15+ Aml analyst definition ideas in 2021

Home » about money loundering Info » 15+ Aml analyst definition ideas in 2021Your Aml analyst definition images are available in this site. Aml analyst definition are a topic that is being searched for and liked by netizens today. You can Get the Aml analyst definition files here. Download all free photos and vectors.

If you’re searching for aml analyst definition images information linked to the aml analyst definition interest, you have pay a visit to the right site. Our site always provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Aml Analyst Definition. Typically empowered with an end-to-end anti-money laundering solution or software AML analysts can use digital tools to better understand financial transactions and identify trends. Latest news reports from the medical literature videos from the experts and more. In this position you will be responsible for aiding in risk management by monitoring money as it comes in and out of our institution to look for suspicious transactions. Our bank is seeking an AML Analyst to assist with our anti-money laundering investigations.

Financial Crime Analyst Cv August 2021 From integratedlearning.net

Financial Crime Analyst Cv August 2021 From integratedlearning.net

The Business Analyst will also be responsible for analyzing. Ad AML coverage from every angle. In this position you will be responsible for aiding in risk management by monitoring money as it comes in and out of our institution to look for suspicious transactions. Focus will primarily be on the evolving Actimize Anti-Money Laundering Monitoring platform for Corporate Banking within Corporate Institutional Banking. Our bank is seeking an AML Analyst to assist with our anti-money laundering investigations. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

Latest news reports from the medical literature videos from the experts and more.

Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Admittedly the day to day experience can be different from bank to bank. An AML Anti-Money Laundering Analyst is primarily responsible for monitoring and investigating suspicious financial activity. An anti-money laundering AML analyst or officer basically investigates monitors and manages suspicious financial activity. Focus will primarily be on the evolving Actimize Anti-Money Laundering Monitoring platform for Corporate Banking within Corporate Institutional Banking. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC.

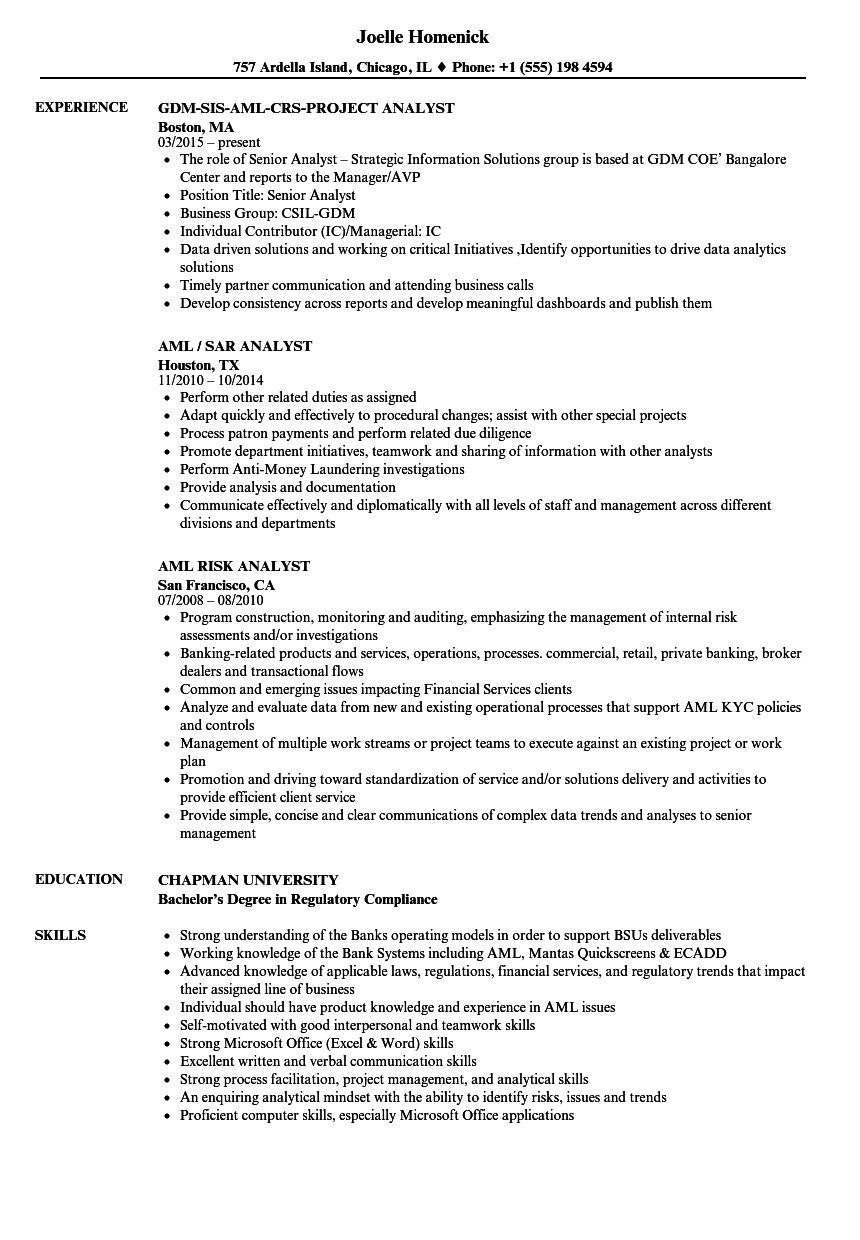

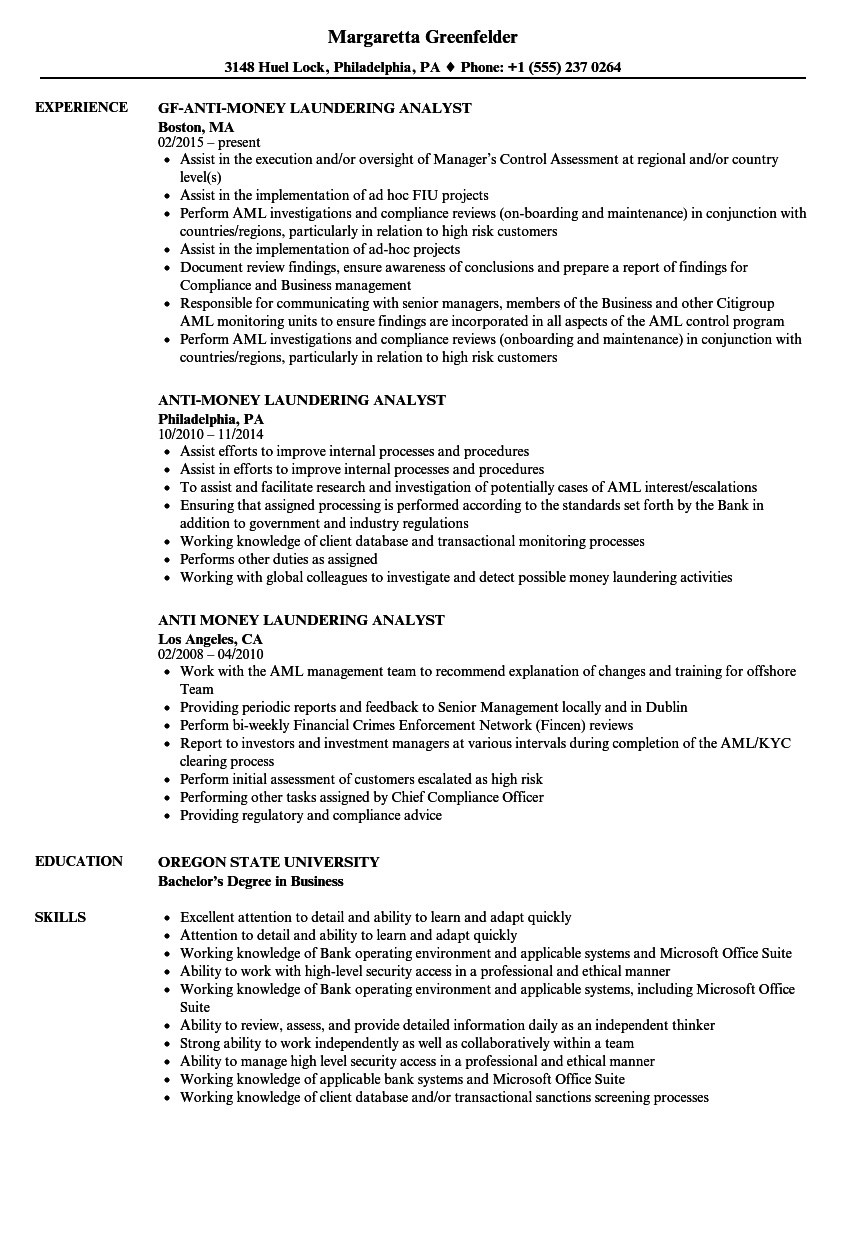

Source: velvetjobs.com

Source: velvetjobs.com

Typically empowered with an end-to-end anti-money laundering solution or software AML analysts can use digital tools to better understand financial transactions and identify trends. The BSAAML Bank Secrecy ActAnti-Money Laundering Business Analyst is responsible for leading business requirements definition to successful completion including the discovery analysis and documentation of business requirements process flows use cases test and training plans within FRBs BSAAML department. An Anti-Money Laundering AML analyst - sometimes referred to as an investigator - essentially monitors and investigates suspicious financial activity. AML Analyst Job Summary. The Senior AML Analyst has the responsibility to perform the organizations anti money laundering AML and counter terrorist financing CTF operations and ensuring that M-PESA and any other qualifying service offered by the organization isare compliant with provisions of the AML Act 2006.

Source: velvetjobs.com

Source: velvetjobs.com

Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Key accountabilities and decision ownership. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. In this position you will be responsible for aiding in risk management by monitoring money as it comes in and out of our institution to look for suspicious transactions.

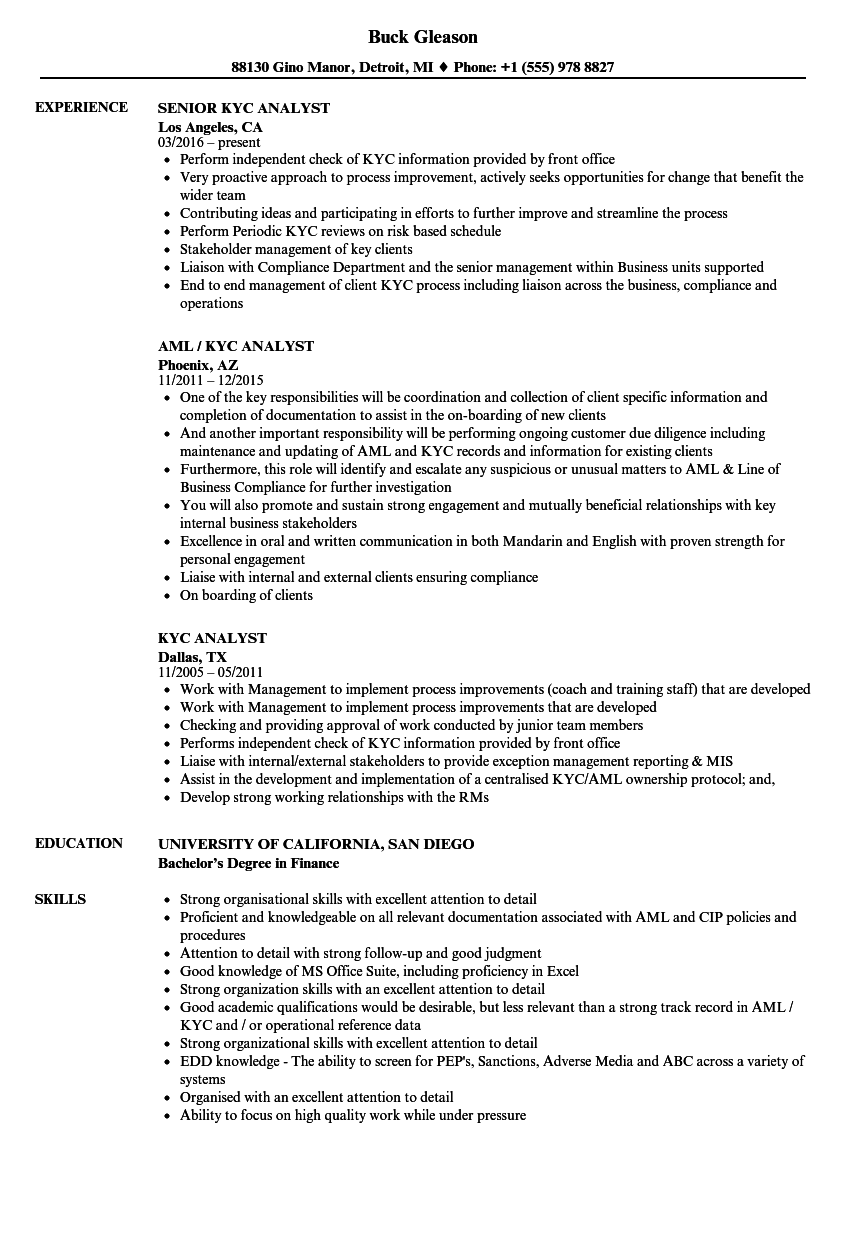

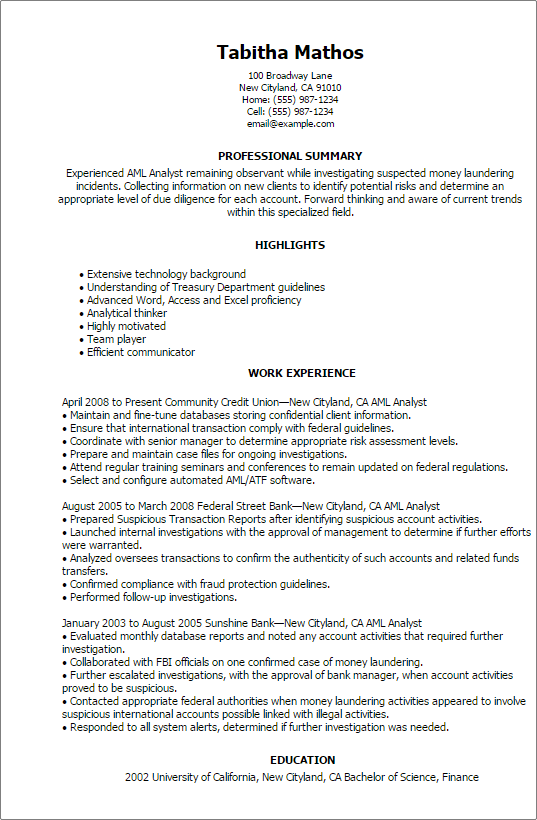

Source: integratedlearning.net

Source: integratedlearning.net

An AML Anti-Money Laundering Analyst is primarily responsible for monitoring and investigating suspicious financial activity. Thats the day to day work of an AML analyst specifically a Transaction Monitoring Analyst working in Correspondent Banking. The Senior AML Analyst has the responsibility to perform the organizations anti money laundering AML and counter terrorist financing CTF operations and ensuring that M-PESA and any other qualifying service offered by the organization isare compliant with provisions of the AML Act 2006. Typically empowered with an end-to-end anti-money laundering solution or software AML analysts can use digital tools to better understand financial transactions and identify trends. They are key personnel within a business to ensure all AML requirements are strictly followed and to prevent businesses companies entities or institutions from being subject to regulatory compliance issues from governing bodies.

Source: integratedlearning.net

Source: integratedlearning.net

Ad AML coverage from every angle. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. The Senior AML Analyst has the responsibility to perform the organizations anti money laundering AML and counter terrorist financing CTF operations and ensuring that M-PESA and any other qualifying service offered by the organization isare compliant with provisions of the AML Act 2006. An AML Anti-Money Laundering Analyst is primarily responsible for monitoring and investigating suspicious financial activity. Focus will primarily be on the evolving Actimize Anti-Money Laundering Monitoring platform for Corporate Banking within Corporate Institutional Banking.

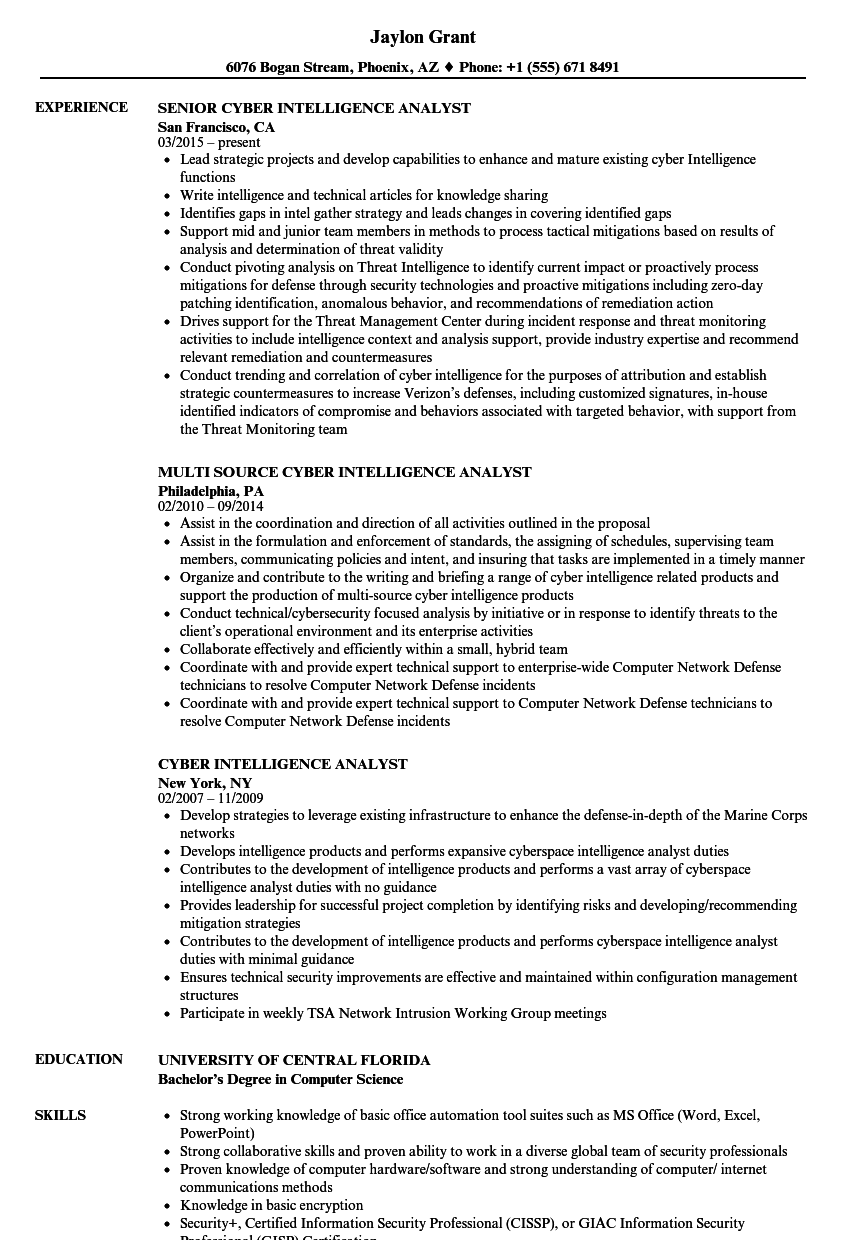

Source: integratedlearning.net

Source: integratedlearning.net

They are key personnel within a business to ensure all AML requirements are strictly followed and to prevent businesses companies entities or institutions from being subject to regulatory compliance issues from governing bodies. They are key personnel within a business to ensure all AML requirements are strictly followed and to prevent businesses companies entities or institutions from being subject to regulatory compliance issues from governing bodies. The BSAAML Bank Secrecy ActAnti-Money Laundering Business Analyst is responsible for leading business requirements definition to successful completion including the discovery analysis and documentation of business requirements process flows use cases test and training plans within FRBs BSAAML department. Ad AML coverage from every angle. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC.

Source: velvetjobs.com

Source: velvetjobs.com

The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. Key accountabilities and decision ownership. An Anti-Money Laundering AML analyst - sometimes referred to as an investigator - essentially monitors and investigates suspicious financial activity. An AML Anti-Money Laundering Analyst is primarily responsible for monitoring and investigating suspicious financial activity. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

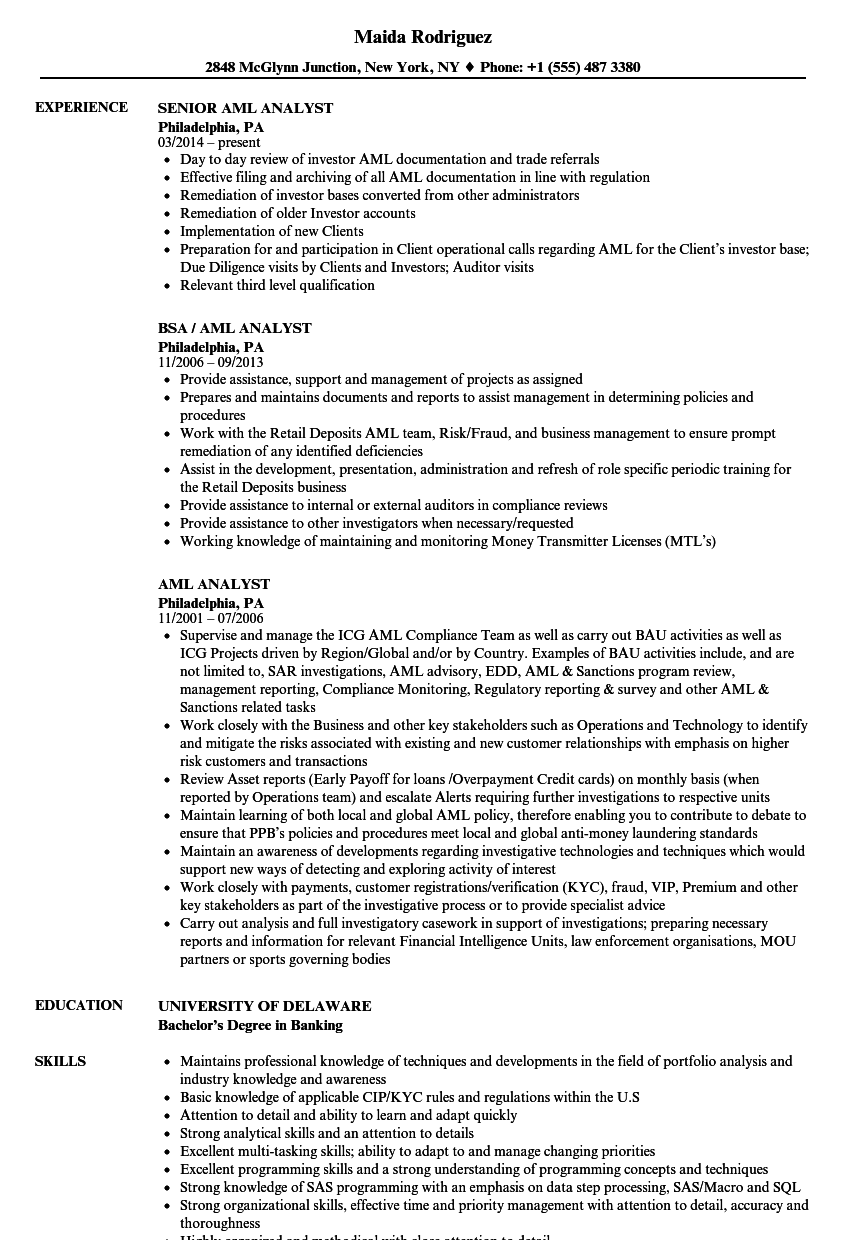

Source: velvetjobs.com

Source: velvetjobs.com

Thats the day to day work of an AML analyst specifically a Transaction Monitoring Analyst working in Correspondent Banking. AML anti-money laundering is a broad process companies do to ensure compliance whereas KYC know your customers is one part of that process. Our bank is seeking an AML Analyst to assist with our anti-money laundering investigations. An AML Anti-Money Laundering Analyst is primarily responsible for monitoring and investigating suspicious financial activity. The role is Business Analyst in the AML Monitoring Corporate Banking domain with experience of working within a dynamic and demanding environment reacting to changing business needs who works equally well as an individual or as part of a team.

Source: in.pinterest.com

Source: in.pinterest.com

The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. Key accountabilities and decision ownership. An Anti-Money Laundering AML analyst - sometimes referred to as an investigator - essentially monitors and investigates suspicious financial activity. Thats the day to day work of an AML analyst specifically a Transaction Monitoring Analyst working in Correspondent Banking. An anti-money laundering AML analyst or officer basically investigates monitors and manages suspicious financial activity.

To do this this analyst begins by sorting the legitimate financial transactions of the company or organization in question from the bad ones in most cases using specialized software. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. The Senior AML Analyst has the responsibility to perform the organizations anti money laundering AML and counter terrorist financing CTF operations and ensuring that M-PESA and any other qualifying service offered by the organization isare compliant with provisions of the AML Act 2006. The role is Business Analyst in the AML Monitoring Corporate Banking domain with experience of working within a dynamic and demanding environment reacting to changing business needs who works equally well as an individual or as part of a team. Thats the day to day work of an AML analyst specifically a Transaction Monitoring Analyst working in Correspondent Banking.

Source: integratedlearning.net

Source: integratedlearning.net

Ad AML coverage from every angle. AML anti-money laundering is a broad process companies do to ensure compliance whereas KYC know your customers is one part of that process. Admittedly the day to day experience can be different from bank to bank. Our bank is seeking an AML Analyst to assist with our anti-money laundering investigations. Key accountabilities and decision ownership.

Source: integratedlearning.net

Source: integratedlearning.net

The Senior AML Analyst has the responsibility to perform the organizations anti money laundering AML and counter terrorist financing CTF operations and ensuring that M-PESA and any other qualifying service offered by the organization isare compliant with provisions of the AML Act 2006. Admittedly the day to day experience can be different from bank to bank. Key accountabilities and decision ownership. They are key personnel within a business to ensure all AML requirements are strictly followed and to prevent businesses companies entities or institutions from being subject to regulatory compliance issues from governing bodies. Our bank is seeking an AML Analyst to assist with our anti-money laundering investigations.

Source: gr.pinterest.com

Source: gr.pinterest.com

In this position you will be responsible for aiding in risk management by monitoring money as it comes in and out of our institution to look for suspicious transactions. Key accountabilities and decision ownership. Ad AML coverage from every angle. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. Thats the day to day work of an AML analyst specifically a Transaction Monitoring Analyst working in Correspondent Banking.

Source: sanctionscanner.com

Source: sanctionscanner.com

AML Analyst Job Summary. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. AML anti-money laundering is a broad process companies do to ensure compliance whereas KYC know your customers is one part of that process. Key accountabilities and decision ownership. Latest news reports from the medical literature videos from the experts and more.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml analyst definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas