12++ Aml inherent risk definition information

Home » about money loundering Info » 12++ Aml inherent risk definition informationYour Aml inherent risk definition images are available in this site. Aml inherent risk definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Aml inherent risk definition files here. Download all royalty-free images.

If you’re looking for aml inherent risk definition images information linked to the aml inherent risk definition keyword, you have come to the right site. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Aml Inherent Risk Definition. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. Thus they reduce but their absence or poor effectiveness can never increase inherent risk. Inherent risk is the risk that exists without any controls in place. The identification of such component at first is easy to take care of as an alternative realizing and encountering such situations in a while within the transaction stage.

Http Pubdocs Worldbank Org En 187851572546448957 Day 3 Kuntay Celik Wb Fintech Risks 002 Pdf From

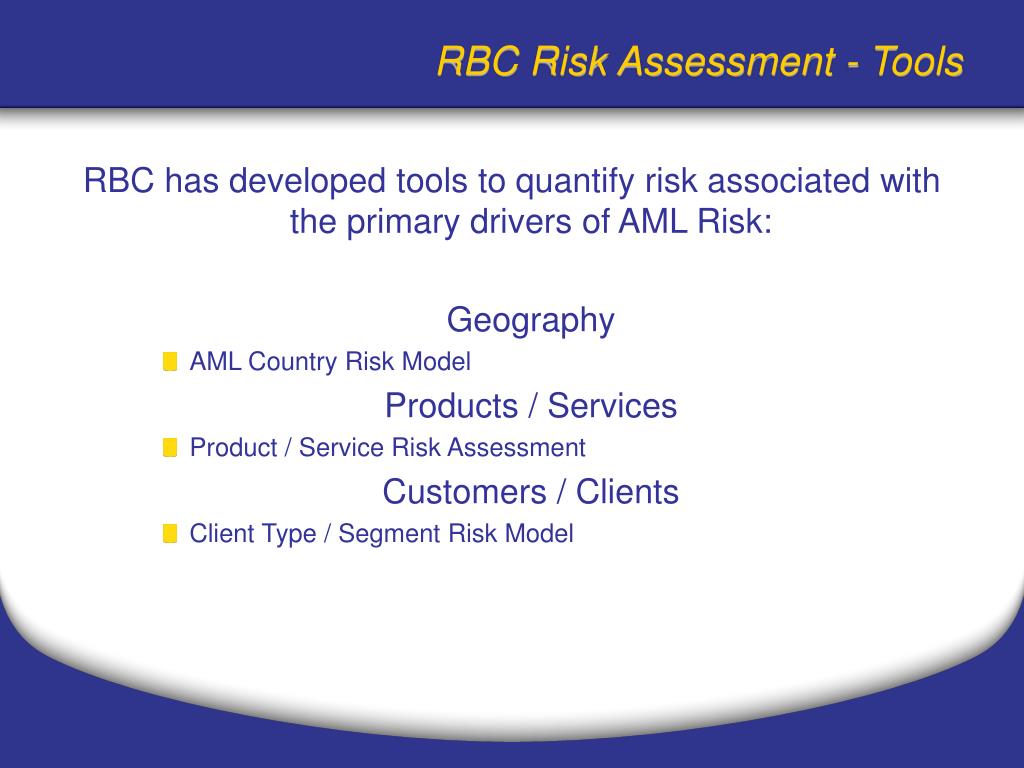

Thus they reduce but their absence or poor effectiveness can never increase inherent risk. The central bank in any nation provides full guides to AML and CFT to combat such actions. Residual risk would then be whatever risk level remain after additional controls are applied. In MLFT there are two types of controls. The properties in a sector product service distribution channel customer base institution system structure or jurisdiction that threat actors can exploit to launder proceeds of crime or to fund terrorism. A group of companies consisting of a parent company its branches its subsidiaries and the entities in which the parent company or its subsidiaries hashave a participating interest as well as the companies related to each other within the meaning of Article 22 of Directive 201334EU of.

The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously.

AMLCFT RISK MANAGEMENT AND REGULATORY RISK COMPLIANCE Risk definition and risk management The risk management framework and risks to be mitigated. Table of Contents FOREWORD V ACKNOWLEDGMENTS ABBREVIATIONS OF COMMON TERMS VI CHAPTER 1. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. When the risk assessment includes the inherent risk and measures the strength of controls this results in a finding of the residual risk. Inherent risks is the risks to an entity in the absence of any action taken by the company to mitigate or control these risks. Inherent risk is the risk that exists without any controls in place.

Source: siorik.com

Source: siorik.com

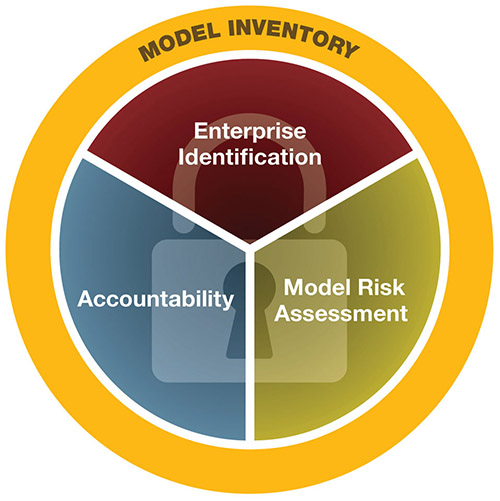

In MLFT there are two types of controls. AMLCFT RISK MANAGEMENT AND REGULATORY RISK COMPLIANCE Risk definition and risk management The risk management framework and risks to be mitigated. Inherent risk is current risk level given the existing set of controls rather than the hypothetical notion of an absence of any controls. Inherent risks is the risks to an entity in the absence of any action taken by the company to mitigate or control these risks. It includes identification and assessment of inherent risks supported by quantitative and quantitative analysis risk mitigation and ability to update the assessment regularly Governance and Oversight.

Source: acamstoday.org

Source: acamstoday.org

Table of Contents FOREWORD V ACKNOWLEDGMENTS ABBREVIATIONS OF COMMON TERMS VI CHAPTER 1. Table of Contents FOREWORD V ACKNOWLEDGMENTS ABBREVIATIONS OF COMMON TERMS VI CHAPTER 1. It is easy to get lost in AML risk terminology in many respects this is often an unnecessary diversion from a focused process. It is commonly used as the factual basis for. Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption.

Source: acamstoday.org

Source: acamstoday.org

When the risk assessment includes the inherent risk and measures the strength of controls this results in a finding of the residual risk. A group of companies consisting of a parent company its branches its subsidiaries and the entities in which the parent company or its subsidiaries hashave a participating interest as well as the companies related to each other within the meaning of Article 22 of Directive 201334EU of. Table of Contents FOREWORD V ACKNOWLEDGMENTS ABBREVIATIONS OF COMMON TERMS VI CHAPTER 1. Residual risk would then be whatever risk level remain after additional controls are applied. General controls and mitigants.

Source:

Secondary acute myeloid leukemia s-AML includes therapy-related AML and AML evolving from antecedent hematological disorder AHD. Table of Contents FOREWORD V ACKNOWLEDGMENTS ABBREVIATIONS OF COMMON TERMS VI CHAPTER 1. A group of companies consisting of a parent company its branches its subsidiaries and the entities in which the parent company or its subsidiaries hashave a participating interest as well as the companies related to each other within the meaning of Article 22 of Directive 201334EU of. 1 Inherent customer risk. The MLTF risk that is present in the absence of any controls to mitigate that risk.

Inherent risk is the risk that exists without any controls in place. 1 Inherent customer risk. Inherent risk is current risk level given the existing set of controls rather than the hypothetical notion of an absence of any controls. AML compliance programme aligns with its risk profile develop risk mitigation strategies including applicable internal controls and therefore lower a business unit or business lines residual risk exposure ensure senior management are made aware of the key risks control gaps and remediation efforts. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate.

Source: pideeco.be

Source: pideeco.be

2 Inherent product risk and Services. Residual risk would then be whatever risk level remain after additional controls are applied. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. General controls and mitigants.

Source: acamstoday.org

Source: acamstoday.org

A group of companies consisting of a parent company its branches its subsidiaries and the entities in which the parent company or its subsidiaries hashave a participating interest as well as the companies related to each other within the meaning of Article 22 of Directive 201334EU of. ESSENTIAL ELEMENTS OF A SOUND AMLCFT PROGRAM 15 31Introduction 15 32Governance. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money laundering terrorist financing and fraud-related risks. 2 Inherent product risk and Services.

Source: za.pinterest.com

Source: za.pinterest.com

INTRODUCTION 1 CHAPTER 2. S-AML arising after treating AHD likely represents a prognostically distinct high-risk disease category. Money laundering and terrorist financing risks arise because the bank may not know the ultimate beneficial owners or the source of funds. Level of risk taking into account the effect of controls on inherent risk. Different customers may carry different levels of risk.

Source: acamstoday.org

Source: acamstoday.org

Secondary acute myeloid leukemia s-AML includes therapy-related AML and AML evolving from antecedent hematological disorder AHD. When the risk assessment includes the inherent risk and measures the strength of controls this results in a finding of the residual risk. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money laundering terrorist financing and fraud-related risks. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. It is easy to get lost in AML risk terminology in many respects this is often an unnecessary diversion from a focused process.

Source:

To develop a strong AML compliance program that helps expose bad actors and stay safe from non-compliance fees businesses have to follow quite a few requirements. It includes identification and assessment of inherent risks supported by quantitative and quantitative analysis risk mitigation and ability to update the assessment regularly Governance and Oversight. S-AML arising after treating AHD likely represents a prognostically distinct high-risk disease category. ESSENTIAL ELEMENTS OF A SOUND AMLCFT PROGRAM 15 31Introduction 15 32Governance. The properties in a sector product service distribution channel customer base institution system structure or jurisdiction that threat actors can exploit to launder proceeds of crime or to fund terrorism.

Source: pideeco.be

Source: pideeco.be

Thus they reduce but their absence or poor effectiveness can never increase inherent risk. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. Inherent risks is the risks to an entity in the absence of any action taken by the company to mitigate or control these risks. S-AML arising after treating AHD likely represents a prognostically distinct high-risk disease category. An initial AMLCFT risk assessment will measure the inherent risk.

Source: slideshare.net

Source: slideshare.net

Inherent risk is the risk that exists without any controls in place. Focus on Governance and Oversight of. 1 Inherent customer risk. Inherent risks is the risks to an entity in the absence of any action taken by the company to mitigate or control these risks. Table of Contents FOREWORD V ACKNOWLEDGMENTS ABBREVIATIONS OF COMMON TERMS VI CHAPTER 1.

Source: slideserve.com

Source: slideserve.com

1 Inherent customer risk. The central bank in any nation provides full guides to AML and CFT to combat such actions. The deposit broker could represent a range of clients that may be of higher risk for money laundering and terrorist financing eg nonresident or offshore customers politically exposed persons PEP or foreign shell banks. When the risk assessment includes the inherent risk and measures the strength of controls this results in a finding of the residual risk. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml inherent risk definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas