14+ Advance money laundering techniques ideas

Home » about money loundering idea » 14+ Advance money laundering techniques ideasYour Advance money laundering techniques images are available in this site. Advance money laundering techniques are a topic that is being searched for and liked by netizens today. You can Download the Advance money laundering techniques files here. Find and Download all free images.

If you’re looking for advance money laundering techniques pictures information linked to the advance money laundering techniques interest, you have come to the right blog. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

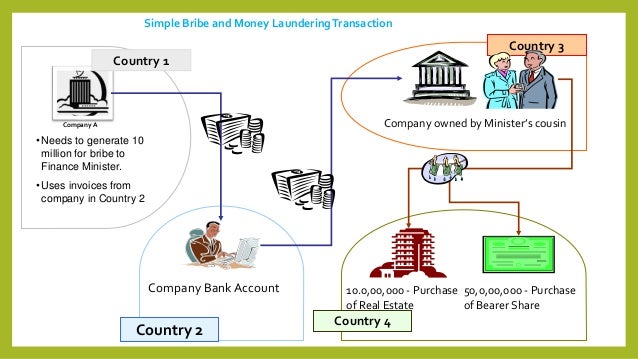

Advance Money Laundering Techniques. Advanced Benfords Law tests are summation and second order. Finally and very much worth looking into further is a very promising ML technique called Bayesian Rules List BRL which combines the best of expert-based systems explainability and the predictive power of some of the best ML based techniques. The techniques used by money launderers are many and varied. This advanced merchant-based fraud scheme takes advantage of legitimate payment ecosystems by.

Money Laundering And Terrorism Financing Prevention Manual From piranirisk.com

Money Laundering And Terrorism Financing Prevention Manual From piranirisk.com

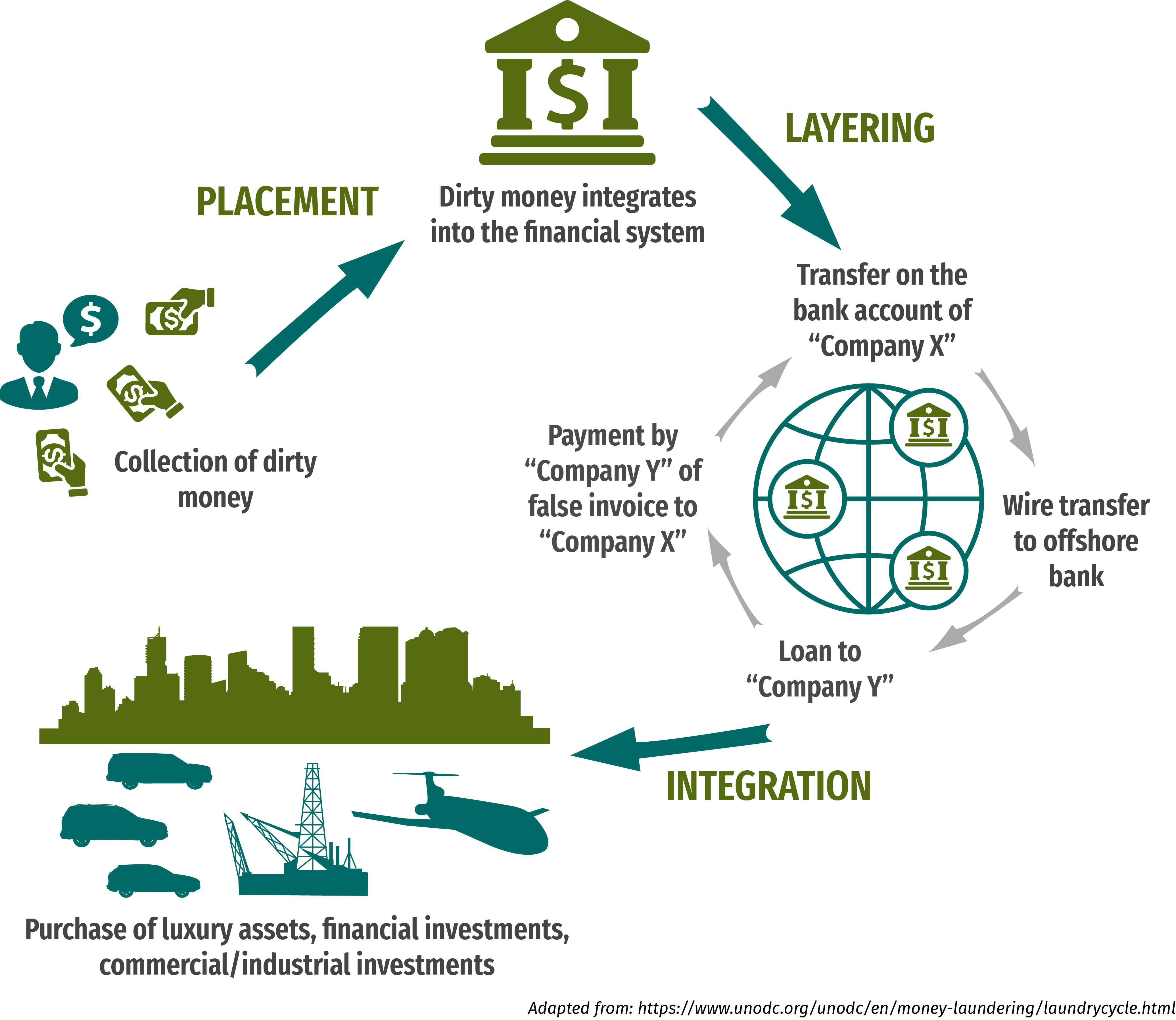

Accordingly the first stage of the money laundering process is known as placement. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as. Benfords analysis when used correctly is a powerful tool for identifying suspect accounts or amounts for further analysis. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. Techniques include deep learning neural networks natural language generation and processing unsupervised learning and clustering robotic process automation and more. The final example of money laundering techniques is the integration of the money back into the economy in such a way as to make it look like a legitimate business transaction with an audit trail.

No good criminal wants their briefcase full of cash taken away.

Anti-money laundering is a process of finding the conversion of black money into white cash. The final example of money laundering techniques is the integration of the money back into the economy in such a way as to make it look like a legitimate business transaction with an audit trail. And TBML is often combined with. Benfords Law tests are the first digit first two digits first three digits and second digit tests. SAS financial crimes solutions include embedded machine learning and other advanced analytics techniques to drastically bolster anti-money laundering efforts. Benfords analysis when used correctly is a powerful tool for identifying suspect accounts or amounts for further analysis.

Source: mckinsey.com

Source: mckinsey.com

In most cases money launderers cover their actions through a series of steps that make it look like money coming from illegal or unethical origin was earned. In most cases money launderers cover their actions through a series of steps that make it look like money coming from illegal or unethical origin was earned. Slowing down the process assists with anti-money laundering measures and allows more time for risk assessments to take place. The sophisticated money launderer usually seeks the part of the financial sector which is the least resistant or the weakest. Accordingly the first stage of the money laundering process is known as placement.

Source: slideshare.net

Source: slideshare.net

No good criminal wants their briefcase full of cash taken away. This technique is based mind you the advantage offered by the laws of the various countries concerning the protection of banking secrecy. With advanced analytics and AI in place banks can tune their algorithms to avoid false positives. Advanced Benfords Law tests are summation and second order. The techniques used by money launderers are many and varied.

Source: researchgate.net

Source: researchgate.net

Money Laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate source. Regardless of the reason why the operational steps of money-laundering techniques involve three stages. Accordingly the first stage of the money laundering process is known as placement. The techniques used by money launderers are many and varied. The sophisticated money launderer usually seeks the part of the financial sector which is the least resistant or the weakest.

Source: slideshare.net

Source: slideshare.net

The purchase of gift certificates is one of the techniques that at the moment is gathering. In most cases money launderers cover their actions through a series of steps that make it look like money coming from illegal or unethical origin was earned. This is a policy where deposits must stay in an account for a minimum of five trading days. The purchase of gift certificates is one of the techniques that at the moment is gathering. Disguise Obscure the money audit trail and sever the link to the original crime.

Source: piranirisk.com

Source: piranirisk.com

The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. This advanced merchant-based fraud scheme takes advantage of legitimate payment ecosystems by. Movement Move the funds away from explicit connection to the illegal activity. The techniques used by money launderers are many and varied. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system.

Source: sas.com

Source: sas.com

And TBML is often combined with. Say for example that the average system flags. They evolve to match the volume of funds to be laundered and the legislative and regulatory environment of the various jurisdictions in which they are laundered. To distinguish TBML and value transfer from legitimate activities of international trade is sometimes quite difficult. Benfords Law tests are the first digit first two digits first three digits and second digit tests.

Source: sas.com

Source: sas.com

Finally and very much worth looking into further is a very promising ML technique called Bayesian Rules List BRL which combines the best of expert-based systems explainability and the predictive power of some of the best ML based techniques. SAS financial crimes solutions include embedded machine learning and other advanced analytics techniques to drastically bolster anti-money laundering efforts. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as. This is a policy where deposits must stay in an account for a minimum of five trading days. They evolve to match the volume of funds to be laundered and the legislative and regulatory environment of the various jurisdictions in which they are laundered.

Source: worldwildlife.org

Source: worldwildlife.org

This advanced merchant-based fraud scheme takes advantage of legitimate payment ecosystems by. Transaction laundering is the new sophisticated form of money laundering and terrorism financing and is one of the biggest challenges facing the AML regime today. This advanced merchant-based fraud scheme takes advantage of legitimate payment ecosystems by. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as.

Source: slideshare.net

Source: slideshare.net

Slowing down the process assists with anti-money laundering measures and allows more time for risk assessments to take place. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system. Say for example that the average system flags. Implement advance and complex monitoring and investigative and reporting tools to combat these problems. Transaction laundering is the new sophisticated form of money laundering and terrorism financing and is one of the biggest challenges facing the AML regime today.

Source: tookitaki.ai

Source: tookitaki.ai

The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as. This is a policy where deposits must stay in an account for a minimum of five trading days. Transaction Laundering is the New Advanced form of Money Laundering. Social Network Analysis AML Techniques. And TBML is often combined with.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Transaction Laundering is the New Advanced form of Money Laundering. Say for example that the average system flags. They evolve to match the volume of funds to be laundered and the legislative and regulatory environment of the various jurisdictions in which they are laundered. The classical methods of money laundering include the structuring of large amounts of money into multiple small transactions at banks often called as smurfing and the use of foreign exchanges cash smugglers and wire transfers to move money across borders. No good criminal wants their briefcase full of cash taken away.

Source: fincen.gov

Source: fincen.gov

Regardless of the reason why the operational steps of money-laundering techniques involve three stages. Say for example that the average system flags. Money Laundering is the process of creating the appearance that large amounts of money obtained from serious crimes such as drug trafficking or terrorist activity originated from a legitimate source. Finally and very much worth looking into further is a very promising ML technique called Bayesian Rules List BRL which combines the best of expert-based systems explainability and the predictive power of some of the best ML based techniques. To distinguish TBML and value transfer from legitimate activities of international trade is sometimes quite difficult.

Source: slideshare.net

Source: slideshare.net

With advanced analytics and AI in place banks can tune their algorithms to avoid false positives. To distinguish TBML and value transfer from legitimate activities of international trade is sometimes quite difficult. Social Network Analysis AML Techniques. Benfords Law tests are the first digit first two digits first three digits and second digit tests. TD Bank group is doing its part by focusing on solving this problem by working with advance anti money laundering tools techniques and resources including Denologix to combat this menacing problem our time.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title advance money laundering techniques by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information