20+ Anti money laundering definition information

Home » about money loundering idea » 20+ Anti money laundering definition informationYour Anti money laundering definition images are available. Anti money laundering definition are a topic that is being searched for and liked by netizens today. You can Get the Anti money laundering definition files here. Find and Download all royalty-free vectors.

If you’re looking for anti money laundering definition images information connected with to the anti money laundering definition interest, you have visit the right blog. Our site frequently gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

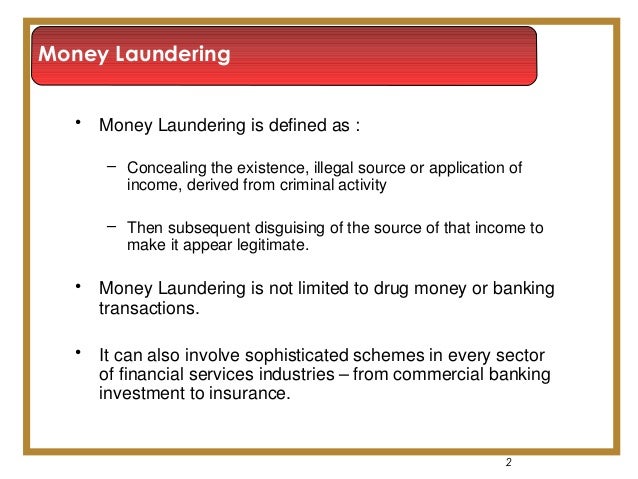

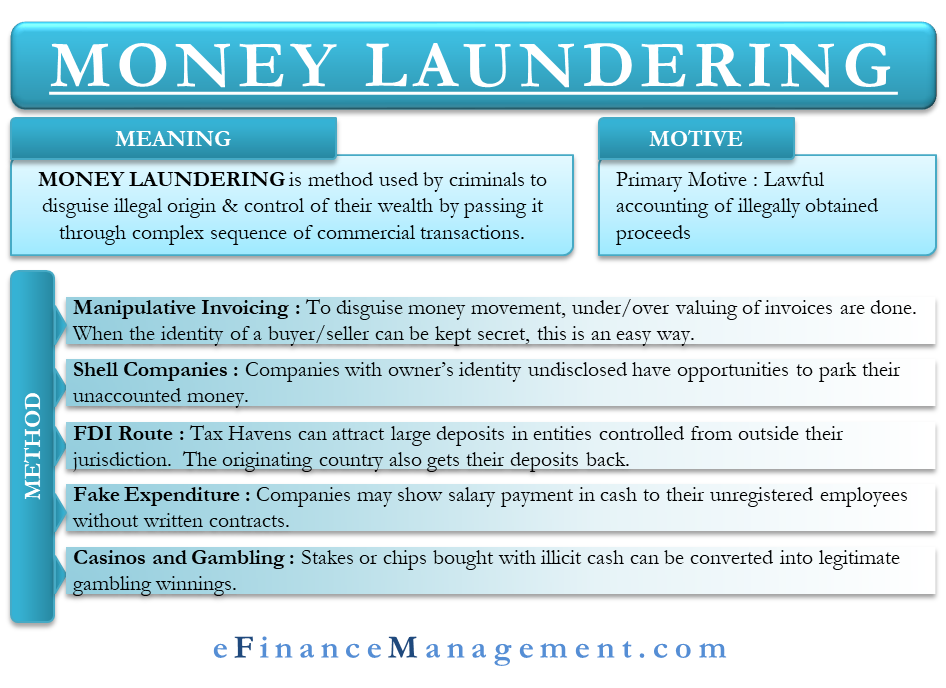

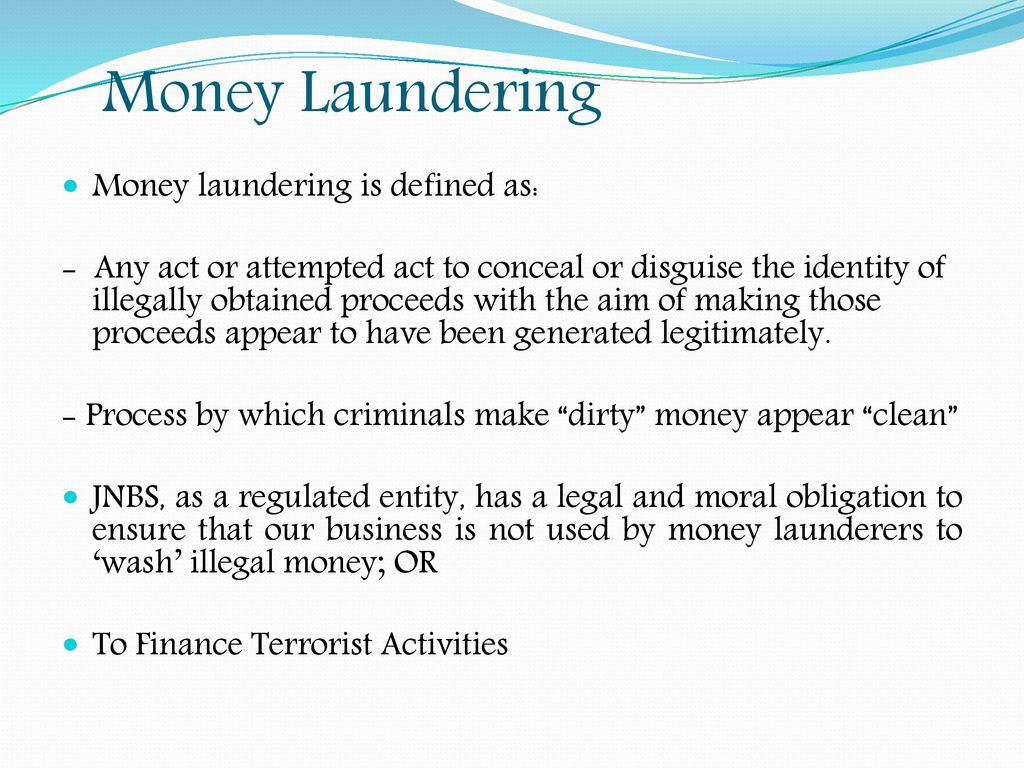

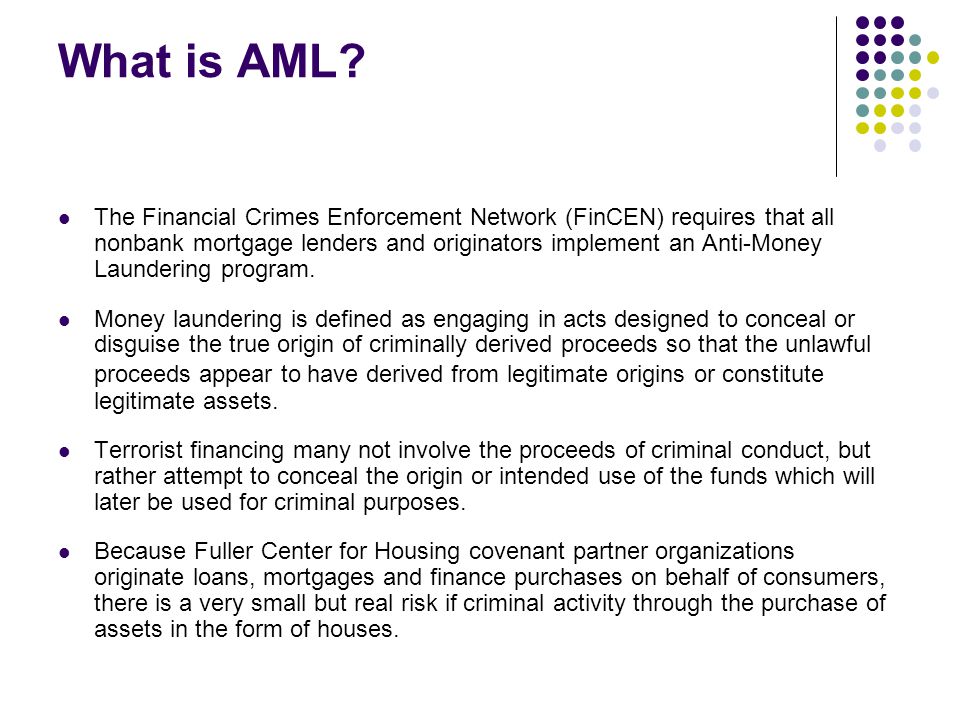

Anti Money Laundering Definition. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Anti-Money Laundering Law means applicable laws or regulations in any jurisdiction in which any Loan Party or any Subsidiary is located or doing business that relates to money laundering any predicate crime to money laundering or any financial record. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. Anti-money laundering AML refers to the set of laws regulations and procedures intended to prevent criminals from obtaining hiding or moving illicit funds.

Money Laundering Definition Business Meaning Pronunciation Translations And Examples From moneylaundry.vercel.app

Money Laundering Definition Business Meaning Pronunciation Translations And Examples From moneylaundry.vercel.app

AML is a worldwide term to prevent money laundering. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Anti-money laundering measures often force launderers to move to parts of the economy with weak or ineffective measures to deal with the problem. While AML covers a range of criminal activity it is particularly aimed at specific types of financial misuse including public corruption tax evasion illegal goods trading and market manipulation. Directly or indirectly attempted to. Anti-Money Laundering Laws means any and all laws statutes regulations or obligatory government orders decrees ordinances or rules applicable to a Credit Party its Subsidiaries or Affiliates related to terrorism financing or money laundering including any applicable provision of the Patriot Act and The Currency and Foreign Transactions Reporting Act also known as the Bank Secrecy Act 31 USC.

Global and local regulators are established around the world to prevent financial.

Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. It is implemented within government systems and large financial institutions to monitor potentially fraudulent activity. Anti-money laundering AML refers to the set of laws regulations and procedures intended to prevent criminals from obtaining hiding or moving illicit funds. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme.

Source: intosaijournal.org

Source: intosaijournal.org

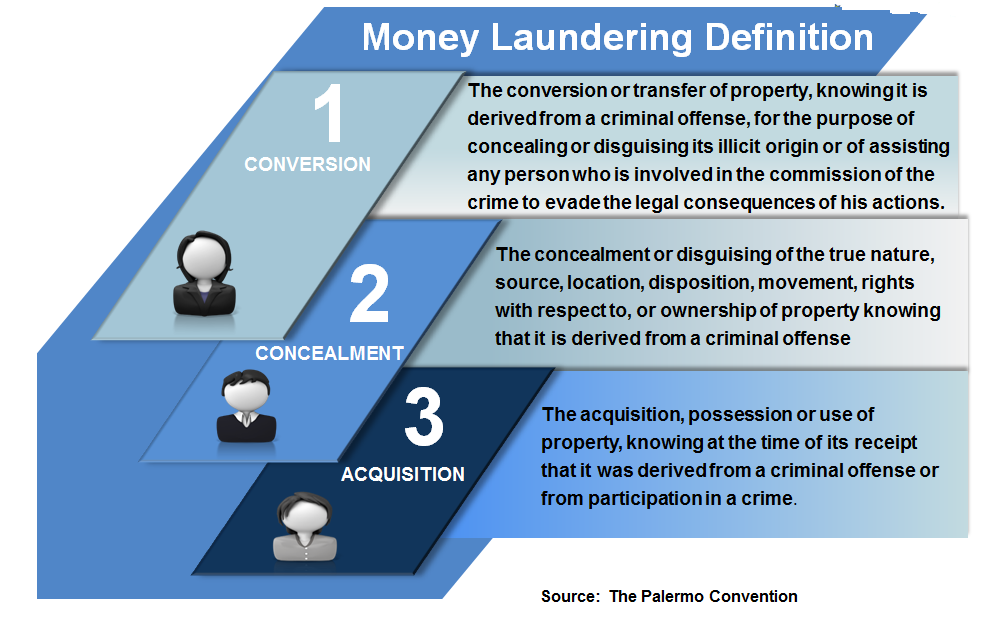

Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. While AML covers a range of criminal activity it is particularly aimed at specific types of financial misuse including public corruption tax evasion illegal goods trading and market manipulation. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Money laundering has been defined in the Prevention of Money Laundering Act of 2002 PMLA under section 3 where a person shall be guilty of the offence if such person is found to have.

Source: researchgate.net

Source: researchgate.net

What is Anti-Money Laundering. Offence of Money Laundering. Anti-Money Laundering Laws means any and all laws statutes regulations or obligatory government orders decrees ordinances or rules applicable to a Credit Party its Subsidiaries or Affiliates related to terrorism financing or money laundering including any applicable provision of the Patriot Act and The Currency and Foreign Transactions Reporting Act also known as the Bank Secrecy Act 31 USC. Anti-Money Laundering What is Anti-Money Laundering. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

It is a process by which soiled m. Although you as a company stick to the rules this does not mean that your partners and business associates adhere to the same AML compliance laws as you. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. Money laundering has been defined in the Prevention of Money Laundering Act of 2002 PMLA under section 3 where a person shall be guilty of the offence if such person is found to have.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Again a national system must be flexible enough to be able to extend countermeasures to new areas of its own economy. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. Global and local regulators are established around the world to prevent financial. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities.

Source: slideshare.net

Source: slideshare.net

Anti-money laundering aims to deter such criminal activities and detects the true source of the funds. Again a national system must be flexible enough to be able to extend countermeasures to new areas of its own economy. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Directly or indirectly attempted to.

Source: efinancemanagement.com

Source: efinancemanagement.com

Offence of Money Laundering. Directly or indirectly attempted to. What is Anti-Money Laundering. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. It is a process by which soiled m.

Source: eimf.eu

Source: eimf.eu

AML is generally employed by the compliance legal and financial sectors to introduce or develop control systems that an organisation should implement with an aim to identify and then stop the activities which can result in money laundering. Anti-Money Laundering AML includes policies laws and regulations to prevent financial crimes. Anti-Money Laundering What is Anti-Money Laundering. Again a national system must be flexible enough to be able to extend countermeasures to new areas of its own economy. Anti-money laundering measures often force launderers to move to parts of the economy with weak or ineffective measures to deal with the problem.

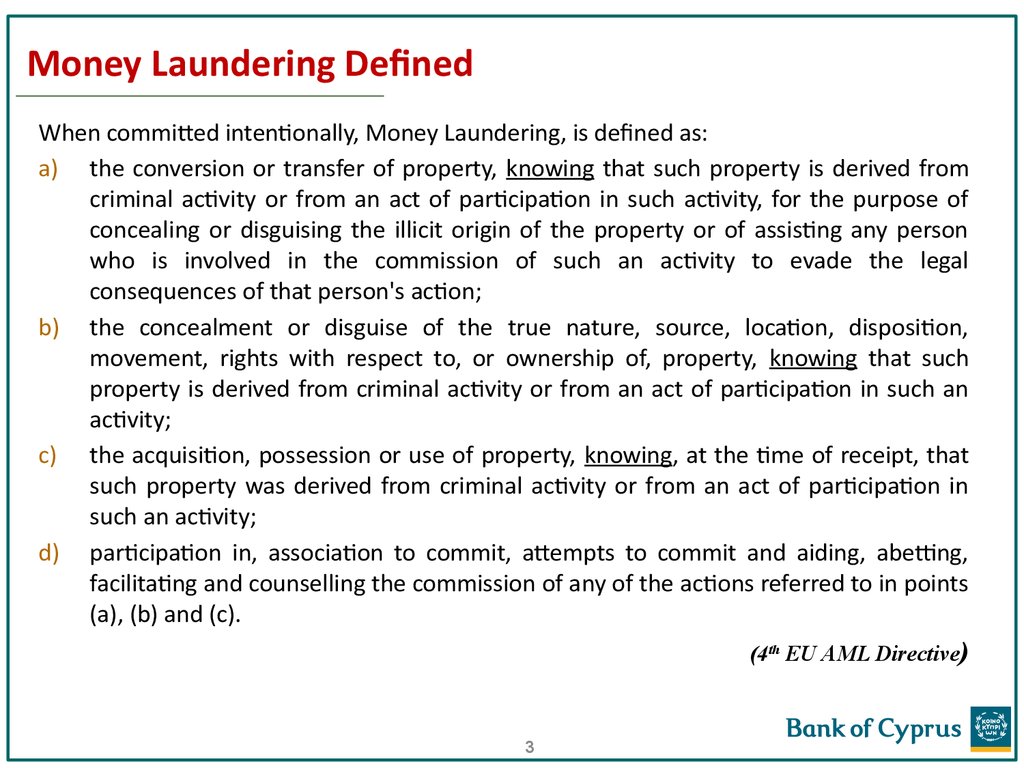

Source: slideplayer.com

Source: slideplayer.com

Offence of Money Laundering. Directly or indirectly attempted to. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities.

Source: en.ppt-online.org

Source: en.ppt-online.org

Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Anti-Money Laundering What is Anti-Money Laundering. Anti-money laundering measures often force launderers to move to parts of the economy with weak or ineffective measures to deal with the problem. Anti-money laundering AML refers to all policies and pieces of legislation that force financial institutions to monitor their clients to prevent money laundering. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme.

Source: quora.com

Source: quora.com

Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. What is Anti-Money Laundering. Anti-Money Laundering and Countering Financing of Terrorism Definitions Regulations 2011 SR 2011222 as at 09 July 2021 Contents New Zealand Legislation. AML is generally employed by the compliance legal and financial sectors to introduce or develop control systems that an organisation should implement with an aim to identify and then stop the activities which can result in money laundering. Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income.

Source: slideplayer.com

Source: slideplayer.com

Offence of Money Laundering. Offence of Money Laundering. Anti-money laundering aims to deter such criminal activities and detects the true source of the funds. AML is generally employed by the compliance legal and financial sectors to introduce or develop control systems that an organisation should implement with an aim to identify and then stop the activities which can result in money laundering. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme.

Source: bi.go.id

Source: bi.go.id

AML is a worldwide term to prevent money laundering. AML is generally employed by the compliance legal and financial sectors to introduce or develop control systems that an organisation should implement with an aim to identify and then stop the activities which can result in money laundering. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Again a national system must be flexible enough to be able to extend countermeasures to new areas of its own economy. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme.

Source: allbankingalerts.com

Source: allbankingalerts.com

Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Global and local regulators are established around the world to prevent financial. Directly or indirectly attempted to. Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Offence of Money Laundering.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information