10+ Anti money laundering act 2017 uganda information

Home » about money loundering Info » 10+ Anti money laundering act 2017 uganda informationYour Anti money laundering act 2017 uganda images are available. Anti money laundering act 2017 uganda are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering act 2017 uganda files here. Download all royalty-free images.

If you’re looking for anti money laundering act 2017 uganda pictures information linked to the anti money laundering act 2017 uganda keyword, you have come to the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

Anti Money Laundering Act 2017 Uganda. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others. THE ANTI-MONEY LAUNDERING AMENDMENT ACT 2017 An Act to amend the Anti-Money Laundering Act 2013 to harmonise the definitions used in the Act. The penalty on conviction is a fine not exceeding UGX 2 Billion andor imprisonment for a term not exceeding 15 years Financial Institutions Act of 2004 not specifically applicable to lawyers. ULII is a project of the Law Reporting Committee of the Judiciary of Uganda.

Pdf Telecharger Anti Money Laundering Policy Template Gratuit Pdf Pdfprof Com From pdfprof.com

Pdf Telecharger Anti Money Laundering Policy Template Gratuit Pdf Pdfprof Com From pdfprof.com

The bill criminalises money laundering and other crimes such as facilitating money laundering. Act 16 of 2017 - Anti-Money Laundering Amendmentpdf. ULII aims to bridge the existing gap in public. It provides that a person. Rwenzori Towers Wing B 4th Floor Plot 6 Nakasero Road POBox 9853 Kampala Uganda. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others.

This Act prohibits and criminalises money laundering.

In exercise of the powers conferred upon the Minister of Finance Planning and Economic Development by section 141 of the Anti-Money Laundering Act 2013 and on the advice of the Financial Intelligence Authority these Regulations were made on December 24 2015 to guide the implemnetation and enforcement of the Anti-Money Laundering Act 2013 and amended in 2017. Anti-money laundering law claims first casualties in Uganda Saturday June 24 2017 Ugandas Anti-Money Laundering Act claimed its first victims last month when a court issued convictions of money laundering suspects in a landmark case that analysts say may influence future suits. It provides that a person. To combat money laundering activities. The bill criminalises money laundering and other crimes such as facilitating money laundering. Some of the key ones are as follows.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

This is the latest version of this legislation. It provides that a person. Anti-Money Laundering Amendment Act 2017 Act 3 of 2017 Uganda Gazette no. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others. In exercise of the powers conferred upon the Minister of Finance Planning and Economic Development by section 141 of the Anti-Money Laundering Act 2013 and on the advice of the Financial Intelligence Authority these Regulations were made on December 24 2015 to guide the implemnetation and enforcement of the Anti-Money Laundering Act 2013 and amended in 2017.

