20++ 5th money laundering directive insurance ideas in 2021

Home » about money loundering Info » 20++ 5th money laundering directive insurance ideas in 2021Your 5th money laundering directive insurance images are available. 5th money laundering directive insurance are a topic that is being searched for and liked by netizens now. You can Get the 5th money laundering directive insurance files here. Get all free photos.

If you’re searching for 5th money laundering directive insurance pictures information connected with to the 5th money laundering directive insurance keyword, you have visit the ideal blog. Our site always gives you hints for viewing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

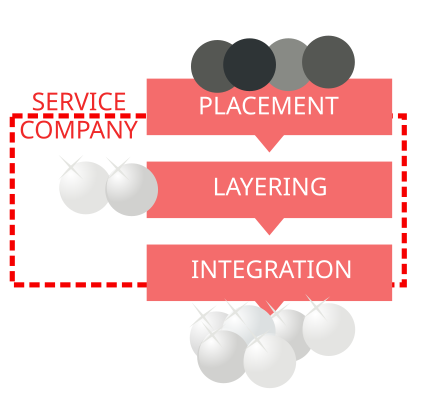

5th Money Laundering Directive Insurance. Implemented in June 2017 this AML-CFT directive allowed a risk-based graded approach. The 5 th Anti-Money Laundering Directive 5AMLD stipulates strict conditions which have to be met for e-money products to be issued anonymously. Extends the scope to virtual currency platforms. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of money laundering and.

All You Need To Know About Anti Money Laundering Aml Compliance From fineksus.com

All You Need To Know About Anti Money Laundering Aml Compliance From fineksus.com

With the 5th EU Anti-Money Laundering Directive EU Directive 2018843 of May 30 2018 which entered into force on July 9 2018 the European legislator now intends to further improve the preventive regime created by the implementation of the 4th EU Anti-Money Laundering Directive in order to combat money laundering practices and terrorist financing more effectively. Member States shall ensure that money laundering and terrorist financing are prohibited. HM Revenue and Customs HMRC published a further technical consultation on 24 January 2020 the Consultation which included draft legislative provisions amending the relevant part of the Money Laundering Terrorist Financing and. The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law. This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing. The 5th anti-money laundering directive.

The consultation outlined how the government intended to implement changes to the Trust Registration.

MLD5 introduces a number of key reforms to the anti-money laundering and counter-terrorist financing regime including. The limit for non-rechargeable prepaid products has been reduced from EUR 250 to EUR 150. The directive called for. The 5th anti-money laundering directive. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the largescale obfuscation of. With the 5th EU Anti-Money Laundering Directive EU Directive 2018843 of May 30 2018 which entered into force on July 9 2018 the European legislator now intends to further improve the preventive regime created by the implementation of the 4th EU Anti-Money Laundering Directive in order to combat money laundering practices and terrorist financing more effectively.

Source: researchgate.net

Source: researchgate.net

Key Changes introduced by the 2021 Act Bringing certain dealers and intermediaries in the art trade within the scope of the regime. Why the need for 5MLD. It was established that there was a need to increase the overall transparency of the European economic and financial environment hence the introduction for the Fifth Money Laundering Directive 1 5MLD which aims to strengthen the measures and controls provided for under the Money Laundering Terrorist Financing and Transfer of Funds. Trusts and the new Fifth Money Laundering Directive 23 December 2019 This note provides an update on the Fifth Money Laundering Directive MLD5 and in particular it focuses on the impact on trustees in the UK their reporting obligations and. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of money laundering and.

Source: thepaypers.com

Source: thepaypers.com

The directive called for. On 10 January 2020 changes to the Governments Money Laundering Regulations came into force. The directive called for. It was established that there was a need to increase the overall transparency of the European economic and financial environment hence the introduction for the Fifth Money Laundering Directive 1 5MLD which aims to strengthen the measures and controls provided for under the Money Laundering Terrorist Financing and Transfer of Funds. Setting up a beneficial ownership register.

Source: pinterest.com

Source: pinterest.com

Anonymous issuances of e-money are now only permitted below this. MLD5 introduces a number of key reforms to the anti-money laundering and counter-terrorist financing regime including. The main changes are focused on enhanced powers for direct access to information and increased transparency around beneficial ownership information and trusts. This page highlights some specific new areas that firms need to comply with. A technical consultation Fifth Money Laundering Directive and Trust Registration Service.

Source: idenfy.com

Source: idenfy.com

The Money Laundering and Terrorist Financing Amendment Regulations 2019. This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing. The 5th Money Laundering Directive 1 5MLD came into force on the 10th January 2020. The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law. We provide an update below on how the UK will transpose the EU Fifth Money Laundering Directive the Directive.

Source: idmerit.com

Source: idmerit.com

The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of money laundering and. The consultation outlined how the government intended to implement changes to the Trust Registration. Why the need for 5MLD. The impact of 5AMLD is far-reaching.

Source: wikiwand.com

Source: wikiwand.com

This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing. At the beginning of the year the Fifth Money Laundering Directive AMLD5 was implemented in Germany. The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law. A technical consultation Fifth Money Laundering Directive and Trust Registration Service. HM Revenue and Customs HMRC published a further technical consultation on 24 January 2020 the Consultation which included draft legislative provisions amending the relevant part of the Money Laundering Terrorist Financing and.

Source: complyadvantage.com

Source: complyadvantage.com

The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the largescale obfuscation of. The impact of 5AMLD is far-reaching. A technical consultation Fifth Money Laundering Directive and Trust Registration Service. This page highlights some specific new areas that firms need to comply with. They update the UKs AML regime to incorporate international standards set by the Financial Action Task Force FATF and to transpose the EUs 5th Money Laundering Directive.

Source: mondaq.com

Source: mondaq.com

The 5th anti-money laundering directive. Thereby the German Money Laundering Act was subjected to an extensive reform in regards to penalty infringements within the scope of the Transparency Register. The 5 th Anti-Money Laundering Directive 5AMLD stipulates strict conditions which have to be met for e-money products to be issued anonymously. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. On 19 April 2018 the European Parliament adopted the 5th AntiMoney Laundering Directive.

Source: camsafroza.com

Source: camsafroza.com

Why the need for 5MLD. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. The directive called for. The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law.

Source: iclg.com

Source: iclg.com

The Fifth Anti-Money Laundering Directive MLD5 entered into force on 9 July 2018 and Member States have until 10 January 2020 to transpose the majority of its provisions. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. HM Revenue and Customs HMRC published a further technical consultation on 24 January 2020 the Consultation which included draft legislative provisions amending the relevant part of the Money Laundering Terrorist Financing and. The impact of 5AMLD is far-reaching. The 2021 Act amends the Criminal Justice Money Laundering and Terrorist Financing Act 2010 2010 Act and transposes the Fifth Money Laundering Directive - Directive EU 2018843 5MLD into Irish Law.

Source: fineksus.com

Source: fineksus.com

The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. Member States shall ensure that money laundering and terrorist financing are prohibited. This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues.

Source: newsoncompliance.com

Source: newsoncompliance.com

5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD. MLD5 introduces a number of key reforms to the anti-money laundering and counter-terrorist financing regime including. This Directive aims to prevent the use of the Unions financial system for the purposes of money laundering and terrorist financing. 5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the largescale obfuscation of.

Source: arachnys.com

Source: arachnys.com

Extends the scope to virtual currency platforms. Key Changes introduced by the 2021 Act Bringing certain dealers and intermediaries in the art trade within the scope of the regime. Extends the scope to virtual currency platforms. 5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD. This page highlights some specific new areas that firms need to comply with.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5th money laundering directive insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas