10+ Anti money laundering checks ideas

Home » about money loundering idea » 10+ Anti money laundering checks ideasYour Anti money laundering checks images are ready. Anti money laundering checks are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering checks files here. Find and Download all free photos.

If you’re looking for anti money laundering checks images information connected with to the anti money laundering checks interest, you have come to the right blog. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Anti Money Laundering Checks. For new applications we need to verify that the name of the person or company paying for a new protection application matches the. AML procedures form part of the customer due diligence and employment. It is a process by which dirty money is converted into clear cash. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests.

How To Run An Aml Check Creditsafe Uk From help.creditsafeuk.com

How To Run An Aml Check Creditsafe Uk From help.creditsafeuk.com

Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund. This is carried out via the use of a mobile app which with the ever-growing use and need for technology is a major development for anti-money laundering checks. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. An AML check is a vital component of employment screening and customer due diligence to ensure that your candidates and customers are not attempting to launder money through your businesscompany which is particularly relevant for banks and other financial institutions. Anti-money laundering checks will help firms in these sectors to follow AML regulations by identifying potential high-risk clients and making companies less vulnerable to money laundering as. Anti-Money Laundering Checks are required by law for all banks before they are allowed to handle money from you.

Anti-Money Laundering Checks are required by law for all banks before they are allowed to handle money from you.

With the whole process completed online its never been easier to get your financial checks. Anti-money laundering checks will help firms in these sectors to follow AML regulations by identifying potential high-risk clients and making companies less vulnerable to money laundering as. Additional anti money laundering AML checks. The checks are made to validate your identity and to ensure that the money has not been acquired illegally or that the bank itself is not being used as part of criminal activity most known as misuse of facility. Anti-Money Laundering checks is a general term used to describe checks carried out as part of the UKs Anti-Money Laundering regulatory framework. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear money and conceal the identity of the prison a.

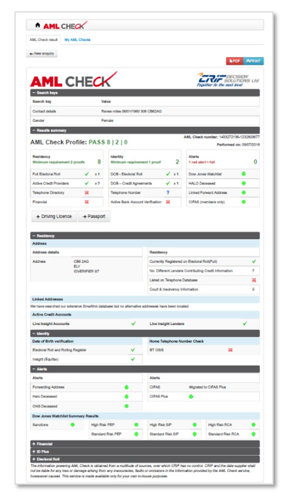

Source: crifdecisionhub.co.uk

Source: crifdecisionhub.co.uk

Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. Anti money laundering refers to a set of laws regulations and procedures. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud. Anti-Money Laundering checks is a general term used to describe checks carried out as part of the UKs Anti-Money Laundering regulatory framework. This is carried out via the use of a mobile app which with the ever-growing use and need for technology is a major development for anti-money laundering checks.

Source: monexfintech.com

Source: monexfintech.com

The checks are made to validate your identity and to ensure that the money has not been acquired illegally or that the bank itself is not being used as part of criminal activity most known as misuse of facility. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. These may impact your customers plans new applications or claim. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud. The concept of money laundering is very important to be understood for these working within the monetary sector.

Source: neuralt.com

Source: neuralt.com

Best practices for Anti-Money Laundering Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities. A check against politically exposed persons PEPs lists sanctions lists and other watchlists. Online AML checks searches Our anti-money laundering AML search helps ensure your due diligence is carried out in line with regulatory bodies giving you accurate results peace of mind and protecting you your clients and your firm. An AML check is a vital component of employment screening and customer due diligence to ensure that your candidates and customers are not attempting to launder money through your businesscompany which is particularly relevant for banks and other financial institutions. The legal framework includes several different Acts and Regulations and some.

Source: amlcheck.es

Source: amlcheck.es

The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear money and conceal the identity of the prison a. Weve added some additional checks to further tighten our money laundering controls. Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. A check to confirm your identity electronically and that there is record of you living at the specified address.

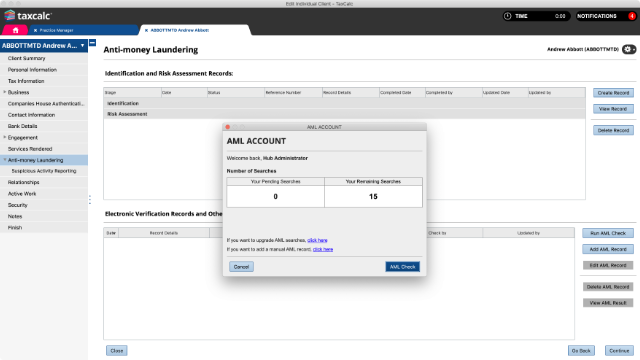

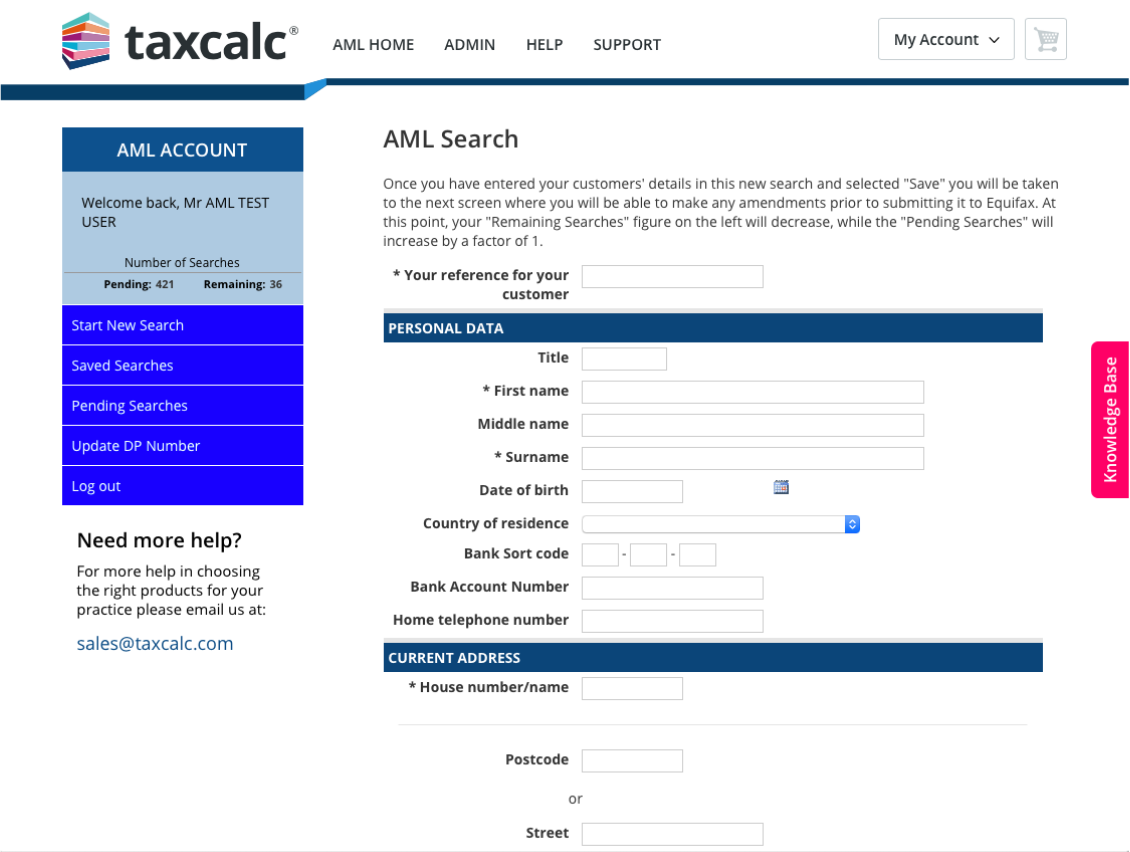

Source: taxcalc.com

Source: taxcalc.com

For a reliable efficient AML check trust CVCheck. Furthermore anti-money laundering checks help prevent a wide range of criminal activities including corruption tax evasion market manipulation and illicit goods trade. For new applications we need to verify that the name of the person or company paying for a new protection application matches the. This can be a check on an individual carrying out a specific function or an organisation providing goods or services. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with.

Source: help.creditsafeuk.com

Source: help.creditsafeuk.com

These may impact your customers plans new applications or claim. Anti-money laundering checks will help firms in these sectors to follow AML regulations by identifying potential high-risk clients and making companies less vulnerable to money laundering as. An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. Our AML offering ensures you comply with the. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering.

Source: crifdecisionsolutions.co.uk

Source: crifdecisionsolutions.co.uk

Anti-Money Laundering Checks are required by law for all banks before they are allowed to handle money from you. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else. AML procedures form part of the customer due diligence and employment. The document provides a framework. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity.

Source: credas.co.uk

Source: credas.co.uk

An AML check is a vital component of employment screening and customer due diligence to ensure that your candidates and customers are not attempting to launder money through your businesscompany which is particularly relevant for banks and other financial institutions. The concept of money laundering is very important to be understood for these working within the monetary sector. Weve added some additional checks to further tighten our money laundering controls. Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear money and conceal the identity of the prison a.

Source: help.creditsafeuk.com

Source: help.creditsafeuk.com

Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund. Our AML offering ensures you comply with the. Weve added some additional checks to further tighten our money laundering controls. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. An AML check is a vital component of employment screening and customer due diligence to ensure that your candidates and customers are not attempting to launder money through your businesscompany which is particularly relevant for banks and other financial institutions.

Source: gbgplc.com

Source: gbgplc.com

AML procedures form part of the customer due diligence and employment. Anti-Money Laundering checks is a general term used to describe checks carried out as part of the UKs Anti-Money Laundering regulatory framework. Anti money laundering refers to a set of laws regulations and procedures. In most cases these checks will be completed in the background using electoral data. For new applications we need to verify that the name of the person or company paying for a new protection application matches the.

Source: help.creditsafeuk.com

Source: help.creditsafeuk.com

For a reliable efficient AML check trust CVCheck. Weve added some additional checks to further tighten our money laundering controls. Furthermore anti-money laundering checks help prevent a wide range of criminal activities including corruption tax evasion market manipulation and illicit goods trade. The legal framework includes several different Acts and Regulations and some. The concept of money laundering is very important to be understood for these working within the monetary sector.

Source: crifdecisionsolutions.co.uk

Source: crifdecisionsolutions.co.uk

When onboarding new customers or reviewing existing ones electronic identity checking helps meet your regulatory obligations. For a reliable efficient AML check trust CVCheck. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations. Additional anti money laundering AML checks. AML compliance checklist.

Source: taxcalc.com

Source: taxcalc.com

Anti Money Laundering Checks Quicker customer onboarding greater confidence in meeting your compliance needs Our AML solutions mean you can easily identify high-risk applicants and manage them appropriately. Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. This is carried out via the use of a mobile app which with the ever-growing use and need for technology is a major development for anti-money laundering checks. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it appear like clear money and conceal the identity of the prison a. In most cases these checks will be completed in the background using electoral data.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering checks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information