10+ Anti money laundering checklist for solicitors information

Home » about money loundering idea » 10+ Anti money laundering checklist for solicitors informationYour Anti money laundering checklist for solicitors images are ready in this website. Anti money laundering checklist for solicitors are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering checklist for solicitors files here. Get all royalty-free photos.

If you’re looking for anti money laundering checklist for solicitors images information linked to the anti money laundering checklist for solicitors keyword, you have visit the right blog. Our site frequently provides you with hints for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Anti Money Laundering Checklist For Solicitors. This research is performed to prevent money-laundering anti-money laundering and the finance of terrorism. This legislation creates a number of requirements for solicitors when they deal with you as a client. This section outlines the anti-money laundering AML roles responsibilities and appointment of senior individuals in a practice including the money laundering reporting officer MLRO money laundering compliance officer MLCO and beneficial owners officers and managers BOOMs as well as some of the structures that practices must or should put in place eg. Home Decorating Style 2021 for Anti Money Laundering Policy Template Solicitors you can see Anti Money Laundering Policy Template Solicitors and more pictures for Home Interior Designing 2021 224547 at Resume Example Ideas.

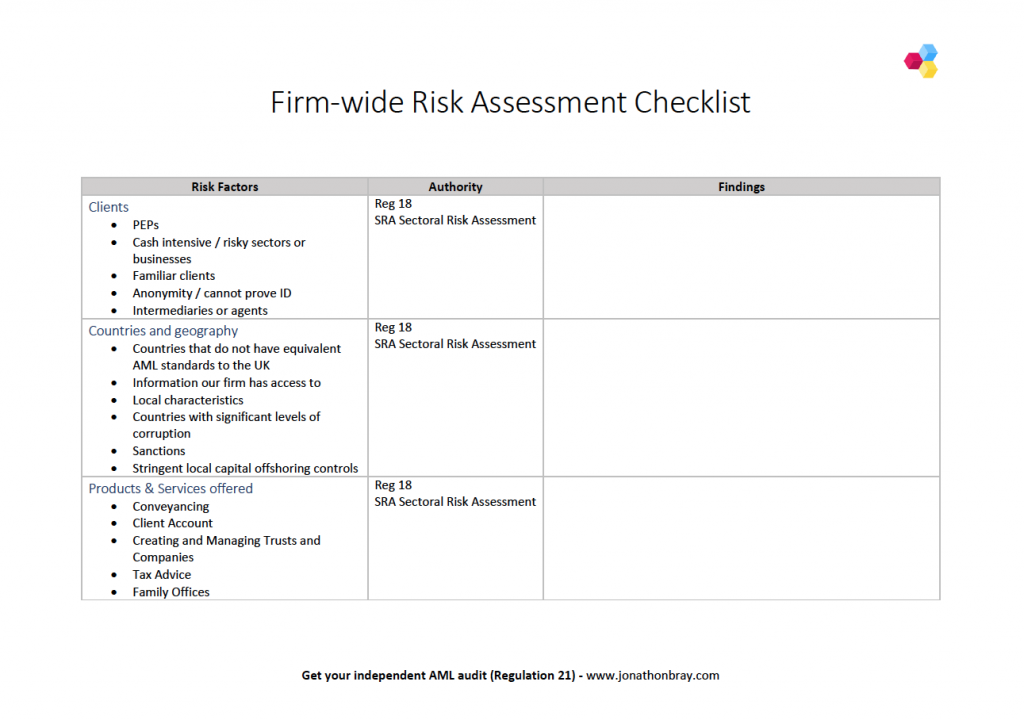

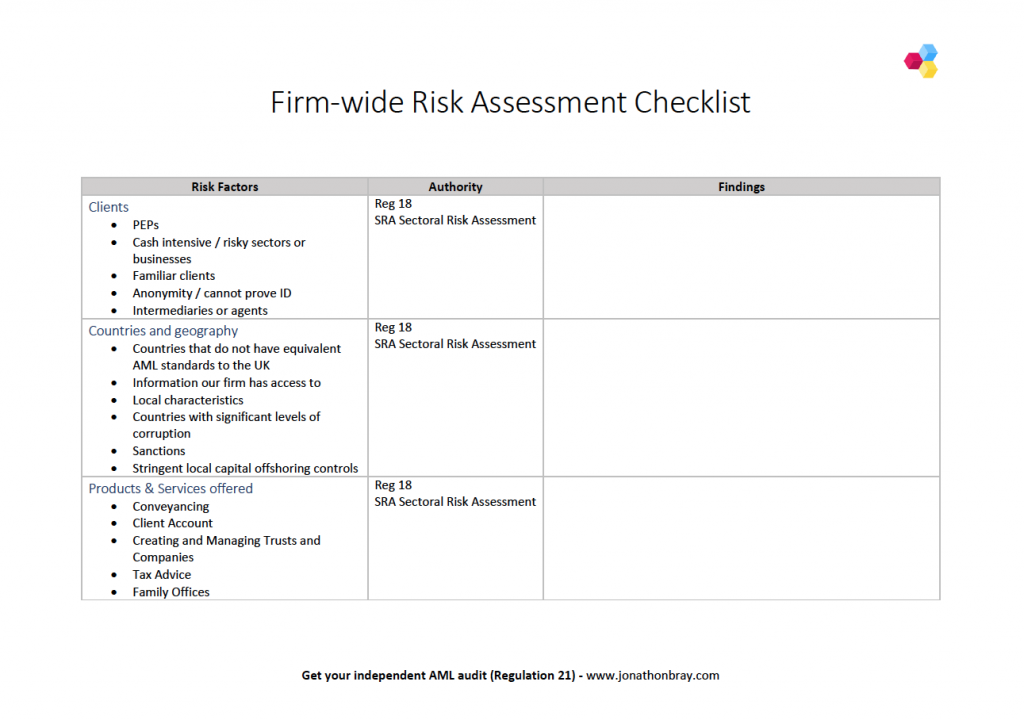

What Should Be In Your Aml Firm Wide Risk Assessment Checklist Lexology From lexology.com

What Should Be In Your Aml Firm Wide Risk Assessment Checklist Lexology From lexology.com

4 easy steps to client onboarding and Anti-Money Laundering AML checks The Sethi Partnership Solicitors strive to make life easier for our clients by embracing new technology. Resources include the Societys Guidance Notes for Solicitors on Anti-Money Laundering. Comply with the Law Society and be sure that your client is who they say they are with online Anti-Money Laundering checks that takes a matter of seconds. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7 Reliance on third parties 51-55 8 Reporting and tipping off 56-65 9 Suspicious transactions 66-71 10 Internal procedures 72-74. In Dutch the law that deals with this is abbreviated as Wwft law to prevent money laundering and the financing of terrorism. This section outlines the anti-money laundering AML roles responsibilities and appointment of senior individuals in a practice including the money laundering reporting officer MLRO money laundering compliance officer MLCO and beneficial owners officers and managers BOOMs as well as some of the structures that practices must or should put in place eg.

This section outlines the anti-money laundering AML roles responsibilities and appointment of senior individuals in a practice including the money laundering reporting officer MLRO money laundering compliance officer MLCO and beneficial owners officers and managers BOOMs as well as some of the structures that practices must or should put in place eg.

The money laundering regulations are clear. In Dutch the law that deals with this is abbreviated as Wwft law to prevent money laundering and the financing of terrorism. Your current residential address. Details of your procedures for identifying and verifying customers and your. We were encouraged that small practices and sole practitioners tended to produce very good and detailed risk assessments often from scratch using their expert knowledge of their clients and work. What are the requirements.

Source: lexology.com

Source: lexology.com

This checklist will be updated to take into account developments in this area of law. Id verification is imperative for good AML practice. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7. We were encouraged that small practices and sole practitioners tended to produce very good and detailed risk assessments often from scratch using their expert knowledge of their clients and work. The basic information we need is.

Source: pdfprof.com

Source: pdfprof.com

This section outlines the anti-money laundering AML roles responsibilities and appointment of senior individuals in a practice including the money laundering reporting officer MLRO money laundering compliance officer MLCO and beneficial owners officers and managers BOOMs as well as some of the structures that practices must or should put in place eg. Understand what you need to do under the money laundering regulations Proceeds of Crime Act 2002 POCA and Terrorism Act 2000. This legislation creates a number of requirements for solicitors when they deal with you as a client. The money laundering regulations are clear. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7.

Know who you are dealing with- reduce your risk of financial and reputational damage by verifying clients. Your date of birth. In Dutch the law that deals with this is abbreviated as Wwft law to prevent money laundering and the financing of terrorism. Anti-Money Laundering Required documents. This legislation creates a number of requirements for solicitors when they deal with you as a client.

Source: goldmanlegal.co.nz

Source: goldmanlegal.co.nz

Veriphy is designed to help assist solicitors with the latest compliance requirements. We were encouraged that small practices and sole practitioners tended to produce very good and detailed risk assessments often from scratch using their expert knowledge of their clients and work. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7 Reliance on third parties 51-55 8 Reporting and tipping off 56-65 9 Suspicious transactions 66-71 10 Internal procedures 72-74. The AML module is turned off by default in Legalsense as not all Legalsense users have need to this module. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML.

Source: skillcast.com

Source: skillcast.com

You should check the sanctions list from the Office of Financial Sanctions. If you are required to comply with the MLR17 we have developed a Anti Money Laundering Checklist that contains over 60 assessment questions and helps firms to assess their compliance with the money laundering. Solutions to Combat Money Laundering. Anti-money laundering legislation The Criminal Justice Money Laundering and Terrorist Financing Acts 2010 and 2013 aim to prevent money laundering. Details of your approach to preventing money laundering including named individuals and their responsibilities.

Source: academia.edu

Source: academia.edu

KYC AML for Solicitors and Legal Firms. In this sense you are the expert. The basic information we need is. What are the requirements. We are required to confirm that these details are correct and need the following documents to help us do so.

Source: djcareynotaries.co.uk

Source: djcareynotaries.co.uk

Solicitors can access a dedicated AML section under the Solicitors Regulations menu providing useful information and links to external AML resources for solicitors. You should check the sanctions list from the Office of Financial Sanctions. Anti Money Laundering Checklist. Solutions to Combat Money Laundering. Id verification is imperative for good AML practice.

Source: docplayer.net

Source: docplayer.net

This information can assist solicitors in interpreting these statutory AML obligations. The basic information we need is. We were encouraged that small practices and sole practitioners tended to produce very good and detailed risk assessments often from scratch using their expert knowledge of their clients and work. We are required to confirm that these details are correct and need the following documents to help us do so. To help firms and individuals comply.

Source: docplayer.net

Source: docplayer.net

KYC AML for Solicitors and Legal Firms. To help firms and individuals comply. You should check the sanctions list from the Office of Financial Sanctions. The basic information we need is. We are required to confirm that these details are correct and need the following documents to help us do so.

To help firms and individuals comply. Comply with the Law Society and be sure that your client is who they say they are with online Anti-Money Laundering checks that takes a matter of seconds. Understand what you need to do under the money laundering regulations Proceeds of Crime Act 2002 POCA and Terrorism Act 2000. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7.

Source: pdfprof.com

Source: pdfprof.com

The first step in the laundering process is for criminals to get their money into an. Details of your procedures for identifying and verifying customers and your. Checklist for Legal Firms contained in Bar Council Circular No 2932010 dated 27 Dec 2010 Note. We are required to confirm that these details are correct and need the following documents to help us do so. This checklist will be updated to take into account developments in this area of law.

What are the requirements. 2 Money laundering and terrorist financing 11-14 3 The anti-money laundering regime and solicitors 15-17 4 The risk based approach 18-25 5 Client due diligence 26-39 6 Identification and verification 40-50 7. Solicitors can access a dedicated AML section under the Solicitors Regulations menu providing useful information and links to external AML resources for solicitors. The changes introduced by the 5th Anti-Money Laundering Directive expand both the requirement to conduct EDD and the factors to be considered. Understand what you need to do under the money laundering regulations Proceeds of Crime Act 2002 POCA and Terrorism Act 2000.

Source: pdfprof.com

Source: pdfprof.com

Id verification is imperative for good AML practice. Your date of birth. 3 Report to the Bar Council on the Impact of AntiMoney Laundering Legislation on the Advocate Solicitor 15 Aug 2003 4 Anti-Money Laundering and Anti-Terrorism Financing Act 2001. Know who you are dealing with- reduce your risk of financial and reputational damage by verifying clients. KYC AML for Solicitors and Legal Firms.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering checklist for solicitors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information