15++ Anti money laundering act uk ideas

Home » about money loundering Info » 15++ Anti money laundering act uk ideasYour Anti money laundering act uk images are ready. Anti money laundering act uk are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering act uk files here. Get all royalty-free vectors.

If you’re looking for anti money laundering act uk images information connected with to the anti money laundering act uk interest, you have pay a visit to the ideal site. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

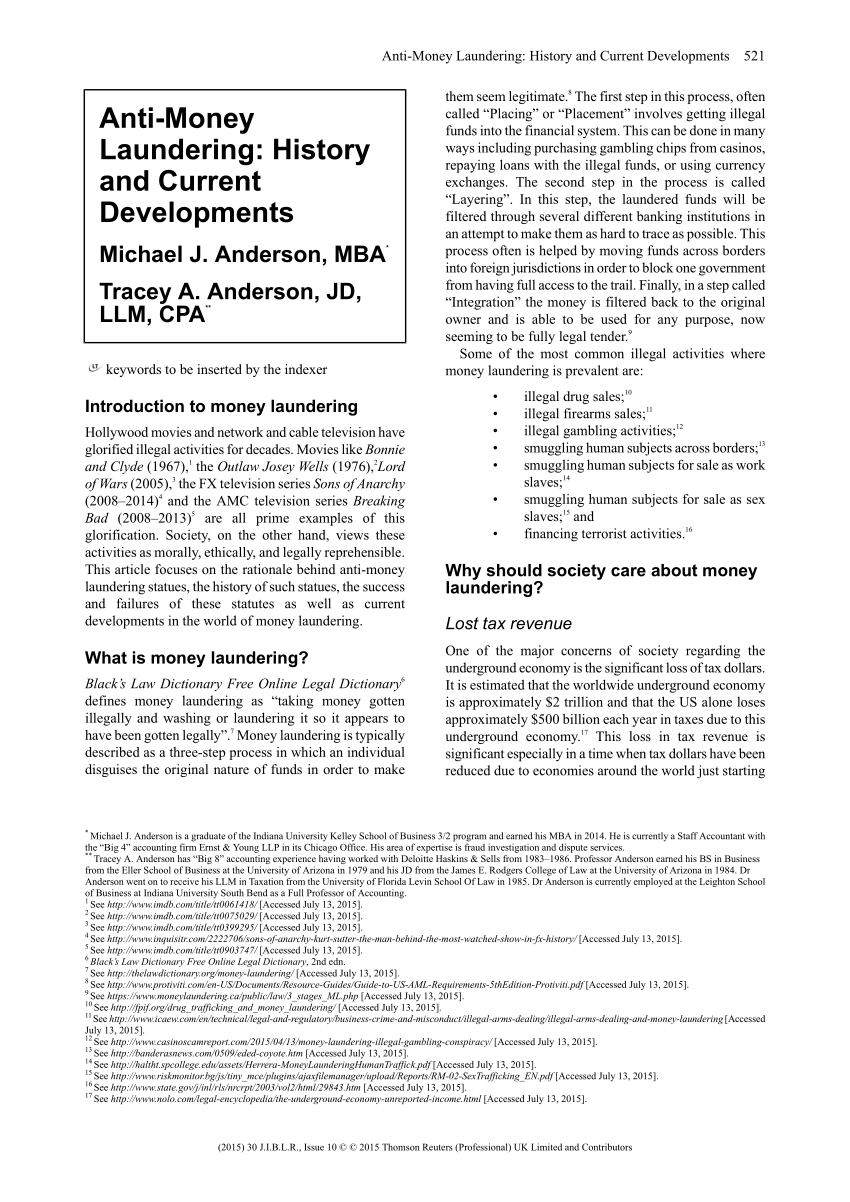

Anti Money Laundering Act Uk. The Fifth Anti Money Laundering Directive 5AMLD for the UK The Fifth Anti Money Laundering Directive 5AMLD entered into force on 10 January 2020 for the EU Member States. With our global AI powered solution verify user ID Passports drivings licenses instantly. This page highlights some specific new areas that firms need to comply with. 26 rows Anti-money laundering registration If you run a business in the financial sector you may need to register with an anti-money laundering scheme.

Https Intranet Royalholloway Ac Uk Iquad Collegepolicies Documents Pdf Fraud Bribery Donationsgifts Anti Money Laundering Policy 2019 Pdf From

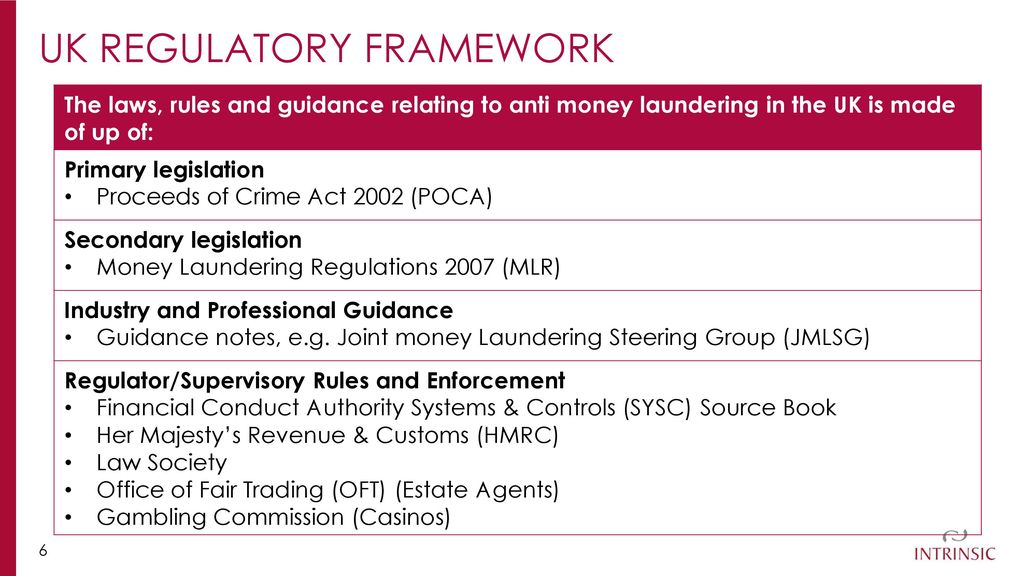

UK law and guidance The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 POCA as amended by the Serious Organised Crime and Police Act 2005 SOCPA the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 and the Terrorism Act 2000 TA 2000 as amended by the Anti. This page highlights some specific new areas that firms need to comply with. Anti money laundering act england. With its own Sanctions and Anti-Money Laundering Act the Sanctions Act and related statutory instruments SI in effect there have been changes that organisations need to keep a check on. Senior Courts Act 1981 c. Its aim is to provide a legal framework to allow the UK to impose sanctions and implement its own sanctions regime once the UK leaves the EU on 29 March 2019.

The Fifth Anti Money Laundering Directive 5AMLD for the UK The Fifth Anti Money Laundering Directive 5AMLD entered into force on 10 January 2020 for the EU Member States.

Part 1 Definitions and obliged entities. Its aim is to provide a legal framework to allow the UK to impose sanctions and implement its own sanctions regime once the UK leaves the EU on 29 March 2019. It hopes that the 2019 Regulations will help the art world to clarify and demystify the muddy waters which have traditionally surrounded many of its transactions. Money laundering is defined in s 340 11 of the POCA as an act which constitutes an offence under ss 327328 or 329 or an attempt conspiracy or incitement to commit any of those offences or aiding abetting counselling or procuring their commission. AMPs must take immediate steps to implement the 2019 Regulations and carry out risk assessments to mitigate. Part 1 Definitions and obliged entities.

Source: slideplayer.com

Source: slideplayer.com

This page highlights some specific new areas that firms need to comply with. Serious Crime Act 2007 c. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. Serious Organised Crime and Police Act 2005 c. Although the UK has more or less adopted the United Nations UN and EU sanctions it has also added its foreign policy objectives into the law.

Source:

Update November 2014 Banks control of financial crime risks in trade finance July 2013 Banks management of high money-laundering risk situations 2011 Anti-money laundering and anti-bribery and corruption systems and controls. AMPs must take immediate steps to implement the 2019 Regulations and carry out risk assessments to mitigate. Other laws relevant to money laundering are the Terrorism Act 2000 TACT which contains offences relating to terrorist financing and the Sanctions and Anti-Money Laundering Act 2018 which is designed to smooth the transition of the UKs departure from the European Union and to ensure that it maintains its existing regulations and keeps pace with the international standards and. Part 1 Definitions and obliged entities. An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of.

Source: researchgate.net

Source: researchgate.net

UK law and guidance The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 POCA as amended by the Serious Organised Crime and Police Act 2005 SOCPA the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 and the Terrorism Act 2000 TA 2000 as amended by the Anti. The Fifth Anti Money Laundering Directive 5AMLD for the UK The Fifth Anti Money Laundering Directive 5AMLD entered into force on 10 January 2020 for the EU Member States. On 23 May 2018 the Sanctions and Anti-Money Laundering Act became law in the United Kingdom. This guidance has been prepared by the Government departments that co-ordinate the UKs anti-money laundering legislation in response to concerns expressed by some banks and other financial. Money laundering is defined in s 340 11 of the POCA as an act which constitutes an offence under ss 327328 or 329 or an attempt conspiracy or incitement to commit any of those offences or aiding abetting counselling or procuring their commission.

Source: mortgagefinancegazette.com

Source: mortgagefinancegazette.com

PART 1 Amendments consequential on Parts 1 and 2. Money Laundering Regulations 2017. Money laundering is defined in s 340 11 of the POCA as an act which constitutes an offence under ss 327328 or 329 or an attempt conspiracy or incitement to commit any of those offences or aiding abetting counselling or procuring their commission. Other laws relevant to money laundering are the Terrorism Act 2000 TACT which contains offences relating to terrorist financing and the Sanctions and Anti-Money Laundering Act 2018 which is designed to smooth the transition of the UKs departure from the European Union and to ensure that it maintains its existing regulations and keeps pace with the international standards and. It hopes that the 2019 Regulations will help the art world to clarify and demystify the muddy waters which have traditionally surrounded many of its transactions.

Source: napier.ai

Source: napier.ai

The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. 1 The purpose of the Act is to prevent and detect money laundering and terrorist financing. The UK Government has made clear that it is committed to targeting corruption money laundering and terrorist financing in whatever guise. Anti money laundering act england. An Act to make provision enabling sanctions to be imposed where appropriate for the purposes of compliance with United Nations obligations or other international obligations or for the purposes of.

Source: researchgate.net

Source: researchgate.net

It hopes that the 2019 Regulations will help the art world to clarify and demystify the muddy waters which have traditionally surrounded many of its transactions. The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. PART 1 Amendments consequential on Parts 1 and 2. Serious Crime Act 2007 c. Immigration Act 1971 c.

Source: legislation.gov.uk

Source: legislation.gov.uk

Anti money laundering act england. Some businesses and individuals in the UK must. UK law and guidance The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 POCA as amended by the Serious Organised Crime and Police Act 2005 SOCPA the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 and the Terrorism Act 2000 TA 2000 as amended by the Anti. PART 1 Amendments consequential on Parts 1 and 2. Senior Courts Act 1981 c.

Source:

The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. AMPs must take immediate steps to implement the 2019 Regulations and carry out risk assessments to mitigate. Its aim is to provide a legal framework to allow the UK to impose sanctions and implement its own sanctions regime once the UK leaves the EU on 29 March 2019. Anti money laundering act england. Part 1 Definitions and obliged entities.

Source: pdfprof.com

Source: pdfprof.com

1 The purpose of the Act is to prevent and detect money laundering and terrorist financing. This page highlights some specific new areas that firms need to comply with. It hopes that the 2019 Regulations will help the art world to clarify and demystify the muddy waters which have traditionally surrounded many of its transactions. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. Immigration Act 1971 c.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

How small banks manage money laundering and sanctions risk. To deal with the transition from the EUs sanctions regime to its new regime the UK passed the Sanctions and Anti-Money Laundering Act SAMLA in 2018. Money Laundering Regulations 2017. 1 The purpose of the Act is to prevent and detect money laundering and terrorist financing. PART 1 Amendments consequential on Parts 1 and 2.

Source: researchgate.net

Source: researchgate.net

Money laundering is defined in s 340 11 of the POCA as an act which constitutes an offence under ss 327328 or 329 or an attempt conspiracy or incitement to commit any of those offences or aiding abetting counselling or procuring their commission. Asset management and platform firms 2013. UK law and guidance The UK anti-money laundering regime requirements are set out in the Proceeds of Crime Act 2002 POCA as amended by the Serious Organised Crime and Police Act 2005 SOCPA the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 and the Terrorism Act 2000 TA 2000 as amended by the Anti. The act gives the UK government powers to lift and impose sanctions in line with its ongoing international obligations and to devise new targeted sanctions as part of its own regime. Its aim is to provide a legal framework to allow the UK to impose sanctions and implement its own sanctions regime once the UK leaves the EU on 29 March 2019.

Source: vinciworks.com

Source: vinciworks.com

This guidance has been prepared by the Government departments that co-ordinate the UKs anti-money laundering legislation in response to concerns expressed by some banks and other financial. It hopes that the 2019 Regulations will help the art world to clarify and demystify the muddy waters which have traditionally surrounded many of its transactions. Ad we have Video KYC Enhanced Kyc Aml solution easy integration with free trial options. This guidance has been prepared by the Government departments that co-ordinate the UKs anti-money laundering legislation in response to concerns expressed by some banks and other financial. Its aim is to provide a legal framework to allow the UK to impose sanctions and implement its own sanctions regime once the UK leaves the EU on 29 March 2019.

Source: legislation.gov.uk

Source: legislation.gov.uk

Asset management and platform firms 2013. To deal with the transition from the EUs sanctions regime to its new regime the UK passed the Sanctions and Anti-Money Laundering Act SAMLA in 2018. With our global AI powered solution verify user ID Passports drivings licenses instantly. With its own Sanctions and Anti-Money Laundering Act the Sanctions Act and related statutory instruments SI in effect there have been changes that organisations need to keep a check on. Serious Organised Crime and Police Act 2005 c.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering act uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas