10+ Aml trigger event definition information

Home » about money loundering Info » 10+ Aml trigger event definition informationYour Aml trigger event definition images are available in this site. Aml trigger event definition are a topic that is being searched for and liked by netizens today. You can Download the Aml trigger event definition files here. Download all royalty-free photos and vectors.

If you’re looking for aml trigger event definition pictures information linked to the aml trigger event definition topic, you have come to the right blog. Our website always provides you with hints for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Aml Trigger Event Definition. While it is understood that beneficial ownership must be obtained at time of account opening or at loan renewal if the loan was underwritten a triggering event is a change in ownership structure account type transaction activity or responsibility control prong that may require verifying and updating previously provided information. What is AML Anti-Money Laundering. So we thought it would be helpful to go over the rules requirements and give examples of potential triggering events. Before we dig in remember that the definition of a beneficial owner includes two prongsownership and controlso when talking about updating information on beneficial owners we are referring to both prongs.

Cdd Rule Beware Of Events That May Trigger Beneficial Ownership Reviews Cfpb Releases Beta Hmda Platform Nafcu From nafcu.org

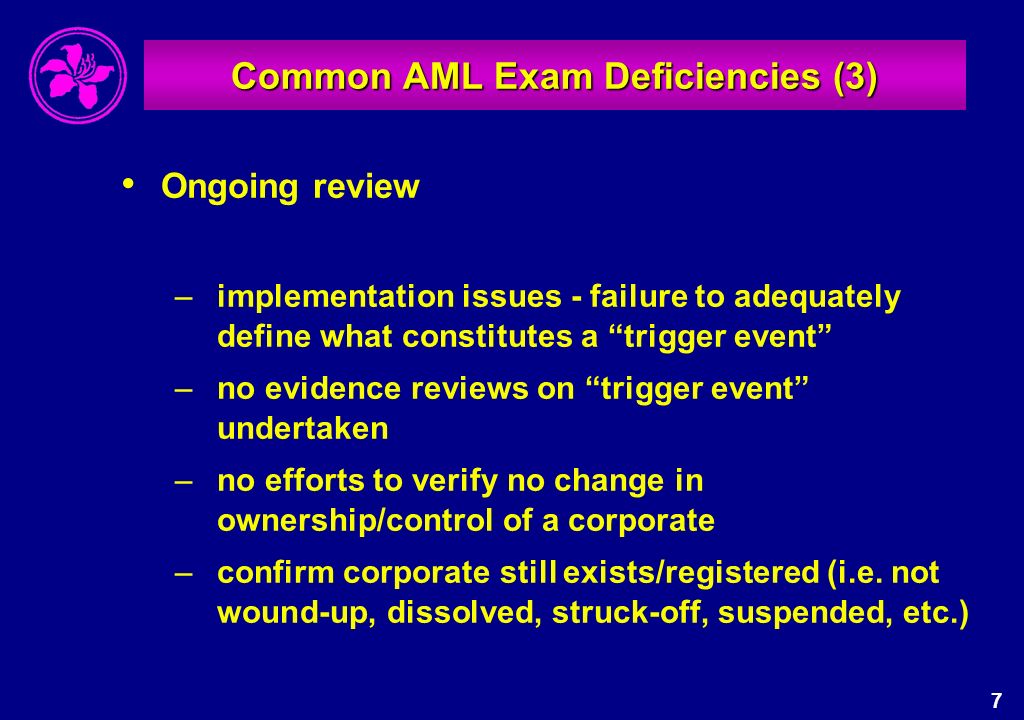

Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Once we define our triggers for our on going customer due diligence and lets say annual reviews is one of them. AMLCFT Guideline Trigger events for an updated IRA What is regarded as a trigger event for the purposes of determining when an AI should undertake a review of its institutional MLTF risk assessment. The trigger event is what brings the investigation before the eyes of the investigator and it will contain information as to why the matter is considered unusual. The Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2021 has been enacted which transposed the 5th AML Directive. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur.

The key changes include.

Do we need to get a new certification signed with each of these triggers. Processes to calibrate AML models over time Defining and managing triggering events analytics and reporting Embedding culture of data and analytics Defined event-based calibration triggers Maintenance of documentation standards Driving consistency across model risk management tasks and efforts Deploying enabling MRM. While it is understood that beneficial ownership must be obtained at time of account opening or at loan renewal if the loan was underwritten a triggering event is a change in ownership structure account type transaction activity or responsibility control prong that may require verifying and updating previously provided information. Do we need to get a new certification signed with each of these triggers. Practices are advised to set out in their AML policy manual the frequency of a periodic review and what constitutes a triggering event for a review of the CDD information held on a particular client including a pre-existing client ie a client with which the practice had a business relationship before the implementation of the amendments to AMLO on 1 March 2018. What is AML Anti-Money Laundering.

Source: slideplayer.com

Source: slideplayer.com

Once we define our triggers for our on going customer due diligence and lets say annual reviews is one of them. The expansion of the PEP definition. SARs are generally more informative than alerts as they contain information about what the submitter has observed or their opinion. While it is understood that beneficial ownership must be obtained at time of account opening or at loan renewal if the loan was underwritten a triggering event is a change in ownership structure account type transaction activity or responsibility control prong that may require verifying and updating previously provided information. Transaction monitoring alerts are prescriptive.

Source: pinterest.com

Source: pinterest.com

Relevant AML related adverse media or adverse client behaviour that results in a material change in the risk profile of the Correspondent Banking Client shall. The trigger event is what brings the investigation before the eyes of the investigator and it will contain information as to why the matter is considered unusual. Creation of new categories of Designated Person. The 5th pillar of BSA compliance established by the final rule requires that credit unions include in their anti-money laundering AML programs CDD procedures for. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur.

Source: acamstoday.org

Source: acamstoday.org

SARs are generally more informative than alerts as they contain information about what the submitter has observed or their opinion. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur. SARs are generally more informative than alerts as they contain information about what the submitter has observed or their opinion. The key changes include. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur.

Source: researchgate.net

Source: researchgate.net

So we thought it would be helpful to go over the rules requirements and give examples of potential triggering events. Tuning methodology articulating trigger events scenario effectiveness ratios criteria for. Once we define our triggers for our on going customer due diligence and lets say annual reviews is one of them. The trigger event is what brings the investigation before the eyes of the investigator and it will contain information as to why the matter is considered unusual. Relevant AML related adverse media or adverse client behaviour that results in a material change in the risk profile of the Correspondent Banking Client shall.

Source:

Before we dig in remember that the definition of a beneficial owner includes two prongsownership and controlso when talking about updating information on beneficial owners we are referring to both prongs. While it is understood that beneficial ownership must be obtained at time of account opening or at loan renewal if the loan was underwritten a triggering event is a change in ownership structure account type transaction activity or responsibility control prong that may require verifying and updating previously provided information. The expansion of the PEP definition. What is AML Anti-Money Laundering. Tuning methodology articulating trigger events scenario effectiveness ratios criteria for.

Source: pinterest.com

Source: pinterest.com

So the Bank rep contacts the customers and obtains updated due diligence information asks if ownership has changed asks if business plan has changed etc. Processes to calibrate AML models over time Defining and managing triggering events analytics and reporting Embedding culture of data and analytics Defined event-based calibration triggers Maintenance of documentation standards Driving consistency across model risk management tasks and efforts Deploying enabling MRM. The 5th pillar of BSA compliance established by the final rule requires that credit unions include in their anti-money laundering AML programs CDD procedures for. The key changes include. Practices are advised to set out in their AML policy manual the frequency of a periodic review and what constitutes a triggering event for a review of the CDD information held on a particular client including a pre-existing client ie a client with which the practice had a business relationship before the implementation of the amendments to AMLO on 1 March 2018.

Source: ocbcnisp.com

Source: ocbcnisp.com

So the Bank rep contacts the customers and obtains updated due diligence information asks if ownership has changed asks if business plan has changed etc. Before we dig in remember that the definition of a beneficial owner includes two prongsownership and controlso when talking about updating information on beneficial owners we are referring to both prongs. The Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2021 has been enacted which transposed the 5th AML Directive. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Do we need to get a new certification signed with each of these triggers.

Source: in.pinterest.com

Source: in.pinterest.com

Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. So we thought it would be helpful to go over the rules requirements and give examples of potential triggering events. Processes to calibrate AML models over time Defining and managing triggering events analytics and reporting Embedding culture of data and analytics Defined event-based calibration triggers Maintenance of documentation standards Driving consistency across model risk management tasks and efforts Deploying enabling MRM. While it is understood that beneficial ownership must be obtained at time of account opening or at loan renewal if the loan was underwritten a triggering event is a change in ownership structure account type transaction activity or responsibility control prong that may require verifying and updating previously provided information. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur.

Source:

Source:

An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur. Tuning methodology articulating trigger events scenario effectiveness ratios criteria for. AMLCFT Guideline Trigger events for an updated IRA What is regarded as a trigger event for the purposes of determining when an AI should undertake a review of its institutional MLTF risk assessment. Creation of new categories of Designated Person. The trigger event is what brings the investigation before the eyes of the investigator and it will contain information as to why the matter is considered unusual.

Source: acamstoday.org

Source: acamstoday.org

Creation of new categories of Designated Person. What is AML Anti-Money Laundering. The Criminal Justice Money Laundering and Terrorist Financing Amendment Act 2021 has been enacted which transposed the 5th AML Directive. AML Monitoring Systems are considered a modelbased on supervisory definition of a model. Relevant AML related adverse media or adverse client behaviour that results in a material change in the risk profile of the Correspondent Banking Client shall.

Source: nafcu.org

SARs are generally more informative than alerts as they contain information about what the submitter has observed or their opinion. What is AML Anti-Money Laundering. So we thought it would be helpful to go over the rules requirements and give examples of potential triggering events. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur. AMLCFT Guideline Trigger events for an updated IRA What is regarded as a trigger event for the purposes of determining when an AI should undertake a review of its institutional MLTF risk assessment.

Source: pinterest.com

Source: pinterest.com

While it is understood that beneficial ownership must be obtained at time of account opening or at loan renewal if the loan was underwritten a triggering event is a change in ownership structure account type transaction activity or responsibility control prong that may require verifying and updating previously provided information. An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Relevant AML related adverse media or adverse client behaviour that results in a material change in the risk profile of the Correspondent Banking Client shall. The 5th pillar of BSA compliance established by the final rule requires that credit unions include in their anti-money laundering AML programs CDD procedures for.

Source: complyadvantage.com

Source: complyadvantage.com

An AI should conduct its institutional MLTF risk assessment every two years and when material trigger events occur. AML Monitoring Systems are considered a modelbased on supervisory definition of a model. Relevant AML related adverse media or adverse client behaviour that results in a material change in the risk profile of the Correspondent Banking Client shall. In addition a trigger event eg. Do we need to get a new certification signed with each of these triggers.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title aml trigger event definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas