anti-Money Laundering Directive of the 5th AMLD The measures put forth are focused on digital forms of payment and digital transactions. 5 th anti-money laundering Directive.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5th money laundering directive cdd by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information