17++ Aml comfort letter definition ideas

Home » about money loundering Info » 17++ Aml comfort letter definition ideasYour Aml comfort letter definition images are ready in this website. Aml comfort letter definition are a topic that is being searched for and liked by netizens now. You can Download the Aml comfort letter definition files here. Get all free photos.

If you’re searching for aml comfort letter definition pictures information linked to the aml comfort letter definition interest, you have pay a visit to the right site. Our website frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Aml Comfort Letter Definition. AML LetterIntroducers Letter that states that anti-money laundering policies and procedures are in place which are reasonably designed to verify the identity of its shareholders partnersmembers and their sources of funds as well as checking against OFAC lists shell banks etc. Access the AMLCTF Act. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML.

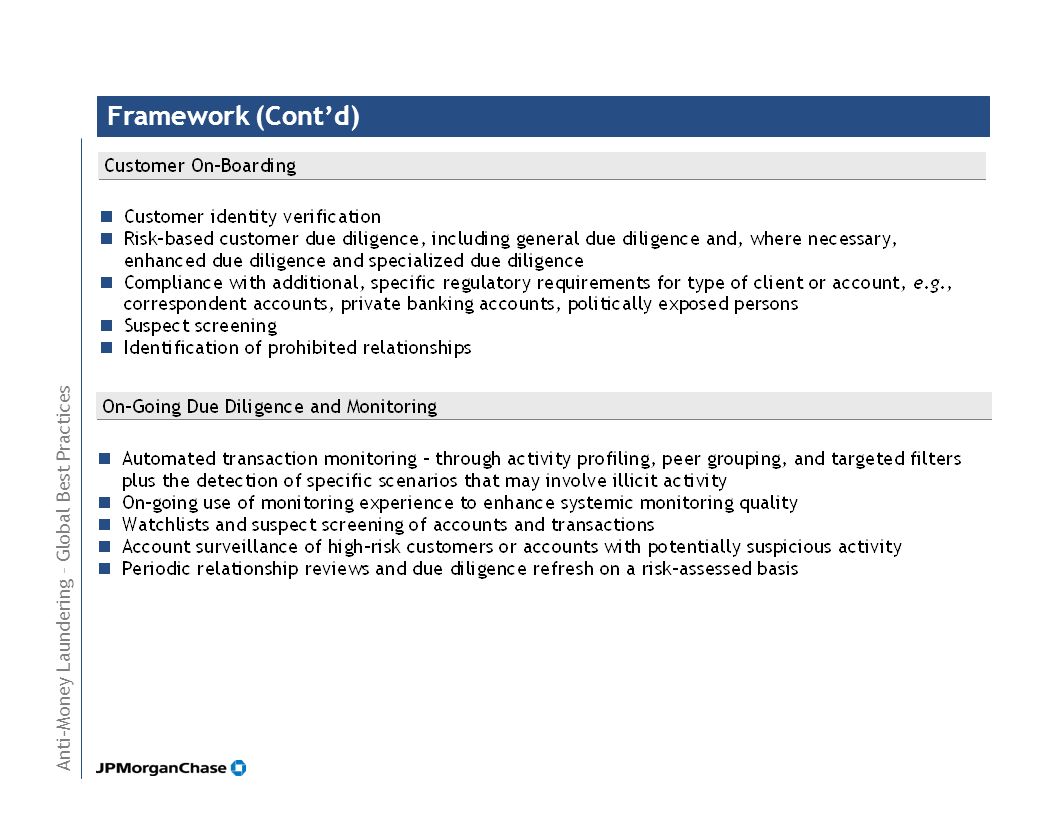

Line Of Business Aml Policies And Procedures Ppt Video Online Download From slideplayer.com

Line Of Business Aml Policies And Procedures Ppt Video Online Download From slideplayer.com

What Is a Comfort Letter. RBCIS shall not open numerated or anonymous accounts. Please tick the provided documents. In addition the auditors will provide a bring. The risk-based approach RBA which is a long-established principle within anti-money laundering AML acknowledges that every situation is different and that the legal practitioners and practices themselves -are best placed to understand the risks and deal with them proportionately. A comfort letter is a document of assurance issued by a parent company or an accounting firm to reassure a subsidiary company of its willingness to provide financial support.

Safeguarding the global financial system is critically important for the economic and national security of.

You can find the AMLCTF Act at the Federal Register of Legislation website. 10 AML comfort letter from the Custodian Nominee stating that they perform KYC due diligence on their Underlying clients. The risk-based approach RBA which is a long-established principle within anti-money laundering AML acknowledges that every situation is different and that the legal practitioners and practices themselves -are best placed to understand the risks and deal with them proportionately. And 2 ensuring that the FSP has the ability to control onward payment to a customer or another party in the event that the third party conducting the AML. This looks set to continue in 2013 if regulators identify further failings in firms compliance with money laundering sanctions and tax requirements. It is an affirmation letter not a confirmation letter that offers backup when a customer requires a loan or a company needs financial help.

Source:

AML LetterIntroducers Letter that states that anti-money laundering policies and procedures are in place which are reasonably designed to verify the identity of its shareholders partnersmembers and their sources of funds as well as checking against OFAC lists shell banks etc. A letter of comfortalso known as a letter of intent or a solvency opinionis a written document that provides a level of assurance that an obligation will ultimately be met. A comfort letter is a business document that is intended to assure the recipient that a financial or contractual obligation with another party can and will be met. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act is the main piece of Australian government legislation that regulates AUSTRACs functions. What Is a Comfort Letter.

Source: slideplayer.com

Source: slideplayer.com

AML LetterIntroducers Letter that states that anti-money laundering policies and procedures are in place which are reasonably designed to verify the identity of its shareholders partnersmembers and their sources of funds as well as checking against OFAC lists shell banks etc. You can find the AMLCTF Act at the Federal Register of Legislation website. The main areas that FSPs in particular investment funds that rely on third parties to satisfy their Cayman AML obligations should think about at this stage are 1 updating disclosures referencing the AML Regulations PCL and Schedule 3 Countries as and when such disclosure documents are being updated. In addition the auditors will provide a bring. This requires adherence to the international standards prescribed.

Source:

In addition the auditors will provide a bring. AML LetterIntroducers Letter that states that anti-money laundering policies and procedures are in place which are reasonably designed to verify the identity of its shareholders partnersmembers and their sources of funds as well as checking against OFAC lists shell banks etc. Access the AMLCTF Act. The guidance is separated into two parts. Anti-Money Laundering Record-breaking fines issued by regulators worldwide notably in the US and UK dominated the financial services landscape in 2012.

Source:

A letter from an independent auditor included in a preliminary prospectus stating that while a full audit has not been undertaken the auditor has done a review sufficient to. Safeguarding the global financial system is critically important for the economic and national security of. The main areas that FSPs in particular investment funds that rely on third parties to satisfy their Cayman AML obligations should think about at this stage are 1 updating disclosures referencing the AML Regulations PCL and Schedule 3 Countries as and when such disclosure documents are being updated. Comfort letter at least two separate letters will be delivered. AML LetterIntroducers Letter that states that anti-money laundering policies and procedures are in place which are reasonably designed to verify the identity of its shareholders partnersmembers and their sources of funds as well as checking against OFAC lists shell banks etc.

A shell bank is defined as a bank incorporated in a jurisdiction in which it has no physical presence and which is unaffiliated with a regulated financial group. In addition the auditors will provide a bring. The risk-based approach RBA which is a long-established principle within anti-money laundering AML acknowledges that every situation is different and that the legal practitioners and practices themselves -are best placed to understand the risks and deal with them proportionately. Please tick the provided documents. And 2 ensuring that the FSP has the ability to control onward payment to a customer or another party in the event that the third party conducting the AML.

Source: pinterest.com

Source: pinterest.com

Comfort letter at least two separate letters will be delivered. Comfort letter at least two separate letters will be delivered. RBCIS shall not open numerated or anonymous accounts. The AML Law prohibits relations with a shell bank or with a bank known to allow a shell bank to use its accounts. What Is a Comfort Letter.

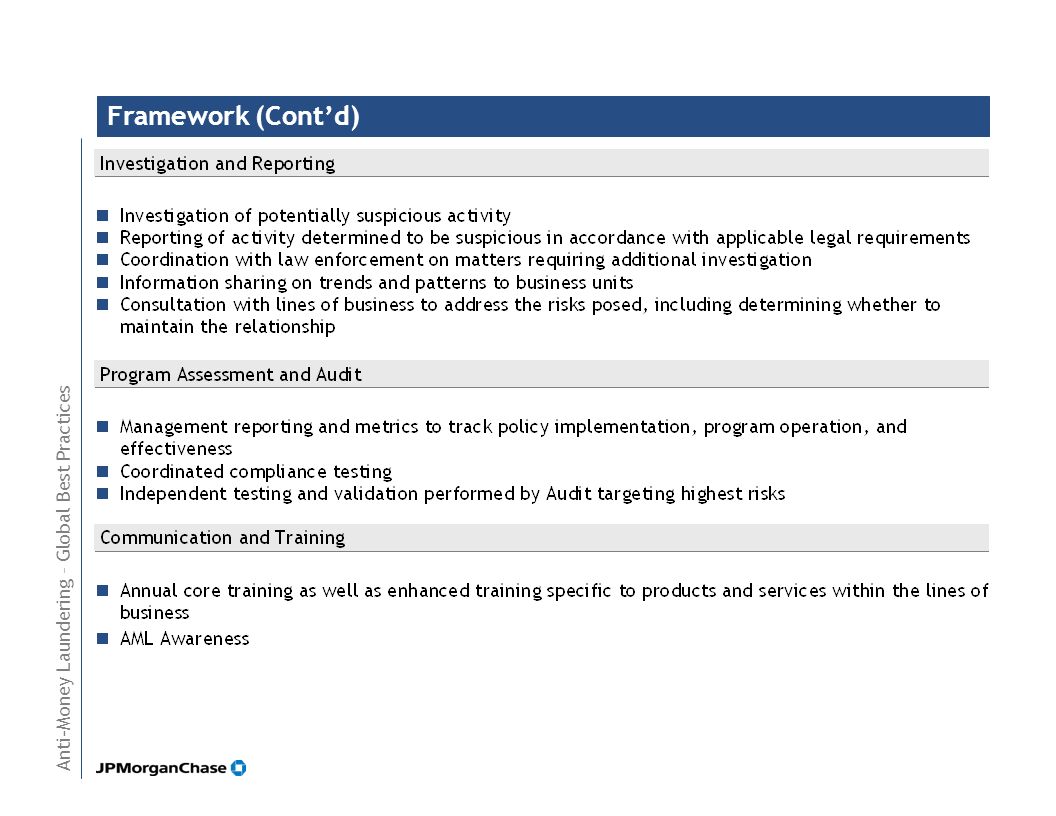

Source: slideplayer.com

Source: slideplayer.com

This requires adherence to the international standards prescribed. The main areas that FSPs in particular investment funds that rely on third parties to satisfy their Cayman AML obligations should think about at this stage are 1 updating disclosures referencing the AML Regulations PCL and Schedule 3 Countries as and when such disclosure documents are being updated. A comfort letter is a document of assurance issued by a parent company or an accounting firm to reassure a subsidiary company of its willingness to provide financial support. A comfort letter is a business document that is intended to assure the recipient that a financial or contractual obligation with another party can and will be met. This looks set to continue in 2013 if regulators identify further failings in firms compliance with money laundering sanctions and tax requirements.

Source:

What Is a Comfort Letter. Comfort letter at least two separate letters will be delivered. It is an affirmation letter not a confirmation letter that offers backup when a customer requires a loan or a company needs financial help. The guidance is separated into two parts. A letter of comfortalso known as a letter of intent or a solvency opinionis a written document that provides a level of assurance that an obligation will ultimately be met.

Source:

9 SWIFT Message MT103 its equivalent. AML ATF framework that protects Bermudas financial system from being targeted and abused by criminals. The guidance is separated into two parts. In addition the auditors will provide a bring. And 2 ensuring that the FSP has the ability to control onward payment to a customer or another party in the event that the third party conducting the AML.

Source:

The AML Law prohibits relations with a shell bank or with a bank known to allow a shell bank to use its accounts. AMLCTF Act current version Your obligations under the AMLCTF Act. Anti-Money Laundering Record-breaking fines issued by regulators worldwide notably in the US and UK dominated the financial services landscape in 2012. It is an affirmation letter not a confirmation letter that offers backup when a customer requires a loan or a company needs financial help. These include the main comfort letter which is delivered at the time that the underwriting agreement is signed and dated as of the pricing date of the offering.

Source: pinterest.com

Source: pinterest.com

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act is the main piece of Australian government legislation that regulates AUSTRACs functions. Please tick the provided documents. The guidance is separated into two parts. Access the AMLCTF Act.

Source: slideplayer.com

Source: slideplayer.com

The risk-based approach RBA which is a long-established principle within anti-money laundering AML acknowledges that every situation is different and that the legal practitioners and practices themselves -are best placed to understand the risks and deal with them proportionately. The nature of the Health Check will be tailored to your organisational. The guidance is separated into two parts. A shell bank is defined as a bank incorporated in a jurisdiction in which it has no physical presence and which is unaffiliated with a regulated financial group. Anti-Money Laundering Record-breaking fines issued by regulators worldwide notably in the US and UK dominated the financial services landscape in 2012.

Source:

What Is a Comfort Letter. A comfort letter is a business document that is intended to assure the recipient that a financial or contractual obligation with another party can and will be met. A comfort letter is a document of assurance issued by a parent company or an accounting firm to reassure a subsidiary company of its willingness to provide financial support. The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act is the main piece of Australian government legislation that regulates AUSTRACs functions. A letter from an independent auditor included in a preliminary prospectus stating that while a full audit has not been undertaken the auditor has done a review sufficient to.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml comfort letter definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas