16+ Aml governance definition ideas in 2021

Home » about money loundering Info » 16+ Aml governance definition ideas in 2021Your Aml governance definition images are available. Aml governance definition are a topic that is being searched for and liked by netizens today. You can Download the Aml governance definition files here. Find and Download all free photos.

If you’re looking for aml governance definition images information related to the aml governance definition topic, you have come to the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Aml Governance Definition. Liaise with multiple stakeholders to assist in the definition of scope benefits deliverables and timelines. Unfortunately such requirements cannot be captured with the existing roles. Strong organisation skills attention to detail and ability to manage and prioritise effectively. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum.

Internal Control System In Accounting Internal Audit Internal Control Business Management From pinterest.com

Internal Control System In Accounting Internal Audit Internal Control Business Management From pinterest.com

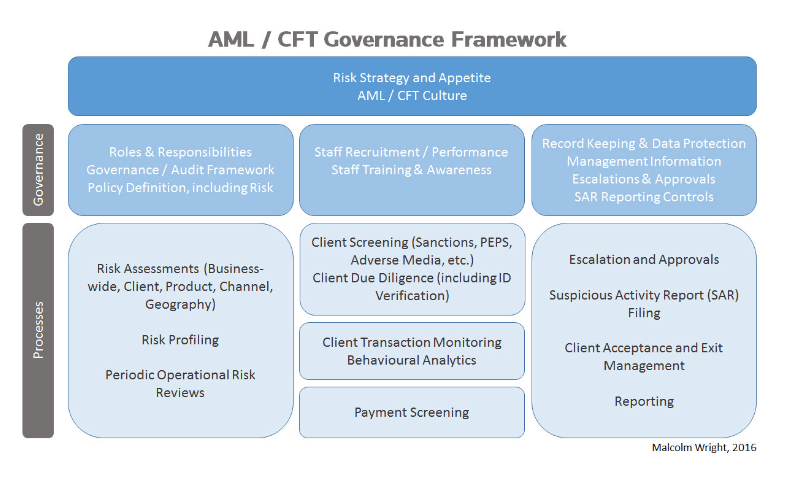

Unfortunately such requirements cannot be captured with the existing roles. By JX 29 Apr 2017. Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. AML Capability Model AML Framework Governance Ownership Responsibility Communication Risk Organisation Risk Based Approach Client On Boarding Transaction Monitoring On Going Management Client Risk Profiling Client Screening Client Due Diligence Client Acceptance Identify Track Suspicious Transactions On Going Client Due Diligence. Liaise with multiple stakeholders to assist in the definition of scope benefits deliverables and timelines. An effective AML governance structure is only possible when its leaders senior management of the organization consistently remain informed of the state of AML compliance within the institution across the firm17 Defining Escalation Requirements for US.

AML Capability Model AML Framework Governance Ownership Responsibility Communication Risk Organisation Risk Based Approach Client On Boarding Transaction Monitoring On Going Management Client Risk Profiling Client Screening Client Due Diligence Client Acceptance Identify Track Suspicious Transactions On Going Client Due Diligence.

AML Capability Model AML Framework Governance Ownership Responsibility Communication Risk Organisation Risk Based Approach Client On Boarding Transaction Monitoring On Going Management Client Risk Profiling Client Screening Client Due Diligence Client Acceptance Identify Track Suspicious Transactions On Going Client Due Diligence. Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. All current beneficial owners officers and managers must be approved by their supervisory authority in accordance with R26 Practices must appoint a MLRO money laundering reporting officer who is responsible for receiving disclosures from staff of suspected money laundering and determining whether they warrant the submission of a suspicious activity report SAR to the. AML Compliance Officer and MLROs knowledge and experience. Such governance policies are crucial for companies to be enforced and monitored to maintain integrity of their business and IT processes. It is therefore important for institutions to define their objectives clearly when designing a data governance function for AML or any other purpose and scope the undertaking appropriately to help them achieve their specific goals of managing protecting ensuring quality and ultimately knowing their data.

