13++ Anti money laundering act estate agents ideas in 2021

Home » about money loundering Info » 13++ Anti money laundering act estate agents ideas in 2021Your Anti money laundering act estate agents images are ready in this website. Anti money laundering act estate agents are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering act estate agents files here. Download all royalty-free photos.

If you’re searching for anti money laundering act estate agents images information related to the anti money laundering act estate agents interest, you have come to the ideal site. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Anti Money Laundering Act Estate Agents. This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. Estate agency is a regulated business sector and therefore the CDD obligations within the regulations apply to estate agents or more appropriately I should say they apply to anyone when they act as an estate agent. Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF. The MLPA recommends that a risk-based approach RBA be applied to combatting money laundering and terrorist financing.

Hmrc Launches Money Laundering Crackdown On Estate Agents Money Laundering Estate Agent Product Launch From in.pinterest.com

Hmrc Launches Money Laundering Crackdown On Estate Agents Money Laundering Estate Agent Product Launch From in.pinterest.com

Real estate agents are at risk of being exploited by criminals to launder money. 1 Each provision of this Act specified in column 1 of the table commences or is taken to have commenced in accordance with column 2 of the table. The sources of the money in precise are criminal and the money is invested in a approach that makes it seem like clear money. Money Laundering Four Stages. Estate agents may face fines or criminal prosecution if they do not comply with regulations. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Amore Estate Agents are committed to complying with the Anti Money Laundering legislation AML.

This guidance helps estate agency and property related businesses meet their requirements for money laundering supervision including. This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. The Criminal Finances Act 2017. The Terrorism Act 2000. Estate agency is a regulated business sector and therefore the CDD obligations within the regulations apply to estate agents or more appropriately I should say they apply to anyone when they act as an estate agent. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: cea.gov.sg

Source: cea.gov.sg

The RBA requires Real Estate Agents to identify assess and understand the MLTF risks to which they are exposed and take the required AMLCFT measures. This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. PART I PRELIMINARY PRovisioNs 1. The Criminal Finances Act 2017. Thistles Estate Agents are committed to complying with the Anti Money Laundering legislation AML.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

The Bribery Act 2010. To help real estate agents understand the risks they face the Department of Internal Affairs has just released. Amore Estate Agents are committed to complying with the Anti Money Laundering legislation AML. Its a course of by which dirty money is converted into clear money. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: researchgate.net

Source: researchgate.net

This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006. This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006. Anti-Money Laundering Letting Agents From 10 January 2020 all letting agents who manage properties which individually yield an income of 10000 Euros per month or equivalent or more must now comply with regulations set out in the Fifth Money Laundering Directive. Its a course of by which dirty money is converted into clear money. There is little reference to the laundering of money in the regulations.

Source: content.harcourts.co.nz

Source: content.harcourts.co.nz

ENACTED by Parliament of the United Republic of Tanzania. Estate agents may face fines or criminal prosecution if they do not comply with regulations. Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF. The RBA requires Real Estate Agents to identify assess and understand the MLTF risks to which they are exposed and take the required AMLCFT measures. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

Source: researchgate.net

Source: researchgate.net

This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. 1 Short title. Estate agents may face fines or criminal prosecution if they do not comply with regulations. To help real estate agents understand the risks they face the Department of Internal Affairs has just released. The RBA requires Real Estate Agents to identify assess and understand the MLTF risks to which they are exposed and take the required AMLCFT measures.

Source: vinciworks.com

Source: vinciworks.com

On money laundering to establish a Financial Intelligence Unit and the National Multi-Disciplinary Committee on Anti-Money Laundering and to provide for matters connected thereto. Anti-Money Laundering Letting Agents From 10 January 2020 all letting agents who manage properties which individually yield an income of 10000 Euros per month or equivalent or more must now comply with regulations set out in the Fifth Money Laundering Directive. On money laundering to establish a Financial Intelligence Unit and the National Multi-Disciplinary Committee on Anti-Money Laundering and to provide for matters connected thereto. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. ENACTED by Parliament of the United Republic of Tanzania.

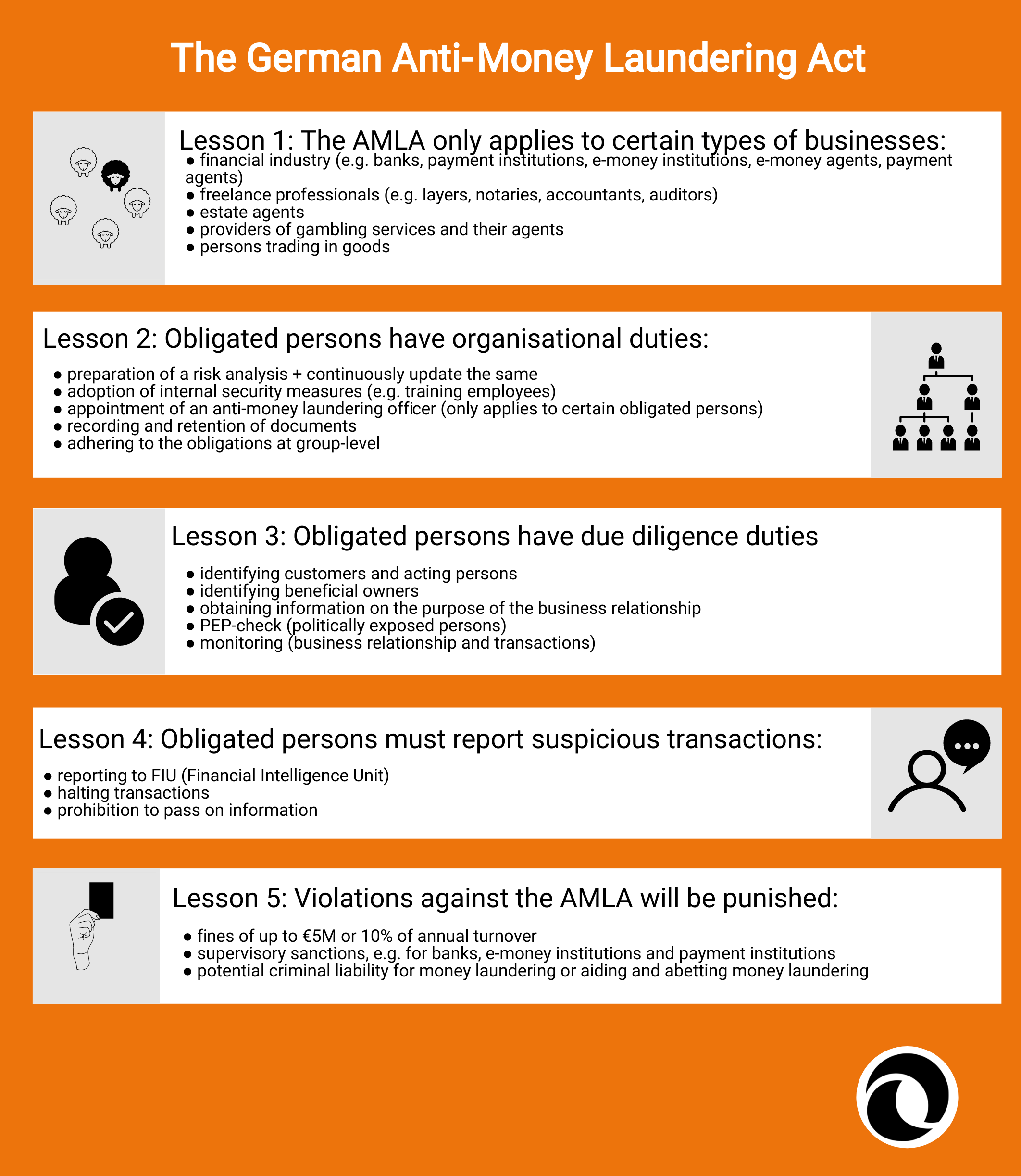

Source: paytechlaw.com

Source: paytechlaw.com

The MLPA recommends that a risk-based approach RBA be applied to combatting money laundering and terrorist financing. This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. Theyre among several professions whose members may be affected by changes to the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act. Money Laundering Four Stages. The Proceeds of Crime Act 2002 and.

Source: cea.gov.sg

Source: cea.gov.sg

The RBA requires Real Estate Agents to identify assess and understand the MLTF risks to which they are exposed and take the required AMLCFT measures. Generally estate agents are regulated by HMRC but they should also follow their countrys regulations or affiliates. The MLPA recommends that a risk-based approach RBA be applied to combatting money laundering and terrorist financing. 1 Each provision of this Act specified in column 1 of the table commences or is taken to have commenced in accordance with column 2 of the table. The Proceeds of Crime Act 2002 and.

Source: sanctionscanner.com

Source: sanctionscanner.com

1 Each provision of this Act specified in column 1 of the table commences or is taken to have commenced in accordance with column 2 of the table. Under MLR 2017 estate agents are to be treated as entering into a business relationship with a purchaser as well as with a seller at the point when the purchasers offer is accepted by the seller. 1 Each provision of this Act specified in column 1 of the table commences or is taken to have commenced in accordance with column 2 of the table. 1 Short title. Thistles Estate Agents are committed to complying with the Anti Money Laundering legislation AML.

Source: cea.gov.sg

Source: cea.gov.sg

This Act may be cited as the AntiMoney Laundering and CounterTerrorism Financing Act 2006. 1 Each provision of this Act specified in column 1 of the table commences or is taken to have commenced in accordance with column 2 of the table. This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. ENACTED by Parliament of the United Republic of Tanzania. This guidance helps estate agency and property related businesses meet their requirements for money laundering supervision including.

Source: in.pinterest.com

Source: in.pinterest.com

The RBA requires Real Estate Agents to identify assess and understand the MLTF risks to which they are exposed and take the required AMLCFT measures. Real estate agents are at risk of being exploited by criminals to launder money. There is little reference to the laundering of money in the regulations. Theyre among several professions whose members may be affected by changes to the Anti-Money Laundering and Countering Financing of Terrorism AMLCFT Act. The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer.

Source: issuu.com

Source: issuu.com

PART I PRELIMINARY PRovisioNs 1. The MLPA recommends that a risk-based approach RBA be applied to combatting money laundering and terrorist financing. The Bribery Act 2010. This guide is designed to help real estate agents develop awareness of money laundering and terrorism financing and build their compliance programmes to meet their obligations under the AMLCFT Act. Amore Estate Agents are committed to complying with the Anti Money Laundering legislation AML.

Source: yumpu.com

Source: yumpu.com

Thistles Estate Agents are committed to complying with the Anti Money Laundering legislation AML. The Proceeds of Crime Act 2002 and. Money Laundering Four Stages. Act on instructions from a customer who wants to buy sell or let an interest in land in the UK or abroad and introduce your customer to a third party who wants to buy sell or let an interest in. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act estate agents by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas