19+ Aim of 5th aml directive ideas in 2021

Home » about money loundering idea » 19+ Aim of 5th aml directive ideas in 2021Your Aim of 5th aml directive images are ready. Aim of 5th aml directive are a topic that is being searched for and liked by netizens now. You can Get the Aim of 5th aml directive files here. Get all free images.

If you’re looking for aim of 5th aml directive images information linked to the aim of 5th aml directive topic, you have pay a visit to the right blog. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Aim Of 5th Aml Directive. The 5th AML Directive. The impact of 5AMLD is far-reaching. The Fifth Money Laundering Directive is now in force and has been transposed into UK law in the form of the Money Laundering and Terrorist Financing Amendment Regulations 2019. The due date for the full adoption of the new.

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

Much of the focus of the Directive is on improving transparency of beneficial ownership including two significant changes. This will bring Ireland in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. In this article well discuss its key changes and hear from industry experts. The 5 th Anti-Money Laundering AML Directive Directive EU 2018843 which is the successor of the 4 th AML Directive was published on 19 June 2018 in the Official Journal of the European Union. On 19 June 2018 Directive EU 2018843 of the European Parliament and of the Council amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU was published in the Official Journal of the EU L 156 43.

With the 5th EU Anti-Money Laundering Directive the European legislator now intends to further improve the preventive regime with the aim of more effectively combatting money laundering practices and terrorist financing.

5 May 2021 Author. The main proposed principles of the 5th AML Directive aim to enhance the transparency within the beneficial owners of the legal entities operating in the European Union via the. This will bring Ireland in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. 02 June 2020 last update on. The deadline for transposition into national law was 10 January 2020 the State was fined 2 million for. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017.

Source: pideeco.be

Source: pideeco.be

In this article well discuss its key changes and hear from industry experts. The Bill will transpose the Fifth EU Money Laundering Directive the Directive. This legislative act is also referred to as the 5th Anti-Money Laundering AML Directive. The 5th AML Directive. The latest round in the EUs struggle against money laundering places further obligations on banks to protect society from criminal predation while EU nations race to bring the Directive into law.

Source: portal.ieu-monitoring.com

Source: portal.ieu-monitoring.com

Banking and financial services. The purpose of the FIU is to collect and analyse the information which they receive with the aim of establishing links between suspicious transactions and underlying criminal activity in order to prevent and combat money laundering and terrorist financing and to disseminate the results of its analysis as well as additional information to the competent authorities where there are grounds to suspect money. Anti-money laundering directive V AMLD V - transposition status. The Fifth Money Laundering Directive is now in force and has been transposed into UK law in the form of the Money Laundering and Terrorist Financing Amendment Regulations 2019. The new regulations amend the Fourth Directive in an effort to clamp down on terrorist financing.

Source: softelligence.net

Source: softelligence.net

This legislative act is also referred to as the 5th Anti-Money Laundering AML Directive. Financial Stability Financial Services and Capital Markets Union. The 5th AML Directive. First firms will be under a new obligation to report discrepancies between the information contained on public registers such as the register of persons of significant control and beneficial ownership information obtained through CDD. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework.

With the 5th EU Anti-Money Laundering Directive the European legislator now intends to further improve the preventive regime with the aim of more effectively combatting money laundering practices and terrorist financing. Banking and financial services. The absolute aim of the 5th AML Directive is to close down criminal finance without disturbing the normal functioning of financial markets and payment systems. The Fifth Money Laundering Directive is now in force and has been transposed into UK law in the form of the Money Laundering and Terrorist Financing Amendment Regulations 2019. Anti-money laundering and countering the financing of terrorism Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth.

Source: fineksus.com

Source: fineksus.com

Anti-money laundering and countering the financing of terrorism Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth. The latest round in the EUs struggle against money laundering places further obligations on banks to protect society from criminal predation while EU nations race to bring the Directive into law. The 5 th Anti-Money Laundering AML Directive Directive EU 2018843 which is the successor of the 4 th AML Directive was published on 19 June 2018 in the Official Journal of the European Union. The deadline for transposition into national law was 10 January 2020 the State was fined 2 million for. Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues.

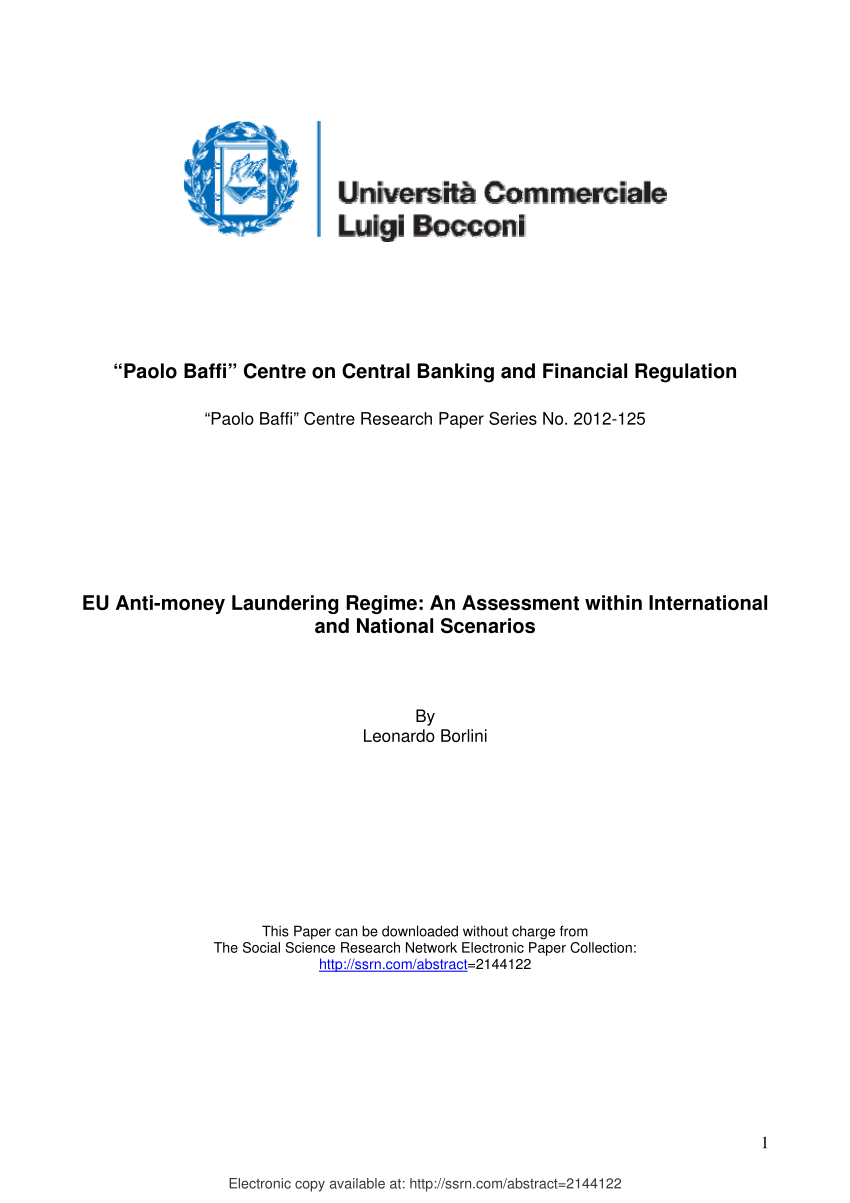

Source: researchgate.net

Source: researchgate.net

The purpose of the FIU is to collect and analyse the information which they receive with the aim of establishing links between suspicious transactions and underlying criminal activity in order to prevent and combat money laundering and terrorist financing and to disseminate the results of its analysis as well as additional information to the competent authorities where there are grounds to suspect money. Anti-money laundering directive V AMLD V - transposition status. The due date for the full adoption of the new. 5 May 2021 Author. The 5thAML Directive aims to put in place certain guidelines for European Member States with a set deadline to implement them by the end of 2019.

Source: psplab.com

Source: psplab.com

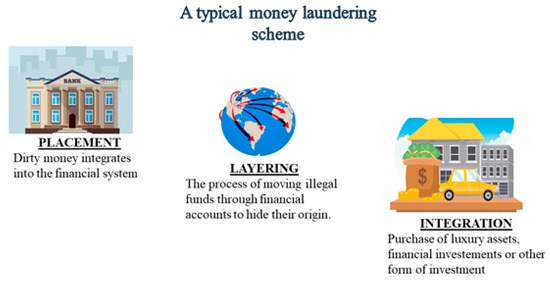

The proposal is part of a Commission action plan against terrorist financing established in 2016 following a spate of terrorist attacks in Europe. On 19 June 2018 Directive EU 2018843 of the European Parliament and of the Council amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU was published in the Official Journal of the EU L 156 43. An extended scope of the persons subject to the anti-money laundering and counter terrorism financing requirements in particular to address terrorism financing risks linked to virtual currencies and anonymous prepaid cards and the constant technological evolutions in such field. The purpose of the FIU is to collect and analyse the information which they receive with the aim of establishing links between suspicious transactions and underlying criminal activity in order to prevent and combat money laundering and terrorist financing and to disseminate the results of its analysis as well as additional information to the competent authorities where there are grounds to suspect money. With the 5th EU Anti-Money Laundering Directive the European legislator now intends to further improve the preventive regime with the aim of more effectively combatting money laundering practices and terrorist financing.

Source: mdpi.com

Source: mdpi.com

The 5thAML Directive aims to put in place certain guidelines for European Member States with a set deadline to implement them by the end of 2019. Financial Stability Financial Services and Capital Markets Union. Anti-money laundering and countering the financing of terrorism Fighting money laundering and terrorist financing contributes to global security integrity of the financial system and sustainable growth. This legislative act is also referred to as the 5th Anti-Money Laundering AML Directive. EU Member States know they need to act together to stand a chance of addressing the massive scale of modern money laundering.

Source: sintesinetwork.com

Source: sintesinetwork.com

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. With the 5th EU Anti-Money Laundering Directive the European legislator now intends to further improve the preventive regime with the aim of more effectively combatting money laundering practices and terrorist financing. On 19 June 2018 Directive EU 2018843 of the European Parliament and of the Council amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU was published in the Official Journal of the EU L 156 43. This legislative act is also referred to as the 5th Anti-Money Laundering AML Directive. The new regulations amend the Fourth Directive in an effort to clamp down on terrorist financing.

Source: merlon.ai

Source: merlon.ai

With the 5th EU Anti-Money Laundering Directive the European legislator now intends to further improve the preventive regime with the aim of more effectively combatting money laundering practices and terrorist financing. The purpose of the FIU is to collect and analyse the information which they receive with the aim of establishing links between suspicious transactions and underlying criminal activity in order to prevent and combat money laundering and terrorist financing and to disseminate the results of its analysis as well as additional information to the competent authorities where there are grounds to suspect money. EU Member States know they need to act together to stand a chance of addressing the massive scale of modern money laundering. The Fifth Anti-Money Laundering Directive 5AMLD came into effect on the 10th January 2020 and serves to address new issues that have been exposed since the Fourth Anti-Money Laundering Directive which came into force back in 2017. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020.

Source: lavenpartners.com

Source: lavenpartners.com

With the 5th EU Anti-Money Laundering Directive the European legislator now intends to further improve the preventive regime with the aim of more effectively combatting money laundering practices and terrorist financing. The due date for the full adoption of the new. This legislative act is also referred to as the 5th Anti-Money Laundering AML Directive. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. The main proposed principles of the 5th AML Directive aim to enhance the transparency within the beneficial owners of the legal entities operating in the European Union via the.

Source: vinciworks.com

Source: vinciworks.com

Much of the focus of the Directive is on improving transparency of beneficial ownership including two significant changes. The proposal is part of a Commission action plan against terrorist financing established in 2016 following a spate of terrorist attacks in Europe. The new regulations amend the Fourth Directive in an effort to clamp down on terrorist financing. EU Member States know they need to act together to stand a chance of addressing the massive scale of modern money laundering. The latest round in the EUs struggle against money laundering places further obligations on banks to protect society from criminal predation while EU nations race to bring the Directive into law.

Source: ec.europa.eu

Source: ec.europa.eu

The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020. In this article well discuss its key changes and hear from industry experts. This legislative act is also referred to as the 5th Anti-Money Laundering AML Directive. The purpose of the FIU is to collect and analyse the information which they receive with the aim of establishing links between suspicious transactions and underlying criminal activity in order to prevent and combat money laundering and terrorist financing and to disseminate the results of its analysis as well as additional information to the competent authorities where there are grounds to suspect money. The deadline for transposition into national law was 10 January 2020 the State was fined 2 million for.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aim of 5th aml directive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information