Source: za.pinterest.com

Source: za.pinterest.com

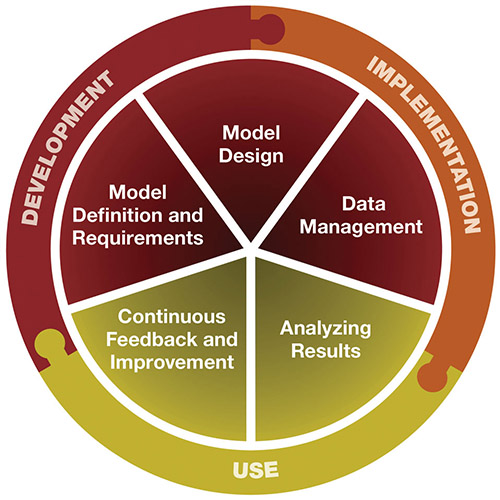

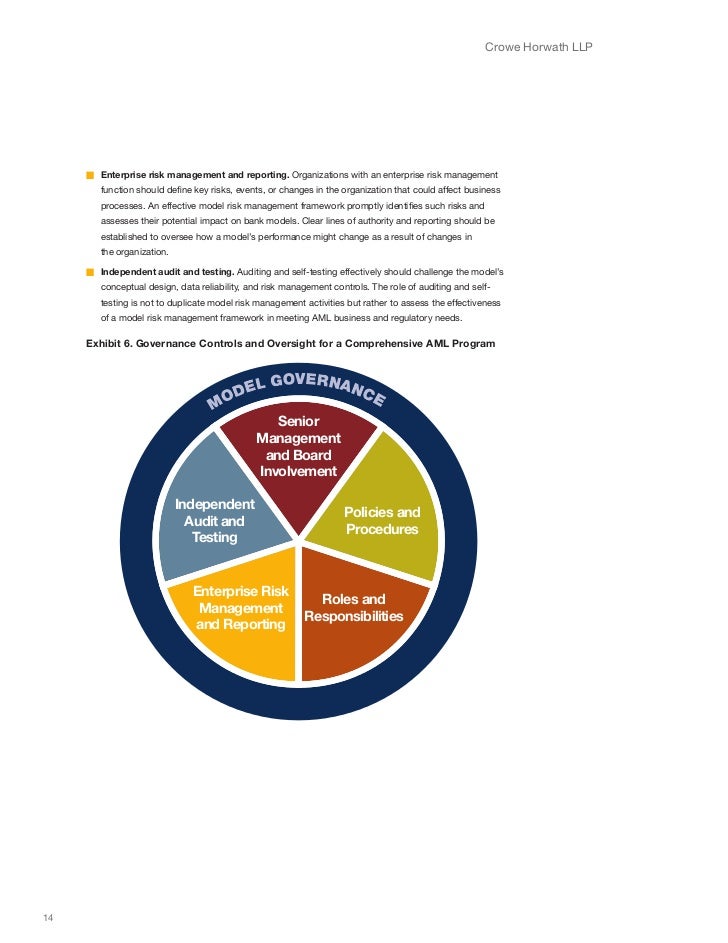

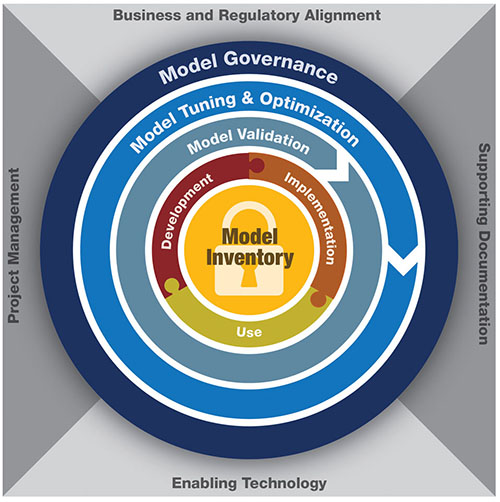

FCC tops the agenda of regulators globally. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. Anti-money laundering compliance has been a main focus of regulators and prosecutors in recent years. Data Governance Understanding its Importance for AML Compliance While the financial institutions have the desire to improve the data quality and availability data governance is often driven by external regulations to implement a program to ensure requirements outlined in DFS Part 504 regulation are met. According to the guidance Even if model development implementation use and validation are satisfactory a weak governance function will reduce the effectiveness of overall model risk management.

Source: eba.europa.eu

Source: eba.europa.eu

Enterprise needs a better mechanism to define policies for various assets in AML to satisfy their business specific requirements. Anti-money laundering compliance has been a main focus of regulators and prosecutors in recent years. Data Governance and Management in BSAAML and Sanctions Compliance. Anti-money laundering and financial crime compliance A viewpoint for revitalization and efficiency Anti-money laundering AML is a fundamentally critical responsibility of the modern financial enterprise. According to the guidance Even if model development implementation use and validation are satisfactory a weak governance function will reduce the effectiveness of overall model risk management.

Source: pinterest.com

Source: pinterest.com

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. Governance Culture Risk Assessment is a driver of all overall AML risks and resource allocation Is senior management a rubber stamp. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. It is therefore important for institutions to define their objectives clearly when designing a data governance function for AML or any other purpose and scope the undertaking appropriately to help them achieve their specific goals of managing protecting ensuring quality and ultimately knowing their data. In order to meet these requirements they will need to monitor regulatory changes and maintain an internal framework to ensure that customers.

Source: slideplayer.com

Source: slideplayer.com

Governance Culture Risk Assessment is a driver of all overall AML risks and resource allocation Is senior management a rubber stamp. Increasing focus has been applied to effective data management in recent years due to the growing reliance on data to manage and optimize operations mitigate risk and support development of new products and services. Governance for AML Governance structure assigns responsibilities for the effective implementation of Banks AML policies and monitoring structure and overall accountability. Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. FCC tops the agenda of regulators globally.

Source: acamstoday.org

Source: acamstoday.org

Such governance policies are crucial for companies to be enforced and monitored to maintain integrity of their business and IT processes. It is therefore important for institutions to define their objectives clearly when designing a data governance function for AML or any other purpose and scope the undertaking appropriately to help them achieve their specific goals of managing protecting ensuring quality and ultimately knowing their data. Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. All financial institutions that rely on models for AML compliance should implement an appropriate governance program.

Source: slideshare.net

Source: slideshare.net

Data Governance Understanding its Importance for AML Compliance While the financial institutions have the desire to improve the data quality and availability data governance is often driven by external regulations to implement a program to ensure requirements outlined in DFS Part 504 regulation are met. Strong organisation skills attention to detail and ability to manage and prioritise effectively. Designing a governance framework for sanctions. Such governance policies are crucial for companies to be enforced and monitored to maintain integrity of their business and IT processes. FCC tops the agenda of regulators globally.

Source: hesfintech.com

Source: hesfintech.com

AML Compliance Officer and MLROs knowledge and experience. Enterprise needs a better mechanism to define policies for various assets in AML to satisfy their business specific requirements. Proactively identify potential risks and interdependencies and propose improvements. All financial institutions that rely on models for AML compliance should implement an appropriate governance program. Anti-money laundering and financial crime compliance A viewpoint for revitalization and efficiency Anti-money laundering AML is a fundamentally critical responsibility of the modern financial enterprise.

Source: acamstoday.org

Source: acamstoday.org

Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. FCC tops the agenda of regulators globally. Data Governance Understanding its Importance for AML Compliance While the financial institutions have the desire to improve the data quality and availability data governance is often driven by external regulations to implement a program to ensure requirements outlined in DFS Part 504 regulation are met. Enterprise needs a better mechanism to define policies for various assets in AML to satisfy their business specific requirements. It effects the stability of the financial system and is essential to safeguarding national and global interests.

Source: pinterest.com

Source: pinterest.com

Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. All financial institutions that rely on models for AML compliance should implement an appropriate governance program. Has senior management identified and assessed the MLTF risks before sign-off. In order to meet these requirements they will need to monitor regulatory changes and maintain an internal framework to ensure that customers. FCC tops the agenda of regulators globally.

Source: elibrary.imf.org

Source: elibrary.imf.org

An effective AML governance structure is only possible when its leaders senior management of the organization consistently remain informed of the state of AML compliance within the institution across the firm17 Defining Escalation Requirements for US. Enterprise needs a better mechanism to define policies for various assets in AML to satisfy their business specific requirements. Increasing focus has been applied to effective data management in recent years due to the growing reliance on data to manage and optimize operations mitigate risk and support development of new products and services. What Does Data Governance Do. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world.

Source: bi.go.id

Source: bi.go.id

In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. Financial institutions have invested significant time money and resources into developing and maintaining anti-money laundering AML compliance programs. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. What Does Data Governance Do. AML Compliance Officer and MLROs knowledge and experience.

Source: pinterest.com

Source: pinterest.com

Proactively identify potential risks and interdependencies and propose improvements. In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. Liaise with multiple stakeholders to assist in the definition of scope benefits deliverables and timelines. Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. Enterprise needs a better mechanism to define policies for various assets in AML to satisfy their business specific requirements.

Designing a governance framework for sanctions. AML Capability Model AML Framework Governance Ownership Responsibility Communication Risk Organisation Risk Based Approach Client On Boarding Transaction Monitoring On Going Management Client Risk Profiling Client Screening Client Due Diligence Client Acceptance Identify Track Suspicious Transactions On Going Client Due Diligence. Advance Resource Access Governance for AML Mar 09 2021 0302 PM Access control is a fundamental building block for enterprise customers where protecting assets at various levels is absolutely necessary to ensure that only the relevant people with certain positions of authority are given access with different privileges. All current beneficial owners officers and managers must be approved by their supervisory authority in accordance with R26 Practices must appoint a MLRO money laundering reporting officer who is responsible for receiving disclosures from staff of suspected money laundering and determining whether they warrant the submission of a suspicious activity report SAR to the. FCC tops the agenda of regulators globally.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml governance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas