19++ Anti money laundering act fines and penalties info

Home » about money loundering Info » 19++ Anti money laundering act fines and penalties infoYour Anti money laundering act fines and penalties images are ready in this website. Anti money laundering act fines and penalties are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering act fines and penalties files here. Download all royalty-free images.

If you’re looking for anti money laundering act fines and penalties images information connected with to the anti money laundering act fines and penalties interest, you have visit the ideal site. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Anti Money Laundering Act Fines And Penalties. But what exactly did it do wrong and how does the penalty stack up. And for a non-individual a fine not exceeding S300000. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. AUTHORITY TO FREEZE UNDER ANTI-MONEY LAUNDERING ACT The penalty of imprisonment from six 6 months to four 4 years or a fine of not less than One hundred thousand Philippine pesos Php10000000 but not more than Five hundred thousand Philippine pesos Php50000000 or both shall be imposed on a person who knowing that a covered or suspicious.

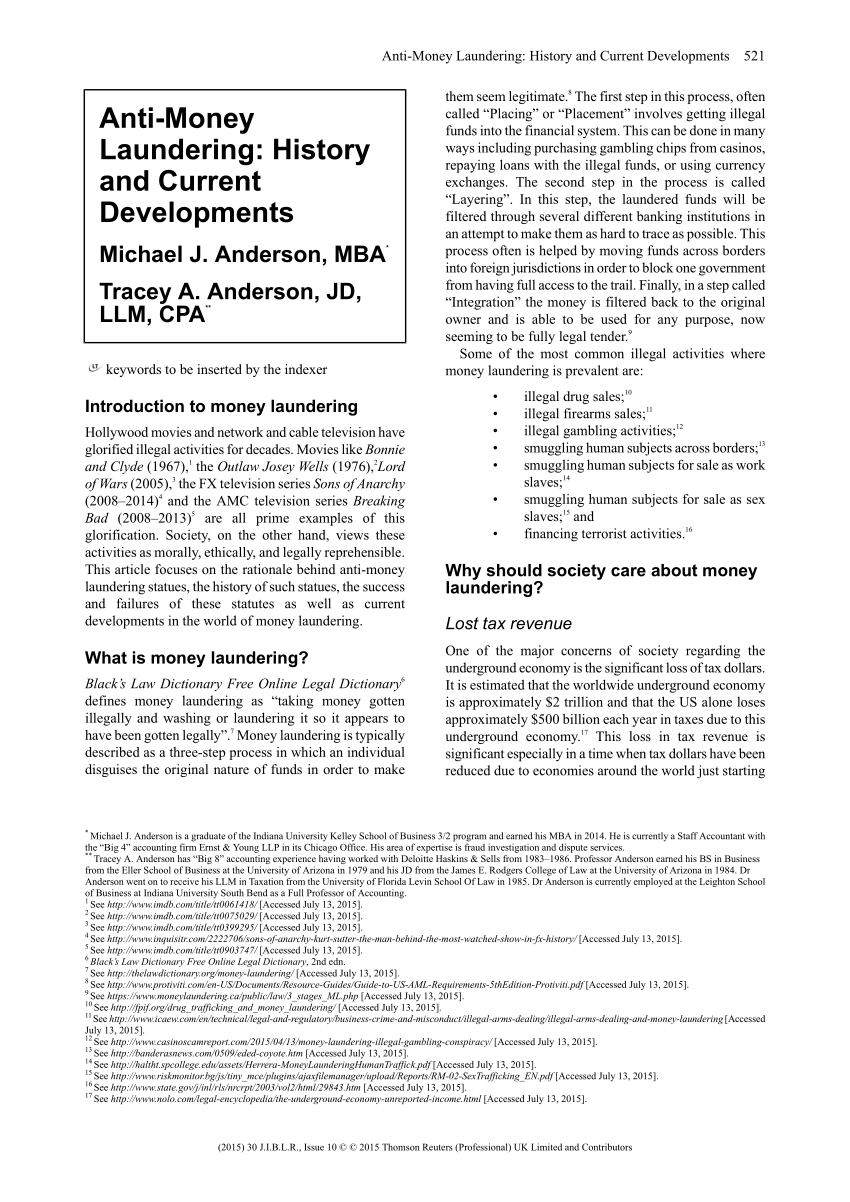

Pdf Anti Money Laundering History And Current Developments From researchgate.net

Pdf Anti Money Laundering History And Current Developments From researchgate.net

But what exactly did it do wrong and how does the penalty stack up. Failure to carry out money laundering and terrorist financing risk assessments. If the bank fails to comply with the subpoena requirements of new 5318 k the government may assess civil penalties of up to 50000 per day and seek an order from the US. AUTHORITY TO FREEZE UNDER ANTI-MONEY LAUNDERING ACT The penalty of imprisonment from six 6 months to four 4 years or a fine of not less than One hundred thousand Philippine pesos Php10000000 but not more than Five hundred thousand Philippine pesos Php50000000 or both shall be imposed on a person who knowing that a covered or suspicious. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Penalty administration charge HMRC introduced a penalty administration charge for all anti-money laundering supervision penalties issued from 25 July 2018.

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

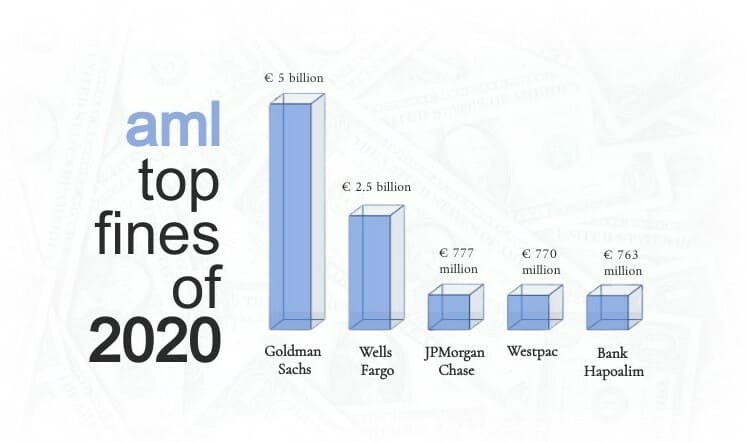

Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to. 17 What is the statute of limitations for money laundering crimes. Thats the total amount of fines global regulators imposed on financial institutions in 2018 for non-compliance with anti-money laundering regulations. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to 100000. While the AML penalties given in 2018 were approximately 4 billion the AML penalties given in 2019 increased by approximately 2 times to approximately 8 billion. If the bank fails to comply with the subpoena requirements of new 5318 k the government may assess civil penalties of up to 50000 per day and seek an order from the US.

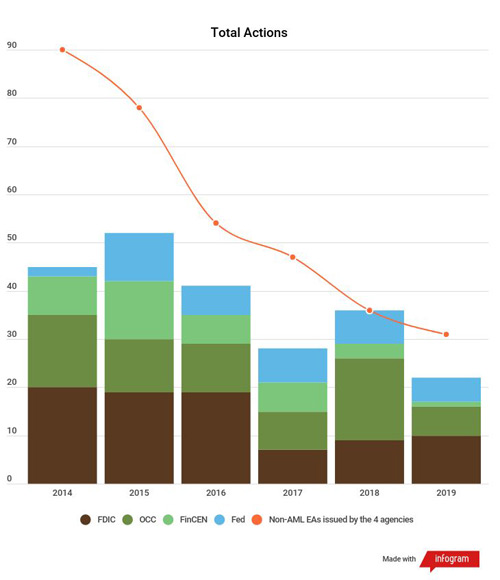

Source: moneylaundering.com

Source: moneylaundering.com

While the AML penalties given in 2018 were approximately 4 billion the AML penalties given in 2019 increased by approximately 2 times to approximately 8 billion. For a legal entity the maximum penalty is an unlimited fine. For an individual a fine not exceeding S150000 or imprisonment not exceeding three years or both. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002.

Source: idmerit.com

Source: idmerit.com

A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. When we examine some of the data announced in 2020 we see that the AML penalties given in the first half of 2020 are close to 6. If the bank fails to comply with the subpoena requirements of new 5318 k the government may assess civil penalties of up to 50000 per day and seek an order from the US. Department of Justice issued a 185 million civil money penalty against US. For a legal entity the maximum penalty is an unlimited fine.

Source: complyadvantage.com

Source: complyadvantage.com

Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Under Section 4 of the AMLA any person who commits a money laundering offence and shall on conviction be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than 5 times the sum or value of the proceeds of an unlawful activity or instrumentalities of an offence at the time the offence was committed or five million ringgit whichever is the higher. Under the BSA penalties may be imposed on each branch or location found to be violation of AML regulations and for each day that the violation occurs. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. The maximum penalty under Section 47AA of the CDSA is.

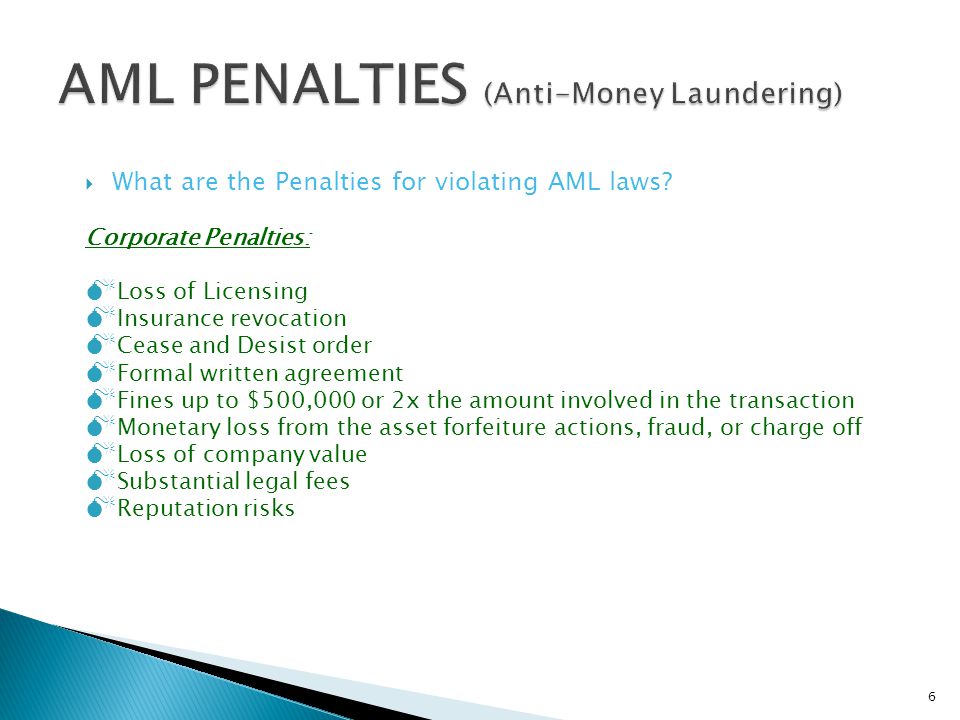

Source: slideplayer.com

Source: slideplayer.com

Lag 2017630 om åtgärder mot penningtvätt och finansiering av terrorism we will refer to it as the Anti-Money Laundering Act and the Penalties for Money Laundering Offences Act. And these penalties can be severe. The maximum penalty under Section 47AA of the CDSA is. Failure to carry out money laundering and terrorist financing risk assessments. What are the laws Westpac broke.

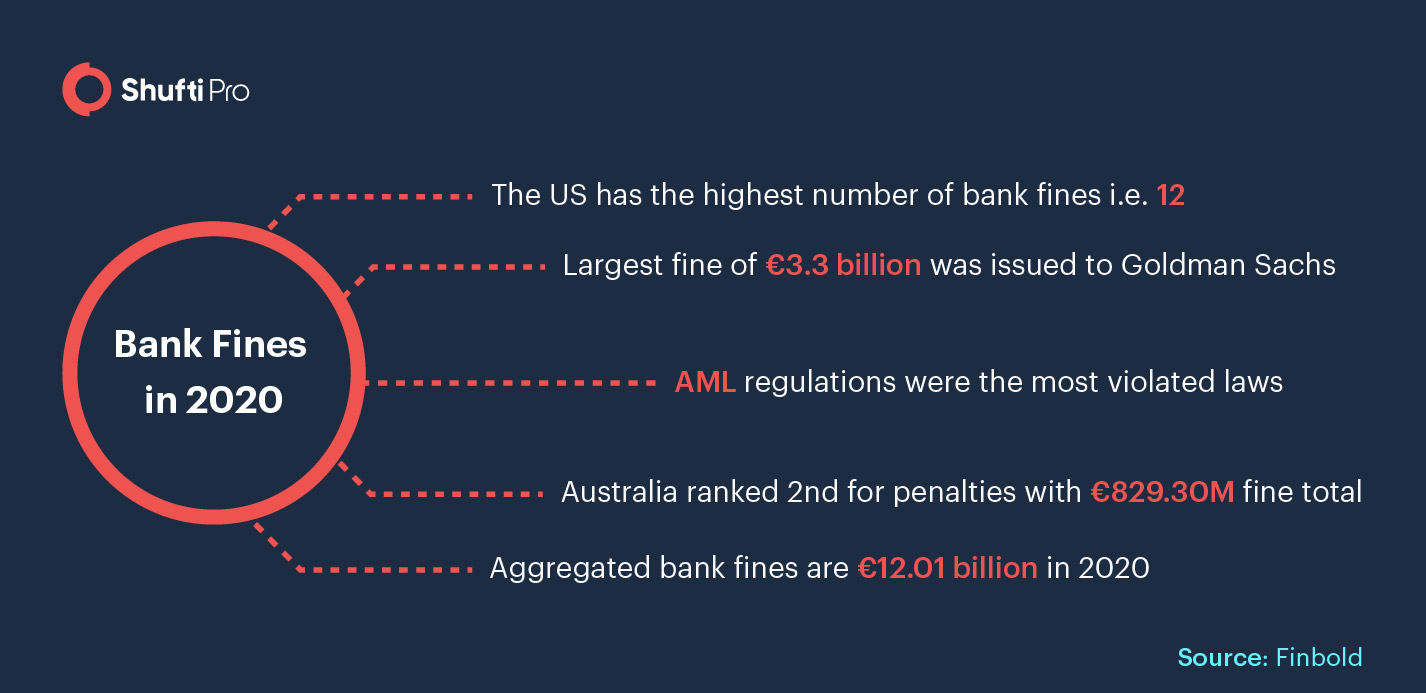

Source: shuftipro.com

Source: shuftipro.com

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Under existing rules the maximum amount of penalties for failing to comply with the regulatory and reporting requirements of covered transactions is. Westpac has agreed to pay the largest fine in Australian corporate history a 13 billion civil penalty for more than 23 million breaches of anti-money laundering laws. Last year the Office of the Comptroller of the Currency levied AML non-compliance fines against eight individuals.

Source: encompasscorporation.com

Maximum penalty increased from 3000 to 70000 imposed on the individual in this case. Maximum penalty increased from 3000 to 70000 imposed on the individual in this case. Last year the Office of the Comptroller of the Currency levied AML non-compliance fines against eight individuals. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to 100000. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

Source: 24newshd.tv

Source: 24newshd.tv

Westpac has agreed to pay the largest fine in Australian corporate history a 13 billion civil penalty for more than 23 million breaches of anti-money laundering laws. Under the BSA penalties may be imposed on each branch or location found to be violation of AML regulations and for each day that the violation occurs. Last year the Office of the Comptroller of the Currency levied AML non-compliance fines against eight individuals. While the AML penalties given in 2018 were approximately 4 billion the AML penalties given in 2019 increased by approximately 2 times to approximately 8 billion. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches.

Source: semanticscholar.org

Source: semanticscholar.org

But what exactly did it do wrong and how does the penalty stack up. And for a non-individual a fine not exceeding S300000. While the AML penalties given in 2018 were approximately 4 billion the AML penalties given in 2019 increased by approximately 2 times to approximately 8 billion. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Department of Justice issued a 185 million civil money penalty against US.

Source: pideeco.be

Source: pideeco.be

Following the US and the UK since 2002 European authorities issue the most anti-money laundering fines. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. But its not just the firms that are penalized for AML non-compliance. 17 What is the statute of limitations for money laundering crimes. Maximum penalty increased from 3000 to 75000.

Source: complyadvantage.com

Source: complyadvantage.com

The maximum penalty under Section 47AA of the CDSA is. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. What are the laws Westpac broke. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. The maximum penalty under Section 47AA of the CDSA is.

Source: researchgate.net

Source: researchgate.net

Under Section 4 of the AMLA any person who commits a money laundering offence and shall on conviction be liable to imprisonment for a term not exceeding 15 years and shall also be liable to a fine of not less than 5 times the sum or value of the proceeds of an unlawful activity or instrumentalities of an offence at the time the offence was committed or five million ringgit whichever is the higher. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Penalty administration charge HMRC introduced a penalty administration charge for all anti-money laundering supervision penalties issued from 25 July 2018. Failure by an employee to report a suspicious activity or transaction. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002.

Source: newsinterpretation.com

Source: newsinterpretation.com

2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. 17 What is the statute of limitations for money laundering crimes. Maximum penalty increased from 3000 to 70000 imposed on the individual in this case. The maximum penalty under Section 47AA of the CDSA is. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to 100000.

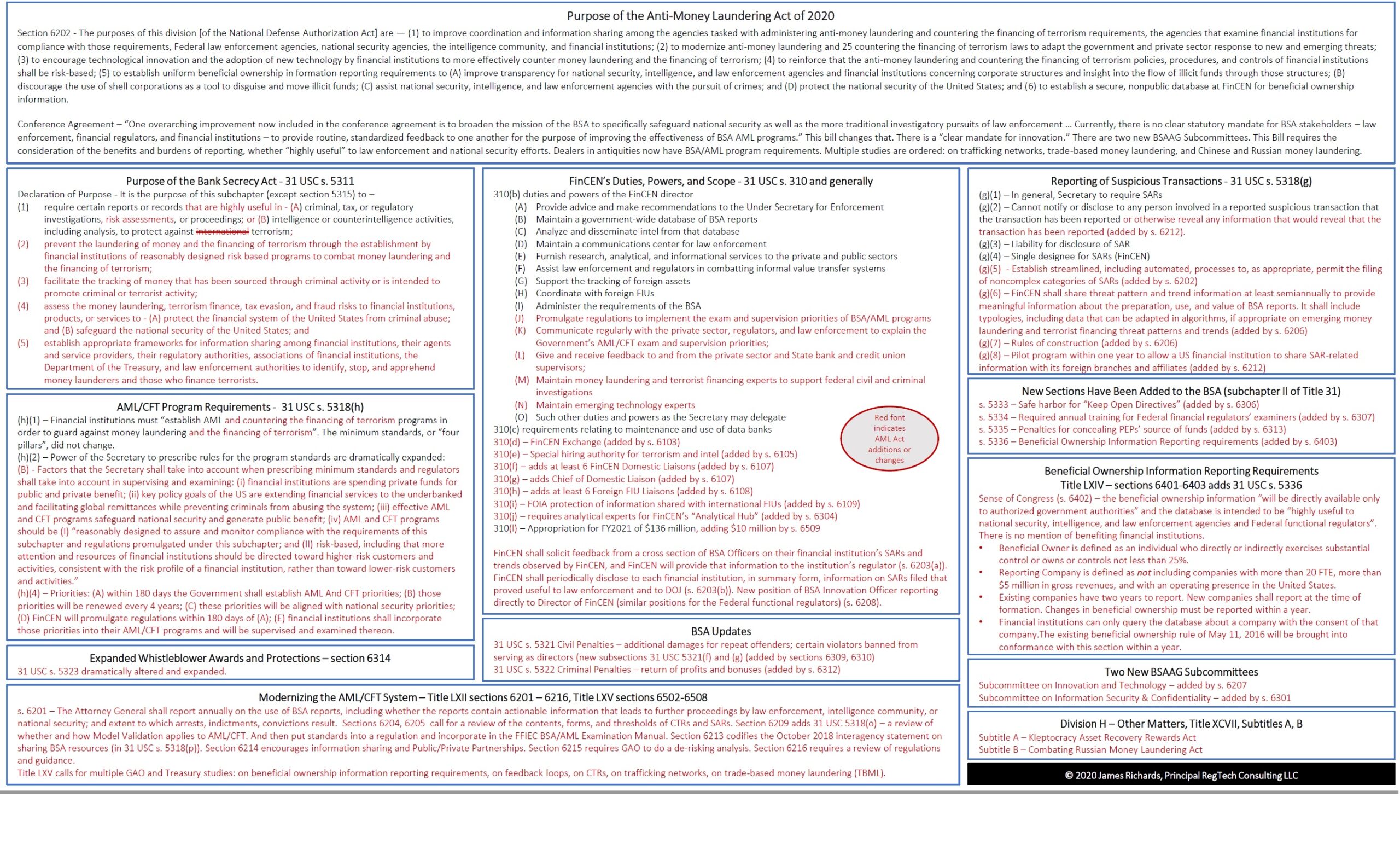

Source: regtechconsulting.net

Source: regtechconsulting.net

2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. The sentence and fine for money laundering depend on the degree of the crime as charged by the prosecutor. Thats the total amount of fines global regulators imposed on financial institutions in 2018 for non-compliance with anti-money laundering regulations. And for a non-individual a fine not exceeding S300000. AUTHORITY TO FREEZE UNDER ANTI-MONEY LAUNDERING ACT The penalty of imprisonment from six 6 months to four 4 years or a fine of not less than One hundred thousand Philippine pesos Php10000000 but not more than Five hundred thousand Philippine pesos Php50000000 or both shall be imposed on a person who knowing that a covered or suspicious.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act fines and penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas