11++ Aml sanctions definition ideas

Home » about money loundering Info » 11++ Aml sanctions definition ideasYour Aml sanctions definition images are available in this site. Aml sanctions definition are a topic that is being searched for and liked by netizens now. You can Download the Aml sanctions definition files here. Find and Download all free vectors.

If you’re looking for aml sanctions definition pictures information connected with to the aml sanctions definition interest, you have visit the right site. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

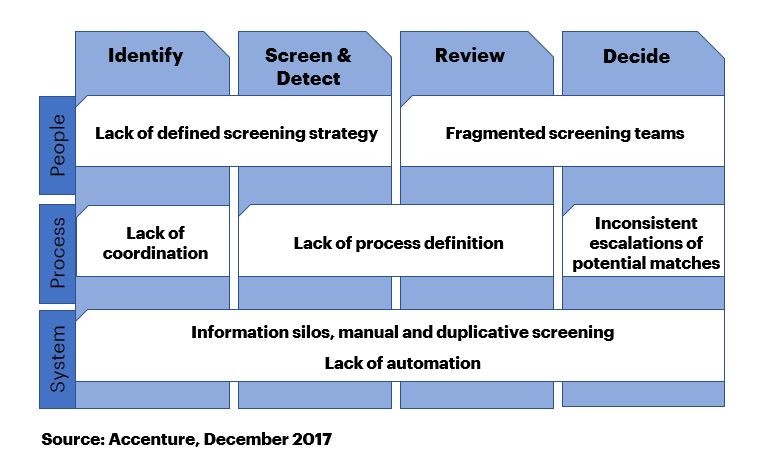

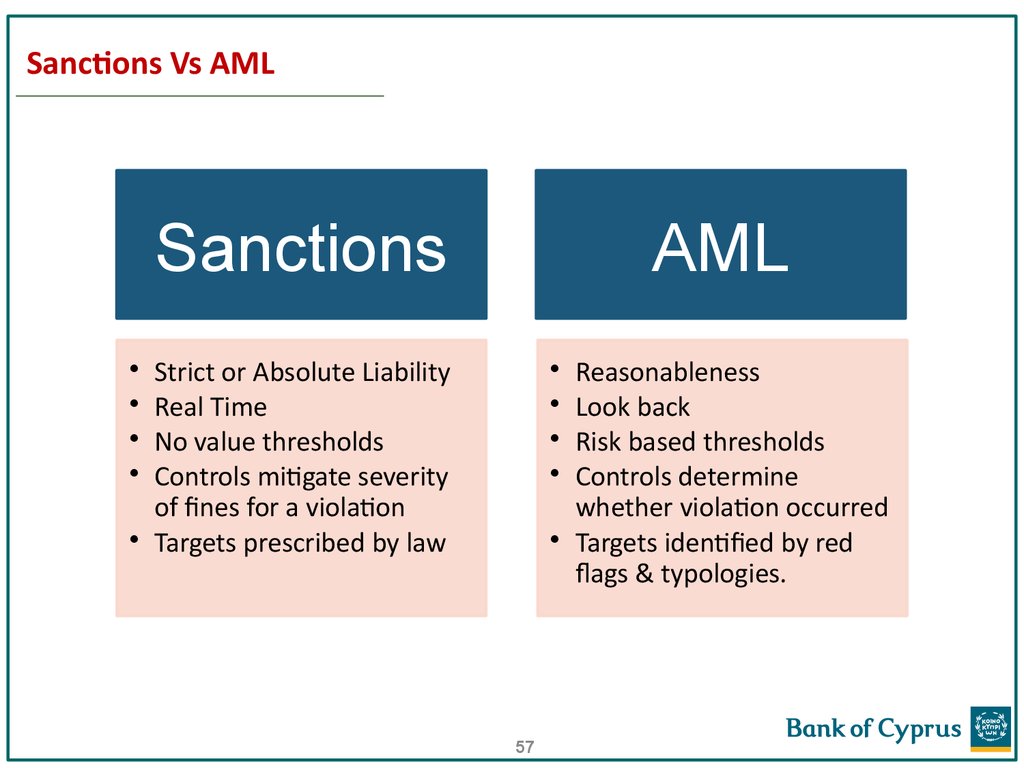

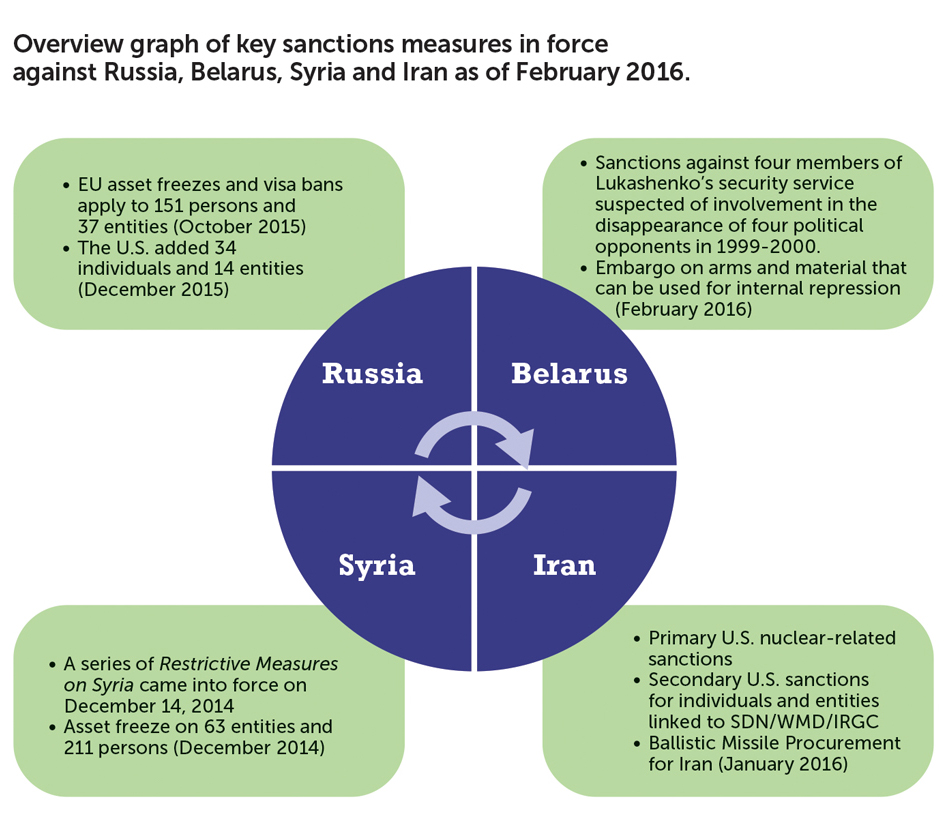

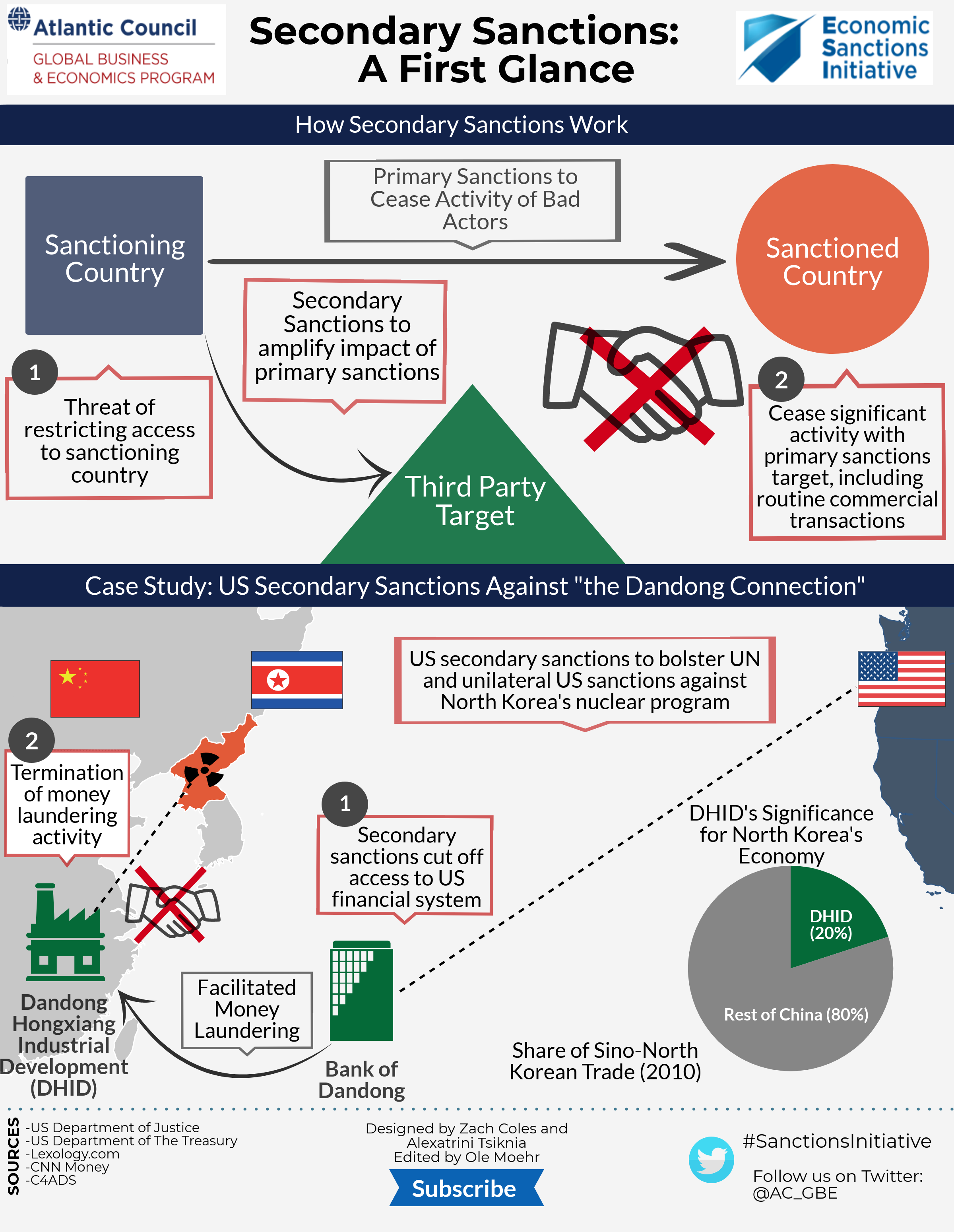

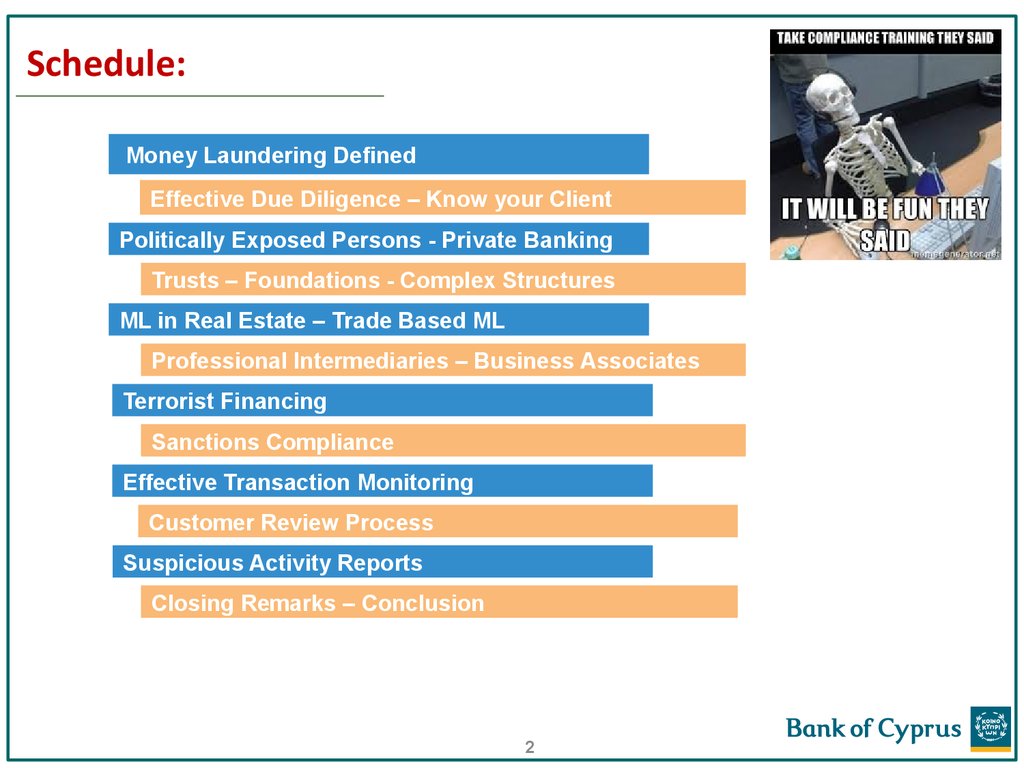

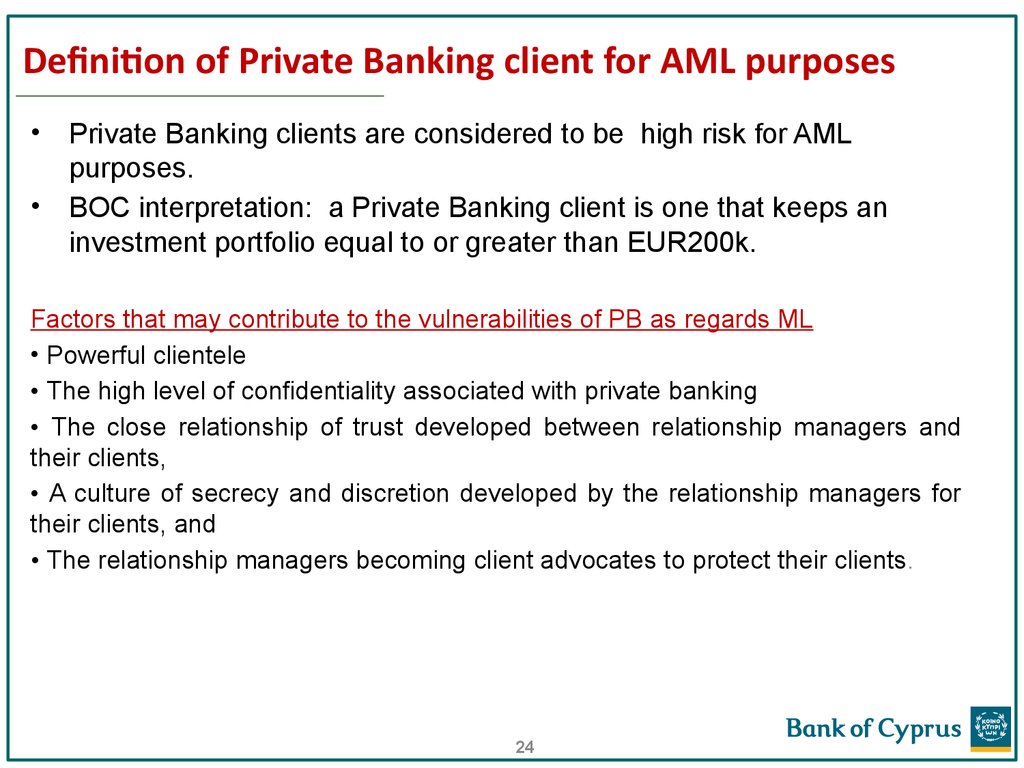

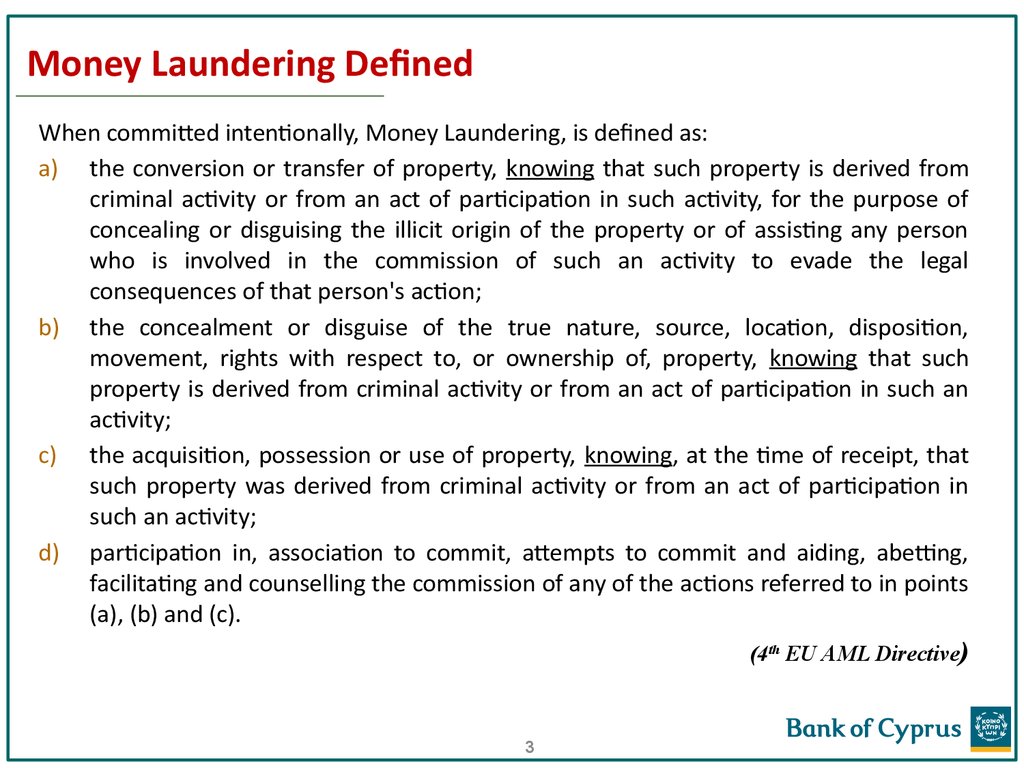

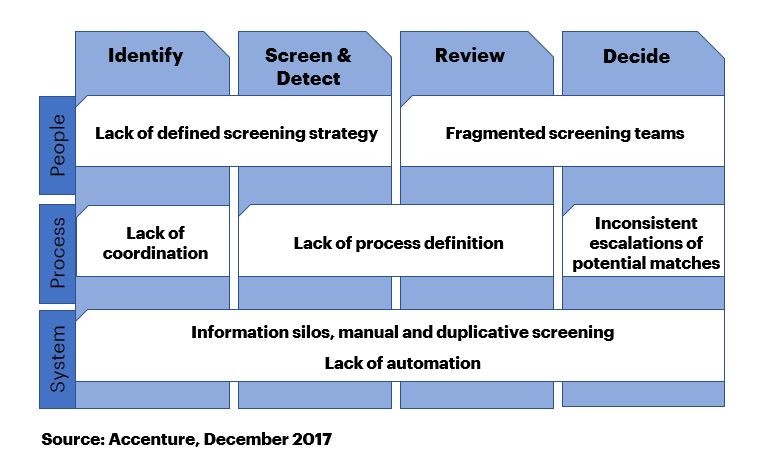

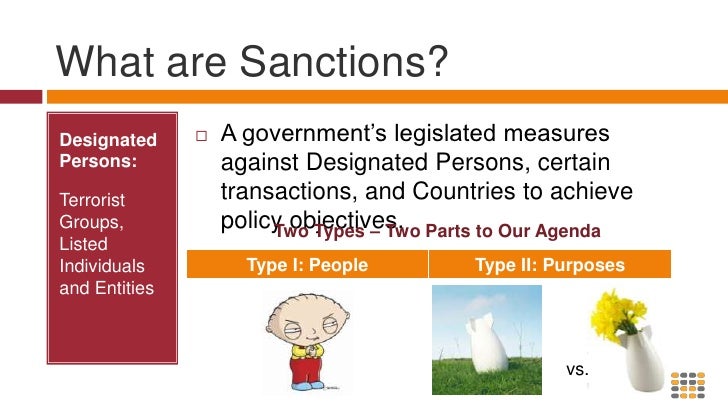

Aml Sanctions Definition. Sanctions are legally enforceable measures against countries organisations individuals and other bodies designed to force compliance with international law contain a threat to peace within a geographical boundary or to express condemnation of a countrys specific actions or policies. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and Sanctions compliance in accordance with the scope of application outlined in Rule 121. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF.

Anti Money Laundering Know Your Customer Adverse Media Screening And The Data Challenge Accenture From financialservicesblog.accenture.com

Anti Money Laundering Know Your Customer Adverse Media Screening And The Data Challenge Accenture From financialservicesblog.accenture.com

Overview of AML Risk Assessment Actions that show crime assets as income from a legitimate source to hide the illegal source of money are called money laundering. Acronyms Description and definition of terms AI An Accountable Institution is a person referred to and listed in Schedule 1 of FICA or similarly designated in terms of equivalent legislation in any other country outside SA. What is AML Anti-Money Laundering. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. Funds may be from an entirely legitimate source. They are designed to protect businesses from high-risk customers helping to ensure the integrity of the global financial system.

These restrictive measures include but are not limited to financial sanctions trade sanctions restrictions on travel or civil aviation restrictions.

Compliance with sanctions means knowing to whom payments are being made. Without the proper anti-money laundering AML compliance procedures companies are in danger of inadvertently facilitating drug trafficking terrorism financing and other crimes. These restrictive measures include but are not limited to financial sanctions trade sanctions restrictions on travel or civil aviation restrictions. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Anti-Money Laundering Sanctions Policy. They are designed to protect businesses from.

Source: ppt-online.org

Source: ppt-online.org

AML regulators impose heavy AML fines on companies that fail. Acronyms Description and definition of terms AI An Accountable Institution is a person referred to and listed in Schedule 1 of FICA or similarly designated in terms of equivalent legislation in any other country outside SA. Compliance with sanctions means knowing to whom payments are being made. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. Financial institutions particularly banks have spent years evolving their AML and sanctions risk.

Source: tookitaki.ai

Source: tookitaki.ai

These systems are considered models and as such they are subject to the Guidance. BSAAML and sanctions automated systems use complex algorithms behavioral monitoring analysis anomaly detection statistical theories and even artificial intelligence to detect potentially suspicious activity or OFAC sanctions matches. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. Sanction lists screening is one of the Anti-Money Laundering and Customer Due Diligence procedures. Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide.

Source: sanctionscanner.com

Source: sanctionscanner.com

Over the past 10 years enforcement actions related to AML have been on the rise. Compliance with sanctions means knowing to whom payments are being made. Overview of AML Risk Assessment Actions that show crime assets as income from a legitimate source to hide the illegal source of money are called money laundering. 31 December 2019 BNMRHPD 030 -3 PART A OVERVIEW. Acronyms Description and definition of terms AI An Accountable Institution is a person referred to and listed in Schedule 1 of FICA or similarly designated in terms of equivalent legislation in any other country outside SA.

Source: acamstoday.org

Source: acamstoday.org

Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. AML and sanctions screening faces many challenges. While not subject to MSBFinancial Instruction requirements Solidity Finance LLC is committed to combating money laundering and. AML regulators impose heavy AML fines on companies that fail. Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide.

Source: atlanticcouncil.org

Source: atlanticcouncil.org

AML and sanctions screening faces many challenges. Without the proper anti-money laundering AML compliance procedures companies are in danger of inadvertently facilitating drug trafficking terrorism financing and other crimes. They are designed to protect businesses from. Sanctions are legally enforceable measures against countries organisations individuals and other bodies designed to force compliance with international law contain a threat to peace within a geographical boundary or to express condemnation of a countrys specific actions or policies. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF.

Source: slideplayer.com

Source: slideplayer.com

Sanctions are restrictive measures imposed on individuals or entities in an effort to curtail their activities and to exert pressure and influence on them. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. 31 December 2019 BNMRHPD 030 -3 PART A OVERVIEW. The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and Sanctions compliance in accordance with the scope of application outlined in Rule 121. Overview of AML Risk Assessment Actions that show crime assets as income from a legitimate source to hide the illegal source of money are called money laundering.

Source: ppt-online.org

Source: ppt-online.org

31 December 2019 BNMRHPD 030 -3 PART A OVERVIEW. These restrictive measures include but are not limited to financial sanctions trade sanctions restrictions on travel or civil aviation restrictions. As a Global Compliance AML Sanctions CAMS Expert you are part of a specialised team for the themes counter terrorism financing CFT anti-money laundering AML and Sanctions. Anti-Money Laundering Sanctions Policy. Companies have to implement AML risk assessment in customer onboarding and customer monitoring processes.

Source: ppt-online.org

Source: ppt-online.org

AML CFT Anti-Money Laundering and Combating the Financing of Terrorism. Accordingly it applies to Relevant Persons but in different degrees as provided. As a Global Compliance AML Sanctions CAMS Expert you are part of a specialised team for the themes counter terrorism financing CFT anti-money laundering AML and Sanctions. They are designed to protect businesses from high-risk customers helping to ensure the integrity of the global financial system. AML CFT Anti-Money Laundering and Combating the Financing of Terrorism.

Source: ppt-online.org

Source: ppt-online.org

They are designed to protect businesses from. BSAAML and sanctions automated systems use complex algorithms behavioral monitoring analysis anomaly detection statistical theories and even artificial intelligence to detect potentially suspicious activity or OFAC sanctions matches. Anti-Money Laundering Countering Financing of Terrorism and Targeted Financial Sanctions for Financial Institutions AMLCFT and TFS for FIs 1 of 185 Issued on. Sanction screenings have become an integral part of anti-money laundering AML know your customer KYC and counter-terrorist financing CTF. Sanction lists screening is one of the Anti-Money Laundering and Customer Due Diligence procedures.

Source: businessforensics.nl

Source: businessforensics.nl

31 December 2019 BNMRHPD 030 -3 PART A OVERVIEW. Compliance with sanctions means knowing to whom payments are being made. Funds may be from an entirely legitimate source. AML CFT Anti-Money Laundering and Combating the Financing of Terrorism. Companies have to implement AML risk assessment in customer onboarding and customer monitoring processes.

Source: aml-cft.net

Source: aml-cft.net

The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and Sanctions compliance in accordance with the scope of application outlined in Rule 121. Sanction lists screening is one of the Anti-Money Laundering and Customer Due Diligence procedures. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Funds may be from an entirely legitimate source. Financial institutions particularly banks have spent years evolving their AML and sanctions risk.

Source: financialservicesblog.accenture.com

Source: financialservicesblog.accenture.com

Regulatory authorities have become more vigilant in the battle against money laundering and terrorist financing with regulators levying 36 billion in fines worldwide. Sanction lists screening is one of the Anti-Money Laundering and Customer Due Diligence procedures. What is AML Anti-Money Laundering. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Regulators and financial institutions alike are renewing their focus on anti-money laundering AML and sanctions risk assessments as part of sound financial crime risk management resource allocation and compliance program development.

Source: slideshare.net

Source: slideshare.net

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Compliance with sanctions means knowing to whom payments are being made. Over the past 10 years enforcement actions related to AML have been on the rise. Acronyms Description and definition of terms AI An Accountable Institution is a person referred to and listed in Schedule 1 of FICA or similarly designated in terms of equivalent legislation in any other country outside SA. The AML Rulebook has been designed to provide a single reference point for all Relevant Persons who are supervised by the Regulator for Anti-Money Laundering and Sanctions compliance in accordance with the scope of application outlined in Rule 121.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml sanctions definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas