10+ Anti money laundering act rbi ideas

Home » about money loundering Info » 10+ Anti money laundering act rbi ideasYour Anti money laundering act rbi images are available in this site. Anti money laundering act rbi are a topic that is being searched for and liked by netizens now. You can Get the Anti money laundering act rbi files here. Find and Download all free images.

If you’re searching for anti money laundering act rbi images information linked to the anti money laundering act rbi keyword, you have visit the ideal site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

Anti Money Laundering Act Rbi. As part of that supervisory role the RBI works to combat financial crime with a focus on anti-money laundering in India and on countering the financing of terrorism. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. Anti money laundering 1. The policy was to lay down the systems and procedures to help control.

Anti Money Laundering Aml Acuity It Solutions From acuityitsol.com

Anti Money Laundering Aml Acuity It Solutions From acuityitsol.com

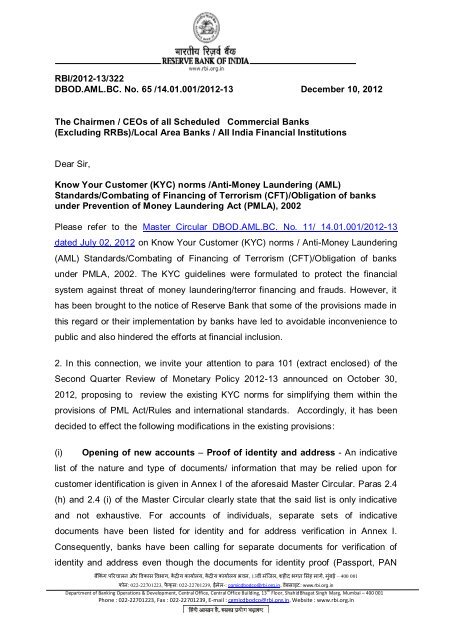

Directly or indirectly attempted to. Master Circular on Know Your Customer KYC NormsAnti-Money Laundering AML MeasuresCombating of Financing of Terrorism CFT Obligations of banks under Prevention of Money Laundering Act PMLA 2002. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. Anti money laundering 1. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. The policy was to lay down the systems and procedures to help control.

The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board.

Framework for Anti Money Laundering Compliance in India. The RBI and Government of India GOI have brought out the Prevention of Money Laundering Act 2002 PMLA. Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain. The policy was to lay down the systems and procedures to help control. The Petitioners sought quashing of provisional attachment impugned original. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act.

Source: studylib.net

Source: studylib.net

Money laundering has been defined in the Prevention of Money Laundering Act of 2002 PMLA under section 3 where a person shall be guilty of the offence if such person is found to have. Ii These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and Verification and Maintenance of Records of the Identity of the Clients of the Banking Companies Financial Institutions. The RBI and Government of India GOI have brought out the Prevention of Money Laundering Act 2002 PMLA. In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing. This Know Your Customer and Anti -Money Laundering P.

As part of that supervisory role the RBI works to combat financial crime with a focus on anti-money laundering in India and on countering the financing of terrorism. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and Verification and. No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism. In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature.

Source: slidetodoc.com

Source: slidetodoc.com

Directly or indirectly attempted to. Framework for Anti Money Laundering Compliance in India. No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism. In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing. Ii These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and Verification and Maintenance of Records of the Identity of the Clients of the Banking Companies Financial Institutions.

Source: acuityitsol.com

Source: acuityitsol.com

No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism. Anti-money laundering refers to the laws rules and procedures purported to forestall criminals from disguising illicitly obtained funds as legitimate gain. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. The Reserve Bank of India is managed by a central board of directors appointed to four-year terms and.

Source: pinterest.com

Source: pinterest.com

KYC procedures also enable banks to knowunderstand their customers and their financial dealings better which in turn help. The Reserve Bank of India is managed by a central board of directors appointed to four-year terms and. The policy was to lay down the systems and procedures to help control. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 7 of Prevention of Money-Laundering Maintenance of Records Rules 2005.

Source: present5.com

Source: present5.com

In this case a writ petition had been filed before the Delhi High Court Court challenging the provisions of Section 51 55 83 85 and 86 of the Prevention of Money Laundering Act 2002 Act. Offence of Money Laundering. Any contravention thereof or non-compliance shall attract penalties under Banking Regulation Act. The Prevention of Money Laundering Act PMLA 2002 is an Act of the Parliament of India enacted in January 2003. Regulation Act 1949 and the Banking Regulation Act AACS 1949 read with Section 56 of the Act and Rule 914 of Prevention of Money.

Source: authorstream.com

Source: authorstream.com

Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. This Know Your Customer and Anti -Money Laundering P. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. Money Laundering is the process by which illegal funds. The Reserve Bank of India is managed by a central board of directors appointed to four-year terms and.

Source: yumpu.com

Source: yumpu.com

Framework for Anti Money Laundering Compliance in India. The objectiveof KYC guidelines is to prevent banks from being used intentionally or unintentionally by criminal elements for money laundering activities. The Reserve Bank of India RBI has issued a number of circulars and guidelines to ensure that proper Know Your Customer KYC norms are foll owed by NBFCs and that adequate checks and measures are in place to prevent money laundering. Framework for Anti Money Laundering Compliance in India. In India the Reserve Bank of India RBI provides guidance on anti-money laundering provisions and the combating of terrorist financing.

Source: slidetodoc.com

Source: slidetodoc.com

And Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and. The Reserve Bank of India RBI had advised all the NBFCs to ensure that a proper policy framework on Know Your Customer and Anti Money Laundering measures is formulated and put in place with approval of the Board. RBI advised the banks to follow certain customer identification procedure for opening of accounts and monitoring transactions of a suspicious nature. RBI2014-15122 DNBSPDCCNo 4000310422014-15 July 14 2014 All Non-Banking Financial Companies Dear Sirs Know Your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism CFT Obligation of NBFCs under. The Petitioners sought quashing of provisional attachment impugned original.

Source: academia.edu

Source: academia.edu

Money Laundering is the process by which illegal funds. This Know Your Customer and Anti -Money Laundering P. These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 7 of Prevention of Money-Laundering Maintenance of Records Rules 2005. Money laundering has been defined in the Prevention of Money Laundering Act of 2002 PMLA under section 3 where a person shall be guilty of the offence if such person is found to have. The Reserve Bank of India is managed by a central board of directors appointed to four-year terms and.

Source: present5.com

Source: present5.com

These guidelines are issued under Section 35A of the Banking Regulation Act 1949 and Rule 9 14 of Prevention of Money-Laundering Maintenance of Records Rules 2005. The Reserve Bank of India is managed by a central board of directors appointed to four-year terms and. Framework for Anti Money Laundering Compliance in India. Regulation Act 1949 and the Banking Regulation Act AACS 1949 read with Section 56 of the Act and Rule 914 of Prevention of Money. Illegal Legal Dirty Conversion whiteMoney MoneyDefinition.

Source: present5.com

Source: present5.com

Regulation Act 1949 and the Banking Regulation Act AACS 1949 read with Section 56 of the Act and Rule 914 of Prevention of Money. The policy was to lay down the systems and procedures to help control. Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the. These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act and Rule 7 of Prevention of Money-Laundering Maintenance of Records of the Nature and Value of Transactions the Procedure and Manner of Maintaining and Time for Furnishing Information and Verification and. Ii These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Ii These guidelines are issued under Sections 45K and 45L of the RBI Act 1934 and any contravention of the same or non-compliance will attract penalties under the relevant provisions of the Act. Directly or indirectly attempted to. No32 09390002007-08 February 25 2008 The Chief Executive Officers All Primary Urban Co-operative Banks Dear Sir Know your Customer KYC Norms Anti-Money Laundering AML Standards Combating of Financing of Terrorism. Money laundering is present in all jurisdictions. Ibid -Laundering Maintenance of Records Rules 2005 the Reserve Bank of India being satisfied that it is necessary and expedient in the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act rbi by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas