14+ Anti money laundering checks fca ideas in 2021

Home » about money loundering Info » 14+ Anti money laundering checks fca ideas in 2021Your Anti money laundering checks fca images are available. Anti money laundering checks fca are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering checks fca files here. Download all free vectors.

If you’re searching for anti money laundering checks fca pictures information related to the anti money laundering checks fca interest, you have come to the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Anti Money Laundering Checks Fca. However if you are making your first investment through Crowdcube we may require a copy of two. It applies only to business relationships undertaken in the course of business in the UK. FCA fines and imposes a restriction on Canara Bank for anti-money laundering systems failings Press Releases First published. We currently have 42 investigations ongoing into firms and individuals involving for example systems and controls over politically exposed persons customers with significant cash intensive operations correspondent banking and trade finance and transaction.

Anti Money Laundering Policy Pdf From pdfprof.com

Anti Money Laundering Policy Pdf From pdfprof.com

The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. FCA requires these. For this reason financial institutions operating in the UK need to carry out the necessary AML checks when collaborating with companies or customers in these countries. The warning came only months after it announced it was launching criminal proceedings against NatWest marking the first prosecution under anti-money laundering rules introduced in 2007. The warning got here simply months after it introduced it was launching felony proceedings in opposition to NatWest marking the primary prosecution under anti-money laundering rules launched in 2007. In March 2021 The Financial Conduct Authority FCA announced that it was launching criminal proceedings against NatWest one of the largest banking groups in the UK for allegedly failing to prevent money laundering in line with Money Laundering Regulations 2007.

Anti Money Laundering and Financial Crime Policy Template for FCA Applications.

FCA fines and imposes a restriction on Canara Bank for anti-money laundering systems failings Press Releases First published. The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. In May the FCA sent letters to chief executives of the UKs retail banks warning that some lenders wanted to evaluate potential gaps of their anti-money laundering checks. AML procedures form part of the customer due diligence and employment. In most cases these checks will be completed in the background using electoral data. FCA requires these.

Source: veriff.com

Source: veriff.com

However if you are making your first investment through Crowdcube we may require a copy of two. FCA and PRA licenses authorisations and ongoing compliance support training recruitment. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else. The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. How small banks manage money laundering and sanctions risk.

Source: qa.nonprod.trulioo.com

Source: qa.nonprod.trulioo.com

Financial institutions and public bodies use them widely to comply with their Know Your Client KYC obligations but other companies also conduct a range of checks to protect their interests. 21 This guidance is aimed at any institution that has its anti-money laundering systems and controls overseen by the FCA1 It discusses how they can meet their obligations when opening new relationships or monitoring existing relationships. Anti-Money Laundering AML checks are an unescapable part of doing business today. FCA requires these. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else.

Source: biia.com

Source: biia.com

The letter which was penned by David Geale the Director of Retail Banking Payments Supervision for the FCA and sent to banking industry chiefs across the UK was issued in May and made public via the FCAs website hub. The document provides a framework. In May the FCA sent letters to chief executives of the UKs retail banks warning that some lenders wanted to evaluate potential gaps of their anti-money laundering checks. 4478 3368 4449 Email. In May the FCA sent letters to chief executives of the UKs retail banks warning that some lenders needed to assess potential gaps in their anti-money laundering checks.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

06062018 Financial services firms are required to maintain robust anti-money laundering AML systems and controls since they are at risk from those seeking to launder the proceeds of crime or to finance terrorism. Sanctions money laundering terrorist financing bribery and corruption human drug and arms trafficking crimes may be higher in these risky countries. Digital bank Monzo is being investigated by the Financial Conduct Authority FCA over potential breaches of financial crime regulations the bank has. AML procedures form part of the customer due diligence and employment. The warning got here simply months after it introduced it was launching felony proceedings in opposition to NatWest marking the primary prosecution under anti-money laundering rules launched in 2007.

Source: webnuk.wordpress.com

Source: webnuk.wordpress.com

The warning got here simply months after it introduced it was launching felony proceedings in opposition to NatWest marking the primary prosecution under anti-money laundering rules launched in 2007. A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money laundering. AML procedures form part of the customer due diligence and employment. Two of our biggest sanctions in the last 12 months related to failures to address financial crime and anti-money laundering AML risks. FCA requires these.

Source: slideplayer.com

Source: slideplayer.com

Anti-Money Laundering AML checks are an unescapable part of doing business today. Anti-Money Laundering AML checks are an unescapable part of doing business today. Sanctions money laundering terrorist financing bribery and corruption human drug and arms trafficking crimes may be higher in these risky countries. FCA fines and imposes a restriction on Canara Bank for anti-money laundering systems failings Press Releases First published. In March 2021 The Financial Conduct Authority FCA announced that it was launching criminal proceedings against NatWest one of the largest banking groups in the UK for allegedly failing to prevent money laundering in line with Money Laundering Regulations 2007.

Source: shuftipro.com

Source: shuftipro.com

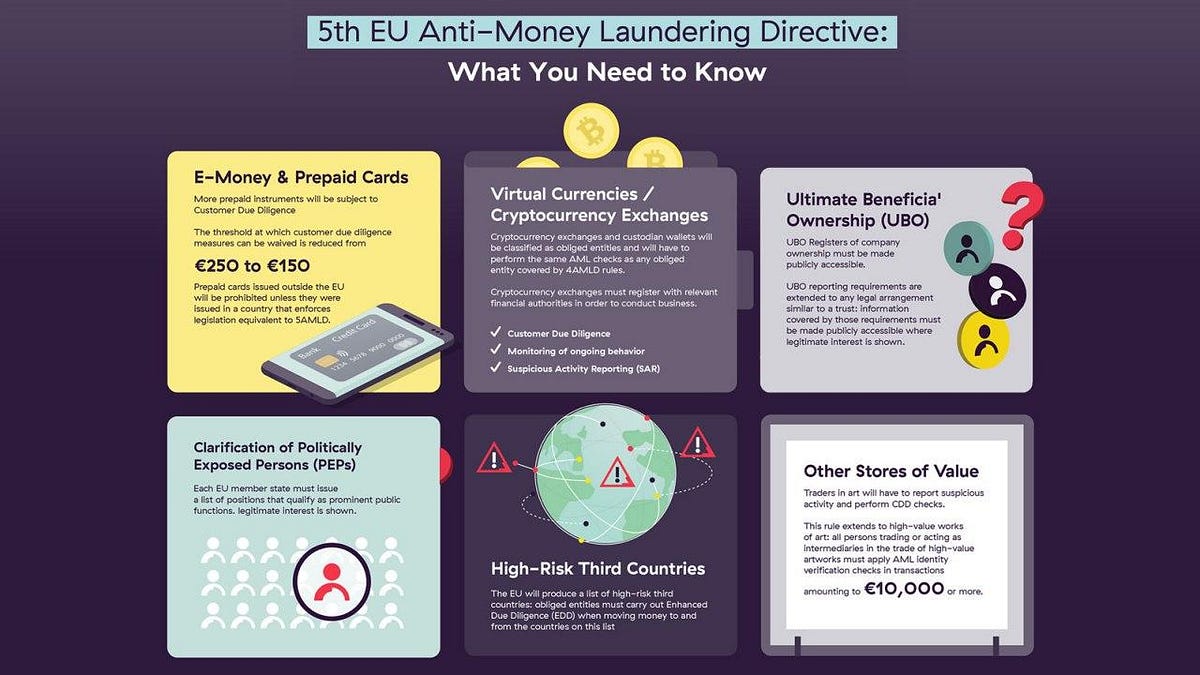

The document provides a framework. Since January 10 2020 Any crypto exchange operating in the UK must register with the FCA under anti-money laundering rules. The document provides a framework. 21 This guidance is aimed at any institution that has its anti-money laundering systems and controls overseen by the FCA1 It discusses how they can meet their obligations when opening new relationships or monitoring existing relationships. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services.

Source: pdfprof.com

Source: pdfprof.com

The warning came only months after it announced it was launching criminal proceedings against NatWest marking the first prosecution under anti-money laundering rules introduced in 2007. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. The warning got here simply months after it introduced it was launching felony proceedings in opposition to NatWest marking the primary prosecution under anti-money laundering rules launched in 2007. How small banks manage money laundering and sanctions risk. Update November 2014 Banks control of financial crime risks in trade finance July 2013 Banks management of high money-laundering risk situations 2011 Anti-money laundering and anti-bribery and corruption systems and controls.

Source: trainingexpress.org.uk

Source: trainingexpress.org.uk

Sanctions money laundering terrorist financing bribery and corruption human drug and arms trafficking crimes may be higher in these risky countries. It applies only to business relationships undertaken in the course of business in the UK. In most cases these checks will be completed in the background using electoral data. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. However if you are making your first investment through Crowdcube we may require a copy of two.

Source: pinterest.com

Source: pinterest.com

06062018 Financial services firms are required to maintain robust anti-money laundering AML systems and controls since they are at risk from those seeking to launder the proceeds of crime or to finance terrorism. Update November 2014 Banks control of financial crime risks in trade finance July 2013 Banks management of high money-laundering risk situations 2011 Anti-money laundering and anti-bribery and corruption systems and controls. The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. FCA and PRA licenses authorisations and ongoing compliance support training recruitment. Digital bank Monzo is being investigated by the Financial Conduct Authority FCA over potential breaches of financial crime regulations the bank has.

Source: pdfprof.com

Source: pdfprof.com

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. 4478 3368 4449 Email. FCA and PRA licenses authorisations and ongoing compliance support training recruitment. The Financial Conduct Authority FCA notified Monzo about its inquiry in May this year saying it was looking into potential breaches of UK rules related to anti-money laundering. In most cases these checks will be completed in the background using electoral data.

Source: medium.com

Source: medium.com

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Sanctions money laundering terrorist financing bribery and corruption human drug and arms trafficking crimes may be higher in these risky countries. We currently have 42 investigations ongoing into firms and individuals involving for example systems and controls over politically exposed persons customers with significant cash intensive operations correspondent banking and trade finance and transaction. It applies only to business relationships undertaken in the course of business in the UK. FCG 318 13122018.

Source: pdfprof.com

Source: pdfprof.com

It applies only to business relationships undertaken in the course of business in the UK. An Anti-Money Laundering AML check is an identity assessment to ensure all investors are who they claim to be and are not investing on behalf of somebody else. In May the FCA sent letters to chief executives of the UKs retail banks warning that some lenders needed to assess potential gaps in their anti-money laundering checks. 4478 3368 4449 Email. For this reason financial institutions operating in the UK need to carry out the necessary AML checks when collaborating with companies or customers in these countries.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering checks fca by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Handwritten declaration for bank po information

- 16+ Anti money laundering news 2021 information

- 12++ Definition of launder money information

- 20+ Bank negara malaysia undergraduate scholarship ideas in 2021

- 11+ Anti money laundering test questions and answers pdf information

- 17++ 3 elements of money laundering ideas

- 19++ Anti money laundering and counter terrorism financing act 2006 information

- 18+ Eso laundering meaning ideas

- 12+ Credit union bank secrecy act policy ideas in 2021

- 18+ How serious is money laundering ideas