15+ Aml program definition info

Home » about money loundering Info » 15+ Aml program definition infoYour Aml program definition images are available in this site. Aml program definition are a topic that is being searched for and liked by netizens now. You can Download the Aml program definition files here. Get all free photos and vectors.

If you’re looking for aml program definition images information linked to the aml program definition keyword, you have pay a visit to the ideal site. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Aml Program Definition. Development of internal policies procedures and controls designation of a AML BSA officer responsible for the program relevant training of employees and independent testing. You understand your business better than anyone else. An employee due diligence program to identify any employees who may put your business or organisation at risk of MLTF. Ad AML coverage from every angle.

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Compliance Jobs From in.pinterest.com

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Compliance Jobs From in.pinterest.com

Develop an AMLCFT Program obtain. This guideline is designed to help you develop and implement your anti-money laundering and countering financing of terrorism programme programme under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. Monitoring changes in the organizations risk profile performance against stated tolerances. You are best placed to. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms.

Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents.

Definition of AML program effectiveness the concept of Strategic AML Priorities Priorities and a possible regulatory requirement for risk assessments. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Development of internal policies procedures and controls designation of a AML BSA officer responsible for the program relevant training of employees and independent testing. In May 2018 a fifth pillar due diligence was added after the. Definition of AML program effectiveness the concept of Strategic AML Priorities Priorities and a possible regulatory requirement for risk assessments. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC.

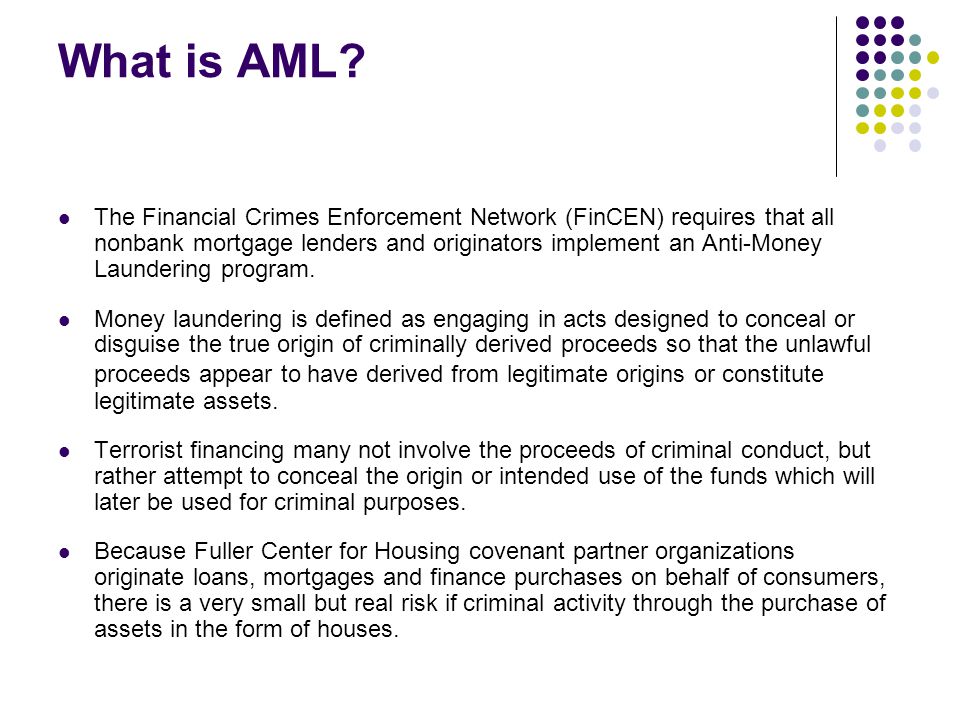

Source: ppt-online.org

Source: ppt-online.org

For obliged entities an Anti-Money Laundering Compliance Program AML is critical. An AMLCTF risk awareness training program for employees so they know the risks to your business or organisation and what they must look out for. This guideline is designed to help you develop and implement your anti-money laundering and countering financing of terrorism programme programme under the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act 2009 the Act. An employee due diligence program to identify any employees who may put your business or organisation at risk of MLTF. Defining the organizations AML risk appetite so that it is clear throughout the organization how much AML risk is acceptable.

Source: acamstoday.org

Source: acamstoday.org

Monitoring changes in the organizations risk profile performance against stated tolerances. Ad AML coverage from every angle. In May 2018 a fifth pillar due diligence was added after the. Defining the organizations AML risk appetite so that it is clear throughout the organization how much AML risk is acceptable. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms.

Source: pinterest.com

Source: pinterest.com

In a welcome and potentially fundamental change the primary focus for AML programs would shift from maintaining technical compliance to focusing on outcomes and. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The main components that must be. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. What is an AML compliance program.

Source: bi.go.id

Source: bi.go.id

An anti-money laundering program is a set of regulations and procedures that financial institutions follow to prevent and detect money laundering or terrorist financing activities. Develop an AMLCFT Program obtain. Development of internal policies procedures and controls designation of a AML BSA officer responsible for the program relevant training of employees and independent testing. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. What is an AML compliance program.

Source: bi.go.id

Source: bi.go.id

AMLCFT Programs are comprised of a detailed and complex set of requirements which must be carefully understood. What is AML Compliance Program. An AML compliance program should focus not only on the effectiveness of internal systems and controls developed to detect money laundering but on the risk posed by the activities of customers and clients with which an institution does business. The main components that must be. AML anti-money laundering is a broad process companies do to ensure compliance whereas KYC know your customers is one part of that process.

Source: plianced.com

Ad AML coverage from every angle. Latest news reports from the medical literature videos from the experts and more. Develop an AMLCFT Program obtain. Development of internal policies procedures and controls designation of a AML BSA officer responsible for the program relevant training of employees and independent testing. The core elements every AMLCFT Program must have in-place includes.

Source: mintos.com

Source: mintos.com

An employee due diligence program to identify any employees who may put your business or organisation at risk of MLTF. Registration with the AML Supervisor. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Ad AML coverage from every angle. An anti-money laundering program is a set of regulations and procedures that financial institutions follow to prevent and detect money laundering or terrorist financing activities.

In May 2018 a fifth pillar due diligence was added after the. AMLCFT Programs are comprised of a detailed and complex set of requirements which must be carefully understood. For obliged entities an Anti-Money Laundering Compliance Program AML is critical. An anti-money laundering program is a set of regulations and procedures that financial institutions follow to prevent and detect money laundering or terrorist financing activities. FINRA reviews a firms compliance with AML rules under FINRA Rule 3310 which sets forth minimum standards for a firms.

Source: shuftipro.com

Source: shuftipro.com

An anti-money laundering AML program is a set of procedures designed to guard against someone using the firm to facilitate money laundering or terrorist financing. An anti-money laundering program is a set of regulations and procedures that financial institutions follow to prevent and detect money laundering or terrorist financing activities. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. What is an AML compliance program.

Source: slideplayer.com

Source: slideplayer.com

For obliged entities an Anti-Money Laundering Compliance Program AML is critical. Initial and ongoing MLFT Risk Assessment. An anti-money laundering program is a set of regulations and procedures that financial institutions follow to prevent and detect money laundering or terrorist financing activities. Means the Anti-Money Laundering Program of the Trust that the Trust is required to adopt and implement under Treasury Rules promulgated under provisions of the Bank Secrecy Act and the USA PATRIOT Act the Patriot Act which program is reasonably designed to prevent the Trust from being used for money laundering funding of terrorist activities or criminal. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents.

Source: bi.go.id

For many years AML compliance programs were built on the four internationally known pillars. AML anti-money laundering is a broad process companies do to ensure compliance whereas KYC know your customers is one part of that process. What is an AML Compliance Program. The importance of the compliance function means that firms must be familiar with the difference between AML and KYC. Among the most impactful actions the Board and senior management can take to promote an effective AML compliance program are.

Source: bi.go.id

Source: bi.go.id

For obliged entities an Anti-Money Laundering Compliance Program AML is critical. Development of internal policies procedures and controls designation of a AML BSA officer responsible for the program relevant training of employees and independent testing. Taking proper steps to prevent money laundering and terrorist financing also helps mitigate the risk of fines for non-compliance and reputational damage. Defining the organizations AML risk appetite so that it is clear throughout the organization how much AML risk is acceptable. What is an AML compliance program.

Source: in.pinterest.com

Source: in.pinterest.com

Defining the organizations AML risk appetite so that it is clear throughout the organization how much AML risk is acceptable. An anti-money laundering AML program is a set of procedures designed to guard against someone using the firm to facilitate money laundering or terrorist financing. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. An AML compliance program should focus not only on the effectiveness of internal systems and controls developed to detect money laundering but on the risk posed by the activities of customers and clients with which an institution does business. What is AML Compliance Program.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml program definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas