17+ Anti money laundering fines and penalties info

Home » about money loundering idea » 17+ Anti money laundering fines and penalties infoYour Anti money laundering fines and penalties images are available. Anti money laundering fines and penalties are a topic that is being searched for and liked by netizens now. You can Download the Anti money laundering fines and penalties files here. Get all free photos and vectors.

If you’re searching for anti money laundering fines and penalties images information linked to the anti money laundering fines and penalties topic, you have visit the right site. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Anti Money Laundering Fines And Penalties. 17 What is the statute of limitations for money laundering crimes. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. Fines for anti-money laundering AML rule breaches hit.

Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. However Westpacs fine per breach 5652 is relatively modest compared to CBA around 13000 and Tabcorp around 417000. There is generally no time limit for prosecutions of money laundering offences under the Criminal Code see Crimes Act 1914 section 15B. The parties will jointly approach the Federal. Following the US and the UK since 2002 European authorities issue the most anti-money laundering fines. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

For a legal entity the maximum penalty is an unlimited fine.

Penalty administration charge HMRC introduced a penalty administration charge for all anti-money laundering supervision penalties issued from 25 July 2018. Penalty administration charge HMRC introduced a penalty administration charge for all anti-money laundering supervision penalties issued from 25 July 2018. BNP Paribas China Unit Receives Fines for Negligence in Anti-Money Laundering May 2020 The Chinese branch of BNP Paribas the European banking giant was fined 27 million yuan or 378200 for failing to correctly verify customer identity and also not report suspicious transactions to the Chinese central bank. In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance. First the maximum penalties for breaches of the core money laundering offences under the PCCA and the Regulations which form the backbone of the AML regime have increased very broadly speaking by a factor of ten.

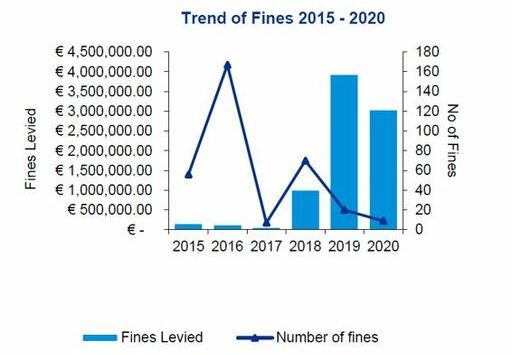

Source: pideeco.be

Source: pideeco.be

17 What is the statute of limitations for money laundering crimes. Penalty administration charge HMRC introduced a penalty administration charge for all anti-money laundering supervision penalties issued from 25 July 2018. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. Anti-money laundering AML regulations Anti-Money Laundering AML Fines audits and penalties continued to rise in 2020. There is generally no time limit for prosecutions of money laundering offences under the Criminal Code see Crimes Act 1914 section 15B.

Fines for anti-money laundering failures rise as companies repeat mistakes One of the highest-profile enforcement actions involved the London branch of Commerzbank which was fined 38m by the UKs. AUSTRAC and CBA agree 700m penalty. An agreement has been reached today between AUSTRAC and the Commonwealth Bank of Australia CBA for a 700 million penalty to resolve Federal Court proceedings relating to serious breaches of anti-money laundering and counter-terrorism financing AMLCTF laws. However Westpacs fine per breach 5652 is relatively modest compared to CBA around 13000 and Tabcorp around 417000. 2014 still holds the record for the highest total value of AML fines at 1089bn but this includes an anomalously large penalty of 89bn.

Source: shuftipro.com

Source: shuftipro.com

There is generally no time limit for prosecutions of money laundering offences under the Criminal Code see Crimes Act 1914 section 15B. There is generally no time limit for prosecutions of money laundering offences under the Criminal Code see Crimes Act 1914 section 15B. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. Following the US and the UK since 2002 European authorities issue the most anti-money laundering fines. BNP Paribas China Unit Receives Fines for Negligence in Anti-Money Laundering May 2020 The Chinese branch of BNP Paribas the European banking giant was fined 27 million yuan or 378200 for failing to correctly verify customer identity and also not report suspicious transactions to the Chinese central bank.

Source: idmerit.com

Source: idmerit.com

The charge is for costs of issuing. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

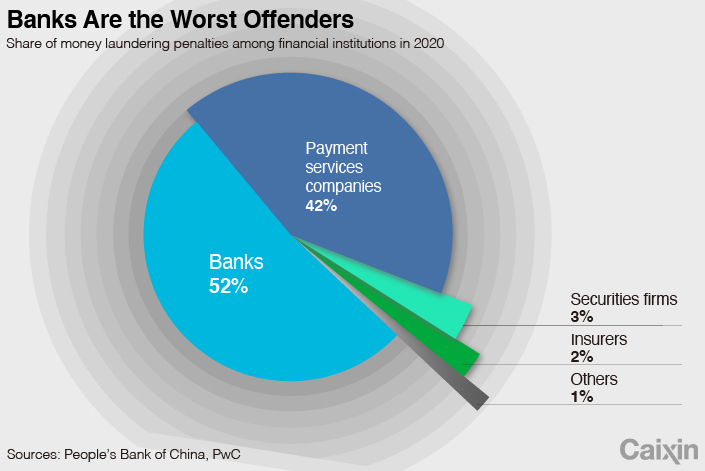

Source: caixinglobal.com

Source: caixinglobal.com

- Agencies can impose civil and criminal penalties for violations of the BSA. - Agencies can impose civil and criminal penalties for violations of the BSA. State banking agencies can impose similar penalties. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine.

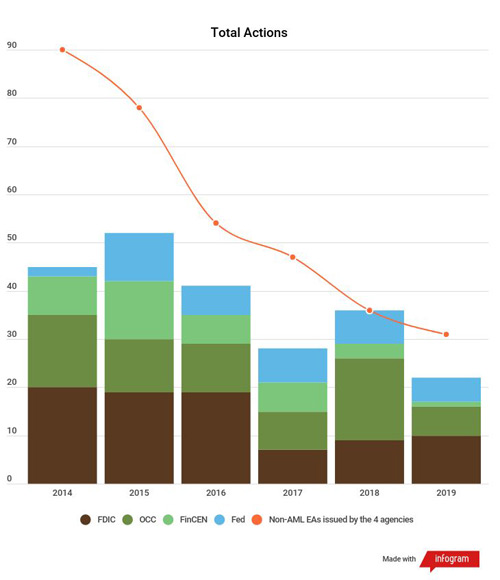

Source: mondaq.com

Source: mondaq.com

Anti-money laundering AML regulations Anti-Money Laundering AML Fines audits and penalties continued to rise in 2020. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. First the maximum penalties for breaches of the core money laundering offences under the PCCA and the Regulations which form the backbone of the AML regime have increased very broadly speaking by a factor of ten. Financial institutions have been hit with 104 billion in global fines and penalties related to Anti-money laundering AML know your customer KYC data privacy and MiFID Markets in Financial Instruments Directive regulations in 2020 notes ComplianceWeek. The parties will jointly approach the Federal.

Source: paymentscardsandmobile.com

Source: paymentscardsandmobile.com

In terms of the punishment for money laundering a conviction typically results in a 20-year prison sentence and a variable fine structure. Fines for anti-money laundering failures rise as companies repeat mistakes One of the highest-profile enforcement actions involved the London branch of Commerzbank which was fined 38m by the UKs. The parties will jointly approach the Federal. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. First the maximum penalties for breaches of the core money laundering offences under the PCCA and the Regulations which form the backbone of the AML regime have increased very broadly speaking by a factor of ten.

Source: thelaundromat.kwm.com

Source: thelaundromat.kwm.com

For bodies corporate the maximum penalty for the same offence is a fine of A2220000 see Crimes Act 1914 section 4B. State banking agencies can impose similar penalties. Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. BNP Paribas China Unit Receives Fines for Negligence in Anti-Money Laundering May 2020 The Chinese branch of BNP Paribas the European banking giant was fined 27 million yuan or 378200 for failing to correctly verify customer identity and also not report suspicious transactions to the Chinese central bank. Following the US and the UK since 2002 European authorities issue the most anti-money laundering fines.

Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance. There is generally no time limit for prosecutions of money laundering offences under the Criminal Code see Crimes Act 1914 section 15B. Following the US and the UK since 2002 European authorities issue the most anti-money laundering fines. - Agencies can impose civil and criminal penalties for violations of the BSA. - The BSA requires financial institutions to have an anti -money laundering compliance program and comply with a number of reporting and recordkeeping requirements.

Source: moneylaundering.com

Source: moneylaundering.com

Gambling company Tabcorp was fined 45 million in March 2017 for its own breaches of anti-money laundering requirements by failing to alert AUSTRAC to suspicious behaviour 108 times over a five-year period. - Agencies can impose civil and criminal penalties for violations of the BSA. AUSTRAC and CBA agree 700m penalty. The parties will jointly approach the Federal. 17 What is the statute of limitations for money laundering crimes.

Source: ctmfile.com

Source: ctmfile.com

- Agencies can impose civil and criminal penalties for violations of the BSA. Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. The charge is for costs of issuing. For a legal entity the maximum penalty is an unlimited fine. - Agencies can impose civil and criminal penalties for violations of the BSA.

Source: paymentscardsandmobile.com

Source: paymentscardsandmobile.com

However Westpacs fine per breach 5652 is relatively modest compared to CBA around 13000 and Tabcorp around 417000. 2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. The parties will jointly approach the Federal. First the maximum penalties for breaches of the core money laundering offences under the PCCA and the Regulations which form the backbone of the AML regime have increased very broadly speaking by a factor of ten. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

Source: newsinterpretation.com

Source: newsinterpretation.com

2019 saw 644 billion in AML fines issued across Europe in the period between January and April with 1043 billion in fines issued since 2002. Federal Money Laundering Penalties. Financial institutions have been hit with 104 billion in global fines and penalties related to Anti-money laundering AML know your customer KYC data privacy and MiFID Markets in Financial Instruments Directive regulations in 2020 notes ComplianceWeek. Major AML enforcement actions by US authorities in 2020 included a 150 million fine of Deutsche Bank for a lack of oversight in the Jeffrey Epstein scandal a 900 million fine for Israels Bank Hapoalim for tax evasion and money laundering a 60 million fine for Bitcoin mixer Helix for money laundering and a 38 million fine for Interactive Brokers LLC for significant BSAAML compliance. Fines for anti-money laundering failures rise as companies repeat mistakes One of the highest-profile enforcement actions involved the London branch of Commerzbank which was fined 38m by the UKs.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title anti money laundering fines and penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information