15+ Anti money laundering act suspicious transactions info

Home » about money loundering Info » 15+ Anti money laundering act suspicious transactions infoYour Anti money laundering act suspicious transactions images are available. Anti money laundering act suspicious transactions are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering act suspicious transactions files here. Find and Download all royalty-free images.

If you’re searching for anti money laundering act suspicious transactions images information connected with to the anti money laundering act suspicious transactions topic, you have come to the right site. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Anti Money Laundering Act Suspicious Transactions. 40 of 2000 applies and to amend or revoke such guidelines from time. A the knowledge intention opinion suspicion belief or purpose of the person. STRs play an important part in the financial intelligence system that provides information when funds are being abused for illegitimate ends. Designated persons are obliged to make suspicious transactions reports STRs to both the Financial Intelligence Unit FIU and Revenue if they know suspect or have grounds to suspect that a client has been or is engaged in money laundering or terrorist financing.

Episode 1 The Suspicious Transaction Report Youtube From youtube.com

Episode 1 The Suspicious Transaction Report Youtube From youtube.com

It was originally created as an appendix to the IAIS Guidance paper on anti-money laundering and combating the financing of terrorism October 2004 and is updated. The transaction is in a way related to an unlawful activity or offense under the Anti-Money Laundering Act that is about to be is being or has been committed. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual. The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. Financial Intelligence Unit Act 2000 Act No. 39 of 2000 to issue suspicious transactions and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No.

Designated persons are obliged to make suspicious transactions reports STRs to both the Financial Intelligence Unit FIU and Revenue if they know suspect or have grounds to suspect that a client has been or is engaged in money laundering or terrorist financing.

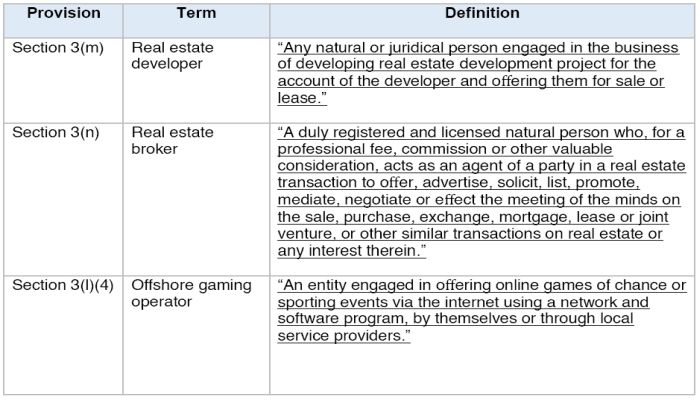

Anti-Money Laundering Bulletin on Suspicious Transaction Reporting November 2017 Anti-Money Laundering and Countering the Finance of Terrorism Correspondence with Industry. The requirement to report suspicious transactions is contained in section 42 of the Criminal Justice Money Laundering and Terrorist Financing Act 2010 CJA 2010 which states that A designated person who knows suspects or has reasonable grounds to suspect on the basis of information obtained in the course of carrying on business as a. State of mind of a person includes. Suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation. Standard antimoney laundering and counterterrorism financing program has the meaning given by subsection 84 1. 39 of 2000 to issue suspicious transactions and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No.

Source: aml-cft.net

Source: aml-cft.net

Suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation. There is no underlying legal or trade obligation purpose or economic justification of the transaction. The requirement to report suspicious transactions is contained in section 42 of the Criminal Justice Money Laundering and Terrorist Financing Act 2010 CJA 2010 which states that A designated person who knows suspects or has reasonable grounds to suspect on the basis of information obtained in the course of carrying on business as a. STRs play an important part in the financial intelligence system that provides information when funds are being abused for illegitimate ends. Standard antimoney laundering and counterterrorism financing program has the meaning given by subsection 84 1.

Source: amlcft.bnm.gov.my

Source: amlcft.bnm.gov.my

Alburo Alburo and Associates Law Offices specializes in business law and labor law. The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. Suspicious transaction and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No. Auditors must make these reports as well if they come across suspicious transactions in the course of an audit. A the knowledge intention opinion suspicion belief or purpose of the person.

Source: issuu.com

Source: issuu.com

The requirement to report suspicious transactions is contained in section 42 of the Criminal Justice Money Laundering and Terrorist Financing Act 2010 CJA 2010 which states that A designated person who knows suspects or has reasonable grounds to suspect on the basis of information obtained in the course of carrying on business as a. The requirement to report suspicious transactions is contained in section 42 of the Criminal Justice Money Laundering and Terrorist Financing Act 2010 CJA 2010 which states that A designated person who knows suspects or has reasonable grounds to suspect on the basis of information obtained in the course of carrying on business as a. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual. Reporting institutions are provided with an effective method to detect suspicious transactions more commonly known as the internal red flag criteria under the Standard Guidelines on on Anti-Money Laundering and Counter Financing of Terrorism 13 Standard Guidelines issued by the Central Bank of Malaysia. Alburo Alburo and Associates Law Offices specializes in business law and labor law.

Source: acamstoday.org

Source: acamstoday.org

39 of 2000 to issue suspicious transactions and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No. Financial Intelligence Unit Act 2000 Act No. The transaction is in a way related to an unlawful activity or offense under the Anti-Money Laundering Act that is about to be is being or has been committed. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance. The requirement to report suspicious transactions is contained in section 42 of the Criminal Justice Money Laundering and Terrorist Financing Act 2010 CJA 2010 which states that A designated person who knows suspects or has reasonable grounds to suspect on the basis of information obtained in the course of carrying on business as a.

Source: dreamstime.com

Source: dreamstime.com

Designated persons are obliged to make suspicious transactions reports STRs to both the Financial Intelligence Unit FIU and Revenue if they know suspect or have grounds to suspect that a client has been or is engaged in money laundering or terrorist financing. 40 of 2000 applies and to amend or revoke such guidelines from time. As part of its anti-money laundering initiatives the Financial Transactions Reporting Act mandates that banks report suspected money-laundering activities and other suspicious transactions to the Financial Intelligence Unit. A the knowledge intention opinion suspicion belief or purpose of the person. Anti-Money Laundering Bulletin on Suspicious Transaction Reporting November 2017 Anti-Money Laundering and Countering the Finance of Terrorism Correspondence with Industry.

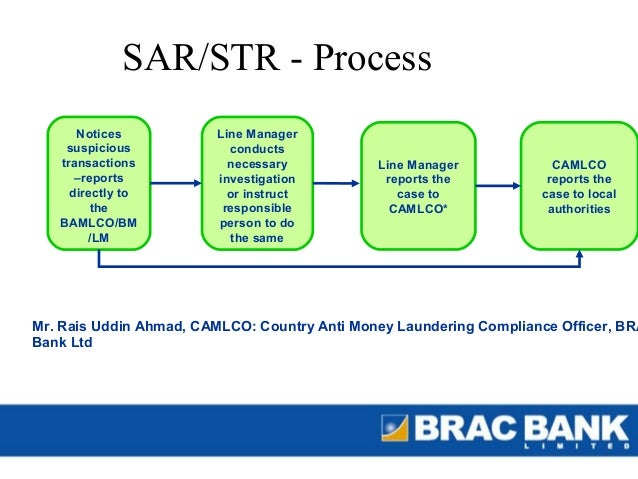

Source: slideshare.net

Source: slideshare.net

Auditors must make these reports as well if they come across suspicious transactions in the course of an audit. Suspicious transactions and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No. STRs play an important part in the financial intelligence system that provides information when funds are being abused for illegitimate ends. Anti-Money Laundering Bulletin on Suspicious Transaction Reporting November 2017 Anti-Money Laundering and Countering the Finance of Terrorism Correspondence with Industry. 40 of 2000 applies and to amend or revoke such guidelines from time.

Source: youtube.com

Source: youtube.com

39 of 2000 to issue suspicious transactions and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No. Or any transactions that is similar or analogous to any of the foregoing. The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. 40 of 2000 applies and to amend or revoke such guidelines from time to time. STRs play an important part in the financial intelligence system that provides information when funds are being abused for illegitimate ends.

Source: aml-cft.net

Source: aml-cft.net

Anti-Money Laundering Bulletin on Suspicious Transaction Reporting November 2017 Anti-Money Laundering and Countering the Finance of Terrorism Correspondence with Industry. Examples of money laundering and suspicious transactions involving insurance This document contains examples of money laundering and suspicious transactions involving insurance. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual. Designated persons are obliged to make suspicious transactions reports STRs to both the Financial Intelligence Unit FIU and Revenue if they know suspect or have grounds to suspect that a client has been or is engaged in money laundering or terrorist financing. 40 of 2000 applies and to amend or revoke such guidelines from time.

Source: mondaq.com

Source: mondaq.com

Suspicious transaction and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No. A the knowledge intention opinion suspicion belief or purpose of the person. The value of the STR depends on the quality of information it contains. Or any transactions that is similar or analogous to any of the foregoing. It was originally created as an appendix to the IAIS Guidance paper on anti-money laundering and combating the financing of terrorism October 2004 and is updated.

The list is non exhaustive and only provides examples of ways in which money may be laundered through the capital market. 40 of 2000 applies and to amend or revoke such guidelines from time. Auditors must make these reports as well if they come across suspicious transactions in the course of an audit. The transaction is in a way related to an unlawful activity or offense under the Anti-Money Laundering Act that is about to be is being or has been committed. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual.

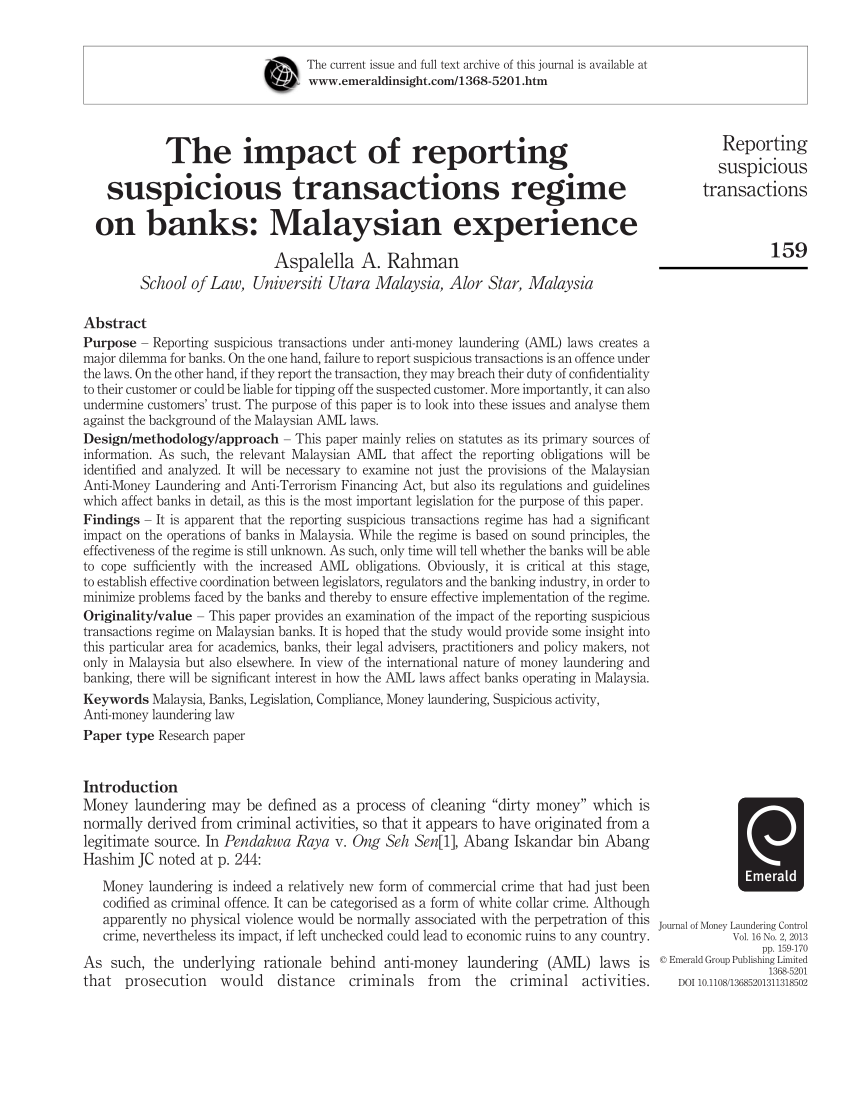

Source: researchgate.net

Source: researchgate.net

STRs play an important part in the financial intelligence system that provides information when funds are being abused for illegitimate ends. The transaction is in a way related to an unlawful activity or offense under the Anti-Money Laundering Act that is about to be is being or has been committed. 40 of 2000 applies and to amend or revoke such guidelines from time. Reporting institutions are provided with an effective method to detect suspicious transactions more commonly known as the internal red flag criteria under the Standard Guidelines on on Anti-Money Laundering and Counter Financing of Terrorism 13 Standard Guidelines issued by the Central Bank of Malaysia. 40 of 2000 applies and to amend or revoke such guidelines from time to time.

Source: bi.go.id

Source: bi.go.id

State of mind of a person includes. 40 of 2000 applies and to amend or revoke such guidelines from time. We are responsible for submitting Large Cash Transaction Reports Casino Disbursement Reports and Suspicious Transaction Reports to the Financial Transaction and Reports Analysis Centre of Canada FINTRAC. Examples of suspicious transactions are listed below. These reports are important in assisting FINTRAC with the detection prevention and deterrence of money laundering.

Source: researchgate.net

Source: researchgate.net

STRs play an important part in the financial intelligence system that provides information when funds are being abused for illegitimate ends. Suspicious transactions to the Anti-Money Laundering Council AMLC 1 real estate developers and brokers and 2 offshore gaming operators as well as their service providers supervised accredited or regulated by the Philippine Amusement and Gaming Corporation. 39 of 2000 to issue suspicious transactions and anti-money laundering guidelines from time to time in respect of each category of financial institution to which the Financial Transactions Reporting Act 2000 Act No. These reports are important in assisting FINTRAC with the detection prevention and deterrence of money laundering. Buying and selling of a security with no discernible purpose or in circumstances which appear unusual.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering act suspicious transactions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas