14+ Aml smurfing definition info

Home » about money loundering idea » 14+ Aml smurfing definition infoYour Aml smurfing definition images are ready. Aml smurfing definition are a topic that is being searched for and liked by netizens today. You can Download the Aml smurfing definition files here. Download all royalty-free vectors.

If you’re searching for aml smurfing definition images information connected with to the aml smurfing definition topic, you have come to the ideal site. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

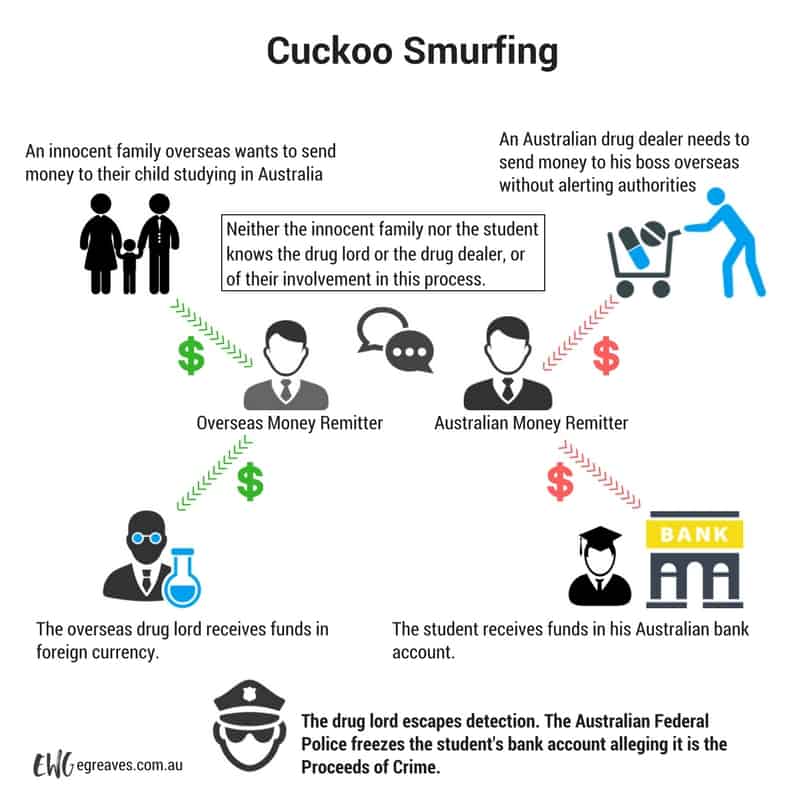

Aml Smurfing Definition. Smurfing lodging small amounts of money below the AML reporting threshold to bank accounts or credit cards then using these to pay expenses etc. Structuring also known as smurfing in banking jargon is the practice of executing financial transactions such as making bank deposits in a specific pattern calculated to avoid triggering financial institutions to file reports required by law such as the United States Bank Secrecy Act BSA and Internal Revenue Code section 6050I relating to the requirement to file Form 8300. The training session is fully exhaustive. How the Islamic State is unlocking the assets of European recruits The cuckoo smurfing scheme involves exploiting an unsuspecting overseas client who wants to send funds to another innocent individual in the UK.

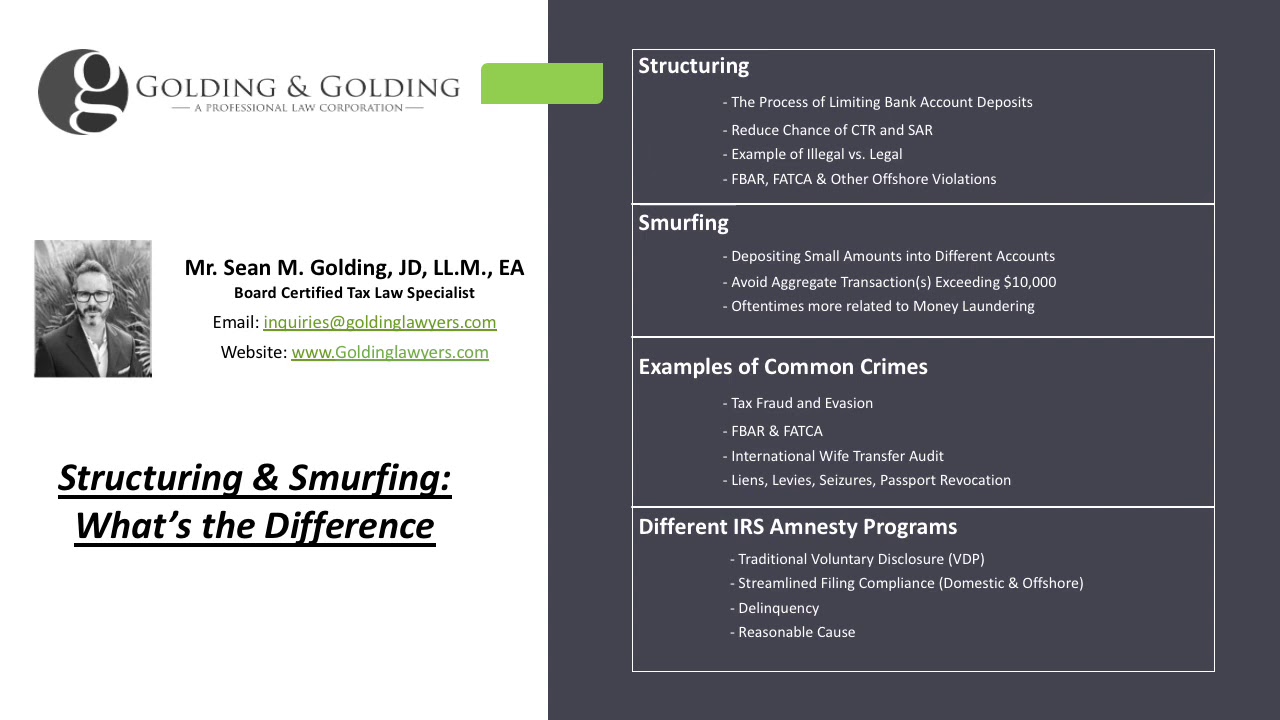

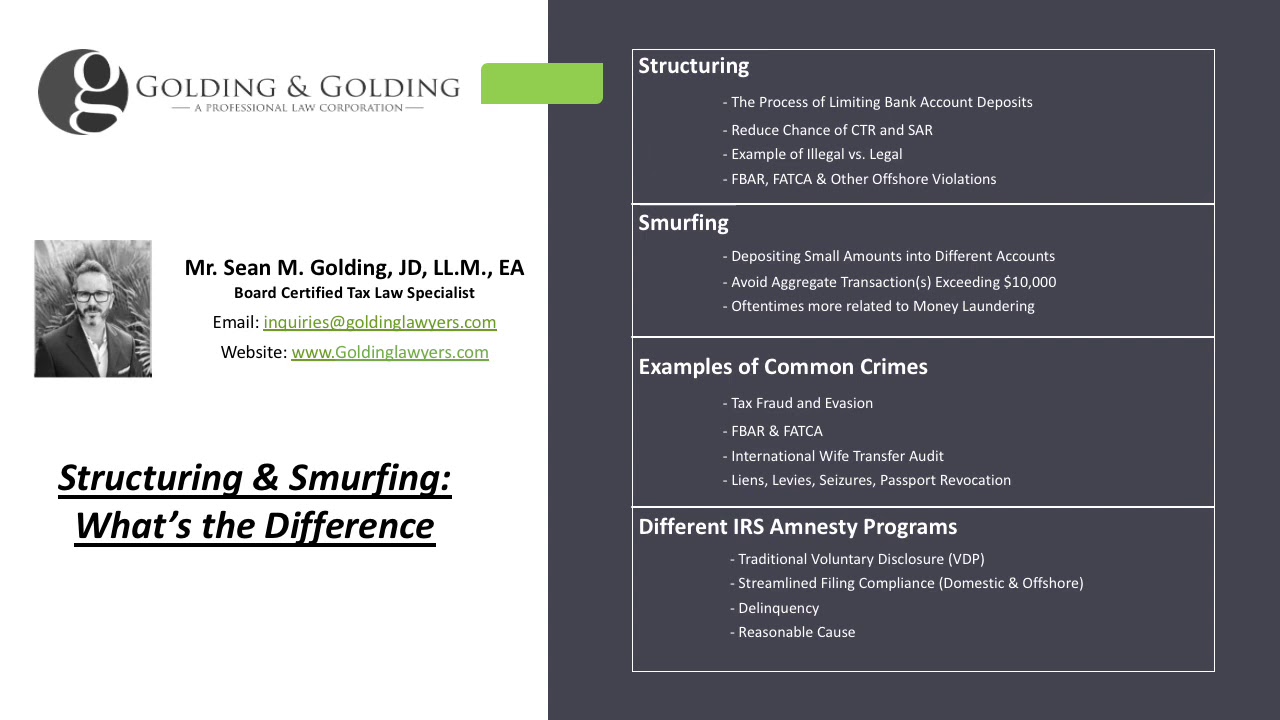

Structuring Smurfing Example What S The Difference From goldinglawyers.com

Structuring Smurfing Example What S The Difference From goldinglawyers.com

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Cash from illegal sources is divided between deposit specialists or smurfs who make multiple deposits into multiple accounts often using various aliases at any number of financial institutions. D Smurfing involves the process of making numerous cash deposits into several bank accounts. Certified Anti-Money Laundering Investigator is a professional who is skilled in AML Investigation working for Banks Financial Institutions Trade houses Payment Facilitators etc. Smurfing is a form of structuring where you get other people who are each going around to make deposits near to or under the 10000 threshold and that makes it harder to detect that the structuring is going on because it looks like a bunch of different individuals all putting money into the system. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Financial institutions across the globe are under increased regulatory scrutiny to comply with anti-money laundering and counter terrorist financing policies and procedures.

Financial institutions across the globe are under increased regulatory scrutiny to comply with anti-money laundering and counter terrorist financing policies and procedures. Cuckoo smurfing is a type of money laundering. What is AML Anti-Money Laundering. However it is possible to structure without the use of. So refining is the changing of an amount of money from. The money laundering process is divided into 3 segments.

Source: namebet.cc

Source: namebet.cc

The training session is fully exhaustive. So refining is the changing of an amount of money from. This money is deposited by the launderer in the various bank accounts. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. What is AML Anti-Money Laundering.

Source: amlcompliance.ie

Source: amlcompliance.ie

In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. Definition of a Smurf A smurf is a money launderer who steals or launders money to avoid regulatory inspection by splitting large transaction into small transactions. Smurfing is a form of structuring where you get other people who are each going around to make deposits near to or under the 10000 threshold and that makes it harder to detect that the structuring is going on because it looks like a bunch of different individuals all putting money into the system. Structuring also known as smurfing in banking jargon is the practice of executing financial transactions such as making bank deposits in a specific pattern calculated to avoid triggering financial institutions to file reports required by law such as the United States Bank Secrecy Act BSA and Internal Revenue Code section 6050I relating to the requirement to file Form 8300. Cash from illegal sources is divided between deposit specialists or smurfs who make multiple deposits into multiple accounts often using various aliases at any number of financial institutions.

Source: goldinglawyers.com

Source: goldinglawyers.com

Definition of a Smurf A smurf is a money launderer who steals or launders money to avoid regulatory inspection by splitting large transaction into small transactions. Financial institutions across the globe are under increased regulatory scrutiny to comply with anti-money laundering and counter terrorist financing policies and procedures. Certified Anti-Money Laundering Investigator is a professional who is skilled in AML Investigation working for Banks Financial Institutions Trade houses Payment Facilitators etc. In the past decade they have witnessed significant enforcement actions and penalties for non-compliance with respect to money laundering and terrorist financing. What is AML Anti-Money Laundering.

Source: regtechtimes.com

Source: regtechtimes.com

In the past decade they have witnessed significant enforcement actions and penalties for non-compliance with respect to money laundering and terrorist financing. The money carriers coming from 3 rd world countries tended to be small in stature and were then nicknamed Smurfs and the cash transmission activity Smurfing See also Structuring. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. That was a major reason the United States took all denominations over the 100 bill out of circulation 40 years ago. Smurfing is a common placement technique.

Source: aml-assassin.com

Source: aml-assassin.com

Vipul Tamhane would guide you on the Anti-Money Laundering investigation process. Smurfs often spread these small transactions over many different. Definition of a Smurf A smurf is a money launderer who steals or launders money to avoid regulatory inspection by splitting large transaction into small transactions. How the Islamic State is unlocking the assets of European recruits The cuckoo smurfing scheme involves exploiting an unsuspecting overseas client who wants to send funds to another innocent individual in the UK. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements.

Source: ppt-online.org

Source: ppt-online.org

It is relatively simple for criminals to use. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. This money is deposited by the launderer in the various bank accounts. However it is possible to structure without the use of.

Source: regtechtimes.com

Source: regtechtimes.com

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. D Smurfing involves the process of making numerous cash deposits into several bank accounts. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. Smurfing is a form of structuring where you get other people who are each going around to make deposits near to or under the 10000 threshold and that makes it harder to detect that the structuring is going on because it looks like a bunch of different individuals all putting money into the system. It is relatively simple for criminals to use.

Source: acamstoday.org

Source: acamstoday.org

Structuring also known as smurfing in banking jargon is the practice of executing financial transactions such as making bank deposits in a specific pattern calculated to avoid triggering financial institutions to file reports required by law such as the United States Bank Secrecy Act BSA and Internal Revenue Code section 6050I relating to the requirement to file Form 8300. Cuckoo Smurfing is a sort of illegal Tax Avoidance. How the Islamic State is unlocking the assets of European recruits The cuckoo smurfing scheme involves exploiting an unsuspecting overseas client who wants to send funds to another innocent individual in the UK. However it is possible to structure without the use of. Vipul Tamhane would guide you on the Anti-Money Laundering investigation process.

Live Virtual Training Sessions for CAMI Mr. Certified Anti-Money Laundering Investigator is a professional who is skilled in AML Investigation working for Banks Financial Institutions Trade houses Payment Facilitators etc. Smurfing is a common placement technique. Cuckoo smurfing is a type of money laundering. Smurfing lodging small amounts of money below the AML reporting threshold to bank accounts or credit cards then using these to pay expenses etc.

Source: egreaves.com.au

Source: egreaves.com.au

In the past decade they have witnessed significant enforcement actions and penalties for non-compliance with respect to money laundering and terrorist financing. Cuckoo Smurfing is a sort of illegal Tax Avoidance. This money is deposited by the launderer in the various bank accounts. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. How the Islamic State is unlocking the assets of European recruits The cuckoo smurfing scheme involves exploiting an unsuspecting overseas client who wants to send funds to another innocent individual in the UK.

Source:

In this way money enters the financial system and is then available for layering. The training session is fully exhaustive. Certified Anti-Money Laundering Investigator is a professional who is skilled in AML Investigation working for Banks Financial Institutions Trade houses Payment Facilitators etc. This money is deposited by the launderer in the various bank accounts. Cuckoo smurfing is a type of money laundering.

Source: acamstoday.org

Source: acamstoday.org

The money laundering process is divided into 3 segments. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. How the Islamic State is unlocking the assets of European recruits The cuckoo smurfing scheme involves exploiting an unsuspecting overseas client who wants to send funds to another innocent individual in the UK. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial.

Source: businessforensics.nl

Source: businessforensics.nl

In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. The money laundering process is divided into 3 segments. Structuring also known as smurfing in banking jargon is the practice of executing financial transactions such as making bank deposits in a specific pattern calculated to avoid triggering financial institutions to file reports required by law such as the United States Bank Secrecy Act BSA and Internal Revenue Code section 6050I relating to the requirement to file Form 8300. It is relatively simple for criminals to use. Definition of a Smurf A smurf is a money launderer who steals or launders money to avoid regulatory inspection by splitting large transaction into small transactions.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml smurfing definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information