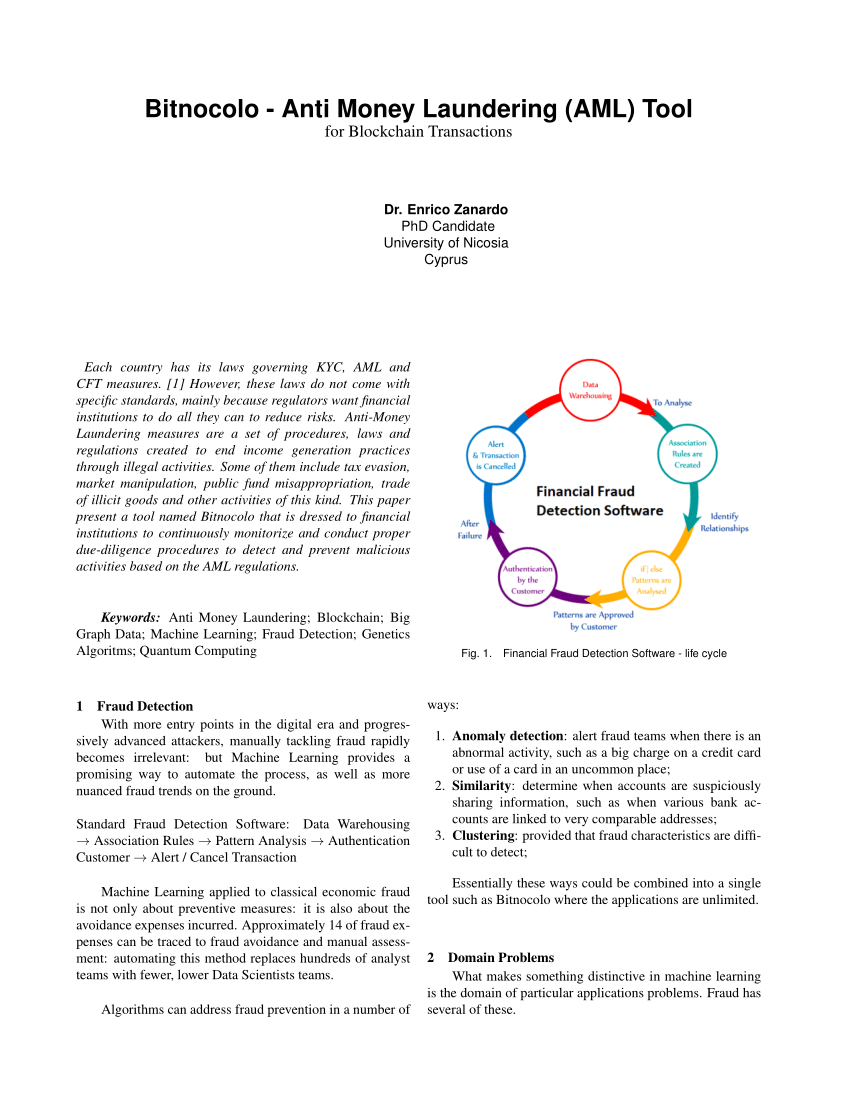

Source: researchgate.net

Source: researchgate.net

To provide for the carrying out of risk assessments by accountable persons. It provides that a person. To impose certain duties on institutions and other persons businesses and professions who might be used for money laundering purposes. The penalty on conviction is a fine not exceeding UGX 2 Billion andor imprisonment for a term not exceeding 15 years Financial Institutions Act of 2004 not specifically applicable to lawyers. Anti-money laundering law claims first casualties in Uganda Saturday June 24 2017 Ugandas Anti-Money Laundering Act claimed its first victims last month when a court issued convictions of money laundering suspects in a landmark case that analysts say may influence future suits.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

The bill criminalises money laundering and other crimes such as facilitating money laundering. ULII aims to bridge the existing gap in public. To impose certain duties on institutions and other persons businesses and professions who might be used for money laundering purposes. Plot 2702 Block 244 Nyangweso Road Kironde Road Tankhill Muyenga. To make orders in.

Rwenzori Towers Wing B 4th Floor Plot 6 Nakasero Road POBox 9853 Kampala Uganda. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others. In exercise of the powers conferred upon the Minister of Finance Planning and Economic Development by section 141 of the Anti-Money Laundering Act 2013 and on the advice of the Financial Intelligence Authority these Regulations were made on December 24 2015 to guide the implemnetation and enforcement of the Anti-Money Laundering Act 2013 and amended in 2017. It provides that a person. 256 312 343 400.

Source: wsbi-esbg.org

Source: wsbi-esbg.org

To provide for the identification of customers and clients of accountable persons. Plot 2702 Block 244 Nyangweso Road Kironde Road Tankhill Muyenga. The bill criminalises money laundering and other crimes such as facilitating money laundering. The bill is based on the 40 plus eight recommendations of the Financial Action Task Force FATF the internationally accepted standard for fighting money laundering and combating the financing of terrorism an attribute that should promote acceptance of our standards by our international trade partners and states. Act 16 of 2017 - Anti-Money Laundering Amendmentpdf.

Send us your Feedback. Anti-Money Laundering Amendment Act 2017 Act 3 of 2017 Uganda Gazette no. To provide for the carrying out of risk assessments by accountable persons. To provide for the identification of customers and clients of accountable persons. Act 16 of 2017 - Anti-Money Laundering Amendmentpdf.

Source: iclg.com

Source: iclg.com

To make orders in. To provide for the carrying out of risk assessments by accountable persons. To provide for the identification of customers and clients of accountable persons. In exercise of the powers conferred upon the Minister of Finance Planning and Economic Development by section 141 of the Anti-Money Laundering Act 2013 and on the advice of the Financial Intelligence Authority these Regulations were made on December 24 2015 to guide the implemnetation and enforcement of the Anti-Money Laundering Act 2013 and amended in 2017. The penalty on conviction is a fine not exceeding UGX 2 Billion andor imprisonment for a term not exceeding 15 years Financial Institutions Act of 2004 not specifically applicable to lawyers.

Source:

To combat money laundering activities. To provide for the carrying out of risk assessments by accountable persons. 1 An accountable person shall on a regular basis conduct anti-money laundering and terrorism financing risk assessment to enable the accountable person to identify assess monitor manage and mitigate the risks associated with money laundering and terrorism financing taking into account all relevant risk factors. Act 16 of 2017 - Anti-Money Laundering Amendmentpdf. ULII aims to bridge the existing gap in public.

1 An accountable person shall on a regular basis conduct anti-money laundering and terrorism financing risk assessment to enable the accountable person to identify assess monitor manage and mitigate the risks associated with money laundering and terrorism financing taking into account all relevant risk factors. Entering or leaving the territory of Uganda and carrying cash or bearer negotiable instruments exceeding one thousand five hundred currency points or the equivalent value in a foreign currency arranging for the transfer of cash or bearer negotiable instruments exceeding one thousand five hundred currency points or the equivalent value in a foreign currency into or out of the territory of Uganda. ULII is a project of the Law Reporting Committee of the Judiciary of Uganda. 1 An accountable person shall on a regular basis conduct anti-money laundering and terrorism financing risk assessment to enable the accountable person to identify assess monitor manage and mitigate the risks associated with money laundering and terrorism financing taking into account all relevant risk factors. Send us your Feedback.

Source: pdfprof.com

Source: pdfprof.com

In exercise of the powers conferred upon the Minister of Finance Planning and Economic Development by section 141 of the Anti-Money Laundering Act 2013 and on the advice of the Financial Intelligence Authority these Regulations were made on December 24 2015 to guide the implemnetation and enforcement of the Anti-Money Laundering Act 2013 and amended in 2017. ULII aims to bridge the existing gap in public. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others. 256 312 343 400. THE ANTI-MONEY LAUNDERING AMENDMENT ACT 2017 An Act to amend the Anti-Money Laundering Act 2013 to harmonise the definitions used in the Act.

Source: pdfprof.com

Source: pdfprof.com

Anti-Money Laundering Amendment Act 2017 Act 3 of 2017 Uganda Gazette no. The penalty on conviction is a fine not exceeding UGX 2 Billion andor imprisonment for a term not exceeding 15 years Financial Institutions Act of 2004 not specifically applicable to lawyers. The Anti-Money Laundering Act 2013 AMLA was passed to provide for the prohibition and prevention of money laundering by establishing the Financial Intelligence Authority FIA to combat money laundering activities impose certain duties on institutions such as NGOs churches and other charitable organisations and other persons among others. To provide for the identification of customers and clients of accountable persons. Entering or leaving the territory of Uganda and carrying cash or bearer negotiable instruments exceeding one thousand five hundred currency points or the equivalent value in a foreign currency arranging for the transfer of cash or bearer negotiable instruments exceeding one thousand five hundred currency points or the equivalent value in a foreign currency into or out of the territory of Uganda.

Source: researchgate.net

Source: researchgate.net

ULII aims to bridge the existing gap in public. 1 An accountable person shall on a regular basis conduct anti-money laundering and terrorism financing risk assessment to enable the accountable person to identify assess monitor manage and mitigate the risks associated with money laundering and terrorism financing taking into account all relevant risk factors. Send us your Feedback. The penalty on conviction is a fine not exceeding UGX 2 Billion andor imprisonment for a term not exceeding 15 years Financial Institutions Act of 2004 not specifically applicable to lawyers. Rwenzori Towers Wing B 4th Floor Plot 6 Nakasero Road POBox 9853 Kampala Uganda.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

1 An accountable person shall on a regular basis conduct anti-money laundering and terrorism financing risk assessment to enable the accountable person to identify assess monitor manage and mitigate the risks associated with money laundering and terrorism financing taking into account all relevant risk factors. ULII is a project of the Law Reporting Committee of the Judiciary of Uganda. Some of the key ones are as follows. To provide for the carrying out of risk assessments by accountable persons. The penalty on conviction is a fine not exceeding UGX 2 Billion andor imprisonment for a term not exceeding 15 years Financial Institutions Act of 2004 not specifically applicable to lawyers.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering act 2017 uganda by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas