16++ Aml customer risk rating methodology information

Home » about money loundering idea » 16++ Aml customer risk rating methodology informationYour Aml customer risk rating methodology images are available. Aml customer risk rating methodology are a topic that is being searched for and liked by netizens today. You can Get the Aml customer risk rating methodology files here. Get all free vectors.

If you’re searching for aml customer risk rating methodology pictures information connected with to the aml customer risk rating methodology keyword, you have come to the ideal blog. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

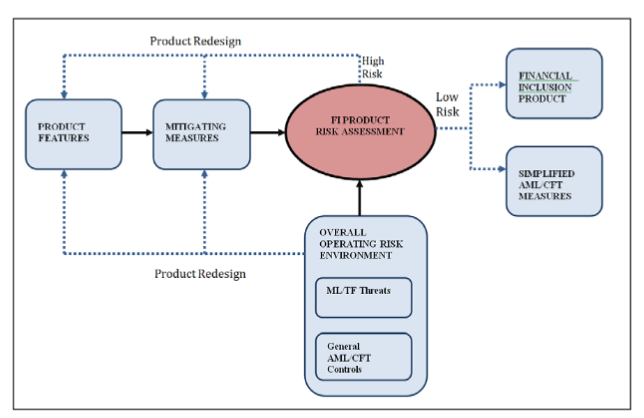

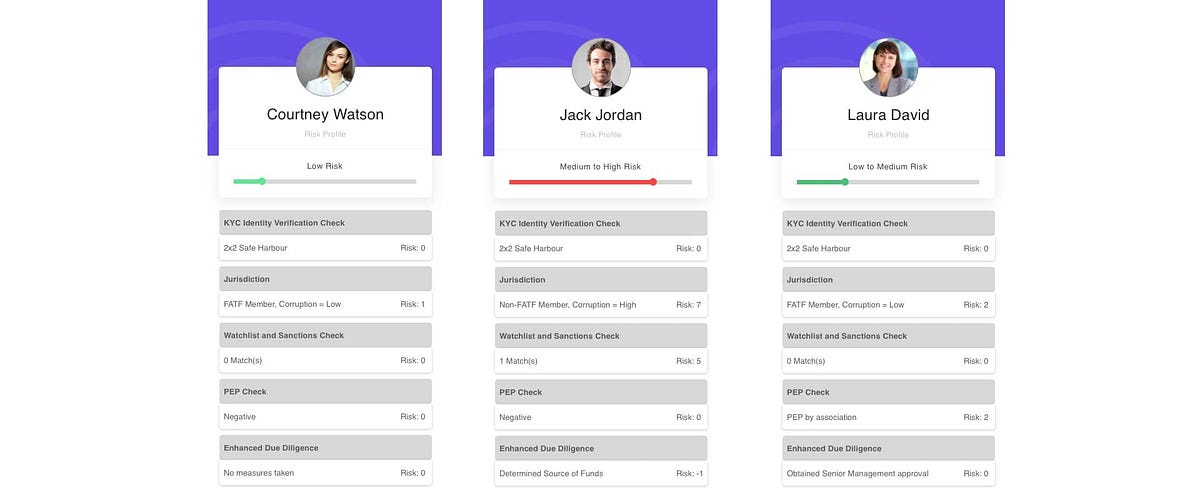

Aml Customer Risk Rating Methodology. Processes and controls are set out in the AML Program and Customer Due Diligence Standards which form part of the AML Program Policy. One could leverage established statistical methodology as diagnostic tools of customer risk ratings to better inform the relevant bank personnel who use them as part of AML surveillance efforts. What types of customers pose a risk. Create a form that asks for all of the types and amounts of activities they will have on the account.

Web Nuk We Epitomize Everything We Like From webnuk.wordpress.com

Web Nuk We Epitomize Everything We Like From webnuk.wordpress.com

You can rate them based upon that information. AML 4 Applying a Risk-Based Approach. AML 3 Interpretation and Terminology. Medium Moderate MLTF risk. Anti-Money Laundering Counter-Terrorist Financing and Sanctions Module AML VER1704-20 AML 1 Introduction. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank.

Processes and controls are set out in the AML Program and Customer Due Diligence Standards which form part of the AML Program Policy.

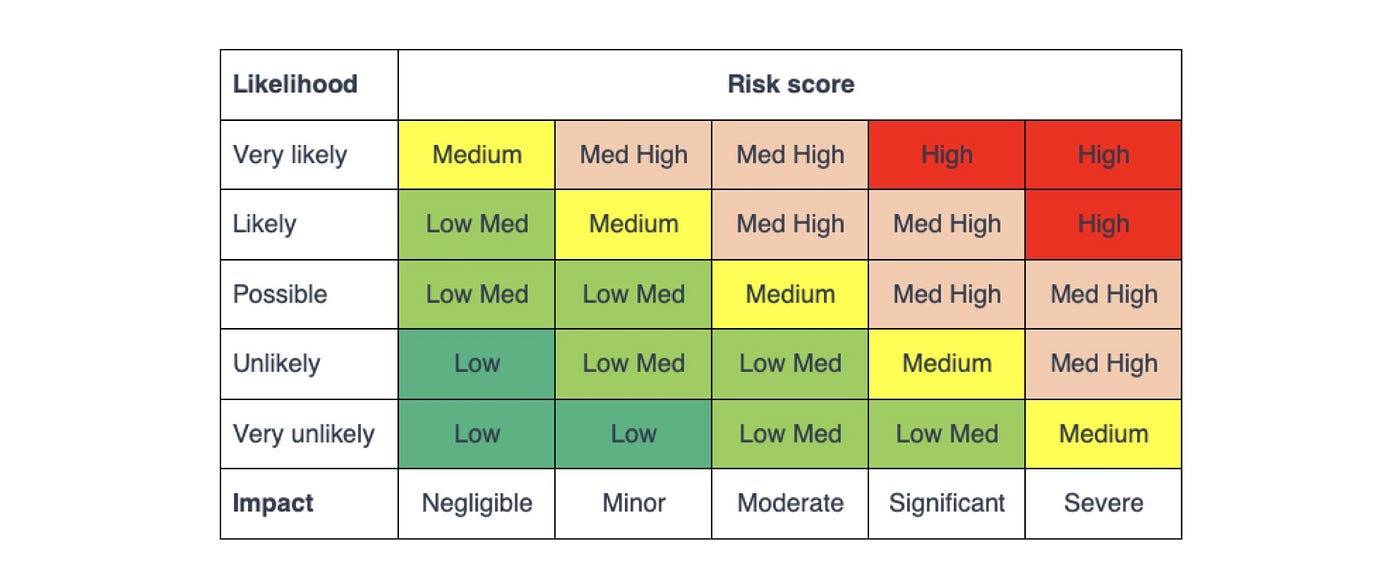

New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a. Medium Moderate MLTF risk. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. Customer Risk Rating Tool and Methodology AML KYC BSA risk assessment and rating is performed during the client onboarding phase and also throughout the life of the customer. On the customer risk rating methodology. Each risk rating is assigned a value ie.

Source: service.betterregulation.com

Source: service.betterregulation.com

Inherent Risk Rating IRR Significant Major MLTF risk. The nature and purpose of your business relationship with your customers. Latest news reports from the medical literature videos from the experts and more. Ad AML coverage from every angle. One could leverage established statistical methodology as diagnostic tools of customer risk ratings to better inform the relevant bank personnel who use them as part of AML surveillance efforts.

Source: financeandriskblog.accenture.com

Source: financeandriskblog.accenture.com

The nature and purpose of your business relationship with your customers. The beneficial owners of your customers. This document proposes a frameworkmethodology based on machine learning approach to establish the risk rating score normally a low medium or high score of customers using various driversattributes as input variables. Each risk rating is assigned a value ie. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts.

Source: acamstoday.org

Source: acamstoday.org

AML 6 Customer Risk Assessment. Examiners must develop an understanding of the banks MLTF and other illicit financial activity risks to evaluate the banks BSAAML compliance program. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. Your AMLCTF program should set out how you minimise and manage each level of risk.

Source: youtube.com

Source: youtube.com

AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. AML 3 Interpretation and Terminology. The beneficial owners of your customers. Each risk rating is assigned a value ie. When developing your customer identification and verification procedures you must also consider the risk posed by.

Source: medium.com

Source: medium.com

Whether your customers or their beneficial owners are PEPs. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. 255 rows AML Risk Assessment Template and Sample Rating Matrix Downloadable Template Raw Data When on-boarding new customers and throughout the relationship with each customer financial institutions are required by regulators to perform anti-money laundering AML and know-your-customer KYC risk assessments to determine a customers overall money laundering risk. Each risk rating is assigned a value ie. Ad AML coverage from every angle.

Source: baselgovernance.org

Source: baselgovernance.org

When developing your customer identification and verification procedures you must also consider the risk posed by. The AML Accelerate risk assessment methodology defines the criteria for rating both the inherent and residual risk as well as consistent criteria for assessing the effectiveness of controls as. Your AMLCTF program should set out how you minimise and manage each level of risk. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business. Inherent Risk Rating IRR Significant Major MLTF risk. What types of customers pose a risk. AML 3 Interpretation and Terminology. Or the level of financial exclusion.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

Generally if ratings cover a broad spectrum ranging from low to high a generalized linear model could be leveraged for statistical analysis. Each risk rating is assigned a value ie. 255 rows AML Risk Assessment Template and Sample Rating Matrix Downloadable Template Raw Data When on-boarding new customers and throughout the relationship with each customer financial institutions are required by regulators to perform anti-money laundering AML and know-your-customer KYC risk assessments to determine a customers overall money laundering risk. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. When developing your customer identification and verification procedures you must also consider the risk posed by.

Source: finchecker.eu

Source: finchecker.eu

Examiners must develop an understanding of the banks MLTF and other illicit financial activity risks to evaluate the banks BSAAML compliance program. Generally if ratings cover a broad spectrum ranging from low to high a generalized linear model could be leveraged for statistical analysis. The AML Accelerate risk assessment methodology defines the criteria for rating both the inherent and residual risk as well as consistent criteria for assessing the effectiveness of controls as. Your customers source of funds and wealth. The customer risk ratings data are described in the ensuing subsections.

Source: service.betterregulation.com

Source: service.betterregulation.com

Ad AML coverage from every angle. Latest news reports from the medical literature videos from the experts and more. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. We obtain maximum likelihood estimates of the models parameters and we analyze the results of various hypothesis tests about specific parame-ters to determine if they have relevance to AML surveillance policies. The customer risk ratings data are described in the ensuing subsections.

Source: advisoryhq.com

Source: advisoryhq.com

AML 2 Overview and Purpose of the Module. The beneficial owners of your customers. Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. This document proposes a frameworkmethodology based on machine learning approach to establish the risk rating score normally a low medium or high score of customers using various driversattributes as input variables. The customer risk ratings data are described in the ensuing subsections.

Source: medium.com

Source: medium.com

Your customers source of funds and wealth. Latest news reports from the medical literature videos from the experts and more. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a. Latest news reports from the medical literature videos from the experts and more. Each risk rating is assigned a value ie.

Source: medium.com

Source: medium.com

The AML Accelerate risk assessment methodology defines the criteria for rating both the inherent and residual risk as well as consistent criteria for assessing the effectiveness of controls as. Inherent Risk Rating IRR Significant Major MLTF risk. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. AML 5 Business Risk Assessment. The level of corruption and the impact of measures to combat corruption.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml customer risk rating methodology by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information