18++ Anti money laundering act designated service information

Home » about money loundering idea » 18++ Anti money laundering act designated service informationYour Anti money laundering act designated service images are ready in this website. Anti money laundering act designated service are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering act designated service files here. Find and Download all royalty-free images.

If you’re looking for anti money laundering act designated service pictures information related to the anti money laundering act designated service keyword, you have visit the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

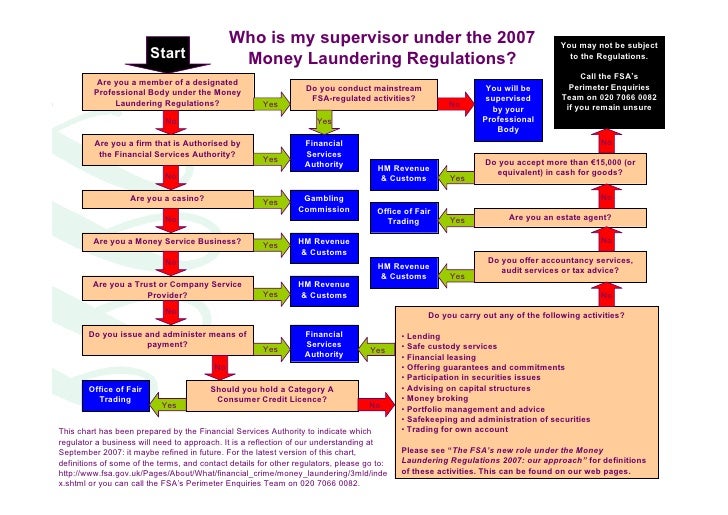

Anti Money Laundering Act Designated Service. The Criminal Justice Money Laundering and Terrorist Financing Act 2010 identifies Property Services Providers as Designated Persons. Note 4 at the end of this reprint provides a list of the amendments incorporated. This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. Designated services in the financial sector include.

Course Unitar From unitar.org

Course Unitar From unitar.org

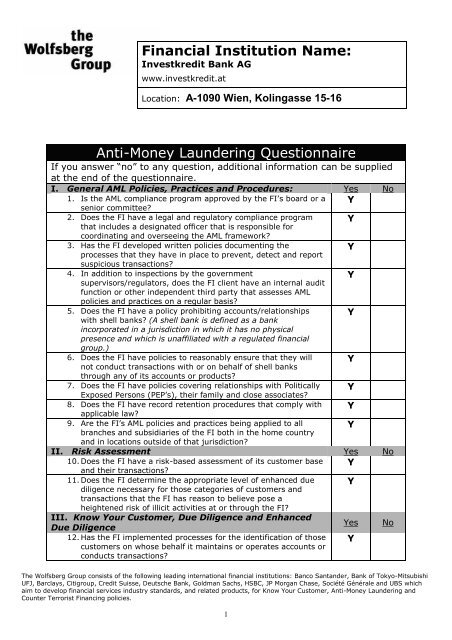

An entitys AMLCTF obligations are triggered by the provision of a designated service with the obligations applying in respect of the customers of such services. Inserted on 11 August 2017 by section 674of the Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 20172017 No 35. The Criminal Justice Money Laundering and Terrorist Financing Act 2010 establishes a number of competent authorities who monitor designated persons and secure compliance with the requirements of the Act. Part 2Transitional provisions relating to Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 2017. This online service provides you with on-demand access to AML training guidance and ready-to-use templates to help your firm comply with the 2017 Money Laundering. The purpose of this overview is to remind Property Service Providers of the important need to know and to comply with their statutory obligations as designated persons under the Act.

This means that Property Service Providers are among a number of professions who may be exposed to money laundering due to the nature of their business.

This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. This Act is administered by the Ministry of Justice. This online service provides you with on-demand access to AML training guidance and ready-to-use templates to help your firm comply with the 2017 Money Laundering. Key anti money laundering responsibilities of property service providers. Note 4 at the end of this reprint provides a list of the amendments incorporated.

CDD is one of the basic requirements of the risk-based AML approach and it has been deemed necessary and recommended by all regulators in the world within the scope of anti-money laundering. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any government. Inserted on 11 August 2017 by section 674of the Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 20172017 No 35. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. Part 1 Introduction 1 Short title This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Relevant to firms from any professional body not just ICAEW. An entitys AMLCTF obligations are triggered by the provision of a designated service with the obligations applying in respect of the customers of such services. Its an entitys customers of designated services that a company must know for the purpose of. The Criminal Justice Money Laundering and Terrorist Financing Act 2010 establishes a number of competent authorities who monitor designated persons and secure compliance with the requirements of the Act. We have partnered with ICAEW to bring you the ICAEW Anti-Money Laundering Service.

Source: slideserve.com

Source: slideserve.com

Anti Money Laundering and Counter Terrorism Financing AML CTF Services. The Anti-Money Laundering and Counter Terrorism Financing Act AMLCTF Act received royal assent on December 12 2006. This means that Property Service Providers are among a number of professions who may be exposed to money laundering due to the nature of their business. Anti money laundering act designated service. CDD is one of the basic requirements of the risk-based AML approach and it has been deemed necessary and recommended by all regulators in the world within the scope of anti-money laundering.

This online service provides you with on-demand access to AML training guidance and ready-to-use templates to help your firm comply with the 2017 Money Laundering. A if all of the designated services provided by the reporting entity are covered by item 54 of table 1 in section 6 and there is no joint antimoney laundering and counterterrorism financing program that applies to and has been adopted by the reporting entity. Part 1 Introduction 1 Short title This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006. There are three different sectors covered - financial services bullion and gambling services. Inserted on 11 August 2017 by section 674of the Anti-Money Laundering and Countering Financing of Terrorism Amendment Act 20172017 No 35.

Source: complyadvantage.com

Source: complyadvantage.com

A if all of the designated services provided by the reporting entity are covered by item 54 of table 1 in section 6 and there is no joint antimoney laundering and counterterrorism financing program that applies to and has been adopted by the reporting entity. Key anti money laundering responsibilities of property service providers. The Anti-Money Laundering and Counter Terrorism Financing Act AMLCTF Act received royal assent on December 12 2006. Part 1 Introduction 1 Short title This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006. Note 4 at the end of this reprint provides a list of the amendments incorporated.

Source: unitar.org

Source: unitar.org

11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any government. Its an entitys customers of designated services that a company must know for the purpose of. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. This online service provides you with on-demand access to AML training guidance and ready-to-use templates to help your firm comply with the 2017 Money Laundering. There are three different sectors covered - financial services bullion and gambling services.

Source: slideshare.net

Source: slideshare.net

Anti Money Laundering and Counter Terrorism Financing AML CTF Services. ICAEW Anti-Money Laundering Service. We have partnered with ICAEW to bring you the ICAEW Anti-Money Laundering Service. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any government.

Source: researchgate.net

Source: researchgate.net

It is being implemented in stages. This online service provides you with on-demand access to AML training guidance and ready-to-use templates to help your firm comply with the 2017 Money Laundering. Schedule 1 Part 2. CDD is one of the basic requirements of the risk-based AML approach and it has been deemed necessary and recommended by all regulators in the world within the scope of anti-money laundering. An entitys AMLCTF obligations are triggered by the provision of a designated service with the obligations applying in respect of the customers of such services.

Source: yumpu.com

Source: yumpu.com

It is being implemented in stages. A service that is listed in section 6 of the AMLCTF Act because it has been identified as posing a risk for money laundering and terrorism financing and which meets the geographical link. An entitys AMLCTF obligations are triggered by the provision of a designated service with the obligations applying in respect of the customers of such services. Designated services include a range of business activities in the financial services bullion gambling and digital currency exchange. Accordance with all relevant anti-money laundering legislation that applies to them.

Source: slideshare.net

Source: slideshare.net

This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. Designated services in the financial sector include. Its an entitys customers of designated services that a company must know for the purpose of. ICAEW Anti-Money Laundering Service.

This online service provides you with on-demand access to AML training guidance and ready-to-use templates to help your firm comply with the 2017 Money Laundering. Designated services include a range of business activities in the financial services bullion gambling and digital currency exchange. This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. Note 4 at the end of this reprint provides a list of the amendments incorporated. The Anti-Money Laundering and Counter Terrorism Financing Act AMLCTF Act received royal assent on December 12 2006.

Source: researchgate.net

Source: researchgate.net

Note 4 at the end of this reprint provides a list of the amendments incorporated. The AMLCTF Act nominates certain types of services particularly in the finance gambling and bullion sectors as designated services because such services have been identified as posing a risk for money laundering andor financing of terrorism. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any government. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. Anti money laundering act designated service.

Source: complyadvantage.com

Source: complyadvantage.com

We have partnered with ICAEW to bring you the ICAEW Anti-Money Laundering Service. This Act is administered by the Ministry of Justice. 59 rows ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING ACT 2006 -. 11521 adds two new covered persons who are now required to report covered and suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation PAGCOR or any government. Of immediate concern to financial services licensees are those obligations that commence on December 12 2007.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act designated service by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information