17++ Anti money laundering act questions answers information

Home » about money loundering idea » 17++ Anti money laundering act questions answers informationYour Anti money laundering act questions answers images are available. Anti money laundering act questions answers are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering act questions answers files here. Download all royalty-free photos and vectors.

If you’re looking for anti money laundering act questions answers pictures information connected with to the anti money laundering act questions answers topic, you have pay a visit to the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Anti Money Laundering Act Questions Answers. You can only give one answer to most of the questions however multiple answers are possible in some cases. Suggested answer any three aspects The key aspects of the 2007 Regulations include requiring banks and other financial intermediaries to. It can now be observed that the economy in the leading countries of the world is evolving towards a network society using alternative energy sources and. Identify three key aspects of the UK Money Laundering Regulations 2007.

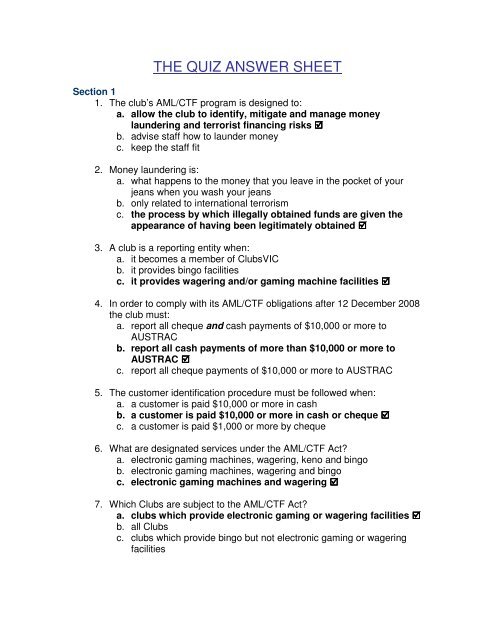

The Quiz Answer Sheet From yumpu.com

The Quiz Answer Sheet From yumpu.com

Money Laundering What two financial statements are usually provided by a business to a financial institution when trying to secure a business loan. It further develops what was established in the 5th Money Laundering Directive 5MLD and in the 4th Anti-Money Laundering Directive 4MLD and was published in the Official Journal of the European Union on 19. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. Answering the banks compliance questions will be much easier when we understand why the bank has to ask them. Under the recently-enacted Anti-Money Laundering Act of 2020 the Secretary of the Treasury is required to issue guidance on the required elements of a keep open request which is forthcoming. There are three stages involved in money laundering.

Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body.

Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations FinCENgov. The 6th Anti-Money Laundering Directive AML6 is Directive 20181673 of the European Union which came into effect on 3 December 2020. FIVE KEY ASPECTS OF UK MONEY LAUNDERING REGULATIONS 2007. Seven key questions answered. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 replace which legislation. Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations FinCENgov.

Source: slideplayer.com

Source: slideplayer.com

Answers to Frequently Asked Questions Regarding Suspicious Activity Reporting and Other Anti-Money Laundering Considerations FinCENgov. The Anti-Money Laundering regulations are governed by 4 Acts. Identify three key aspects of the UK Money Laundering Regulations 2007. The key aspects of the 2007 Regulations include requiring banks and other financial intermediaries to. Seven key questions answered.

Source: researchgate.net

Source: researchgate.net

Balance sheet and income statement. This is stated with the question. Each section consists of several subsections. Questions and Answers. Placement layering and integration.

Source: researchgate.net

Source: researchgate.net

Money Laundering What two financial statements are usually provided by a business to a financial institution when trying to secure a business loan. Anti-Money Laundering Quiz questions Money laundering is the act of failing to disclose money got by criminal means and passing it off as legitimate money. The Anti-Money Laundering regulations are governed by 4 Acts. This is stated with the question. The 6th Anti-Money Laundering Directive AML6 is Directive 20181673 of the European Union which came into effect on 3 December 2020.

Source: researchgate.net

Source: researchgate.net

Answering the banks compliance questions will be much easier when we understand why the bank has to ask them. The Anti-Money Laundering regulations are governed by 4 Acts. According to the United Nations Office on Drugs and Crime UNODC which precursor to money laundering is the most lucrative form of business for criminals. Anti-Money Laundering Quiz questions Money laundering is the act of failing to disclose money got by criminal means and passing it off as legitimate money. New rules relating to anti-money laundering law now apply in the UK.

Source: pdfprof.com

Source: pdfprof.com

The Anti-Money Laundering regulations are governed by 4 Acts. Answering the banks compliance questions will be much easier when we understand why the bank has to ask them. There are many controls measures and processes for preventing and mitigating against money laundering and those taking the assessment may refer to your own firms measures which may be in addition to the above answers. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. According to the United Nations Office on Drugs and Crime UNODC which precursor to money laundering is the most lucrative form of business for criminals.

Source: in.pinterest.com

Source: in.pinterest.com

The key aspects of the 2007 Regulations include requiring banks and other financial intermediaries to. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. Identify three key aspects of the UK Money Laundering Regulations 2007. Appendix A - Anti-Money Laundering Questionnaire Each National Futures Association NFA futures commission merchant FCM and introducing broker IB Member firm must adopt a written anti-money laundering AML program tailored to its operations. See 6306 of the Anti-Money Laundering Act of 2020 Pub.

Source: slideshare.net

Source: slideshare.net

FIVE KEY ASPECTS OF UK MONEY LAUNDERING REGULATIONS 2007. Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body. There are many controls measures and processes for preventing and mitigating against money laundering and those taking the assessment may refer to your own firms measures which may be in addition to the above answers. Anti-Money Laundering Quiz questions Money laundering is the act of failing to disclose money got by criminal means and passing it off as legitimate money. Questions and Answers.

Appendix A - Anti-Money Laundering Questionnaire Each National Futures Association NFA futures commission merchant FCM and introducing broker IB Member firm must adopt a written anti-money laundering AML program tailored to its operations. This is stated with the question. The purpose of this document is to promote common supervisory approaches and practices in the application of anti-money laundering rules to. All official European Union website addresses are in the europaeu domain. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 replace which legislation.

Source: researchgate.net

Source: researchgate.net

Placement layering and integration. New rules relating to anti-money laundering law now apply in the UK. Each section consists of several subsections. FIVE KEY ASPECTS OF UK MONEY LAUNDERING REGULATIONS 2007. Questions and Answers.

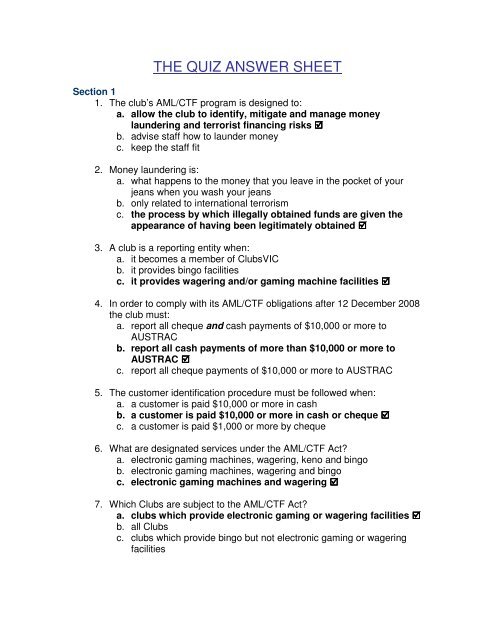

Source: yumpu.com

Source: yumpu.com

The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. Appendix A - Anti-Money Laundering Questionnaire Each National Futures Association NFA futures commission merchant FCM and introducing broker IB Member firm must adopt a written anti-money laundering AML program tailored to its operations. It further develops what was established in the 5th Money Laundering Directive 5MLD and in the 4th Anti-Money Laundering Directive 4MLD and was published in the Official Journal of the European Union on 19. FIVE KEY ASPECTS OF UK MONEY LAUNDERING REGULATIONS 2007. According to the United Nations Office on Drugs and Crime UNODC which precursor to money laundering is the most lucrative form of business for criminals.

Source: slideshare.net

Source: slideshare.net

Suggested answer any three aspects The key aspects of the 2007 Regulations include requiring banks and other financial intermediaries to. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. Identify three key aspects of the UK Money Laundering Regulations 2007. At a recent seminar organised by the Responsible Art Market Initiative RAM a panel of experts answered questions from the floor about the new law. The 6th Anti-Money Laundering Directive AML6 is Directive 20181673 of the European Union which came into effect on 3 December 2020.

Source: researchgate.net

Source: researchgate.net

Have a risk assessment in place in respect of money laundering. Have a risk assessment in place in respect of money laundering. A subsection consists of questions relating to the same subject. There are many controls measures and processes for preventing and mitigating against money laundering and those taking the assessment may refer to your own firms measures which may be in addition to the above answers. You can only give one answer to most of the questions however multiple answers are possible in some cases.

Source: slideserve.com

Source: slideserve.com

It can now be observed that the economy in the leading countries of the world is evolving towards a network society using alternative energy sources and. Balance sheet and income statement. It further develops what was established in the 5th Money Laundering Directive 5MLD and in the 4th Anti-Money Laundering Directive 4MLD and was published in the Official Journal of the European Union on 19. The Anti-Money Laundering regulations are governed by 4 Acts. This is stated with the question.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering act questions answers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information