16++ Anti money laundering and know your customer questions ideas

Home » about money loundering Info » 16++ Anti money laundering and know your customer questions ideasYour Anti money laundering and know your customer questions images are available. Anti money laundering and know your customer questions are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering and know your customer questions files here. Find and Download all free photos and vectors.

If you’re searching for anti money laundering and know your customer questions pictures information related to the anti money laundering and know your customer questions topic, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Anti Money Laundering And Know Your Customer Questions. 2 Hours 120 Minutes Exam Fees. And commonly a legal requirement that many organizations need to comply with in terms of anti-money laundering gloss effective know your customer or KYC involves knowing a customers identity their financial activities and the risks they. There are three stages involved in money laundering. Know your customerKYC KYC is the process that institutions must take in order to verify their customers identities before providing services.

Top 10 Questions About Aml Compliance Answered By The Cto Of Shufti Pro From shuftipro.com

Top 10 Questions About Aml Compliance Answered By The Cto Of Shufti Pro From shuftipro.com

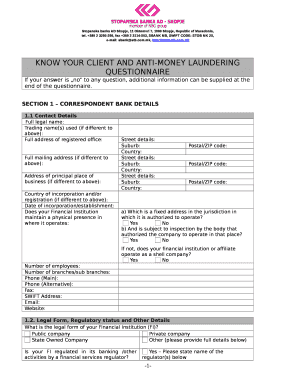

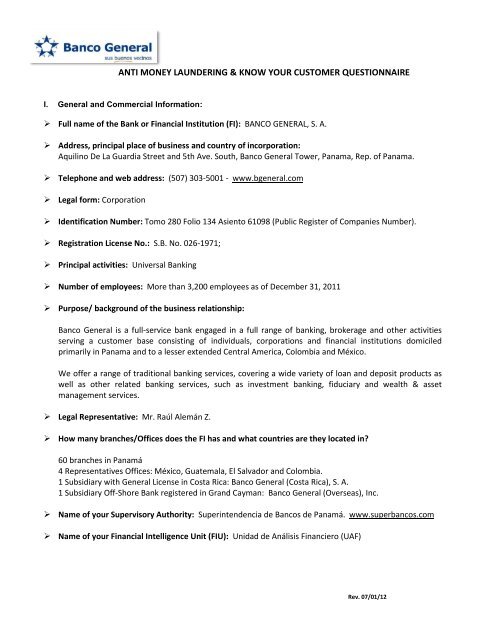

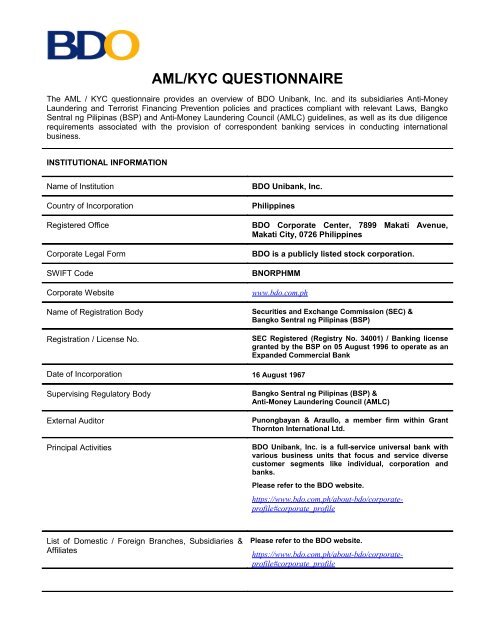

Do the regulations require banks financial institutions to Know Your Customer. Know Your Customer Anti-Money Laundering Questionnaire As a part of our Anti-Money Laundering and Combatting the Financing of Terrorism policy were writing to our valued business partners to assist us in completing a questionnaire to comply with regulatory requirements. Non Members of IIBF. The 5th Anti-Money Laundering Directive provided a reference framework for KYC Know Your Customer processes in Europe and was scheduled to be implemented by Member States by 10 January 2020 aimed at tackling emerging issues and the funding of criminal activities. Within the past 5 years has your institution been subject to civil or criminal penalties stemming from deficiencies in your AMLATF program. Anti-money Laundering Quiz Questions.

It incorporates the main local AML requirements for over 70 different countries.

Non Members of IIBF. Anti-money Laundering Quiz Questions. I have dealt with my clients for many years do I still need to carry out Customer Due Diligence. AML operates on a much broader level and are the measures that institutions take to prevent and combat money laundering. Within the past 5 years has your institution been subject to civil or criminal penalties stemming from deficiencies in your AMLATF program. What is Money Laundering.

Source: amazon.in

Source: amazon.in

Against Money Laundering and Financing Terrorism. Why do I need to perform Anti-Money Laundering checks. Does your institutions AML policy and program include the following. Reached out to law enforcement to make them aware of this system and encourage them to reach out to us with any questions or concerns. I have dealt with my clients for many years do I still need to carry out Customer Due Diligence.

Source: shuftipro.com

Source: shuftipro.com

Please describe your Institutions Know-Your-Customer KYC policies. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. Bank of Commerce AML Questionnaire Page 4 of 5 E. Know your Customer KYC. Reached out to law enforcement to make them aware of this system and encourage them to reach out to us with any questions or concerns.

Source: youtube.com

Source: youtube.com

Anti-Money Laundering Control 1. Anti-Money Laundering Quiz questions. Bank of Commerce AML Questionnaire Page 4 of 5 E. Within the past 5 years has your institution been subject to civil or criminal penalties stemming from deficiencies in your AMLATF program. There are three stages involved in money laundering.

Source: pdffiller.com

Source: pdffiller.com

AML operates on a much broader level and are the measures that institutions take to prevent and combat money laundering. Within the past 5 years has your institution been subject to civil or criminal penalties stemming from deficiencies in your AMLATF program. Registered address Head Office. Reached out to law enforcement to make them aware of this system and encourage them to reach out to us with any questions or concerns. IIBF AML-KYC Certification Registration Fees.

Source: medium.com

Source: medium.com

Know your customer procedures are a critical function to assess customer risk. KNOW YOUR CUSTOMER KYC QUESTIONNAIRE. Anti Money Laundering AML. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. Oversight and that Anti Money Laundering AML regulatory requirements are being adhered to at both a local and global level.

Source:

Know your customerKYC KYC is the process that institutions must take in order to verify their customers identities before providing services. The 5th Anti-Money Laundering Directive provided a reference framework for KYC Know Your Customer processes in Europe and was scheduled to be implemented by Member States by 10 January 2020 aimed at tackling emerging issues and the funding of criminal activities. Anti-Money Laundering Control 1. Does your institutions AML policy and program include the following. There are three stages involved in money laundering.

Source: amazon.in

Source: amazon.in

Know your Customer KYC. Quick and easy access to global Anti-Money Laundering AML and Know Your Customer KYC information is helpful to mitigating risk. Registered address Head Office. Are your policiesprocedures compliant with Financial Action Task Forces FATF Recommendations. Do the regulations require banks financial institutions to Know Your Customer.

Source: yumpu.com

Source: yumpu.com

Regulation 242000 concerning procedures for Anti-Money Laundering dated 14 November 2000 and subsequent amendments issued by Central Bank of the United Arab Emirates. Thats why its important to know who youre doing business with. And commonly a legal requirement that many organizations need to comply with in terms of anti-money laundering gloss effective know your customer or KYC involves knowing a customers identity their financial activities and the risks they. Customer identification requirements at the inception of the relationship. To monitor the accordance with legal requirements.

Source: yumpu.com

Source: yumpu.com

KNOW YOUR CUSTOMER KYC QUESTIONNAIRE. Are your policiesprocedures compliant with Financial Action Task Forces FATF Recommendations. 120 Objective - Multiple Choice Questions MCQs Total Marks. Bank of Commerce AML Questionnaire Page 4 of 5 E. Thats why its important to know who youre doing business with.

Source: justcoded.com

Source: justcoded.com

Non Members of IIBF. To monitor the accordance with legal requirements. Customer identification requirements at the inception of the relationship. Why do I need to perform Anti-Money Laundering checks. 2 Hours 120 Minutes Exam Fees.

The UK has opted out of complying with the new 6th Anti-Money Laundering Directive as the UK Government considers that domestic legislation is already largely compliant with the. KNOW YOUR CUSTOMER KYC QUESTIONNAIRE. IS YOUR INSTITUTION COMPLIANT WITH THE ANTI-MONEY LAUNDERING LAWSTERRORIST FINANCING LAWS OF THE JURISDICTION IN WHICH YOU OPERATE. IIBF AML-KYC Certification Registration Fees. Why do I need to perform Anti-Money Laundering checks.

Source: researchgate.net

Source: researchgate.net

Anti-Money Laundering Know Your Customer. Know your customer procedures are a critical function to assess customer risk. And commonly a legal requirement that many organizations need to comply with in terms of anti-money laundering gloss effective know your customer or KYC involves knowing a customers identity their financial activities and the risks they. Registered address Head Office. Know Your Customer Anti-Money Laundering Questionnaire As a part of our Anti-Money Laundering and Combatting the Financing of Terrorism policy were writing to our valued business partners to assist us in completing a questionnaire to comply with regulatory requirements.

Source: tookitaki.ai

Source: tookitaki.ai

PayPal is committed to compliance with all applicable laws and regulations regarding Anti-Money Laundering AML. In light of the above we have developed a Know Your Customer KYC quick reference guide which provides quick and easy access to global AML and KYC information to. Know your customer procedures are a critical function to assess customer risk. Know your Customer KYC. Questionnaire Anti-Money Laundering Anti-Terrorist Financing Know Your Customer Landesbank Hessen-Thüringen Girozentrale including its foreign branch offices and subsidiaries hereinafter referred to as Helaba have implemented internal procedures to detect and to intercept money laundering channels or chains involving the proceeds of.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering and know your customer questions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas