12++ Aml kyc requirements canada ideas

Home » about money loundering idea » 12++ Aml kyc requirements canada ideasYour Aml kyc requirements canada images are ready. Aml kyc requirements canada are a topic that is being searched for and liked by netizens now. You can Download the Aml kyc requirements canada files here. Find and Download all free vectors.

If you’re searching for aml kyc requirements canada images information related to the aml kyc requirements canada interest, you have visit the ideal site. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

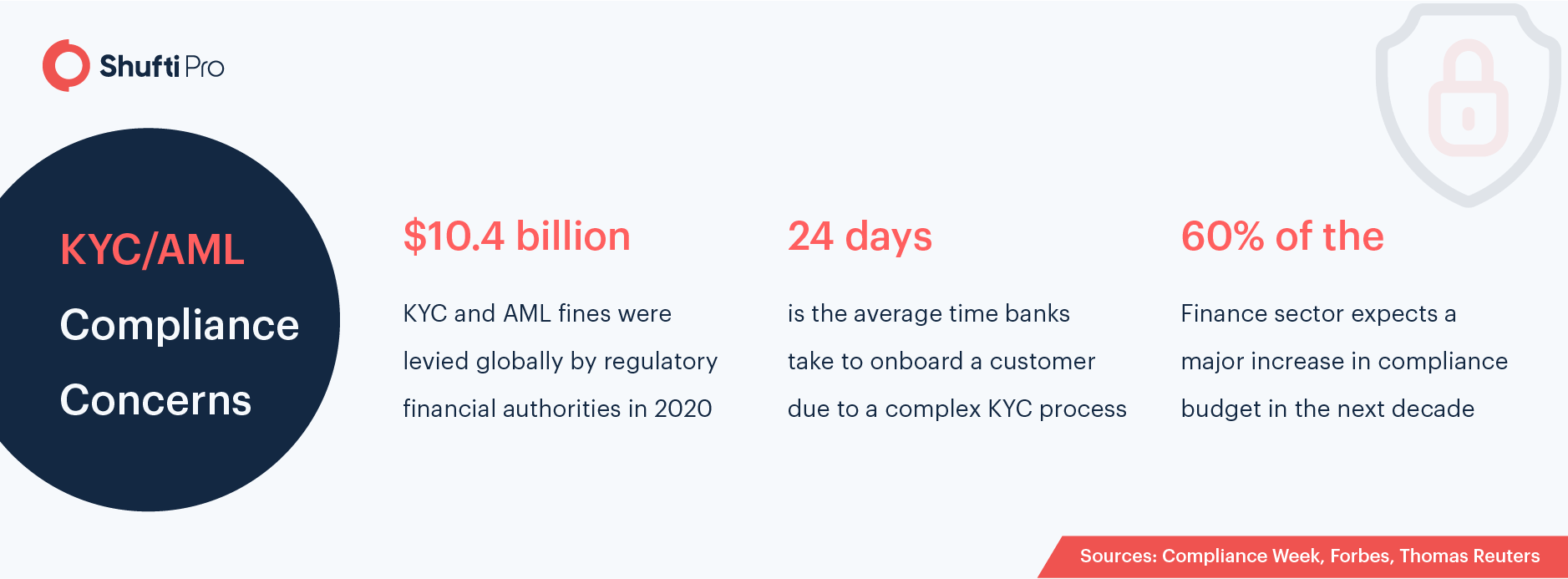

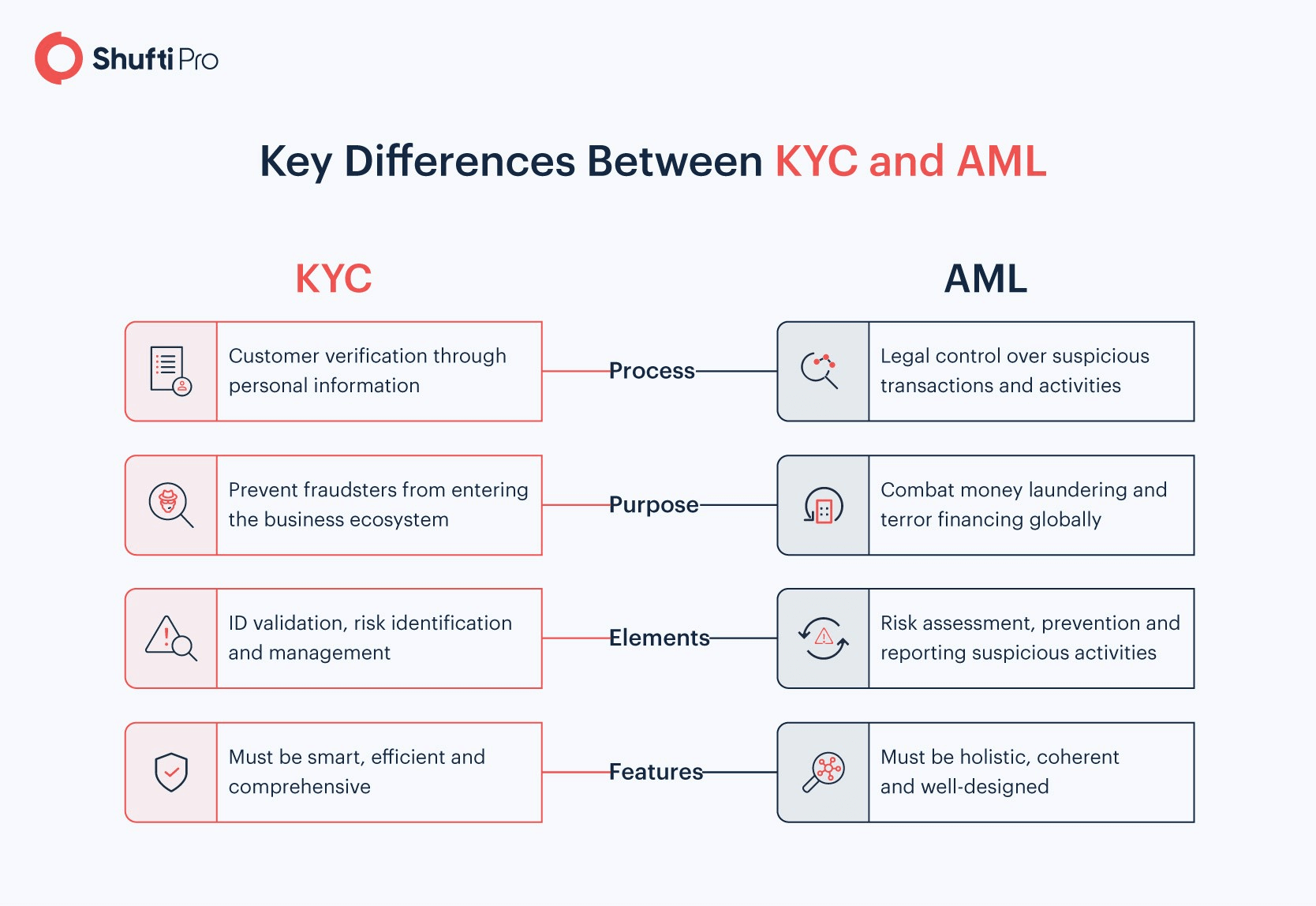

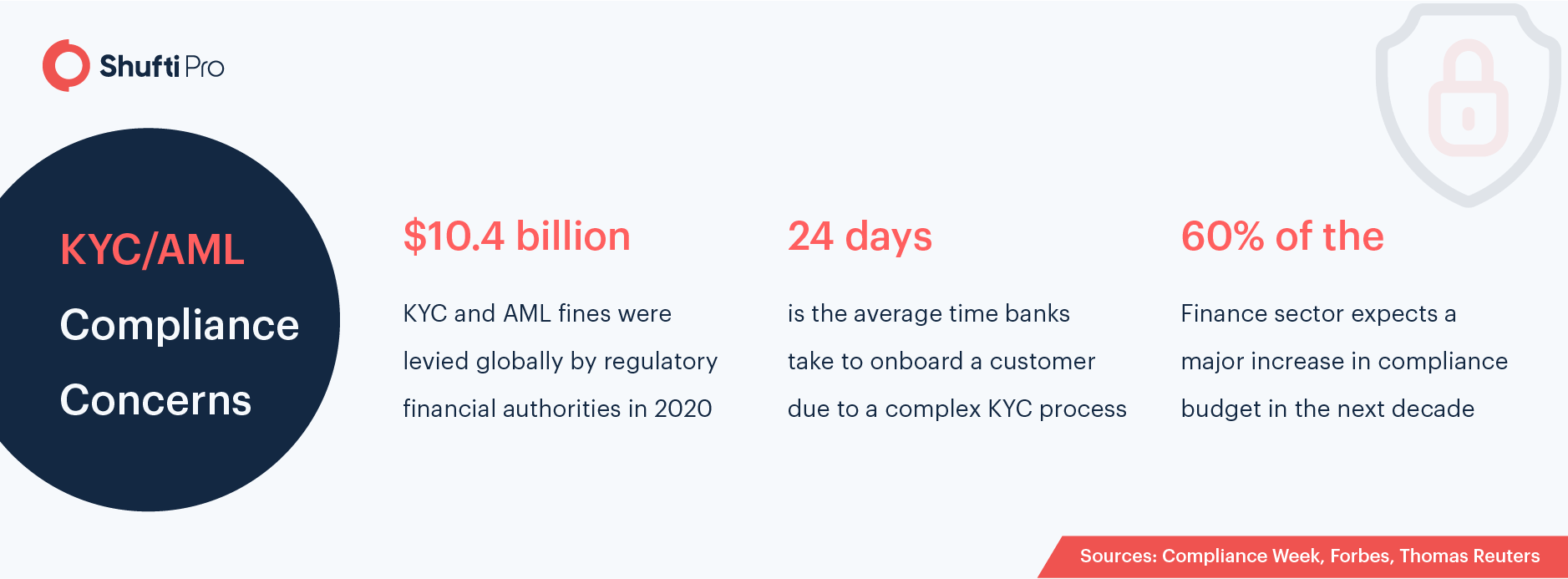

Aml Kyc Requirements Canada. Whereas the AML rules are in place to help protect and report suspicious activity with respect to financial transactions. KYC is a banking regulation and a requirement in the process of complying with the preventive measures mandatory to monitor money laundering techniques used by suspected parties. The mutual evaluation of the Canadian regulatory framework in 2008 found substantial gaps in its implementation of the FATFs 40 recommendations and as a result it was subject to annual follow-up reviews. Establish a risk-based AMLCFT compliance program.

Aml And Kyc Compliance Big Data Optimising The Regulatory Landscape From shuftipro.com

Aml And Kyc Compliance Big Data Optimising The Regulatory Landscape From shuftipro.com

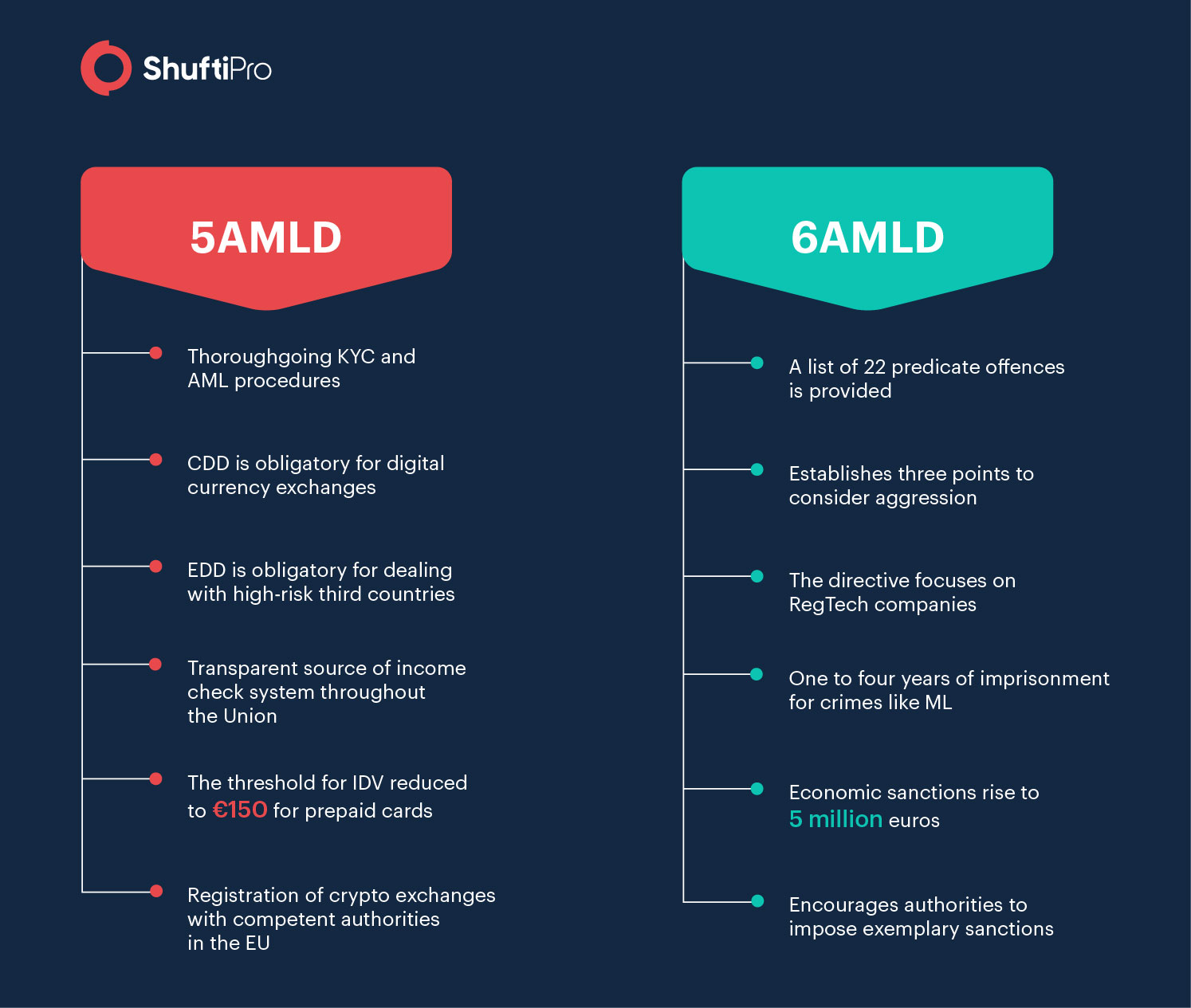

Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. The KYC and AML regulations differ across countries. The PCMLTFA is particularly important because sets out the regulations for AMLCFT compliance in Canada and requires all firms including fintech service providers to. The mutual evaluation of the Canadian regulatory framework in 2008 found substantial gaps in its implementation of the FATFs 40 recommendations and as a result it was subject to annual follow-up reviews. Rules like EUs 4 th Anti Money Laundering Directive and the US Bank Secrecy Act must be taken into consideration. There were numerous additions refinements and alterations so any regulated.

AML Regulations for Banks and Fintechs in Canada 08 May 2020 Updates to Canadas enemy of Anti-Money Laundering AML and against Anti-Terrorist Financing ATF guidelines are going to make client onboarding and consistence a lot simpler for banks and fintechs because they change the way end clients can confirm their personalities.

Businesses need to perform a standard KYCAML procedure to obtain and confirm the identities of beneficiaries. The KYC and AML regulations differ across countries. Information on company ownership control and structure. The PCMLTFA is particularly important because sets out the regulations for AMLCFT compliance in Canada and requires all firms including fintech service providers to. Establish and verify the identities of their customers and clients. AML Regulations for Banks and Fintechs in Canada 08 May 2020 Updates to Canadas enemy of Anti-Money Laundering AML and against Anti-Terrorist Financing ATF guidelines are going to make client onboarding and consistence a lot simpler for banks and fintechs because they change the way end clients can confirm their personalities.

Source: shuftipro.com

Source: shuftipro.com

These requirements are approximated from relevant informationlawsdirectives from the aforementioned document. There were numerous additions refinements and alterations so any regulated. These requirements are approximated from relevant informationlawsdirectives from the aforementioned document. Establish and verify the identities of their customers and clients. Businesses need to perform a standard KYCAML procedure to obtain and confirm the identities of beneficiaries.

Source: shuftipro.com

Source: shuftipro.com

These requirements are approximated from relevant informationlawsdirectives from the aforementioned document. As a result Canadian companies finally received the opportunity to employ remote verification. A financial enterprise should formulate AML policies based on the rules and regulations of AML in the country it functions in. At the end of 2019 amendments to the primary AML regulation PCMLTFA supervised by the Financial Transactions and Reports Analysis Centre of Canada FinTRAC came into force. Establish a risk-based AMLCFT compliance program.

Source: bi.go.id

Source: bi.go.id

There were numerous additions refinements and alterations so any regulated. These requirements are approximated from relevant informationlawsdirectives from the aforementioned document. Establish and verify the identities of their customers and clients. Under Canadian legislation beneficial owners are individuals who directly or indirectly own or control at least 25 of a company regardless of where the company is located. Define standard identification procedures which apply for each type of investor and Intermediary investing into the Funds 3.

Source: cz.pinterest.com

Source: cz.pinterest.com

KYC is a banking regulation and a requirement in the process of complying with the preventive measures mandatory to monitor money laundering techniques used by suspected parties. Rules like EUs 4 th Anti Money Laundering Directive and the US Bank Secrecy Act must be taken into consideration. Establish and verify the identities of their customers and clients. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. Ad AML coverage from every angle.

Source: slideshare.net

Source: slideshare.net

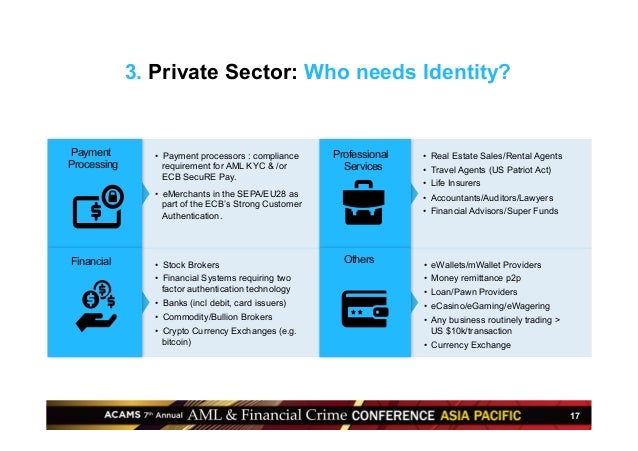

Ad AML coverage from every angle. Amendments to the Canadian Know Your CustomerAnti-Money Laundering KYC AML regulations the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA were registered on June 25 2019. Jumios AI-powered online identity verification solutions can help Canadian banks and financial organizations replace slow ineffective and costly manual AMLKYC processes with more automated solutions that can be embedded within the account setup and onboarding experience. Canada is a founding member of the Financial Action Task Force FATF and its KYC and AML regulations are largely consistent with the FATFs standards. Define standard identification procedures which apply for each type of investor and Intermediary investing into the Funds 3.

Source: shuftipro.com

Source: shuftipro.com

The KYC and AML regulations differ across countries. Businesses need to perform a standard KYCAML procedure to obtain and confirm the identities of beneficiaries. These requirements are approximated from relevant informationlawsdirectives from the aforementioned document. Ad AML coverage from every angle. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

Source: bi.go.id

Source: bi.go.id

To develop a KYCAML compliance system that can be used and shared by multiple FIs the participating FIs must agree upon certain standard KYCAML forms and processes that will be acceptable to them. Establish a risk-based AMLCFT compliance program. Under Canadian legislation beneficial owners are individuals who directly or indirectly own or control at least 25 of a company regardless of where the company is located. Establish and verify the identities of their customers and clients. Learn more by visiting our Banking Digitization page.

Source: researchgate.net

Source: researchgate.net

As a result Canadian companies finally received the opportunity to employ remote verification. A financial enterprise should formulate AML policies based on the rules and regulations of AML in the country it functions in. AML Regulations for Banks and Fintechs in Canada 08 May 2020 Updates to Canadas enemy of Anti-Money Laundering AML and against Anti-Terrorist Financing ATF guidelines are going to make client onboarding and consistence a lot simpler for banks and fintechs because they change the way end clients can confirm their personalities. Ad AML coverage from every angle. Under Canadian legislation beneficial owners are individuals who directly or indirectly own or control at least 25 of a company regardless of where the company is located.

Source: slideshare.net

Source: slideshare.net

As a result Canadian companies finally received the opportunity to employ remote verification. As a result Canadian companies finally received the opportunity to employ remote verification. The aims of the Guidelines are to. Define standard identification procedures which apply for each type of investor and Intermediary investing into the Funds 3. Amendments to the Canadian Know Your CustomerAnti-Money Laundering KYC AML regulations the Proceeds of Crime Money Laundering and Terrorist Financing Act PCMLTFA were registered on June 25 2019.

Source: bi.go.id

Source: bi.go.id

Learn more by visiting our Banking Digitization page. KYC is a banking regulation and a requirement in the process of complying with the preventive measures mandatory to monitor money laundering techniques used by suspected parties. Information on company ownership control and structure. To develop a KYCAML compliance system that can be used and shared by multiple FIs the participating FIs must agree upon certain standard KYCAML forms and processes that will be acceptable to them. Jumios AI-powered online identity verification solutions can help Canadian banks and financial organizations replace slow ineffective and costly manual AMLKYC processes with more automated solutions that can be embedded within the account setup and onboarding experience.

Source: resolutioninc.ca

Source: resolutioninc.ca

Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. With our global AI powered solution verify user ID Passports drivings licenses instantly. AML Regulations for Banks and Fintechs in Canada 08 May 2020 Updates to Canadas enemy of Anti-Money Laundering AML and against Anti-Terrorist Financing ATF guidelines are going to make client onboarding and consistence a lot simpler for banks and fintechs because they change the way end clients can confirm their personalities. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options.

Source: pinterest.com

Source: pinterest.com

Ad AML coverage from every angle. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. As a result Canadian companies finally received the opportunity to employ remote verification. With our global AI powered solution verify user ID Passports drivings licenses instantly. Latest news reports from the medical literature videos from the experts and more.

Source: pinterest.com

Source: pinterest.com

The PCMLTFA is particularly important because sets out the regulations for AMLCFT compliance in Canada and requires all firms including fintech service providers to. KYC is a banking regulation and a requirement in the process of complying with the preventive measures mandatory to monitor money laundering techniques used by suspected parties. To develop a KYCAML compliance system that can be used and shared by multiple FIs the participating FIs must agree upon certain standard KYCAML forms and processes that will be acceptable to them. Ad AML coverage from every angle. These requirements are approximated from relevant informationlawsdirectives from the aforementioned document.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title aml kyc requirements canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information