11++ Aml risk meaning info

Home » about money loundering idea » 11++ Aml risk meaning infoYour Aml risk meaning images are ready. Aml risk meaning are a topic that is being searched for and liked by netizens today. You can Find and Download the Aml risk meaning files here. Download all free vectors.

If you’re searching for aml risk meaning images information related to the aml risk meaning keyword, you have pay a visit to the right site. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

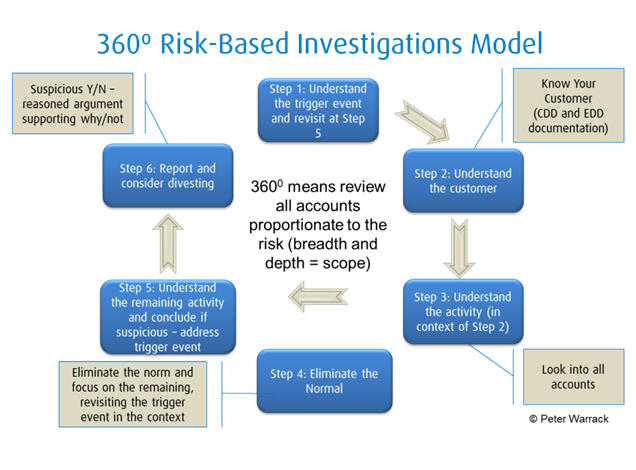

Aml Risk Meaning. This gives organisations the best possible chance at identifying the signs and. Translocation between chromosome 6 and 9. AML Partners Legitimacy Lifecycle provides the conceptual framework for AML Compliance that spans the entire lifecycle of a customer relationship. How to Comply Foreign currency exchange FX is a popular methodology for money launderers who seek to exploit a range of vulnerabilities associated with the service.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Deletion of part of chromosome 5 or 7. A RBA to AMLCFT means that countries competent authorities and financial institutions are expected to identify assess and understand the MLTF risks to which they are exposed and take AMLCFT measures commensurate to those risks in order to mitigate them effectively. Money Laundering Risks The money laundering risk associated with eWallets and mobile money derives from the relative anonymity offered by online financial services and other aspects of the technology including the speed with which transactions can take place and a lack of regulation from national and international authorities. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Translocation or inversion of chromosome 3. Countries should apply a risk-based approach RBA to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified.

Poor or less-favourable risk means that the person with AML has the following chromosome changes.

Abnormalities of chromosome 11. AML scheme requires an assessment of corruption-related risk and protecting against the laundering of corruption proceeds across the spectrum of customers and business relationships regardless of whether a FATF-defined PEP is involved. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. Translocation or inversion of chromosome 3. Countries should apply a risk-based approach RBA to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified.

Source: complyadvantage.com

Source: complyadvantage.com

Poor or less-favourable risk means that the person with AML has the following chromosome changes. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption. T he risk-based anti-money laundering AML principle was first promoted by British regulatory authorities.

Source: acamstoday.org

Source: acamstoday.org

Abnormalities of chromosome 11. AML Risks in Foreign Exchange. In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. How to Comply Foreign currency exchange FX is a popular methodology for money launderers who seek to exploit a range of vulnerabilities associated with the service. A RBA to AMLCFT means that countries competent authorities and financial institutions are expected to identify assess and understand the MLTF risks to which they are exposed and take AMLCFT measures commensurate to those risks in order to mitigate them effectively.

Source: bi.go.id

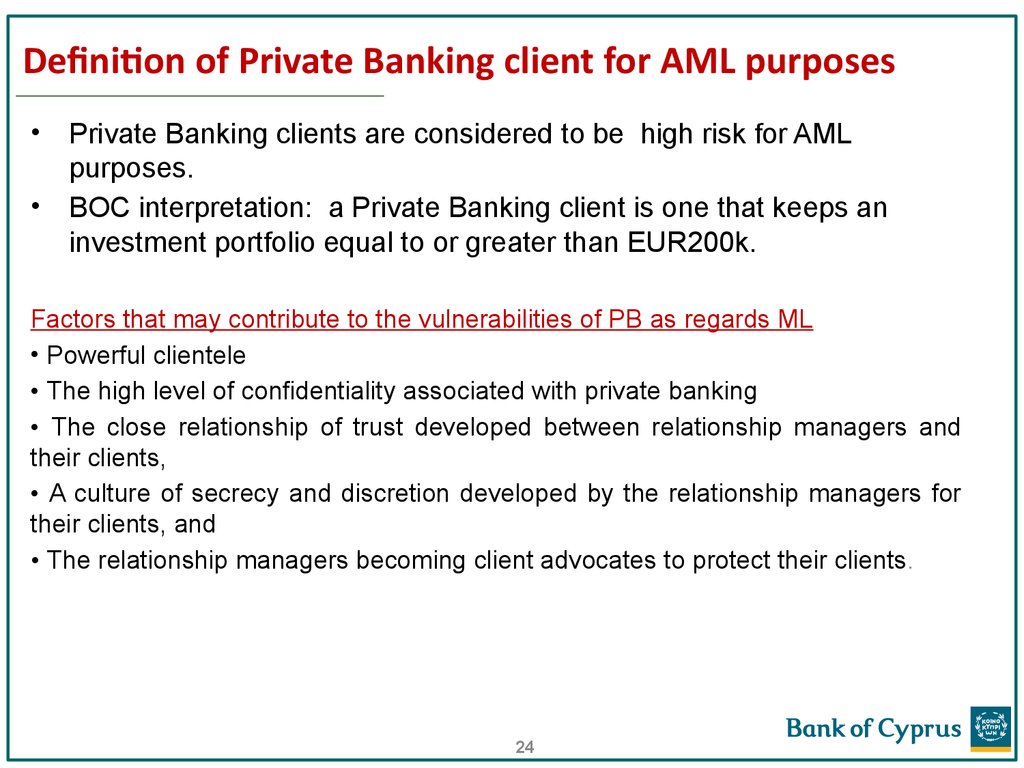

Poor or less-favourable risk means that the person with AML has the following chromosome changes. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. Effective policies procedures and processes can help protect banks from becoming conduits for or victims of money laundering terrorist financing and other financial crimes that are perpetrated through private banking relationships. Translocation between chromosome 6 and 9. A risk-based approach to AML is flexible and allows each company to make adjustments as they see increases in certain kinds of activity or behavior.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Higher-risk customers should be subject to stricter AML measures while lower-risk customers should be subject to simplified measures. In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. Countries should apply a risk-based approach RBA to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified. Translocation between chromosome 6 and 9.

Source: tookitaki.ai

Source: tookitaki.ai

Translocation between chromosome 6 and 9. For AML Partners those two elements are our Legitimacy Lifecycle and the Principles of Risk Mitigation. Money Laundering Risks The money laundering risk associated with eWallets and mobile money derives from the relative anonymity offered by online financial services and other aspects of the technology including the speed with which transactions can take place and a lack of regulation from national and international authorities. The FATF have published standards for putting in place a good framework for analysing and mitigating money laundering risk. Translocation or inversion of chromosome 3.

Source: bi.go.id

Source: bi.go.id

RBA was highlighted in the 2012 FATF Recommendations. A Risk-based approach RBA is an essential part of Risk Management and the AMLCFT framework. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. AML Partners Legitimacy Lifecycle provides the conceptual framework for AML Compliance that spans the entire lifecycle of a customer relationship. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Source: pideeco.be

Source: pideeco.be

RBA was highlighted in the 2012 FATF Recommendations. Translocation or inversion of chromosome 3. Translocation between chromosomes 9 and 11. In practice digital lenders must put AMLCFT measures in place that reflect their level of risk. Money Laundering Risks The money laundering risk associated with eWallets and mobile money derives from the relative anonymity offered by online financial services and other aspects of the technology including the speed with which transactions can take place and a lack of regulation from national and international authorities.

Source: mintos.com

Source: mintos.com

AML Partners Legitimacy Lifecycle provides the conceptual framework for AML Compliance that spans the entire lifecycle of a customer relationship. Countries should apply a risk-based approach RBA to ensure that measures to prevent or mitigate money laundering and terrorist financing are commensurate with the risks identified. In practice digital lenders must put AMLCFT measures in place that reflect their level of risk. Translocation between chromosome 9 and 22. How to Comply Foreign currency exchange FX is a popular methodology for money launderers who seek to exploit a range of vulnerabilities associated with the service.

Source: bi.go.id

Source: bi.go.id

In practice digital lenders must put AMLCFT measures in place that reflect their level of risk. In January 2000 the Financial Services Authority FSA was the first to put forth such a concept in its book titled A New Regulator for the New Millennium. Money Laundering Risks The money laundering risk associated with eWallets and mobile money derives from the relative anonymity offered by online financial services and other aspects of the technology including the speed with which transactions can take place and a lack of regulation from national and international authorities. For AML Partners those two elements are our Legitimacy Lifecycle and the Principles of Risk Mitigation. RBA was highlighted in the 2012 FATF Recommendations.

Source: ppt-online.org

Source: ppt-online.org

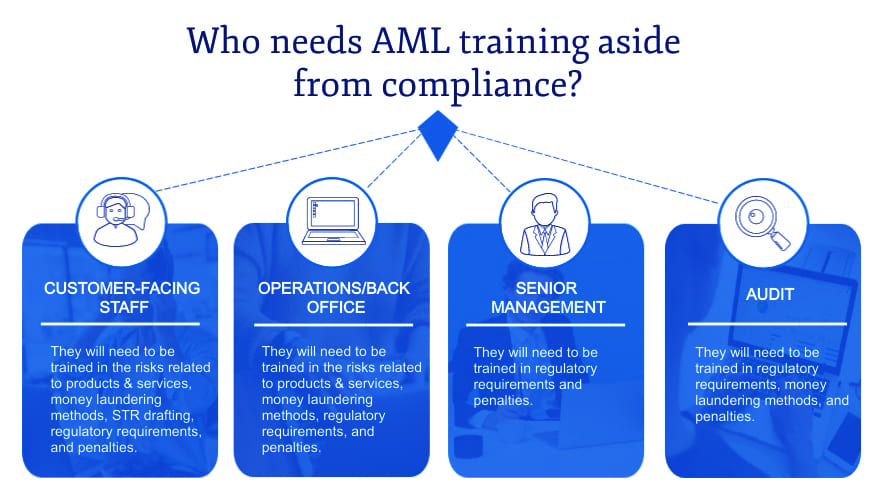

What is AML Anti-Money Laundering. Translocation or inversion of chromosome 3. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. The FATF requires that firms implement a risk-based approach to AML. T he risk-based anti-money laundering AML principle was first promoted by British regulatory authorities.

Source: bi.go.id

Source: bi.go.id

Translocation between chromosome 9 and 22. Translocation between chromosome 9 and 22. Poor or less-favourable risk means that the person with AML has the following chromosome changes. This means you can catch the signs and investigate any risk factors before theyve entered the financial system - assuring the integrity of the business and mitigating the chance for criminals to profit. Significant profit potential for the bank.

Source: bi.go.id

Source: bi.go.id

The FATF have published standards for putting in place a good framework for analysing and mitigating money laundering risk. Deletion of part of chromosome 5 or 7. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering or financing of terrorism. AML scheme requires an assessment of corruption-related risk and protecting against the laundering of corruption proceeds across the spectrum of customers and business relationships regardless of whether a FATF-defined PEP is involved. Effective policies procedures and processes can help protect banks from becoming conduits for or victims of money laundering terrorist financing and other financial crimes that are perpetrated through private banking relationships.

Source: shuftipro.com

Source: shuftipro.com

This gives organisations the best possible chance at identifying the signs and. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Poor or less-favourable risk means that the person with AML has the following chromosome changes. Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption. Translocation or inversion of chromosome 3.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml risk meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information