17++ Aml customer risk scoring methodology ideas in 2021

Home » about money loundering idea » 17++ Aml customer risk scoring methodology ideas in 2021Your Aml customer risk scoring methodology images are available. Aml customer risk scoring methodology are a topic that is being searched for and liked by netizens today. You can Find and Download the Aml customer risk scoring methodology files here. Get all free vectors.

If you’re looking for aml customer risk scoring methodology images information related to the aml customer risk scoring methodology topic, you have visit the right site. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

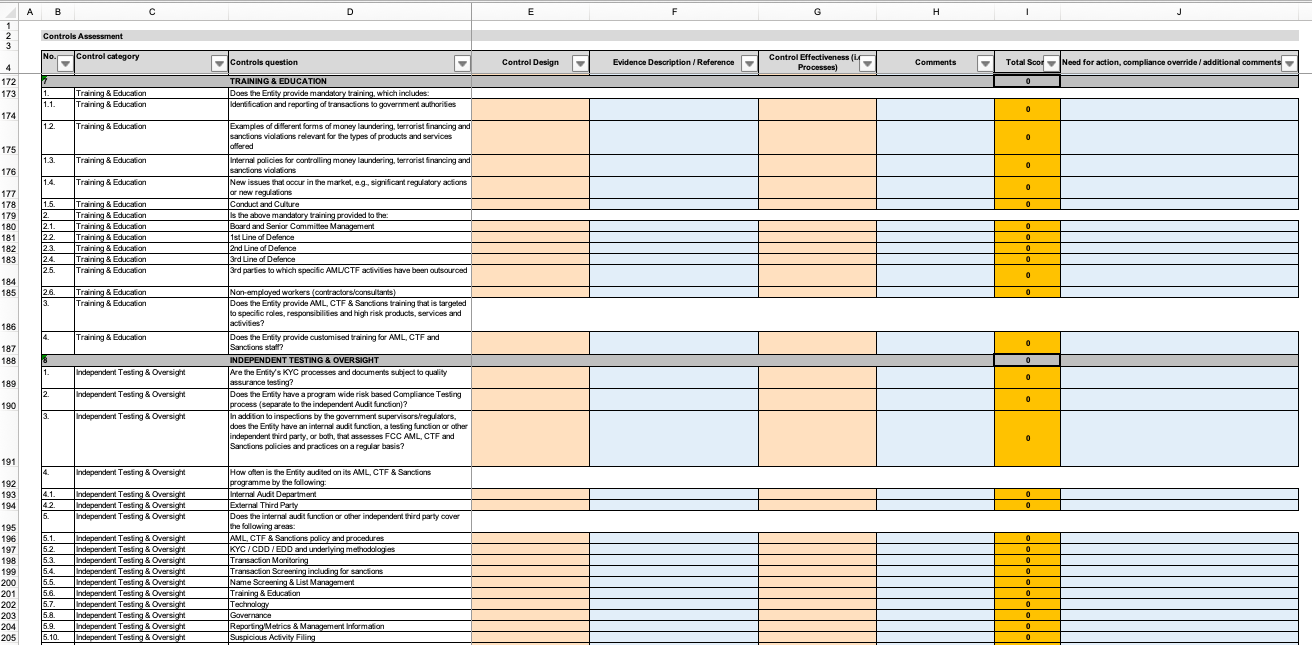

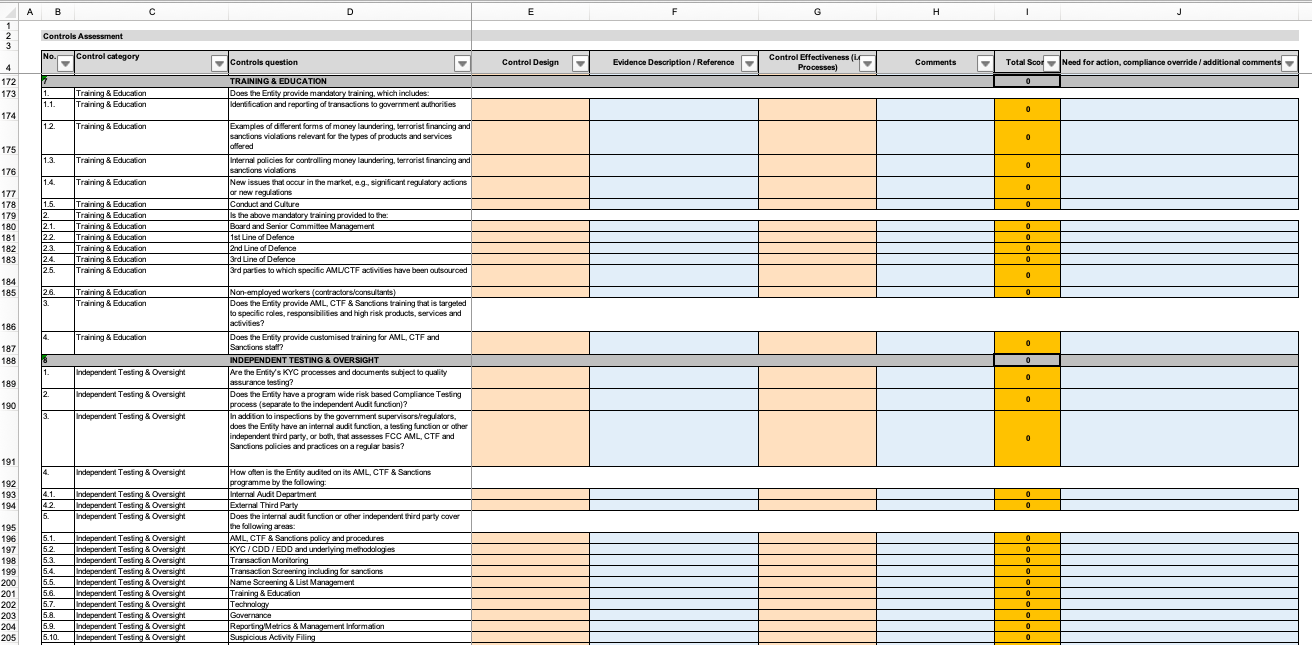

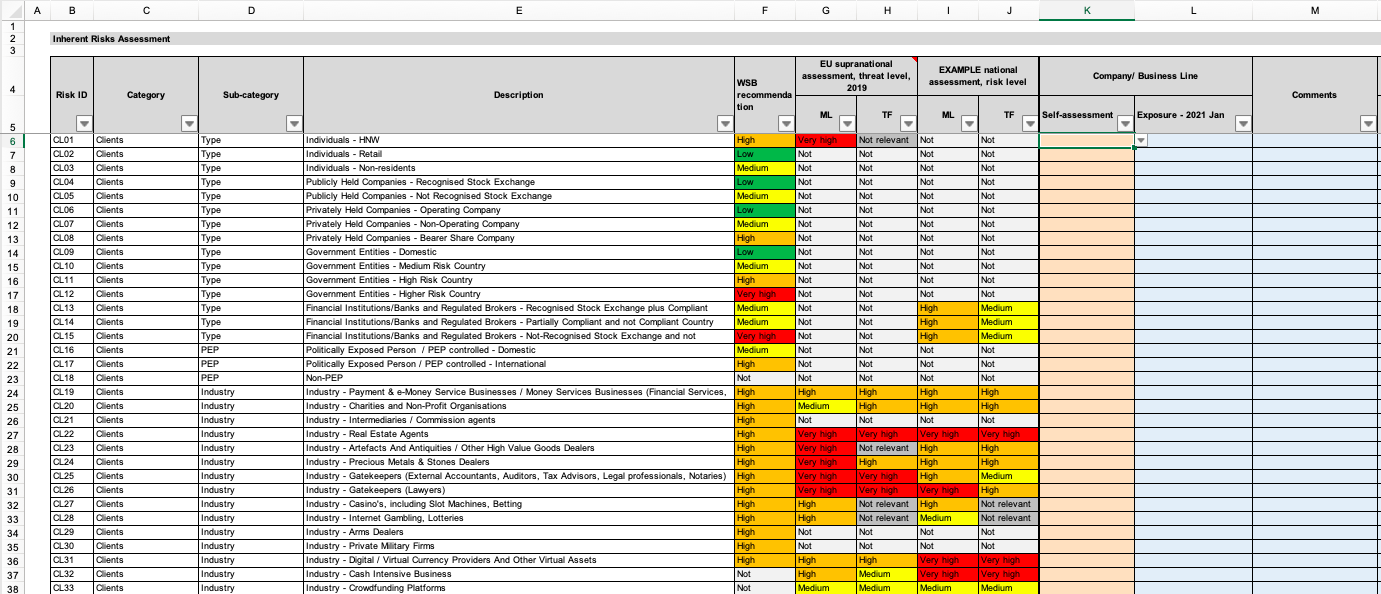

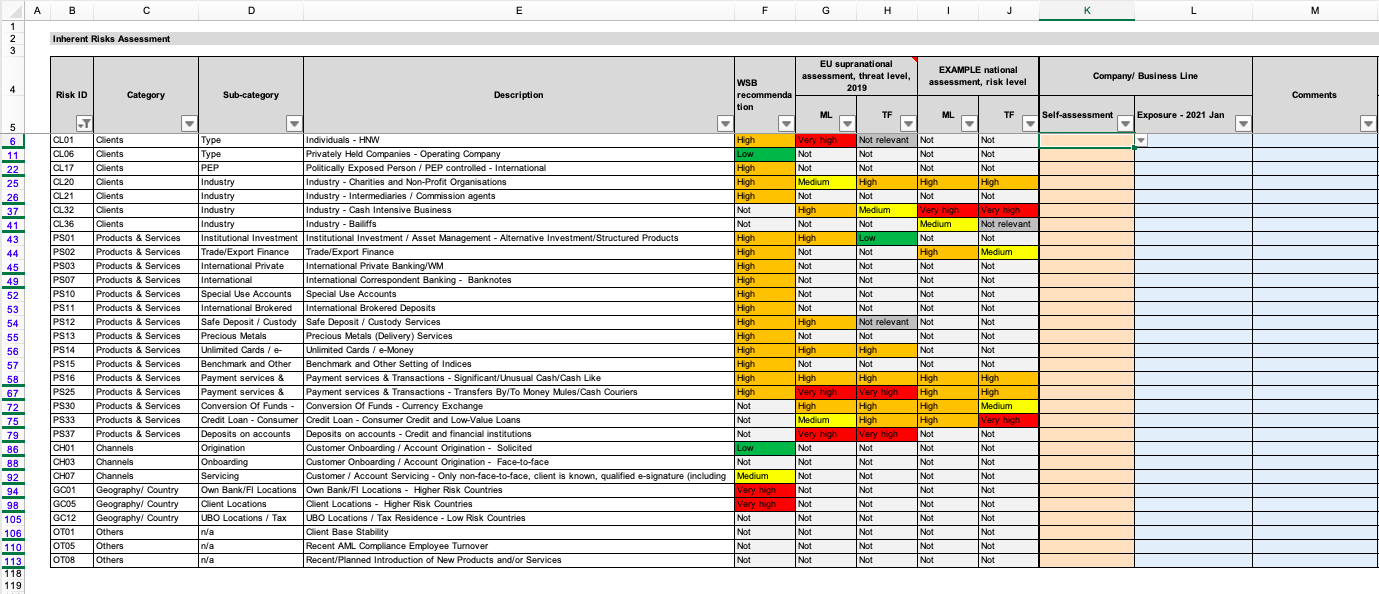

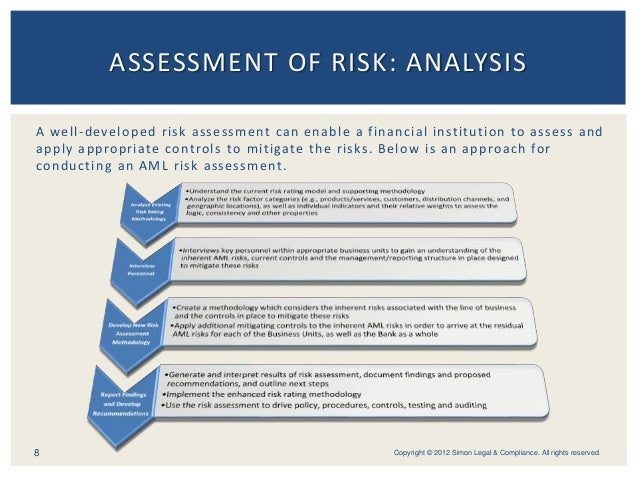

Aml Customer Risk Scoring Methodology. The ever-present dependence on individual subjective assessments and inherent bias is totally eliminated from the on-boarding process thanks to KYC Portals risk assessment module. In other words the higher your score the higher your risk rating. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. The workflow of KYC enables financial institutions to perform Due Diligence Enhanced Due Diligence and continuous monitoring of customers.

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens From eloquens.com

Enterprise Wide Aml Ctf Sanctions Risk Assessment Ewra Template Eloquens From eloquens.com

Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer. Anti-Money Laundering Counter-Terrorist Financing and Sanctions Module AML VER1704-20 AML 1 Introduction. In other words the higher your score the higher your risk rating. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a.

The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF.

The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer. AML 2 Overview and Purpose of the Module.

Source: advisoryhq.com

Source: advisoryhq.com

AML KYC BSA risk assessment and rating is performed during the client onboarding phase and also throughout the life of the customer. Automated Custom Risk Scoring. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating. Our validation methods assess whether AMLCRR effectively determine the risk level each customer presents to your organization including Model Governance review Model Methodology Assessment Model Scoring. So if a customer had very few risk factors they would have a lower risk rating.

Source: youtube.com

Source: youtube.com

AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. AML 5 Business Risk Assessment. AMLCFT measures include the maturity and sophistication of the regulatory and supervisory regime in the country. So if a customer had very few risk factors they would have a lower risk rating. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank.

Source: eloquens.com

Source: eloquens.com

Without a standard model for risk scoring risk and security teams would continually struggle to communicate internally about how to allocate resources appropriately in order to minimize costs and impact to business. AML KYC BSA risk assessment and rating is performed during the client onboarding phase and also throughout the life of the customer. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a.

Source:

Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. An exhaustive audit trail. Remember we are not considering any factor in a vacuum. Our validation methods assess whether AMLCRR effectively determine the risk level each customer presents to your organization including Model Governance review Model Methodology Assessment Model Scoring.

Source: eloquens.com

Source: eloquens.com

In other words the higher your score the higher your risk rating. Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. The World Bank Risk Assessment Methodology 1.

Source: service.betterregulation.com

Source: service.betterregulation.com

Anti-Money Laundering Counter-Terrorist Financing and Sanctions Module AML VER1704-20 AML 1 Introduction. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. The attributes differ based on the customer type. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community. AML 3 Interpretation and Terminology.

Source:

Not only was a baseline CRR methodology established across the organization it was done without revising any lines of business. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. AML 4 Applying a Risk-Based Approach. Or the level of financial exclusion. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF.

Source: finchecker.eu

Source: finchecker.eu

An exhaustive audit trail. What types of customers pose a risk. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. So if a customer had very few risk factors they would have a lower risk rating.

Source: eloquens.com

Source: eloquens.com

AML 4 Applying a Risk-Based Approach. AML KYC BSA risk assessment and rating is performed during the client onboarding phase and also throughout the life of the customer. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. Oracle Financial Services Know Your Customer assesses the risk associated with a customer by considering different attributes of the customer. The attributes differ based on the customer type.

Source: advisoryhq.com

Source: advisoryhq.com

A transaction monitoring product in its most basic form is not a model. Risk scoring is the process of attaining a calculated score that tells you how severe a risk is based off of several factors. AML 2 Overview and Purpose of the Module. The solution incorporated the ability to periodically conduct customer data analyses to keep compliance management personnel informed of new risks to the bank. New customers carrying out large one-off transactions Introduced customers because the introducer may not have carried out due diligence thoroughly Customers who arent local to you Customers involved in a.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. We established a scoring methodology for each risk factor and it was cumulative. The attributes differ based on the customer type. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. The theory supporting risk assessment tools and templates is based on the concept that a clients risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. An exhaustive audit trail. 255 rows Key Assessment Factors. Remember we are not considering any factor in a vacuum. AML 3 Interpretation and Terminology.

Source: slideshare.net

Source: slideshare.net

In this webinar we explore one objective methodology financial institutions may consider to assess individual countries money laundering risk which in turn may be used in transaction activity monitoring customer risk scoring and the institutions high level money laundering risk assessment. The methodology applied to assess customer MLTF risk at an enterprise level through the AML Accelerate platform defines customer risk as the combination of. AML 2 Overview and Purpose of the Module. The customer footprint within the customer base which consists of their geographic location and if they are engaged in business activities that are vulnerable to MLTF. Risk scoring is the process of attaining a calculated score that tells you how severe a risk is based off of several factors.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml customer risk scoring methodology by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information