17+ Amlcft risk definition information

Home » about money loundering Info » 17+ Amlcft risk definition informationYour Amlcft risk definition images are available in this site. Amlcft risk definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Amlcft risk definition files here. Download all royalty-free photos and vectors.

If you’re searching for amlcft risk definition pictures information connected with to the amlcft risk definition topic, you have come to the ideal blog. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Amlcft Risk Definition. Banks AMLCFT measures and related supervision should follow a risk-based approach. The Guidance reviews the different steps of the AMLCFT process Customer Due Diligence CDD record-keeping requirements report of suspicious transactions use. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. The Guidance is based on the important assumption that financially excluded and underserved.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

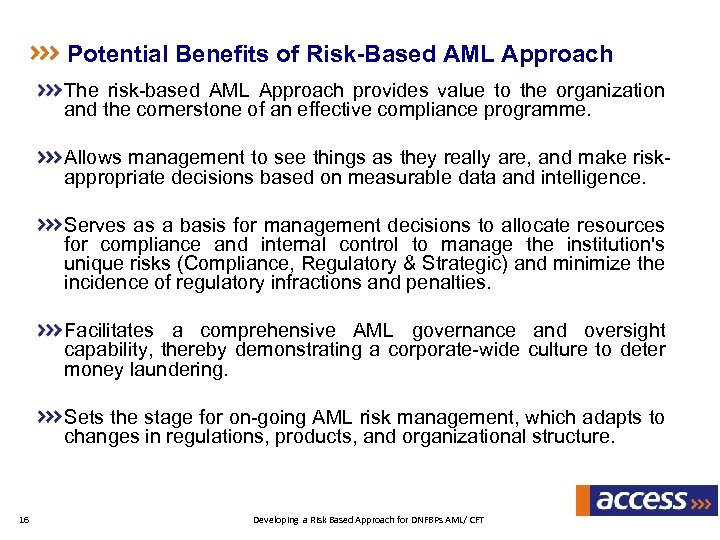

An anti-money laundering risk assessment measures risk exposure. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. Different customers may carry different levels of risk. The Guidance reviews the different steps of the AMLCFT process Customer Due Diligence CDD record-keeping requirements report of suspicious transactions use. AMLCFT Law Policy. Banks AMLCFT measures and related supervision should follow a risk-based approach.

AML CFT compliance has become a credibility issue for regulators to demonstrate that the country is part of the international network in combating AML CFT.

This entails a differentiation of risk classes and their separate management. There is an adverse impact on financial transparency created by the cumulative effects of poor implementation of standards on. Which could benefit from an exemption and lower risks which could be applied simplified AMLCFT measures. This entails a differentiation of risk classes and their separate management. Within the main body of the Handbook the definition of politically exposed person has been updated to reflect the changes made in the AMLCFT Code that came into force on 1 June 2019. Force FATF1 the anti-money laundering and countering financing of terrorism AMLCFT reporting obligations imposed on reporting institutions are risk-informed and subject to periodic review in tandem with any material changes to the international standards or the MLTF risk situation in Malaysia.

Source: bi.go.id

Source: bi.go.id

Specifically the risk-based approach requires the identification and assessment of the individual risk at hand application of specific mitigation and monitoring measures and documentation of the strategy taken and any major. Of terrorism AMLCFT risks associated with one kind of internet-based payment system. Key Definitions and Potential AMLCFT Risks. Appendix Da and Appendix Db have been amended to reflect the FATF statement issued on 21 June 2019 and the FATFs statement entitled Improving Global AMLCFT Compliance. An AMLCFT programme sets out a reporting entitys internal policies procedures and controls to detect money laundering and financing of terrorism and to manage and mitigate the risk of it occurring.

Source: es.pinterest.com

Source: es.pinterest.com

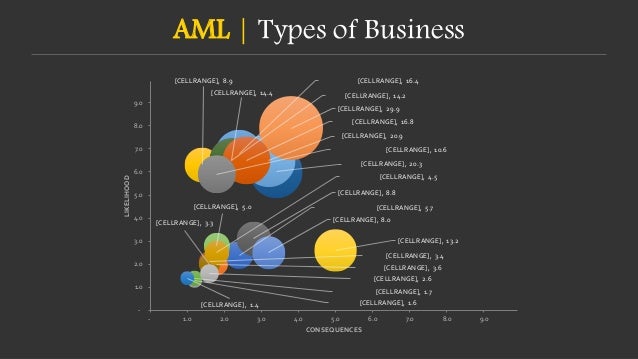

This entails a differentiation of risk classes and their separate management. An anti-money laundering risk assessment measures risk exposure. Now after we have determined how you calculate risk lets determine our risk factors for AMLCFT. Update on on-going process also. A RBA to AMLCFT means that countries competent authorities and financial institutions are expected to identify assess and understand the MLTF risks to which they are exposed and take AMLCFT measures commensurate to those risks in order to mitigate them effectively.

Source: bi.go.id

Source: bi.go.id

The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. FINRA FSA now FCA focus on individuals AMLOs for AML weaknesses Huge fines imposed by US regulators for sanctions and AML failures. Virtual currencies offer an innovative cheap and flexible method of payment. Banks AMLCFT measures and related supervision should follow a risk-based approach. This entails a differentiation of classes and their separate management.

Source: taxguru.in

Source: taxguru.in

FINRA FSA now FCA focus on individuals AMLOs for AML weaknesses Huge fines imposed by US regulators for sanctions and AML failures. Banks AMLCFT measures and related supervision should follow a risk-based approach. HKMA and sets out the relevant anti-money laundering and counter-financing of terrorism AMLCFT statutory and regulatory requirements and the AMLCFT standards which Authorized Institutions AIs including Registered Institutions RIs 1 should meet in order to comply with the statutory. The Bank may face MLFT risks if they are not properly identified and their transactions are not monitored effectively and continuously. Anti-money laundering - combating the financing of terrorism.

Source: slideshare.net

Source: slideshare.net

There is an adverse impact on financial transparency created by the cumulative effects of poor implementation of standards on. Within the main body of the Handbook the definition of politically exposed person has been updated to reflect the changes made in the AMLCFT Code that came into force on 1 June 2019. The programme must be in writing and be based on its risk assessment. In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance. Appendix Da and Appendix Db have been amended to reflect the FATF statement issued on 21 June 2019 and the FATFs statement entitled Improving Global AMLCFT Compliance.

Source: bi.go.id

Source: bi.go.id

The AMLCFT context taken in developing countries since this is where the challenge is the greatest but it also considers examples of action taken in developed countries also. An AMLCFT programme sets out a reporting entitys internal policies procedures and controls to detect money laundering and financing of terrorism and to manage and mitigate the risk of it occurring. A RBA to AMLCFT means that countries competent authorities and financial institutions are expected to identify assess and understand the MLTF risks to which they are exposed and take AMLCFT measures commensurate to those risks in order to mitigate them effectively. Specifically the riskrisk -based approach requires the identification and assessment of the individual risk at hand application of specific mitigation. Banks AMLCFT measures and related supervision should follow a risk-based approach.

Source: pinterest.com

Source: pinterest.com

AMLCFT Law Policy. Now after we have determined how you calculate risk lets determine our risk factors for AMLCFT. The European Investment Bank Group EIB Group consisting of the European Investment Bank EIB and the European Investment Fund EIF places great emphasis on integrity and good governance and is committed to the highest standards of anti-money laundering AML and combating the financing of terrorism CFT and together with AML AML-CFT in line with the. This entails a differentiation of classes and their separate management. Specifically the riskrisk -based approach requires the identification and assessment of the individual risk at hand application of specific mitigation.

Source: bi.go.id

The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. Within the main body of the Handbook the definition of politically exposed person has been updated to reflect the changes made in the AMLCFT Code that came into force on 1 June 2019. An AMLCFT programme sets out a reporting entitys internal policies procedures and controls to detect money laundering and financing of terrorism and to manage and mitigate the risk of it occurring.

Source: present5.com

Source: present5.com

Specifically the risk-based approach requires the identification and assessment of the individual risk at hand application of specific mitigation and monitoring measures and documentation of the strategy taken and any major. An AMLCFT programme sets out a reporting entitys internal policies procedures and controls to detect money laundering and financing of terrorism and to manage and mitigate the risk of it occurring. An anti-money laundering risk assessment measures risk exposure. Within the main body of the Handbook the definition of politically exposed person has been updated to reflect the changes made in the AMLCFT Code that came into force on 1 June 2019. There is an adverse impact on financial transparency created by the cumulative effects of poor implementation of standards on.

Source: pinterest.com

Source: pinterest.com

The programme must be in writing and be based on its risk assessment. Now after we have determined how you calculate risk lets determine our risk factors for AMLCFT. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. Of terrorism AMLCFT risks associated with one kind of internet-based payment system. We find that overall compliance is low.

Source: pinterest.com

Source: pinterest.com

Update on on-going process also. Update on on-going process also. Banks AMLCFT measures and related supervision should follow a risk-based approach. The Guidance reviews the different steps of the AMLCFT process Customer Due Diligence CDD record-keeping requirements report of suspicious transactions use. An AMLCFT programme sets out a reporting entitys internal policies procedures and controls to detect money laundering and financing of terrorism and to manage and mitigate the risk of it occurring.

Source: bi.go.id

Source: bi.go.id

The Guidance reviews the different steps of the AMLCFT process Customer Due Diligence CDD record-keeping requirements report of suspicious transactions use. 1 Inherent customer risk. Different customers may carry different levels of risk. A RBA to AMLCFT means that countries competent authorities and financial institutions are expected to identify assess and understand the MLTF risks to which they are exposed and take AMLCFT measures commensurate to those risks in order to mitigate them effectively. The programme must be in writing and be based on its risk assessment.

Source: slideshare.net

Source: slideshare.net

A RBA to AMLCFT means that countries competent authorities and financial institutions are expected to identify assess and understand the MLTF risks to which they are exposed and take AMLCFT measures commensurate to those risks in order to mitigate them effectively. Update on on-going process also. The Guidance is based on the important assumption that financially excluded and underserved. There is an adverse impact on financial transparency created by the cumulative effects of poor implementation of standards on. AML CFT compliance has become a credibility issue for regulators to demonstrate that the country is part of the international network in combating AML CFT.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title amlcft risk definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas