15++ Aml customer risk scoring excel ideas in 2021

Home » about money loundering idea » 15++ Aml customer risk scoring excel ideas in 2021Your Aml customer risk scoring excel images are ready in this website. Aml customer risk scoring excel are a topic that is being searched for and liked by netizens today. You can Download the Aml customer risk scoring excel files here. Get all royalty-free photos.

If you’re looking for aml customer risk scoring excel pictures information connected with to the aml customer risk scoring excel keyword, you have come to the right site. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and images that fit your interests.

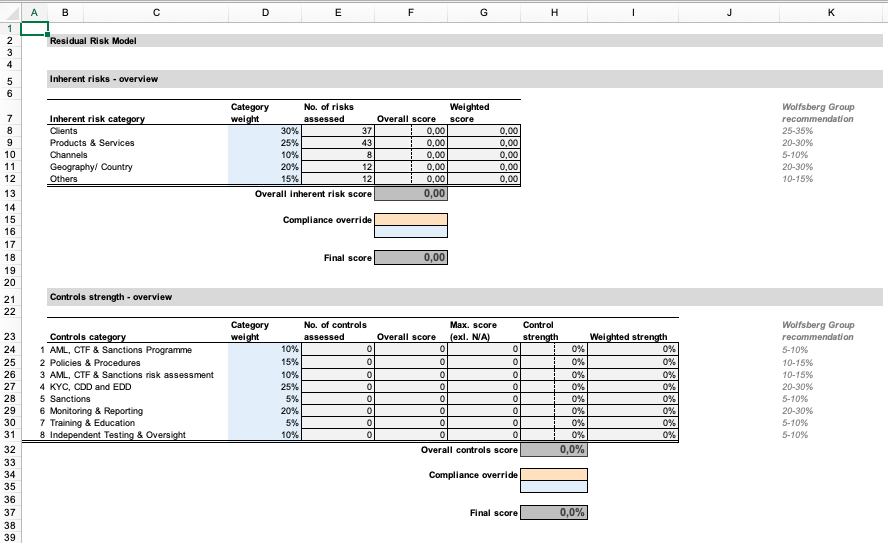

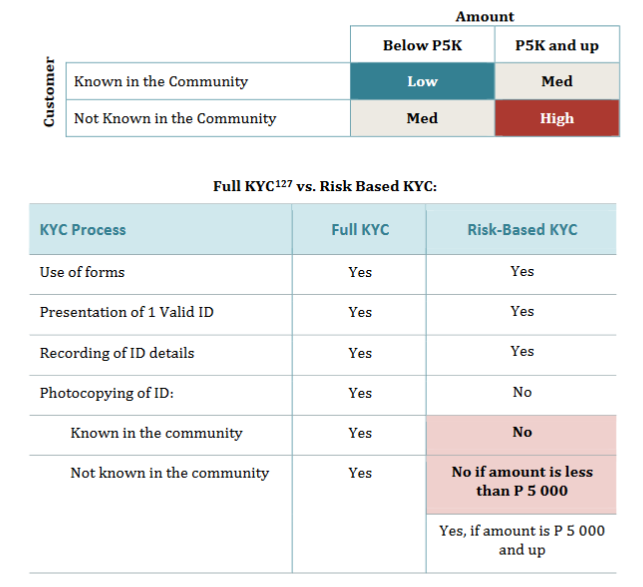

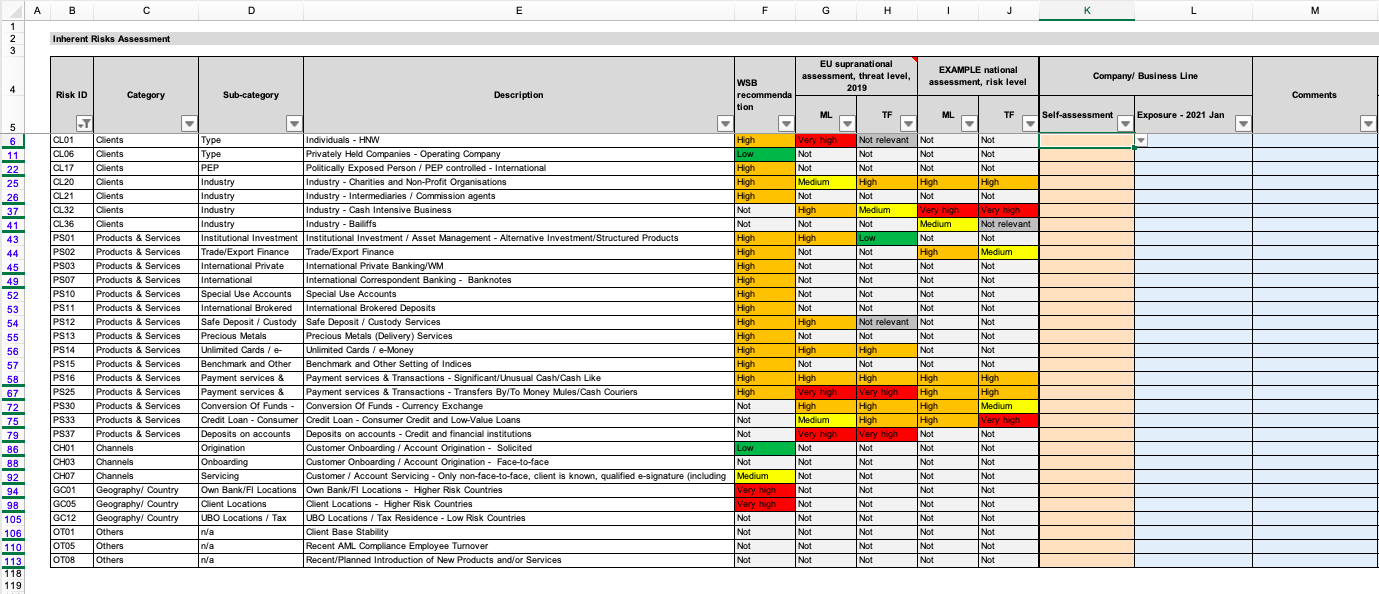

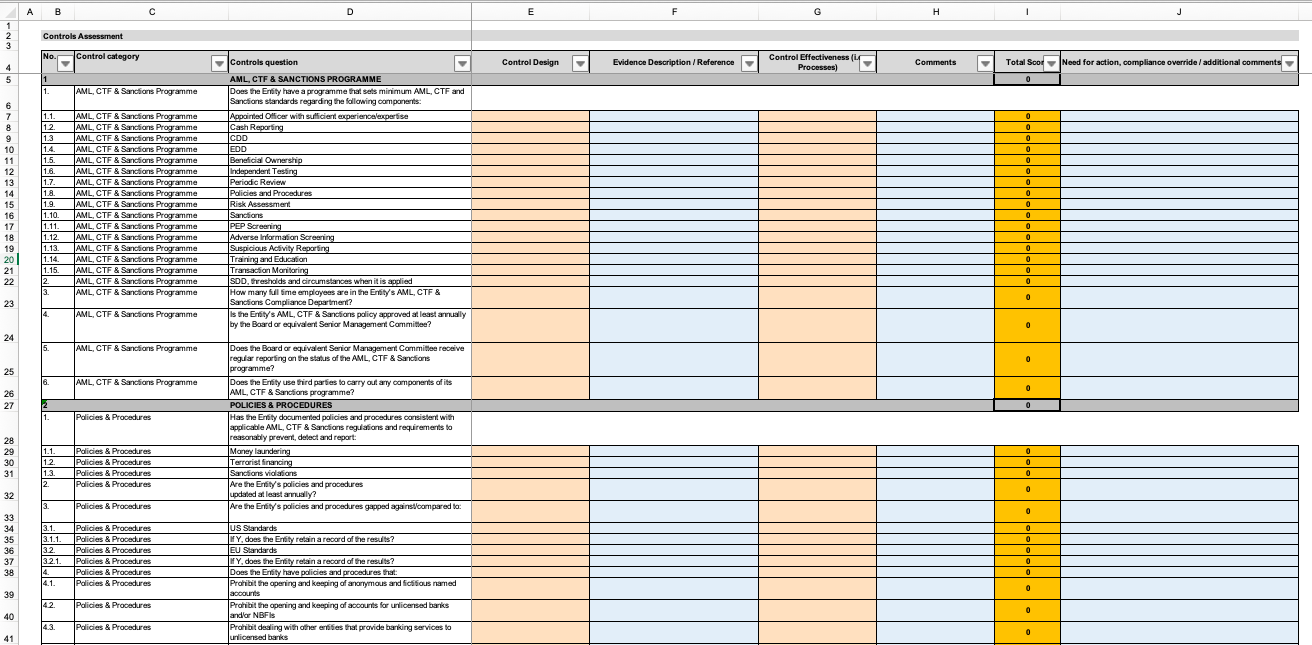

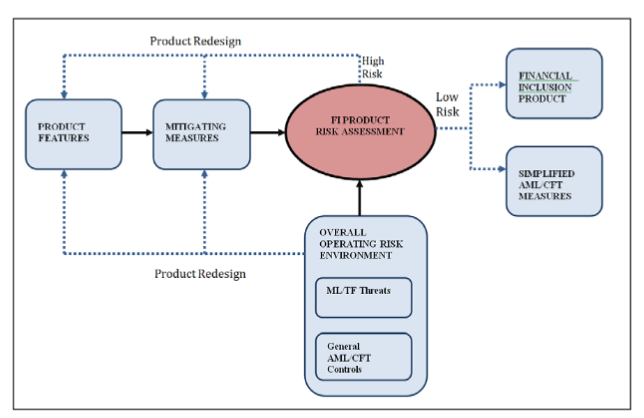

Aml Customer Risk Scoring Excel. The first purpose is to assign customers with a risk score as part of the institutions due diligence processes. Assess the Risk by using. Or the level of financial exclusion. The conclusion should include a short narrative in support of the conclusion.

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens From eloquens.com

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens From eloquens.com

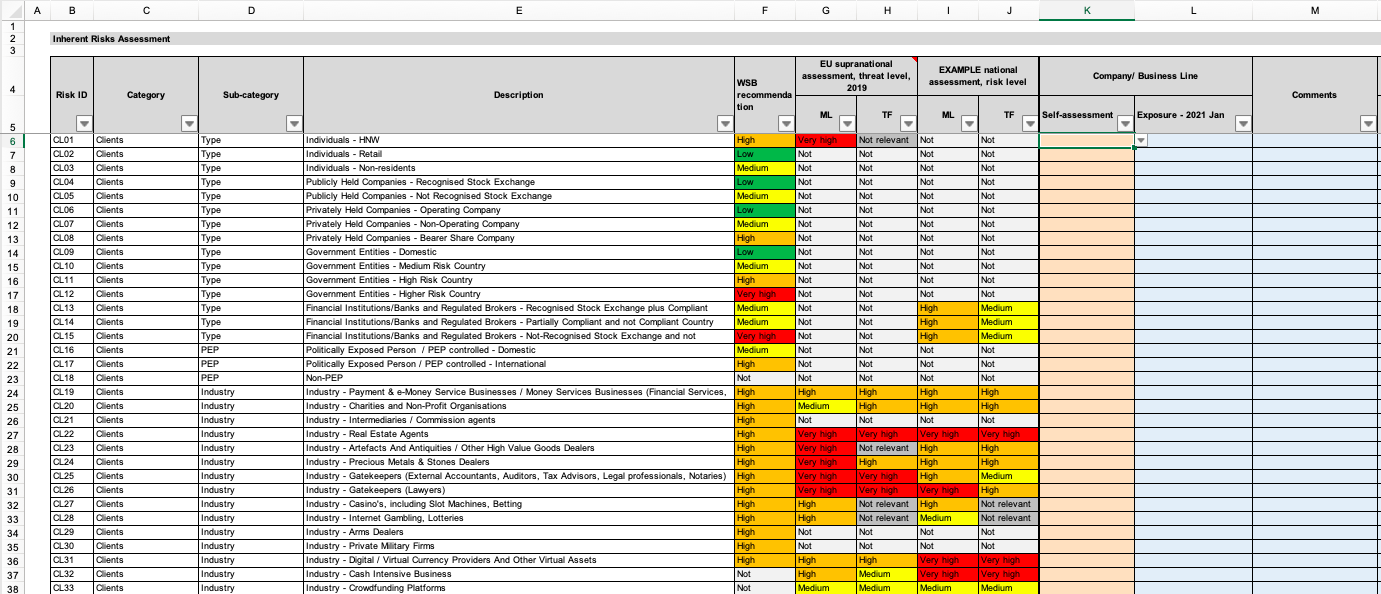

Minimise and manage the risks apply strategies policies and procedures Manage the regulatory risks. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Put in place systems and controls carry out the risk plan AMLCTF program Monitor review the risk plan. The level of corruption and the impact of measures to combat corruption. Or the level of financial exclusion.

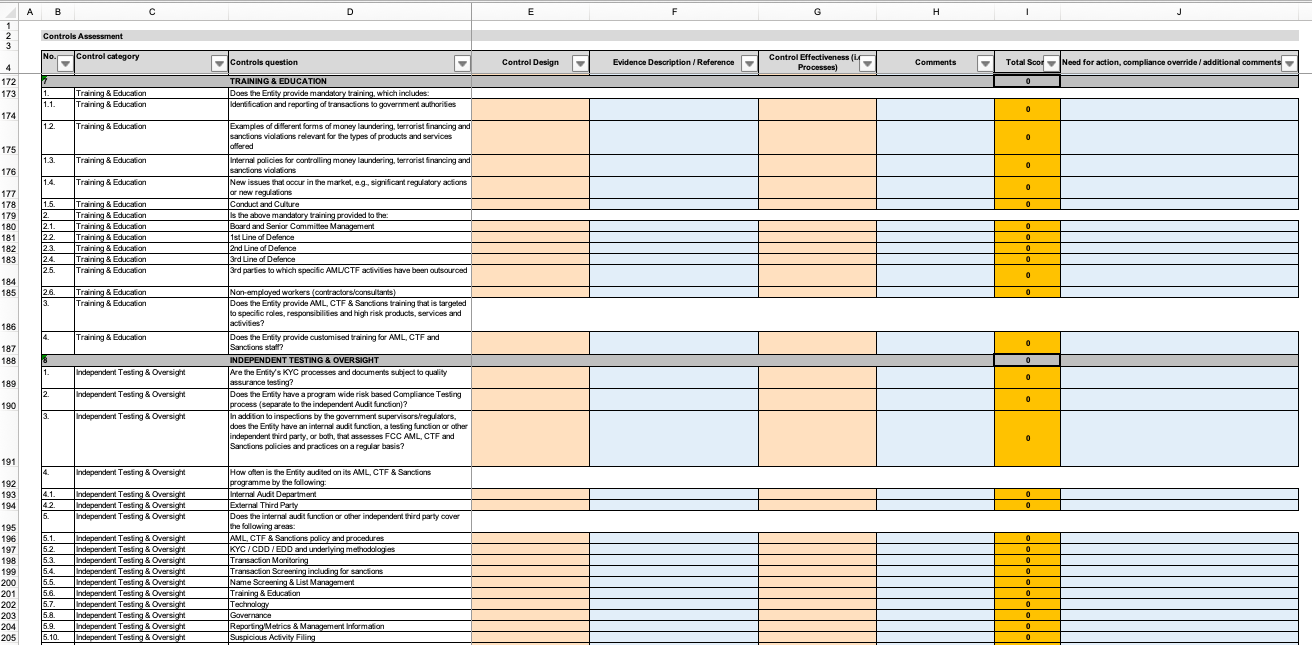

255 rows Risk assessment templates used by financial institution firms are either in Excel in a third-party platform or built into and managed within an internal tool.

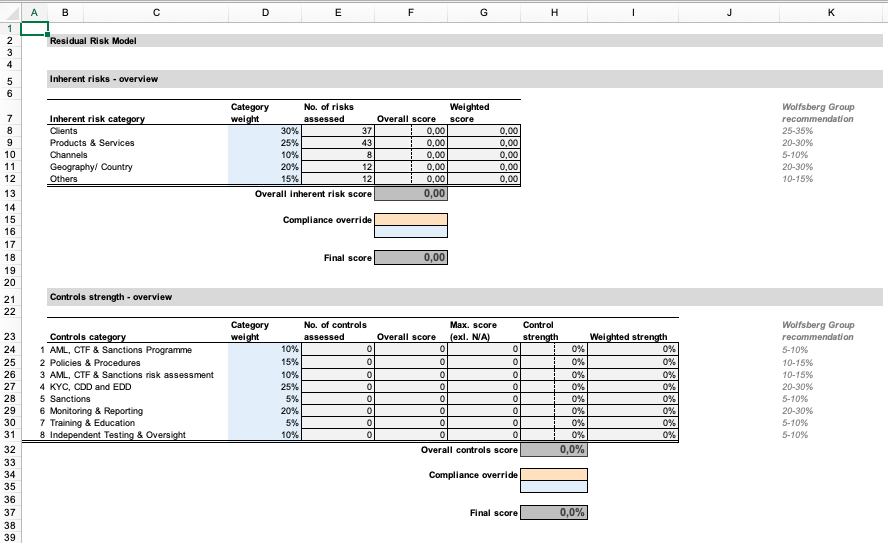

Based on the customers risk score the KYC system determines the next review date. Approval may be evidenced in writing or electronically. The re-review period is defined in the Risk Category table based on the ranges of the Customer Effective Risk CER score. All foreign customers Customer from higher risk countries 8 Other factors please specify. The level of corruption and the impact of measures to combat corruption. Assess the Risk by using.

Source: advisoryhq.com

Source: advisoryhq.com

AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters. Risk score summaries and. Equal weights or custom user defined. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts.

Source: advisoryhq.com

Source: advisoryhq.com

Equal weights or custom user defined. Additionally FATCA monitoring for change in circumstances is not riskbased must be monitored as it occurs and applies to all customers January 2015 the FDIC released a statement encouraging institutions to take a risk based approach in assessing all. Develop and carry out monitoring process keep necessary records review risk plan and AMLCTF program. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Formulas include two options for both inherent risk and controls weighting.

Source:

Minimise and manage the risks apply strategies policies and procedures Manage the regulatory risks. AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. What types of customers pose a risk. The conclusion should include a short narrative in support of the conclusion. Develop and carry out monitoring process keep necessary records review risk plan and AMLCTF program.

Source: eloquens.com

Source: eloquens.com

Based on the customers risk score the KYC system determines the next review date. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Generating a Customer Risk Rating. Formulas include two options for both inherent risk and controls weighting.

Source: service.betterregulation.com

Source: service.betterregulation.com

Or the level of financial exclusion. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. What types of customers pose a risk. Low Medium High c Geographical Location Risk Total Percentage Local Headquarters and Branch Location No of branches including headquarters located.

Source: eloquens.com

Source: eloquens.com

Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters. Automated Custom Risk Scoring Fully dynamic risk engine allowing you to define any aspect of risk both regulatory and internal risk appetite. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Assess the Risk by using. Based on the customers risk score the KYC system determines the next review date.

Source: eloquens.com

Source: eloquens.com

Risk score summaries and. Institutions that have nonresidential aliens NRAs as customers can use the country of origin to assign a risk rating to the customer. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Low Medium High c Geographical Location Risk Total Percentage Local Headquarters and Branch Location No of branches including headquarters located. What types of customers pose a risk.

Source: eloquens.com

Source: eloquens.com

Generating a Customer Risk Rating. Or the level of financial exclusion. The ever-present dependence on individual subjective assessments and inherent bias is totally eliminated from the on-boarding process thanks to KYC Portals risk assessment module. Put in place systems and controls carry out the risk plan AMLCTF program Monitor review the risk plan. Institutions that have nonresidential aliens NRAs as customers can use the country of origin to assign a risk rating to the customer.

Source: rur.senecvks.pw

Source: rur.senecvks.pw

All foreign customers Customer from higher risk countries 8 Other factors please specify. What types of customers pose a risk. The risk model should be designed to generate a revised risk score and rating when such an event is triggered. An exhaustive audit trail. Institutions that have nonresidential aliens NRAs as customers can use the country of origin to assign a risk rating to the customer.

Source: advisoryhq.com

Source: advisoryhq.com

The level of corruption and the impact of measures to combat corruption. Risks assessed by the AML Accelerate risk assessment model. Institutions that have nonresidential aliens NRAs as customers can use the country of origin to assign a risk rating to the customer. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine. This should indicate why customers have been rated as high medium or low and also if any customer has been overridden manually to a higher or lower risk rating over the system generated risk score and rating.

Source:

Or the level of financial exclusion. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. The first purpose is to assign customers with a risk score as part of the institutions due diligence processes. Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters. Based on the customers risk score the KYC system determines the next review date.

Source: eloquens.com

Source: eloquens.com

If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. If the customer poses high risk to the bank or FI then the customer will be reviewed more often compared to medium or low risk customers. Based on the various considerations above which are intended to prompt considerations of areas that may be considered to be of a higher risk from a money laundering perspective each firm is required to conclude on an overall money laundering risk assessment for the firm. Quantitative and qualitative criteria customisable risk factors such as customer risk country risk productservice risk industry risk and delivery channel risk. Risk assessment and scoring tool to assess the AML Risk for your clients based on the customers profile risk factors and weighted parameters.

Source: service.betterregulation.com

Source: service.betterregulation.com

AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine. The ever-present dependence on individual subjective assessments and inherent bias is totally eliminated from the on-boarding process thanks to KYC Portals risk assessment module. AML Accelerate calculates the consolidated risk ratings at levels 1 2 3 and 4 by assigning a numerical score to the rating results at the level below and aggregating those scores to determine. The risk model should be designed to generate a revised risk score and rating when such an event is triggered. Formulas include two options for both inherent risk and controls weighting.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml customer risk scoring excel by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information