17+ Anti money laundering compliance meaning information

Home » about money loundering idea » 17+ Anti money laundering compliance meaning informationYour Anti money laundering compliance meaning images are available in this site. Anti money laundering compliance meaning are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering compliance meaning files here. Get all royalty-free photos.

If you’re looking for anti money laundering compliance meaning images information linked to the anti money laundering compliance meaning interest, you have visit the right blog. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Anti Money Laundering Compliance Meaning. Anti-money laundering AML compliance. The AML compliance procedure is a continuous procedure that acquires observant consideration. Applicability of Anti Money Laundering Compliance. Another advantage of KYC is to understand the dealings of customers and prevent any form of risk that is prone to customer dealings.

What Is Anti Money Laundering Compliance Tookitaki Tookitaki From tookitaki.ai

What Is Anti Money Laundering Compliance Tookitaki Tookitaki From tookitaki.ai

Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. Criminals use money laundering to conceal their crimes and the money derived from them. Applicability of Anti Money Laundering Compliance. Money laundering and terrorist financing are global issues. AML laws require that financial instutions report any financial crime they detect to relevant regulators.

It is the companys anti-money laundering compliance officers responsibility to make sure anti-money laundering compliance of a company and the implementation of the stages of the money laundering program.

AML laws require that financial instutions report any financial crime they detect to relevant regulators. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. Anti-money laundering compliance refers to the measures institutions follow in order to be fully AML compliant. Corporations consumers and financial institutions. Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities. They must be prevented from financing money laundering and or terrorism.

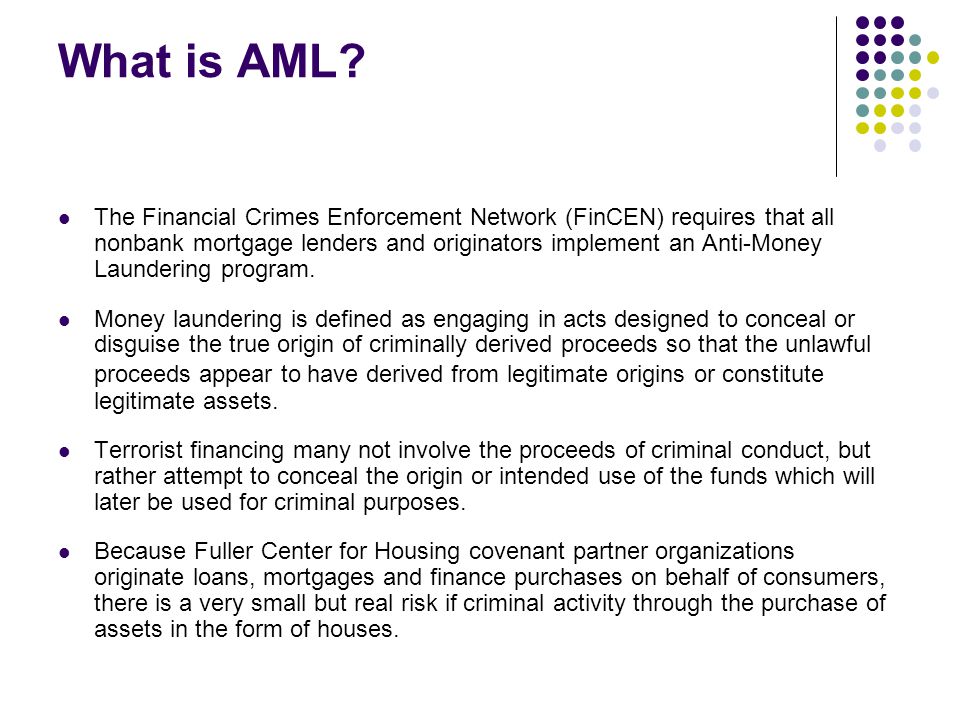

Source: slideplayer.com

Source: slideplayer.com

These include risk assessments parts of an AMLCFT programme and making suspicious activity reports or prescribed transaction reports. They must be prevented from financing money laundering and or terrorism. Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes. The AML compliance procedure is a continuous procedure that acquires observant consideration. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money.

Source: shuftipro.com

Source: shuftipro.com

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. The AML compliance procedure is a continuous procedure that acquires observant consideration. Anti money laundering meaning hindi. Criminals use money laundering to conceal their crimes and the money derived from them. For businesses the anti-money laundering compliance officer is a very vital.

Source: bi.go.id

Source: bi.go.id

Faster payments are a response to the need to modernise current payment settlement networks as a result of market technology and demographic trends. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Money laundering and terrorist financing are global issues. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Anti-money laundering compliance refers to the measures institutions follow in order to be fully AML compliant.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Anti money laundering meaning hindi. Anti-money laundering compliance refers to the measures institutions follow in order to be fully AML compliant. For businesses the anti-money laundering compliance officer is a very vital. AML laws require that financial instutions report any financial crime they detect to relevant regulators. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services.

Source: veriff.com

Source: veriff.com

Faster payments are a response to the need to modernise current payment settlement networks as a result of market technology and demographic trends. Anti-money laundering AML compliance. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. It is the companys anti-money laundering compliance officers responsibility to make sure anti-money laundering compliance of a company and the implementation of the stages of the money laundering program. Corporations consumers and financial institutions.

Source: shuftipro.com

Source: shuftipro.com

Money laundering is a way to conceal illegally obtained funds. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Criminals use money laundering to conceal their crimes and the money derived from them. It is the companys anti-money laundering compliance officers responsibility to make sure anti-money laundering compliance of a company and the implementation of the stages of the money laundering program. Another advantage of KYC is to understand the dealings of customers and prevent any form of risk that is prone to customer dealings.

Source: bi.go.id

Source: bi.go.id

Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. The AML compliance procedure is a continuous procedure that acquires observant consideration. AML laws require that financial instutions report any financial crime they detect to relevant regulators. Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities. Anti-money laundering compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate any efforts of money laundering.

Source: complyadvantage.com

Source: complyadvantage.com

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. Applicability of Anti Money Laundering Compliance. They must be prevented from financing money laundering and or terrorism. AML legislation is becoming increasingly strict for financial service providers. Faster payments are a response to the need to modernise current payment settlement networks as a result of market technology and demographic trends.

Source: plianced.com

The code identifies the factors associated with high-risk money laundering by identifying common features in such areas. Through KYC banks will comply with the norms issued by the RBI. The customer is screened against global watchlists sanctions and PEPs lists. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes.

Source: tookitaki.ai

Source: tookitaki.ai

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Anti-money laundering risk assessment is required to determine the risk exposure and the secretary singles out factors such as certain areas having unusually high rates of suspicious illegal and money laundering activities. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Applicability of Anti Money Laundering Compliance. Through KYC banks will comply with the norms issued by the RBI.

Source: slidetodoc.com

Source: slidetodoc.com

We also require that firms. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. Anti-money laundering AML compliance. Money laundering and terrorist financing are global issues. It is the companys anti-money laundering compliance officers responsibility to make sure anti-money laundering compliance of a company and the implementation of the stages of the money laundering program.

Source: trulioo.com

Source: trulioo.com

We also require that firms. They must be prevented from financing money laundering and or terrorism. Anti Money Laundering and KYC compliance are carried out to prevent money laundering activities. The code identifies the factors associated with high-risk money laundering by identifying common features in such areas. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services.

Source: tookitaki.ai

Source: tookitaki.ai

Anti-money laundering refers to a set of rules and regulations that have been implemented to validate transactions and identification. Anti-money laundering AML compliance. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. AML laws require that financial instutions report any financial crime they detect to relevant regulators. Anti-Money Laundering Compliance Program The Anti-Money Laundering AML Compliance Program is everything that companies at risk of financial crime do in combating financial crime and compliance processes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering compliance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information