17++ Aml definition of integration info

Home » about money loundering Info » 17++ Aml definition of integration infoYour Aml definition of integration images are ready in this website. Aml definition of integration are a topic that is being searched for and liked by netizens today. You can Download the Aml definition of integration files here. Download all royalty-free photos and vectors.

If you’re looking for aml definition of integration pictures information linked to the aml definition of integration keyword, you have pay a visit to the right blog. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

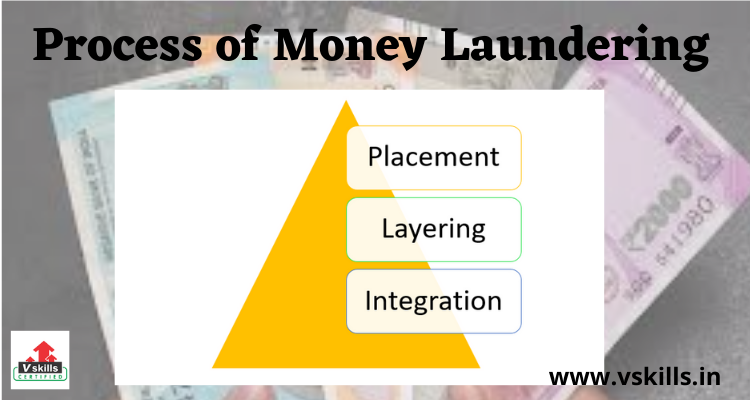

Aml Definition Of Integration. The final stage is where the money is returned to the criminal from what seem to be legitimate sources. In situations where the layering process succeeds integration schemes effectively return the laundered proceeds back into the general financial system and the proceeds appear to. Transactions normally involve buying property or high value items or engaging in legal businesses by using funds that have been successfully placed or layered in the financial system. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions.

What Is Money Laundering Three Methods Or Stages In Money Laundering From allbankingalerts.com

What Is Money Laundering Three Methods Or Stages In Money Laundering From allbankingalerts.com

Integration the final stage at which the laundered property is re-introduced into the legitimate economy. Latest news reports from the medical literature videos from the experts and more. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Who is an AML officer. In situations where the layering process succeeds integration schemes effectively return the laundered proceeds back into the general financial system and the proceeds appear to. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Who is an AML officer.

Definitions are the key to setting up your cyber-reporting program. Rather it is the role of the AML department to capitalize on their expertise leverage their work output and provide an effective workflow to integrate their cyber information for AML reporting purposes. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Definitions are the key to setting up your cyber-reporting program.

Source: allbankingalerts.com

Source: allbankingalerts.com

It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. The reality is that the so called stages often overlap and in some cases for example in cases of financial crimes there is no requirement for the proceeds of crime to be placed. Latest news reports from the medical literature videos from the experts and more. Transactions normally involve buying property or high value items or engaging in legal businesses by using funds that have been successfully placed or layered in the financial system. C Integration - creating the impression of apparent legitimacy to criminally derived wealth.

Source: pinterest.com

Source: pinterest.com

In situations where the layering process succeeds integration schemes effectively return the laundered proceeds back into the general financial system and the proceeds appear to. The reality is that the so called stages often overlap and in some cases for example in cases of financial crimes there is no requirement for the proceeds of crime to be placed. 1 Anti-Money Laundering and Countering the Financing of Terrorism AMLCFT Fundamentals 11 Definition of Money Laundering Money laundering is the process criminals use to try to conceal the true origin and ownership of the proceeds of drug trafficking and other serious crimes listed in. Define the Behavior and the Process. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income.

Source: researchgate.net

Integration the final stage at which the laundered property is re-introduced into the legitimate economy. Latest news reports from the medical literature videos from the experts and more. The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 AMLCFT Act was passed in 2009 and came fully into effect on 30 June 2013. Define the Behavior and the Process. 1 Anti-Money Laundering and Countering the Financing of Terrorism AMLCFT Fundamentals 11 Definition of Money Laundering Money laundering is the process criminals use to try to conceal the true origin and ownership of the proceeds of drug trafficking and other serious crimes listed in.

Source: researchgate.net

Source: researchgate.net

There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering. AML stands for Anti-Money Laundering and is a set of measures for combating the laundering of money and other financial crimes. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions. The Integration Stage Investment.

Source: in.pinterest.com

Source: in.pinterest.com

Having been placed initially as cash and layered through a number of financial transactions the criminal proceeds are now fully integrated into the financial system and can be used for any purpose. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. AML stands for Anti-Money Laundering and is a set of measures for combating the laundering of money and other financial crimes. Latest news reports from the medical literature videos from the experts and more.

Source: innovativesystems.com

Source: innovativesystems.com

Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. The final stage is where the money is returned to the criminal from what seem to be legitimate sources. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Having been placed initially as cash and layered through a number of financial transactions the criminal proceeds are now fully integrated into the financial system and can be used for any purpose.

Source: researchgate.net

Source: researchgate.net

Who is an AML officer. C Integration - creating the impression of apparent legitimacy to criminally derived wealth. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. The time period was intended to give reporting entities time to undertake their risk assessments and to plan and implement their systems and controls before requirements came into force.

Source: vskills.in

Source: vskills.in

The final stage is where the money is returned to the criminal from what seem to be legitimate sources. In situations where the layering process succeeds integration schemes effectively return the laundered proceeds back into the general financial system and the proceeds appear to. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. AML stands for Anti-Money Laundering and is a set of measures for combating the laundering of money and other financial crimes. Typically empowered with an end-to-end anti-money laundering solution or software AML analysts can use digital tools to better understand financial transactions and identify trends.

Source: letstalkaml.com

Source: letstalkaml.com

Definitions are the key to setting up your cyber-reporting program. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. In situations where the layering process succeeds integration schemes effectively return the laundered proceeds back into the general financial system and the proceeds appear to. An Anti-Money Laundering AML analyst - sometimes referred to as an investigator - essentially monitors and investigates suspicious financial activity.

Source: researchgate.net

Source: researchgate.net

Definitions are the key to setting up your cyber-reporting program. Latest news reports from the medical literature videos from the experts and more. This three staged definition of money laundering is highly simplistic. What is AML Anti-Money Laundering. Anti-money laundering AML regulations are mandated by both national and international authorities around the world and place a wide variety of screening and monitoring obligations on financial institutions.

Source: researchgate.net

Source: researchgate.net

The time period was intended to give reporting entities time to undertake their risk assessments and to plan and implement their systems and controls before requirements came into force. What is AML Anti-Money Laundering. This three staged definition of money laundering is highly simplistic. Ad AML coverage from every angle. C Integration - creating the impression of apparent legitimacy to criminally derived wealth.

Source: pinterest.com

Source: pinterest.com

1 Anti-Money Laundering and Countering the Financing of Terrorism AMLCFT Fundamentals 11 Definition of Money Laundering Money laundering is the process criminals use to try to conceal the true origin and ownership of the proceeds of drug trafficking and other serious crimes listed in. Define the Behavior and the Process. Ad AML coverage from every angle. The reality is that the so called stages often overlap and in some cases for example in cases of financial crimes there is no requirement for the proceeds of crime to be placed. Latest news reports from the medical literature videos from the experts and more.

Source: calert.info

Source: calert.info

The final stage of the money laundering process is termed the integration stage. Who is an AML officer. An Anti-Money Laundering AML analyst - sometimes referred to as an investigator - essentially monitors and investigates suspicious financial activity. An AML officer is a person who is responsible for the companys compliance with the requirements for preventing money laundering. The final stage of the money laundering process is termed the integration stage.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml definition of integration by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas