15+ Anti money laundering act record keeping requirements ideas in 2021

Home » about money loundering Info » 15+ Anti money laundering act record keeping requirements ideas in 2021Your Anti money laundering act record keeping requirements images are available. Anti money laundering act record keeping requirements are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering act record keeping requirements files here. Get all free photos and vectors.

If you’re looking for anti money laundering act record keeping requirements images information connected with to the anti money laundering act record keeping requirements keyword, you have visit the right blog. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

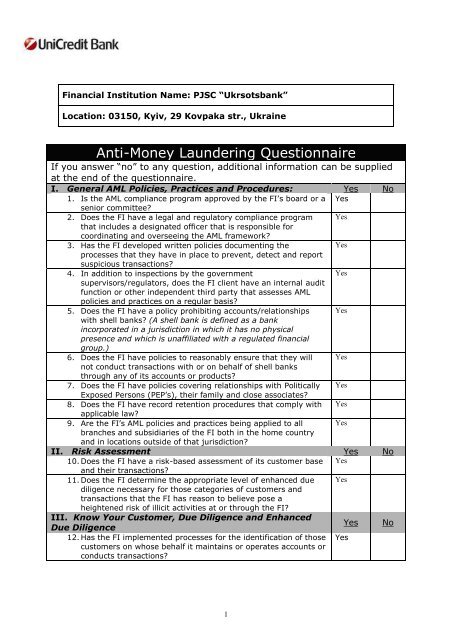

Anti Money Laundering Act Record Keeping Requirements. What is an AML Compliance Program required to have. In general the BSA requires that a bank maintain most records for at least five years. The principal Act is amended to include record-keeping where an accountable person shall establish and maintain all necessary books and records relating to. You need to keep a record of all customer due diligence measures that you carry out including.

Pdf International Anti Money Laundering Programs From researchgate.net

Pdf International Anti Money Laundering Programs From researchgate.net

Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. In compliance with the BSA firms must maintain detailed records on their customers and submit reports to the BSA when their customers engage in certain transactions or financial activities. Amongst these responsibilities is the submission of suspicious activity reports SARs for transactions over 5000 or for transactions that are suspected to be in violation of the BSA. An index of anti-money laundering laws since 1970 with their respective requirements and goals are listed below in chronological order. Rule 17a-8 under the Securities Exchange Act of 1934 Exchange Act requires broker-dealers to comply with the reporting recordkeeping and record retention rules adopted under the. Under the FIAMLA and the UN Sanctions Act and any regulations or guidelines made.

In compiling this Guide and the input of the Law Councils Anti-Money Laundering.

Bank Secrecy Act 1970 Established requirements for recordkeeping and reporting by private individuals banks and other financial institutions. Of the Financial Intelligence and Anti-Money Laundering Act 2002 sections 64B and 100 of the Banking Act 2004 section 502 of. What is an AML Compliance Program required to have. Under the FIAMLA and the UN Sanctions Act and any regulations or guidelines made. In general the BSA requires that a bank maintain most records for at least five years. An index of anti-money laundering laws since 1970 with their respective requirements and goals are listed below in chronological order.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Section 7 GwG Money laundering officer Section 8 GwG Record-keeping and retention requirement Section 9 GwG Group-wide requirements Part 3 Customer due diligence requirements Section 10 GwG General due diligence requirements Section 11 GwG Identification Section 11a GwG Processing of personal data by obliged entities. Record the date the staff who were in attendance and at least bullet points on the topics of discussion. Members are also governed by the anti-money laundering rule in FINRA. When we published the first edition of the Guide our intent was to provide clear and concise answers to basic questions that surfaced in our discussions with clients attorneys regulators and others both in the United States and other jurisdictions. In compliance with the BSA firms must maintain detailed records on their customers and submit reports to the BSA when their customers engage in certain transactions or financial activities.

Source: researchgate.net

Source: researchgate.net

Record the date the staff who were in attendance and at least bullet points on the topics of discussion. Data collected and information gathered in the fulfilment of its due diligence requirements. And any enquiries relating to money laundering. Rule 17a-8 under the Securities Exchange Act of 1934 Exchange Act requires broker-dealers to comply with the reporting recordkeeping and record retention rules adopted under the. Regulations 2014Cth and Anti-Money Laundering and Counter-Terrorism Financing Rules Instrument 2007 No1 together with other legislation are.

Source: yumpu.com

Source: yumpu.com

Data collected and information gathered in the fulfilment of its due diligence requirements. The Bank Secrecy Act among other things requires financial institutions including broker-dealers to develop and implement AML compliance programs. Chapter 10 Record-keeping Chapter 11 Staff training. Section 7 GwG Money laundering officer Section 8 GwG Record-keeping and retention requirement Section 9 GwG Group-wide requirements Part 3 Customer due diligence requirements Section 10 GwG General due diligence requirements Section 11 GwG Identification Section 11a GwG Processing of personal data by obliged entities. The identity of a person obtained per customer due to diligence measures to all transactions both domestic and international carried out by it and correspondence relating to the transactions all reports made to the Authority under this Act.

Source: researchgate.net

Source: researchgate.net

These Regulations have however been amended by the Financial Intelligence and Anti-Money Laundering Amendment Regulations 2005 GN. Rule 17a-8 under the Securities Exchange Act of 1934 Exchange Act requires broker-dealers to comply with the reporting recordkeeping and record retention rules adopted under the. Subjects digital currency providers to Australias anti -money laundering and counter-terrorism regulations. Amongst these responsibilities is the submission of suspicious activity reports SARs for transactions over 5000 or for transactions that are suspected to be in violation of the BSA. The BSA establishes recordkeeping requirements related to various types of records including.

Source: complyadvantage.com

Source: complyadvantage.com

Record keeping and transactions. These Regulations have however been amended by the Financial Intelligence and Anti-Money Laundering Amendment Regulations 2005 GN. Amongst these responsibilities is the submission of suspicious activity reports SARs for transactions over 5000 or for transactions that are suspected to be in violation of the BSA. The AMLCTF Amendment Act. Bank Secrecy Act 1970 Established requirements for recordkeeping and reporting by private individuals banks and other financial institutions.

Source: researchgate.net

Source: researchgate.net

For further information on Anti-Money Laundering requirements please visit the FINRA Anti-Money Laundering AML page. An index of anti-money laundering laws since 1970 with their respective requirements and goals are listed below in chronological order. Section 7 GwG Money laundering officer Section 8 GwG Record-keeping and retention requirement Section 9 GwG Group-wide requirements Part 3 Customer due diligence requirements Section 10 GwG General due diligence requirements Section 11 GwG Identification Section 11a GwG Processing of personal data by obliged entities. The principal Act is amended to include record-keeping where an accountable person shall establish and maintain all necessary books and records relating to. Members are also governed by the anti-money laundering rule in FINRA.

Source: yumpu.com

Source: yumpu.com

The identity of a person obtained per customer due to diligence measures to all transactions both domestic and international carried out by it and correspondence relating to the transactions all reports made to the Authority under this Act. What is an AML Compliance Program required to have. For further information on Anti-Money Laundering requirements please visit the FINRA Anti-Money Laundering AML page. Including any accompanying documentation. The AMLCTF Amendment Act.

Source: regtechconsulting.net

Source: regtechconsulting.net

Section 7 GwG Money laundering officer Section 8 GwG Record-keeping and retention requirement Section 9 GwG Group-wide requirements Part 3 Customer due diligence requirements Section 10 GwG General due diligence requirements Section 11 GwG Identification Section 11a GwG Processing of personal data by obliged entities. Act 2017 AMLCTF Amendment Act. The BSA establishes recordkeeping requirements related to various types of records including. In general the BSA requires that a bank maintain most records for at least five years. For further information on Anti-Money Laundering requirements please visit the FINRA Anti-Money Laundering AML page.

Source: branddocs.com

Source: branddocs.com

Section 7 GwG Money laundering officer Section 8 GwG Record-keeping and retention requirement Section 9 GwG Group-wide requirements Part 3 Customer due diligence requirements Section 10 GwG General due diligence requirements Section 11 GwG Identification Section 11a GwG Processing of personal data by obliged entities. Subjects digital currency providers to Australias anti -money laundering and counter-terrorism regulations. Intelligence and Anti-Money Laundering Act 2002 to provide among other things for verification of identity and record keeping. Act 2017 AMLCTF Amendment Act. Record keeping and transactions.

Source: complyadvantage.com

Source: complyadvantage.com

To meet the criteria of record keeping it is recommended you consider the following Should a meeting between staff be held where AML CFT compliance is discussed ensure there is some type of written record of these discussions. Record the date the staff who were in attendance and at least bullet points on the topics of discussion. Members are also governed by the anti-money laundering rule in FINRA. Section 8 GwG Record-keeping and retention requirement 1 1The obliged entity is required to record and retain. The AMLCTF Amendment Act.

Source: branddocs.com

Source: branddocs.com

Or b a record copy or extract. The identity of a person obtained per customer due to diligence measures to all transactions both domestic and international carried out by it and correspondence relating to the transactions all reports made to the Authority under this Act. Regulations 2014Cth and Anti-Money Laundering and Counter-Terrorism Financing Rules Instrument 2007 No1 together with other legislation are. In compliance with the BSA firms must maintain detailed records on their customers and submit reports to the BSA when their customers engage in certain transactions or financial activities. Or b a record copy or extract.

Intelligence and Anti-Money Laundering Act 2002 to provide among other things for verification of identity and record keeping. Rule 17a-8 under the Securities Exchange Act of 1934 Exchange Act requires broker-dealers to comply with the reporting recordkeeping and record retention rules adopted under the. In general the BSA requires that a bank maintain most records for at least five years. Data collected and information gathered in the fulfilment of its due diligence requirements. An index of anti-money laundering laws since 1970 with their respective requirements and goals are listed below in chronological order.

Source: docplayer.net

Source: docplayer.net

What is an AML Compliance Program required to have. Data collected and information gathered in the fulfilment of its due diligence requirements. Of the Financial Intelligence and Anti-Money Laundering Act 2002 sections 64B and 100 of the Banking Act 2004 section 502 of. Increases the powers and functions of the Australian Transaction Reports and Analysis Centres AUSTRAC CEO. In compliance with the BSA firms must maintain detailed records on their customers and submit reports to the BSA when their customers engage in certain transactions or financial activities.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act record keeping requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas