12++ 5th money laundering directive uk fca info

Home » about money loundering Info » 12++ 5th money laundering directive uk fca infoYour 5th money laundering directive uk fca images are available in this site. 5th money laundering directive uk fca are a topic that is being searched for and liked by netizens today. You can Get the 5th money laundering directive uk fca files here. Download all free vectors.

If you’re searching for 5th money laundering directive uk fca images information linked to the 5th money laundering directive uk fca keyword, you have come to the ideal blog. Our site always gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

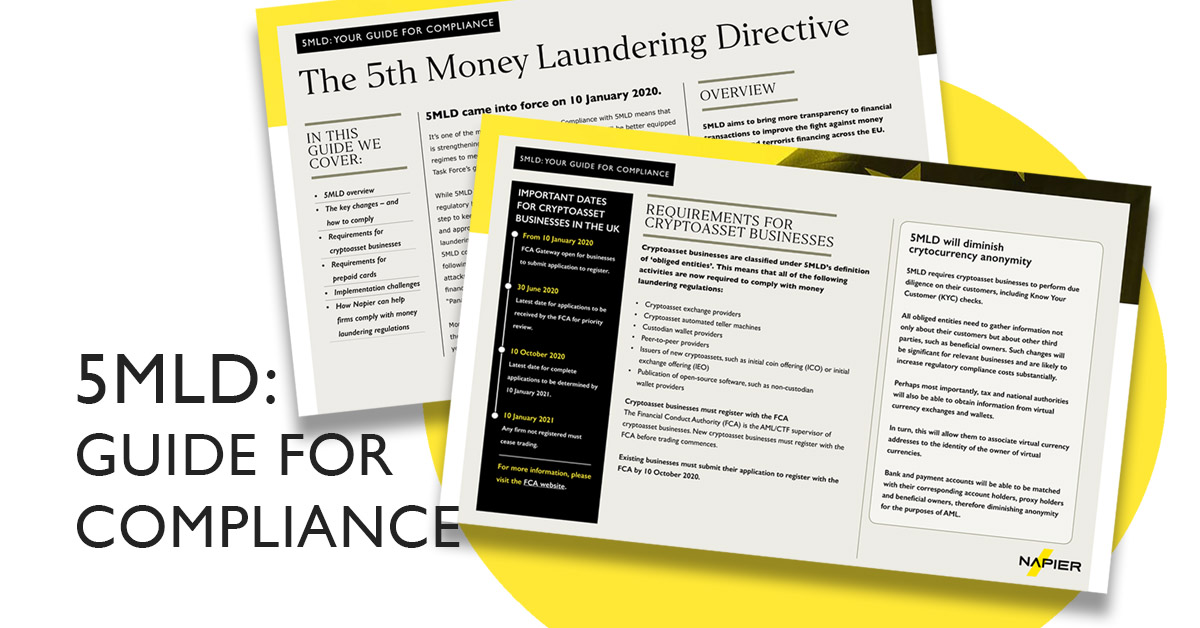

5th Money Laundering Directive Uk Fca. 5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the. The latest version the 5th Anti-Money Laundering Directive is said to further strengthen transparency and the existing preventative framework whilst ensuring the UK adheres to international. The Directive will come into force on 10th January 2020 and contains enhancements to the existing provisions as mandated by the EUs 4th Money Laundering Directive 4MLD which was. 5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD.

Fintech And Fincrime The Global Regulatory Landscape From shuftipro.com

Fintech And Fincrime The Global Regulatory Landscape From shuftipro.com

On 10 January 2020 updates to the UK anti-money laundering and counter-terrorist financing together AML laws come into force that bring the UK in line with international standards set by the Financial Action Task Force FATF and implement the EUs Fifth Money Laundering Directive the 2019 Amendments. The UK amended its anti-money laundering AML framework on 10 January 2020 enforcing Money Laundering and Terrorist Financing Amendment Regulations 2019. The impact of 5AMLD is far-reaching. The consultation document detailed the steps that the government proposed to meet the UKs obligation to transpose the directive EU 2018843 5MLD into UK law by 10 January 2020. The Anti Money Laundering Directives aimed to effect industry change at all levels via revised scope and defined reductions in threshold values. Key changes re-defining the AML.

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues.

5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The 5th Money Laundering Directive 5MLD was implemented on 10 January 2020. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. The following are the high-level changes it makes to comply with standards set by the Financial Action Task Force FATF and the EUs Fifth Anti-Money Laundering Directive 5 AMLD. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of money laundering and.

Source: medium.com

Source: medium.com

The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The following are the high-level changes it makes to comply with standards set by the Financial Action Task Force FATF and the EUs Fifth Anti-Money Laundering Directive 5 AMLD. The UKs revisions implement the European Unions Fifth Anti-Money Laundering Directive commonly referred to as 5MLD 1 and are designed to strengthen the UKs AML and CTF regimes in order to meet the Financial Action Task Forces global standards. The latest version the 5th Anti-Money Laundering Directive is said to further strengthen transparency and the existing preventative framework whilst ensuring the UK adheres to international.

Source: ar.pinterest.com

Source: ar.pinterest.com

The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. The impact of 5AMLD is far-reaching. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as. The Money Laundering and Terrorist Financing Amendment Regulations 2019. On 10 January 2020 updates to the UK anti-money laundering and counter-terrorist financing together AML laws come into force that bring the UK in line with international standards set by the Financial Action Task Force FATF and implement the EUs Fifth Money Laundering Directive the 2019 Amendments.

Source: argos-solutions.io

Source: argos-solutions.io

5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the. Revisions to its anti-money laundering and counter terrorist financing regime come into force on 10 January 2020. The purpose of 5MLD is to strengthen the UKs financial system in order to prevent criminals laundering money and funding terrorism. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. Key changes re-defining the AML.

Source: pinterest.com

Source: pinterest.com

4MLD was predominantly transposed into UK law through the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. 5 MLD replaces 4MLD with the intention of improving transparency and the existing preventative framework to more effectively counter money laundering and terrorist financing across the EU. The latest version the 5th Anti-Money Laundering Directive is said to further strengthen transparency and the existing preventative framework whilst ensuring the UK adheres to international. On 10 January 2020 updates to the UK anti-money laundering and counter-terrorist financing together AML laws come into force that bring the UK in line with international standards set by the Financial Action Task Force FATF and implement the EUs Fifth Money Laundering Directive the 2019 Amendments. 5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the.

Source: u.today

Source: u.today

The UKs revisions implement the European Unions Fifth Anti-Money Laundering Directive commonly referred to as 5MLD 1 and are designed to strengthen the UKs AML and CTF regimes in order to meet the Financial Action Task Forces global standards. The Anti Money Laundering Directives aimed to effect industry change at all levels via revised scope and defined reductions in threshold values. Her Majestys Treasury published a consultation paper on the UKs transposition efforts relating to the EUs 5th Money Laundering Directive 5MLD earlier this year. 5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the. Revisions to its anti-money laundering and counter terrorist financing regime come into force on 10 January 2020.

Source: lavenpartners.com

Source: lavenpartners.com

Her Majestys Treasury published a consultation paper on the UKs transposition efforts relating to the EUs 5th Money Laundering Directive 5MLD earlier this year. Her Majestys Treasury published a consultation paper on the UKs transposition efforts relating to the EUs 5th Money Laundering Directive 5MLD earlier this year. The Money Laundering and Terrorist Financing Amendment Regulations 2019. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. The 5th Money Laundering Directive 1 5MLD came into force on the 10th January 2020.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

UK implementation of the Fifth Money Laundering Directive Regulatory change waits for no firm and whilst firms have only recently completed implementing the fourth money laundering directive 4MLD into their sales practices firms now need to get ready to implement the fifth money laundering directive. 4MLD was predominantly transposed into UK law through the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. 5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD. 5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the. The consultation document detailed the steps that the government proposed to meet the UKs obligation to transpose the directive EU 2018843 5MLD into UK law by 10 January 2020.

Source: pinterest.com

Source: pinterest.com

The 5th Money Laundering Directive 5MLD was implemented on 10 January 2020. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. On 10 January 2020 updates to the UK anti-money laundering and counter-terrorist financing together AML laws come into force that bring the UK in line with international standards set by the Financial Action Task Force FATF and implement the EUs Fifth Money Laundering Directive the 2019 Amendments. Her Majestys Treasury published a consultation paper on the UKs transposition efforts relating to the EUs 5th Money Laundering Directive 5MLD earlier this year. In April 2019 the government held a consultation seeking views on transposing the Fifth Money Laundering Directive into national law.

On 10 January 2020 updates to the UK anti-money laundering and counter-terrorist financing together AML laws come into force that bring the UK in line with international standards set by the Financial Action Task Force FATF and implement the EUs Fifth Money Laundering Directive the 2019 Amendments. Key changes re-defining the AML. The Money Laundering and Terrorist Financing Amendment Regulations 2019. The Anti Money Laundering Directives aimed to effect industry change at all levels via revised scope and defined reductions in threshold values. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as.

Source: pinterest.com

Source: pinterest.com

4MLD was predominantly transposed into UK law through the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer. 5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD. On 10 January 2020 updates to the UK anti-money laundering and counter-terrorist financing together AML laws come into force that bring the UK in line with international standards set by the Financial Action Task Force FATF and implement the EUs Fifth Money Laundering Directive the 2019 Amendments. The Anti Money Laundering Directives aimed to effect industry change at all levels via revised scope and defined reductions in threshold values. The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of money laundering and.

Source: shuftipro.com

Source: shuftipro.com

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. The Money Laundering and Terrorist Financing Amendment Regulations 2019. 5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the. In April 2019 the government held a consultation seeking views on transposing the Fifth Money Laundering Directive into national law. Key changes re-defining the AML.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

The Directive will come into force on 10th January 2020 and contains enhancements to the existing provisions as mandated by the EUs 4th Money Laundering Directive 4MLD which was. The 5th Money Laundering Directive 5MLD was implemented on 10 January 2020. The transposition of this EU directive has resulted in amendments to the existing Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The 5th Money Laundering Directive 1 5MLD came into force on the 10th January 2020. The consultation document detailed the steps that the government proposed to meet the UKs obligation to transpose the directive EU 2018843 5MLD into UK law by 10 January 2020.

Source: coinfirm.com

Source: coinfirm.com

The Fifth Money Laundering Directive makes amendments to the Fourth Money Laundering Directive on the prevention of the use of the financial system for the purposes of money laundering and. Key changes re-defining the AML. 5MLD was introduced by the EU in relation to changes in how terrorists operate in response to the. The Anti Money Laundering Directives aimed to effect industry change at all levels via revised scope and defined reductions in threshold values. 5MLD is set to build on the regulatory requirements under the 4th Money Laundering Directive 2 4MLD.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5th money laundering directive uk fca by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas