11+ Anti money laundering act 2017 pakistan ideas

Home » about money loundering idea » 11+ Anti money laundering act 2017 pakistan ideasYour Anti money laundering act 2017 pakistan images are available in this site. Anti money laundering act 2017 pakistan are a topic that is being searched for and liked by netizens today. You can Download the Anti money laundering act 2017 pakistan files here. Download all free vectors.

If you’re looking for anti money laundering act 2017 pakistan images information connected with to the anti money laundering act 2017 pakistan topic, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

Anti Money Laundering Act 2017 Pakistan. The government has appointed the Directorate General of II-IR as investigating and prosecuting agency in cases where tax-evaded money is laundered. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. More fundamentally money that is unknowingly unwittingly or in the case of fraud and corruption even consciously laundered through the organisation could ultimately support finance and promote international terrorism and the drugs trade. Most of the reports and indexes of the international organizations rank Pakistan as one of the worst countries having a poor Anti-Money LaunderingCombating Financing of Terrorism strategy.

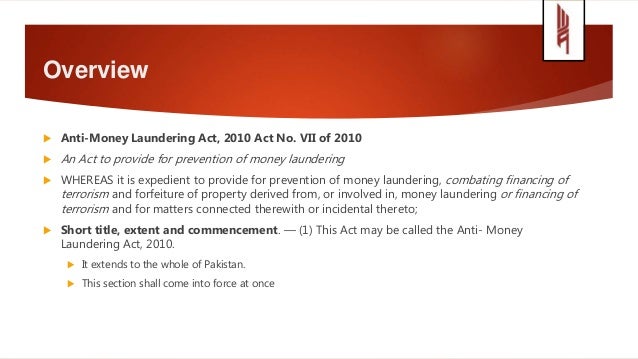

Anti Money Laundering Act 2010 From slideshare.net

Anti Money Laundering Act 2010 From slideshare.net

1170 12018 dated 1st October 2018. Enhancing the role of regulators particularly the Securities and Exchange Commission of Pakistan SECP Federal Board of Revenue and Ministry of Finance to regulate at-risk sectors in the economy particularly Pakistan Post and Central Directorate. 3rd 4th and 5th Schedule to the Companies Act 2017. A brief on Anti Money Laundering. The Anti-Terrorism Act 1997 Amended upto Feb 2017. Tax evasion is a predicate offense under Anti-Money Laundering Act 2010.

Anti Money Laundering Amendment Act 2015.

21 rows The Securities and Exchange Commission of Pakistan Act 1997 with up-to-date amendments. From the Dawn article it cites. 2 It extends to the whole of Pakistan. Amendments to the Companies Act 2017 to comply with FATF standards in curbing money laundering. The Islamabad Capital Territory Waqf Properties Act 2020. However it is relevant to note that the passage of an anti-money laundering law was a time-bound condition under the International Monetary Funds IMF 664 billion dollar Extended Fund Facility approved in September 2013 and completed in September 2016.

Source: bi.go.id

Source: bi.go.id

Most of the reports and indexes of the international organizations rank Pakistan as one of the worst countries having a poor Anti-Money LaunderingCombating Financing of Terrorism strategy. The Anti-Terrorism Act 1997 Amended upto Feb 2017. More fundamentally money that is unknowingly unwittingly or in the case of fraud and corruption even consciously laundered through the organisation could ultimately support finance and promote international terrorism and the drugs trade. Amendments to the Companies Act 2017 to comply with FATF standards in curbing money laundering. And UKs Proceeds of Crime Act POCA 2000.

Source: slideshare.net

Source: slideshare.net

2 It extends to the whole of Pakistan. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. Anti Money Laundering Act 2010 As amended upto May2016. Pakistans regulatory status on anti-money laundering provisions In Pakistan the primary regulation dealing with this subject is the Anti-Money Laundering Act 2010 the Anti-Money Laundering Regulations 2015 and the Anti-Money Laundering and the Combating the Financing of Terrorism AMLCFI Regulations for Banks and DFIs issued by State Bank of Pakistan dated. The Anti-Money Laundering Second Amendment Act 2020.

Source: dailytimes.com.pk

Source: dailytimes.com.pk

1Definitions In this Act unless there is anything repugnant in the subject or context i AMLCFT means Anti Money Laundering and Countering Financing of Terrorism. The following regulators are the anti-money launderingcombatting the financing of terrorism AMLCFT regulatory authorities for the purposes of the Act. 1170 12018 dated 1st October 2018. 3rd 4th and 5th Schedule to the Companies Act 2017. 770 12018 dated 13 June 2018 Regulations and subsequently amended vide SRO.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

Anti-Money Laundering and Combating Financing of Terrorism Regulations for Cost and Management Accountants Reporting Firms Issued by Institute of Cost and Management Accountants of Pakistan ICMA Pakistan under Section 6A2 of AML Act Short Title Extent and Commencement. Pakistans regulatory status on anti-money laundering provisions In Pakistan the primary regulation dealing with this subject is the Anti-Money Laundering Act 2010 the Anti-Money Laundering Regulations 2015 and the Anti-Money Laundering and the Combating the Financing of Terrorism AMLCFI Regulations for Banks and DFIs issued by State Bank of Pakistan dated. Of terrorism and forfeiture of property derived from or involved in money laundering or financing of terrorism and for matters connected therewith or incidental thereto. The concept of ultimate beneficial ownership has been introduced to Pakistans business law by amending the Companies Act 2017 the Limited Liability Partnership Act 2017 and the Cooperative Societies Act 1925. Pakistan Climate Change Act 2017.

Source:

Section 453 of the 2017 Companies Act Pakistan. 770 12018 dated 13 June 2018 Regulations and subsequently amended vide SRO. The Companies Appointment of Legal Advisors Act 1974. However it is relevant to note that the passage of an anti-money laundering law was a time-bound condition under the International Monetary Funds IMF 664 billion dollar Extended Fund Facility approved in September 2013 and completed in September 2016. Pakistan was first evaluated in 2005 by financial action.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

Pakistan was first evaluated in 2005 by financial action. 3rd 4th and 5th Schedule to the Companies Act 2017. The State Bank of Pakistan SBP for any reporting entity licensed or regulated under any law administered by the SBP. 1Definitions In this Act unless there is anything repugnant in the subject or context i AMLCFT means Anti Money Laundering and Countering Financing of Terrorism. The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO.

Source: slideshare.net

Source: slideshare.net

The Anti-Terrorism Act 1997 Amended upto Feb 2017. 3rd 4th and 5th Schedule to the Companies Act 2017. The following regulators are the anti-money launderingcombatting the financing of terrorism AMLCFT regulatory authorities for the purposes of the Act. Corporate Rehabilitation Act 2018. The Anti-Money Laundering Second Amendment Act 2020.

Source: slideshare.net

Source: slideshare.net

2 It extends to the whole of Pakistan. The Islamabad Capital Territory Waqf Properties Act 2020. However it is relevant to note that the passage of an anti-money laundering law was a time-bound condition under the International Monetary Funds IMF 664 billion dollar Extended Fund Facility approved in September 2013 and completed in September 2016. Short title extent and commencement 1 This Act may be called the Anti-Money Laundering Act 2010. As per Basel Institute on Governance report of 2017 Pakistan ranked worst 46th country among 146 countries on money laundering.

Source: bi.go.id

Source: bi.go.id

Of terrorism and forfeiture of property derived from or involved in money laundering or financing of terrorism and for matters connected therewith or incidental thereto. Pakistan Climate Change Act 2017. Corporate Rehabilitation Act 2018. However it is relevant to note that the passage of an anti-money laundering law was a time-bound condition under the International Monetary Funds IMF 664 billion dollar Extended Fund Facility approved in September 2013 and completed in September 2016. Anti Money Laundering Amendment Act 2015.

Source: propakistani.pk

Source: propakistani.pk

21 rows The Securities and Exchange Commission of Pakistan Act 1997 with up-to-date amendments. The Islamabad Capital Territory Waqf Properties Act 2020. The State Bank of Pakistan SBP for any reporting entity licensed or regulated under any law administered by the SBP. 3rd 4th and 5th Schedule to the Companies Act 2017. The Anti-Money Laundering Second Amendment Act 2020.

Source: researchgate.net

Source: researchgate.net

The following regulators are the anti-money launderingcombatting the financing of terrorism AMLCFT regulatory authorities for the purposes of the Act. Tax evasion is a predicate offense under Anti-Money Laundering Act 2010. More fundamentally money that is unknowingly unwittingly or in the case of fraud and corruption even consciously laundered through the organisation could ultimately support finance and promote international terrorism and the drugs trade. And UKs Proceeds of Crime Act POCA 2000. The Limited Liability Partnership Act 2017.

Source: iclg.com

Source: iclg.com

The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. Pakistan Climate Change Act 2017. 1 This Act may be called the Anti-Money Laundering Act 2010. However it is relevant to note that the passage of an anti-money laundering law was a time-bound condition under the International Monetary Funds IMF 664 billion dollar Extended Fund Facility approved in September 2013 and completed in September 2016. More fundamentally money that is unknowingly unwittingly or in the case of fraud and corruption even consciously laundered through the organisation could ultimately support finance and promote international terrorism and the drugs trade.

Source: propakistani.pk

Source: propakistani.pk

The Securities and Exchange Commission of Pakistan SECP in order to maintain integrity of its regulated financial sector notified Anti Money Laundering Regulations 2018 vide SRO. The Anti-Money Laundering Second Amendment Act 2020. 1 This Act may be called the Anti-Money Laundering Act 2010. The Anti-Terrorism Act 1997 Amended upto Feb 2017. Whoever commits the offence of 1 money laundering or property of corresponding value shall be punishable with rigorous imprisonment for a term which shall not be less than one year but may extend to ten years and shall also be liable to fine which may extend to one million rupees and shall also be liable to forfeiture of property involved in the money laundering.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act 2017 pakistan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information