14++ Anti money laundering act explained ideas

Home » about money loundering Info » 14++ Anti money laundering act explained ideasYour Anti money laundering act explained images are ready. Anti money laundering act explained are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering act explained files here. Find and Download all free images.

If you’re looking for anti money laundering act explained pictures information linked to the anti money laundering act explained topic, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

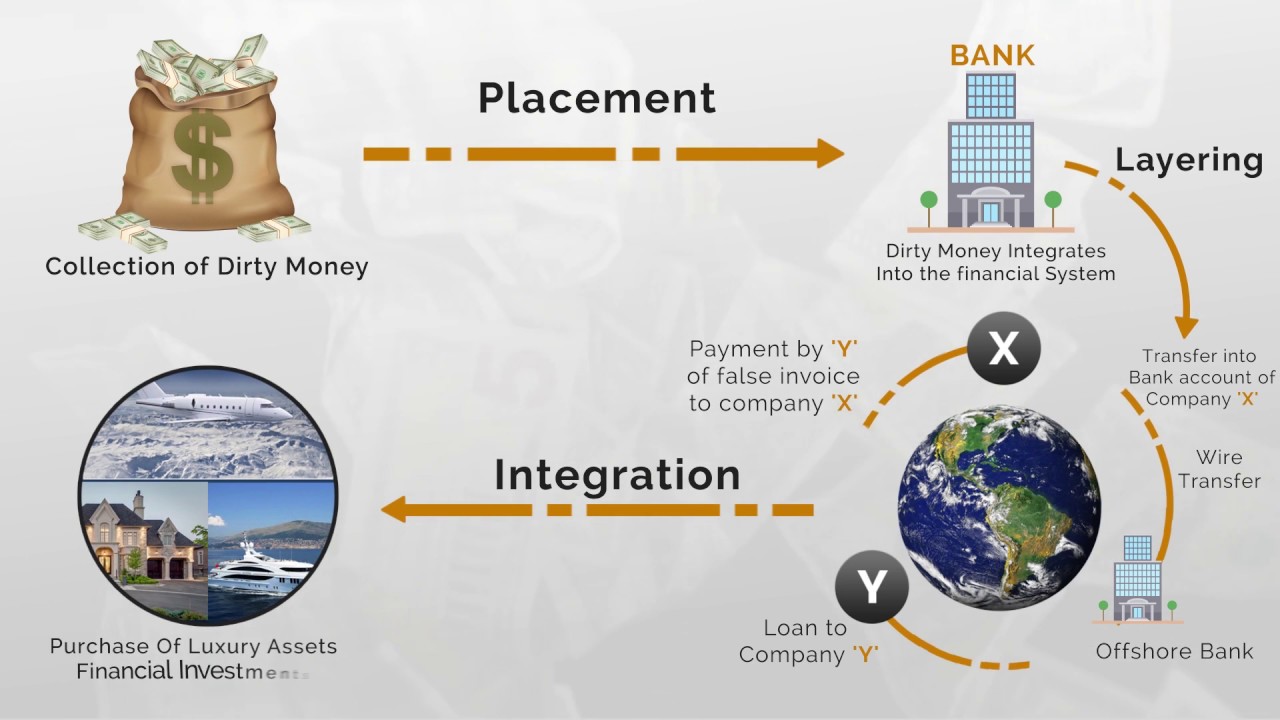

Anti Money Laundering Act Explained. The first is the Bank Secrecy Act of 1970 BSA. Two laws are the foundation of the US efforts to combat money laundering. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. If youre into news you might remember the RCBC Money Laundering Scam and how the Senate hearing dragged through local channels.

Anti Money Laundering Overview Process And History From corporatefinanceinstitute.com

Anti Money Laundering Overview Process And History From corporatefinanceinstitute.com

An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or. Anti-Money Laundering Counter Terrorism Financing Explained. 12 Both the AMLA and BSA enable the Treasury Departments Financial Crimes Enforcement Network FinCEN to regulate the activity of. The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporate Transparency Act CTA and the Anti-Money Laundering Act of 2020 AMLA. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Date of Royal Assent 25-Jun-2001 Date of publication in the Gazette5-Jul-2001 An Act to provide for the offence of money laundering the measures to be taken for the prevention of money laundering and terrorism financing offences and to provide.

Two laws are the foundation of the US efforts to combat money laundering.

Parliament of the United Kingdom. The first is the Bank Secrecy Act of 1970 BSA. The fight against money launderers also involves the collaboration between several domestic and international government organizations as this crime often takes place in various countries. This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. FINRA reviews a firms compliance with AML rules under FINRA Rule.

Source: veriff.com

Source: veriff.com

An overview of anti-money laundering and the AMLD5. Anti-Money Laundering Counter Terrorism Financing Explained. An overview of anti-money laundering and the AMLD5. Date of Royal Assent 25-Jun-2001 Date of publication in the Gazette5-Jul-2001 An Act to provide for the offence of money laundering the measures to be taken for the prevention of money laundering and terrorism financing offences and to provide. Sanctions and Anti-Money Laundering Act 2018.

Source: mintos.com

Source: mintos.com

The 6 key AMLD5 guidelines explained. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. Anti-Money Laundering Counter Terrorism Financing Explained. 12 Both the AMLA and BSA enable the Treasury Departments Financial Crimes Enforcement Network FinCEN to regulate the activity of. Two laws are the foundation of the US efforts to combat money laundering.

Source: pideeco.be

Source: pideeco.be

Background The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act became law on 12 December 2006. The Money Laundering Regulations require certain types of businesses to establish certain anti money laundering AML procedures for preventing money laundering. The Act also makes it a crime to conceal falsify or attempt to misrepresent information. The fight against money launderers also involves the collaboration between several domestic and international government organizations as this crime often takes place in various countries. The 6 key AMLD5 guidelines explained.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. Two laws are the foundation of the US efforts to combat money laundering. Parliament of the United Kingdom. The Act specifically prohibits a person from concealing falsifying or attempting to conceal a material fact regarding a monetary transaction of a senior foreign political figure or their immediate family member. The Anti-Money Laundering Act is a collection of several acts and policies that work together to prevent and prosecute money-laundering crimes in the US.

Source: pinterest.com

Source: pinterest.com

The businesses are required to set up risk sensitive procedures and policies in order to detect money laundering. Parliament of the United Kingdom. Anti-Money Laundering AML is the process of detecting and disrupting money laundering and terrorism funding activities. If youre into news you might remember the RCBC Money Laundering Scam and how the Senate hearing dragged through local channels. The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporate Transparency Act CTA and the Anti-Money Laundering Act of 2020 AMLA.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Background The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act became law on 12 December 2006. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. The fight against money launderers also involves the collaboration between several domestic and international government organizations as this crime often takes place in various countries. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Two laws are the foundation of the US efforts to combat money laundering.

Source: shuftipro.com

Source: shuftipro.com

Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. Date of Royal Assent 25-Jun-2001 Date of publication in the Gazette5-Jul-2001 An Act to provide for the offence of money laundering the measures to be taken for the prevention of money laundering and terrorism financing offences and to provide. The Money Laundering Regulations require certain types of businesses to establish certain anti money laundering AML procedures for preventing money laundering. Background The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 AMLCTF Act became law on 12 December 2006. The Act specifically prohibits a person from concealing falsifying or attempting to conceal a material fact regarding a monetary transaction of a senior foreign political figure or their immediate family member.

Source: academia.edu

Source: academia.edu

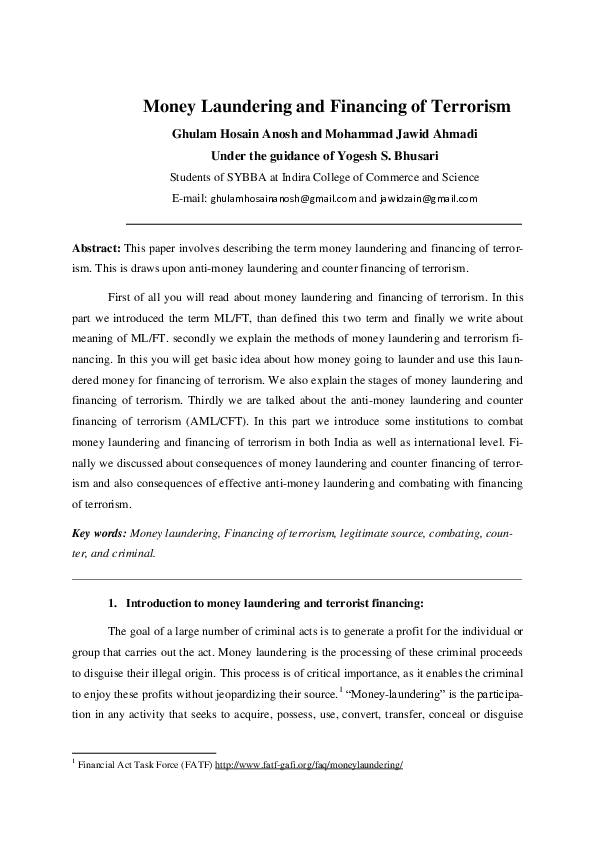

This is a compilation of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 that shows the text of the law as amended and in force on 20 December 2018 the compilation date. Anti-Money Laundering AML is the process of detecting and disrupting money laundering and terrorism funding activities. The Anti-Money Laundering Act is a collection of several acts and policies that work together to prevent and prosecute money-laundering crimes in the US. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. FINRA reviews a firms compliance with AML rules under FINRA Rule.

Source: ppt-online.org

Source: ppt-online.org

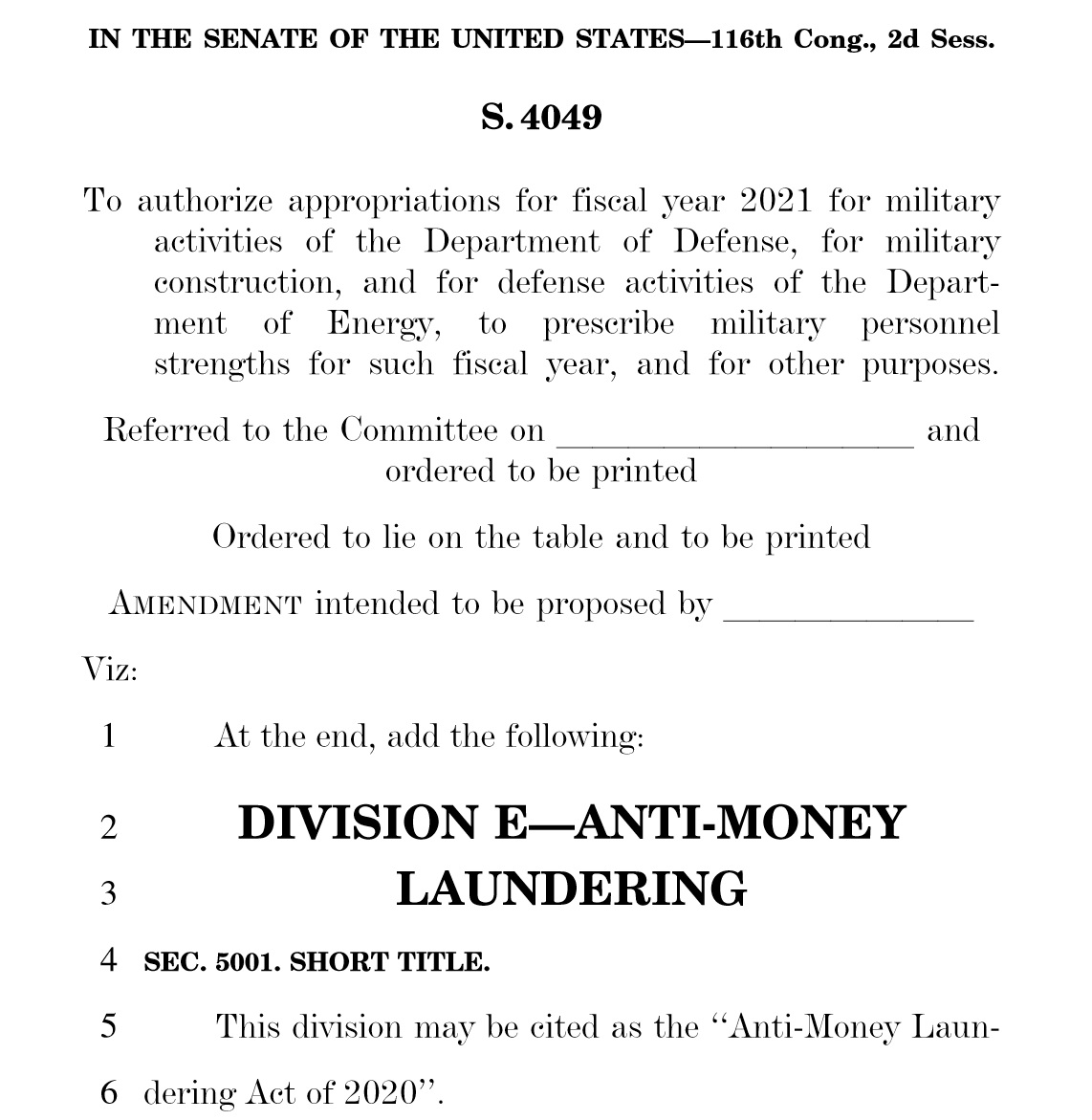

The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporate Transparency Act CTA and the Anti-Money Laundering Act of 2020 AMLA. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The Act also makes it a crime to conceal falsify or attempt to misrepresent information. The 6 key AMLD5 guidelines explained. The country created an Anti-Money Laundering Council AMLC to ensure that the Anti-Money Laundering Act AMLA is being observed by those within the financial industry.

Source: regtechconsulting.net

Source: regtechconsulting.net

The Money Laundering Regulations require certain types of businesses to establish certain anti money laundering AML procedures for preventing money laundering. Anti-Money Laundering AML is the process of detecting and disrupting money laundering and terrorism funding activities. On January 1 2021 Congress passed the Anti-Money Laundering Act of 2020 AMLA which provides the most comprehensive update to anti-money laundering laws under the BSA since the Patriot Act. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. If youre into news you might remember the RCBC Money Laundering Scam and how the Senate hearing dragged through local channels.

Source: pinterest.com

Source: pinterest.com

An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or. Anti-Money Laundering Counter Terrorism Financing Explained. The Act specifically prohibits a person from concealing falsifying or attempting to conceal a material fact regarding a monetary transaction of a senior foreign political figure or their immediate family member. Date of Royal Assent 25-Jun-2001 Date of publication in the Gazette5-Jul-2001 An Act to provide for the offence of money laundering the measures to be taken for the prevention of money laundering and terrorism financing offences and to provide. The 6 key AMLD5 guidelines explained.

Source: pinterest.com

Source: pinterest.com

An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of furthering the prevention of terrorism or. The Anti-Money Laundering Act is a collection of several acts and policies that work together to prevent and prosecute money-laundering crimes in the US. The ACT includes significant reforms to the Bank Secrecy Act BSA and anti-money laundering AML and countering the financing of terrorism CFT laws introduced through the Corporate Transparency Act CTA and the Anti-Money Laundering Act of 2020 AMLA. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. The first is the Bank Secrecy Act of 1970 BSA.

Source: youtube.com

Source: youtube.com

Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. Firms must comply with the Bank Secrecy Act and its implementing regulations AML rules. An overview of anti-money laundering and the AMLD5. The Anti-Money Laundering Act is a collection of several acts and policies that work together to prevent and prosecute money-laundering crimes in the US. The 6 key AMLD5 guidelines explained.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering act explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas