11+ Amlctf risk definition information

Home » about money loundering idea » 11+ Amlctf risk definition informationYour Amlctf risk definition images are ready in this website. Amlctf risk definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Amlctf risk definition files here. Download all royalty-free photos and vectors.

If you’re searching for amlctf risk definition images information related to the amlctf risk definition topic, you have visit the right site. Our site frequently provides you with hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Amlctf Risk Definition. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Find info on TravelSearchExpert. This means VASP standards should equal other regulated FS institutions. Latest news reports from the medical literature videos from the experts and more.

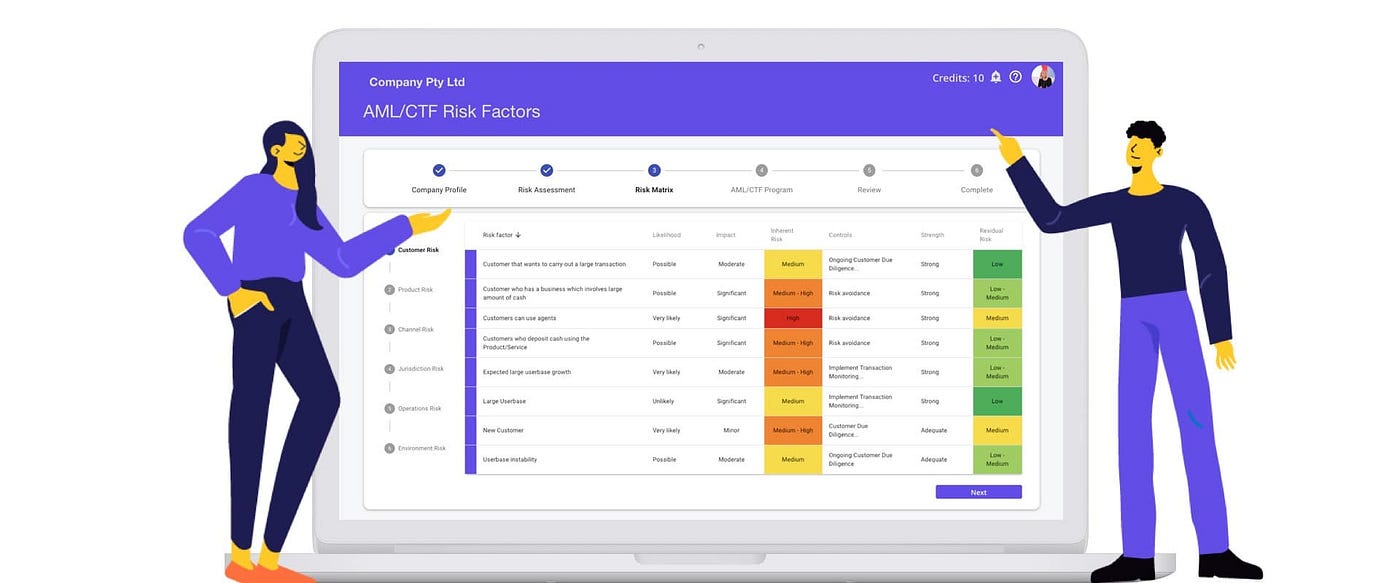

Conduct An Aml Ctf Risk Assessment By Mitchell Travers Bronid Medium From medium.com

Conduct An Aml Ctf Risk Assessment By Mitchell Travers Bronid Medium From medium.com

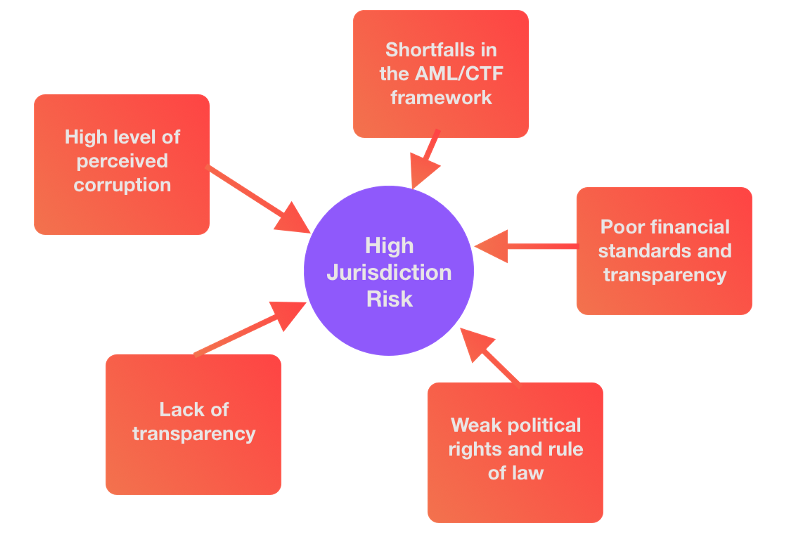

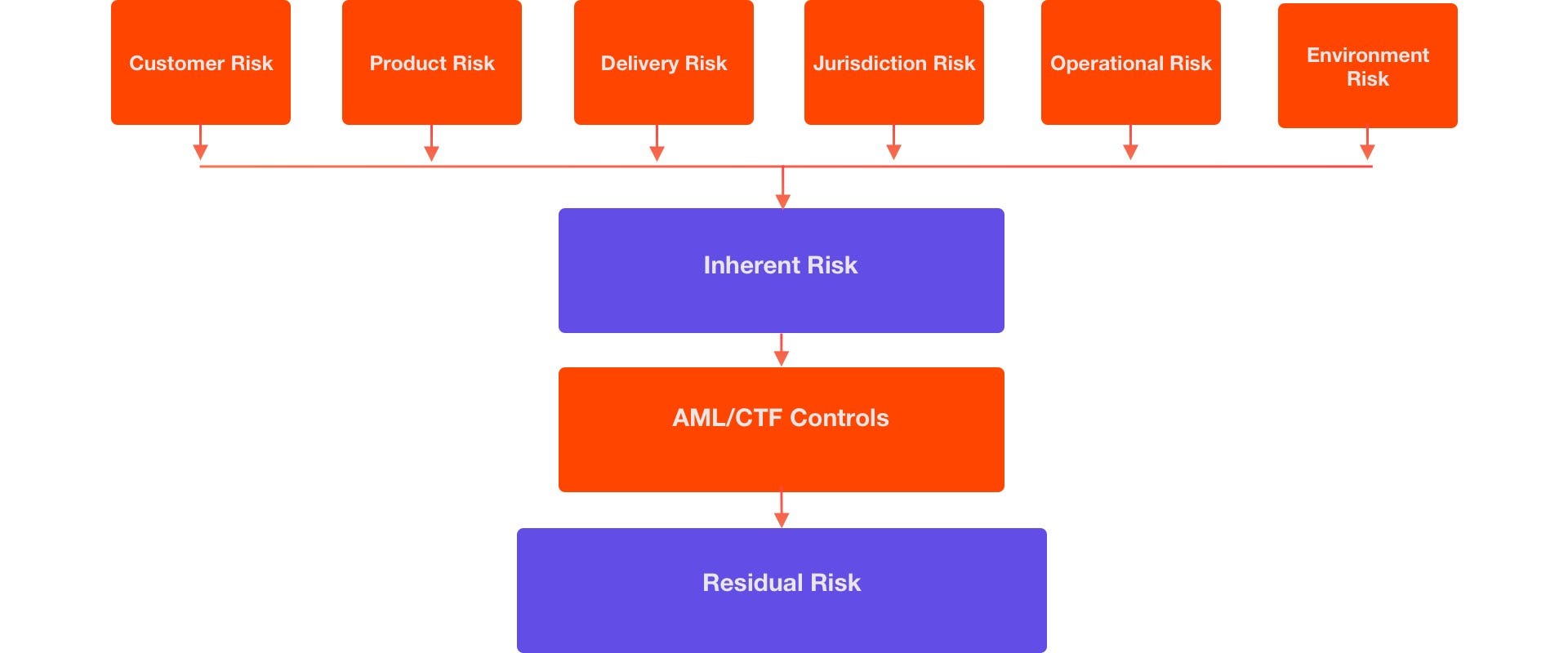

Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to. Understand its AMLCT Regulatorycompliance Universe Understand the implications and requirements of new legislations and regulations Implement appropriate processes policies and procedures Design and assess policies and procedures. The Luxembourg AMLCTF regulation requires the implementation of a clear AMLCTF risk appetite and strategy in line with the principle of sound and prudent management and aligned with the organisations goals in terms of AMLCTF prevention. Latest news reports from the medical literature videos from the experts and more. Explain the methodology used to conduct the MLTF Risk Assessment and either includes the AMLCTF Risk Assessment in the Program or referring to where it can be found. Formulas include two options for both inherent risk and controls weighting.

Latest news reports from the medical literature videos from the experts and more.

Appoint a person in your business to be the AUSTRAC contact person and to keep the Board or senior management informed of. Find info on TravelSearchExpert. MLD4 recognises that the risk of money laundering and terrorist financing can vary and that Member States competent authorities and firms within its scope have to identify and assess. Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to. Risk score summaries and dashboards are. Complying with AMLCTF laws and regulations Providing highly useful information to relevant government agencies in defined priority areas2 Establishing a reasonable and risk-based set of controls to mitigate the risks of a Financial Institution FI being used to facilitate illicit activity.

Source: slideshare.net

Source: slideshare.net

AMLCTF Risk Assessment. An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. The AMLCTF supervision off-site and on-site supervision by the CSSF is organised pursuant to the principles of a risk-based approach that takes into account the money laundering and terrorist financing risks to which the supervised entities and the sectors at large are exposed to. Appoint a person in your business to be the AUSTRAC contact person and to keep the Board or senior management informed of.

Source: bi.go.id

An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. Promotes Financial Action policies to and the financingproliferation of weapons is an independent inter-governmentalthat developsrecognised as the global anti-money laundering AML and counter-terrorist financing CFT standard. Explain the methodology used to conduct the MLTF Risk Assessment and either includes the AMLCTF Risk Assessment in the Program or referring to where it can be found. Understand its AMLCT Regulatorycompliance Universe Understand the implications and requirements of new legislations and regulations Implement appropriate processes policies and procedures Design and assess policies and procedures. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms.

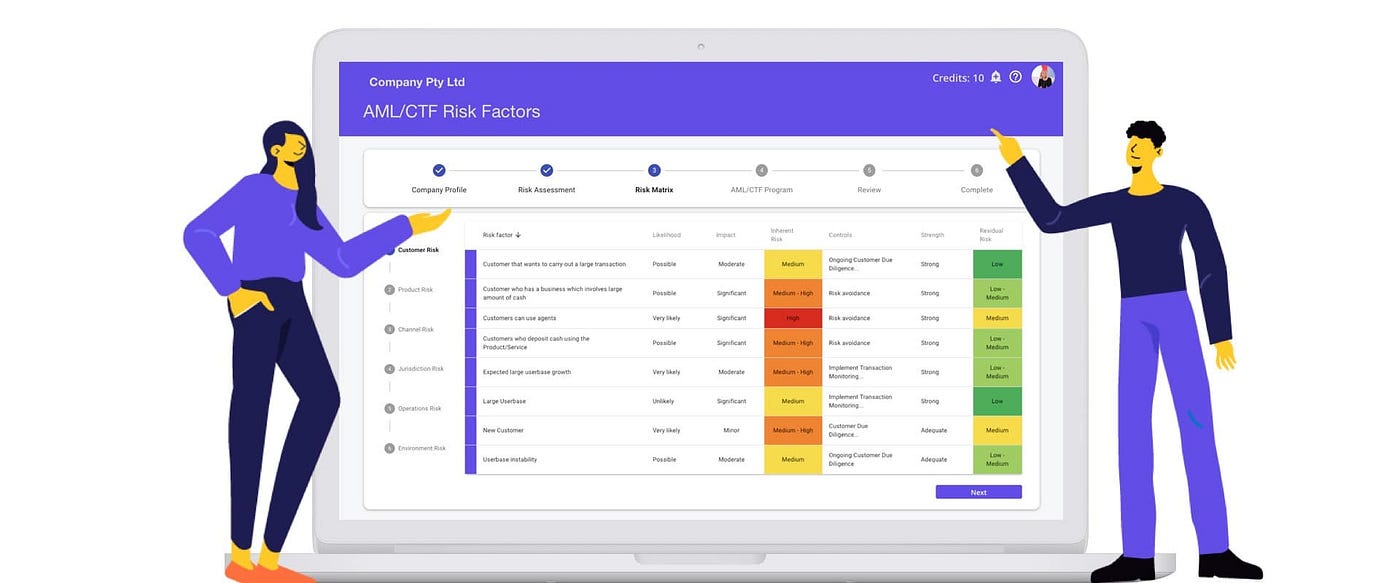

Source: medium.com

Source: medium.com

An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. MLD4 recognises that the risk of money laundering and terrorist financing can vary and that Member States competent authorities and firms within its scope have to identify and assess. An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to. The limited identification and verification of participants.

Source: bi.go.id

Source: bi.go.id

The limited identification and verification of participants. Risk score summaries and dashboards are. Find info on TravelSearchExpert. We asked that question in light of the stark change in the regulatory landscape over the last 12 18 months particularly with AUSTRACs well-publicised actions against various major organisations in the banking and payment space. However other characteristics of virtual currencies coupled with their global reach present potential AMLCFT risks such as.

Source: siorik.com

Source: siorik.com

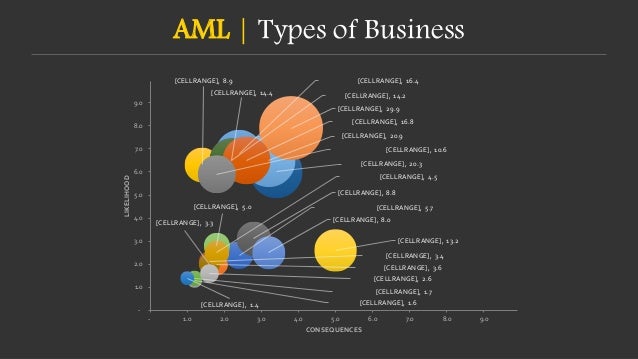

FCC tops the agenda of regulators globally. Equal weights or custom user defined. However AMLCTF is often looked at as just another third-party system to be integrated rather than a foundation for organizational strategy on tackling money laundering and terrorism financing risks. The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations.

Source: bi.go.id

Source: bi.go.id

The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. However other characteristics of virtual currencies coupled with their global reach present potential AMLCFT risks such as. However AMLCTF is often looked at as just another third-party system to be integrated rather than a foundation for organizational strategy on tackling money laundering and terrorism financing risks. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in.

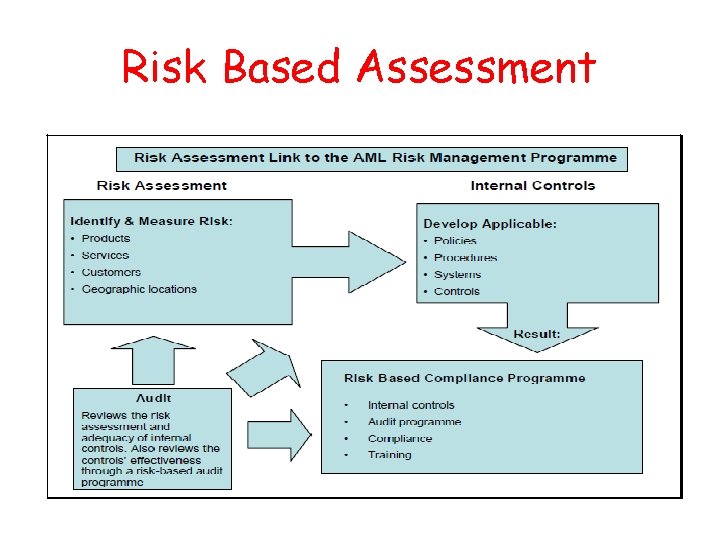

Source: slidetodoc.com

Source: slidetodoc.com

Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire. The limited identification and verification of participants. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. The Luxembourg AMLCTF regulation requires the implementation of a clear AMLCTF risk appetite and strategy in line with the principle of sound and prudent management and aligned with the organisations goals in terms of AMLCTF prevention. The European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules.

Source: bi.go.id

Source: bi.go.id

However other characteristics of virtual currencies coupled with their global reach present potential AMLCFT risks such as. The limited identification and verification of participants. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. Promotes Financial Action policies to and the financingproliferation of weapons is an independent inter-governmentalthat developsrecognised as the global anti-money laundering AML and counter-terrorist financing CFT standard. Model is populated with the most common AML CTF Sanctions risks as well as controls questionnaire.

Source: bi.go.id

Source: bi.go.id

Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. This means VASP standards should equal other regulated FS institutions. An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. The AMLCTF supervision off-site and on-site supervision by the CSSF is organised pursuant to the principles of a risk-based approach that takes into account the money laundering and terrorist financing risks to which the supervised entities and the sectors at large are exposed to. Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to.

Source: medium.com

Source: medium.com

In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. Ad AML coverage from every angle. Ad AML coverage from every angle. The AMLCTF supervision off-site and on-site supervision by the CSSF is organised pursuant to the principles of a risk-based approach that takes into account the money laundering and terrorist financing risks to which the supervised entities and the sectors at large are exposed to.

Source: pinterest.com

Source: pinterest.com

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in. Today it is not uncommon to see the US Justice Department and regulators announce multimillion dollar criminal or civil fines as settlements for AML violations. The package harmonises AMLCFT rules across the EU. Identifying and assessing AMLCFT regulatory compliance risk helps an FSP to.

Source: medium.com

Source: medium.com

An AMLCTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk whilst assessing the likelihood and severity of facilitating. Equal weights or custom user defined. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money. However other characteristics of virtual currencies coupled with their global reach present potential AMLCFT risks such as. Complying with AMLCTF laws and regulations Providing highly useful information to relevant government agencies in defined priority areas2 Establishing a reasonable and risk-based set of controls to mitigate the risks of a Financial Institution FI being used to facilitate illicit activity.

Source: slideshare.net

Source: slideshare.net

In recent years regulators have dramatically stepped up enforcement of antimoney laundering AML and CFT laws and regulations. The anonymity provided by the trade in virtual currencies on the internet. The aim of an AML compliance program is to detect respond and eliminate inherent and residual money. Understand its AMLCT Regulatorycompliance Universe Understand the implications and requirements of new legislations and regulations Implement appropriate processes policies and procedures Design and assess policies and procedures. Latest news reports from the medical literature videos from the experts and more.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title amlctf risk definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information