17++ Anti money laundering firm risk assessment checklist information

Home » about money loundering idea » 17++ Anti money laundering firm risk assessment checklist informationYour Anti money laundering firm risk assessment checklist images are ready. Anti money laundering firm risk assessment checklist are a topic that is being searched for and liked by netizens now. You can Find and Download the Anti money laundering firm risk assessment checklist files here. Get all royalty-free photos and vectors.

If you’re looking for anti money laundering firm risk assessment checklist images information related to the anti money laundering firm risk assessment checklist keyword, you have visit the ideal blog. Our site always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Anti Money Laundering Firm Risk Assessment Checklist. Of the 400 firms we contacted. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Identify the money laundering risks faced by the different areas of your business and the clients and markets you serve.

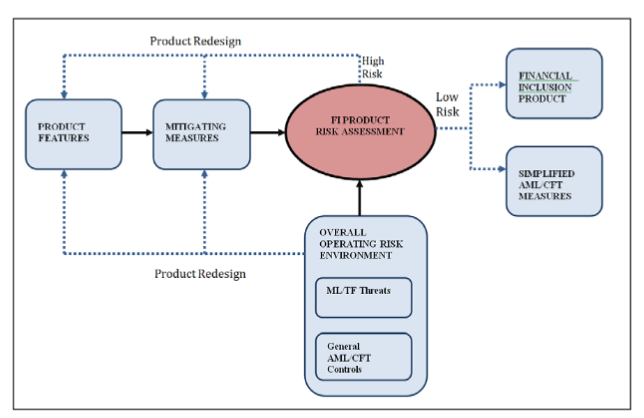

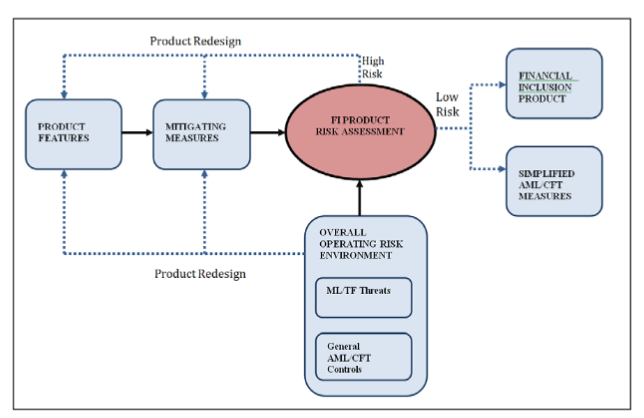

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation From service.betterregulation.com

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation From service.betterregulation.com

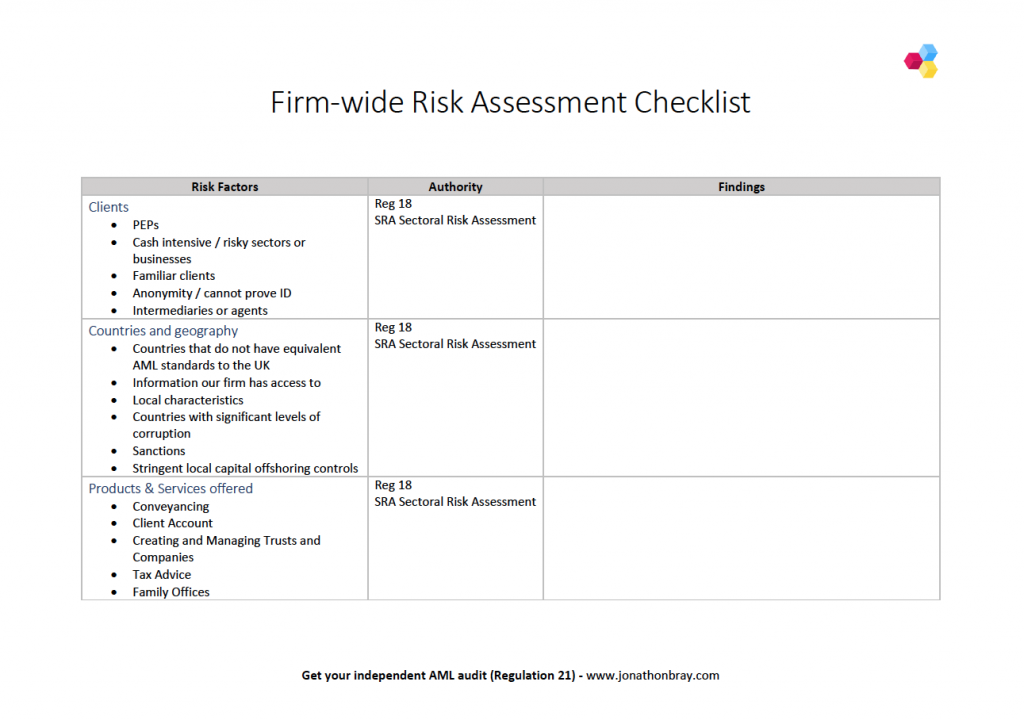

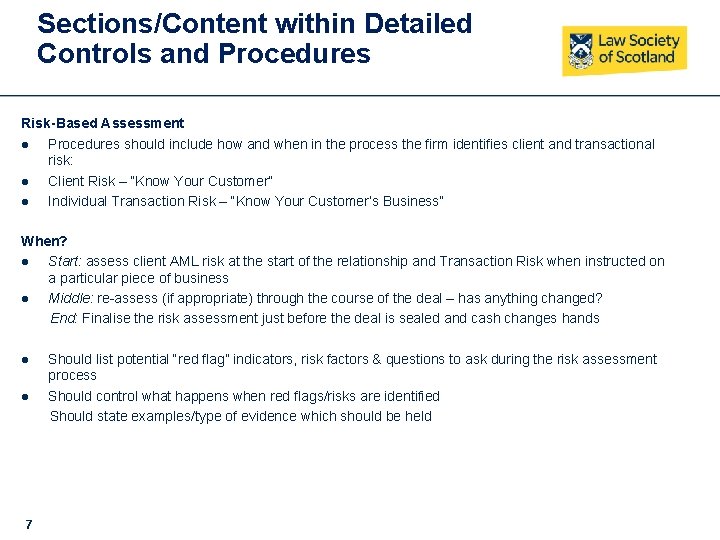

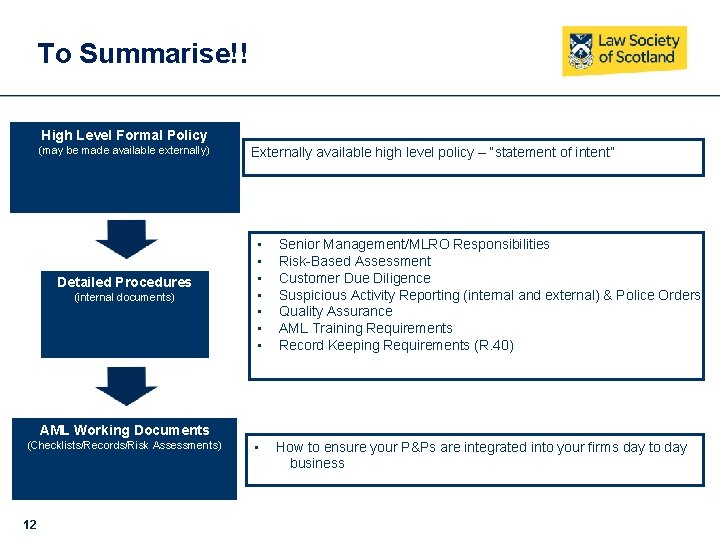

CHECKLIST FOR COMPLIANCE WITH MONEY LAUNDERING REGULATIONS 2017 MLR17 Contents 1. You must also have a thorough policy in place which details your firms AML policies and procedures. Money Laundering Risk Assessment Form The concept of money laundering is very important to be understood for these working within the monetary sector. Client Due Diligence CDD 8. An assessment of risk. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment.

Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets.

This policy must include but isnt limited to the following. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. 0 No sums of money could be laundered in the circumstances. We found high levels of non-compliance with the money laundering regulations with 21 not compliant. Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist. An assessment of risk.

Source: dfsaen.thomsonreuters.com

Source: dfsaen.thomsonreuters.com

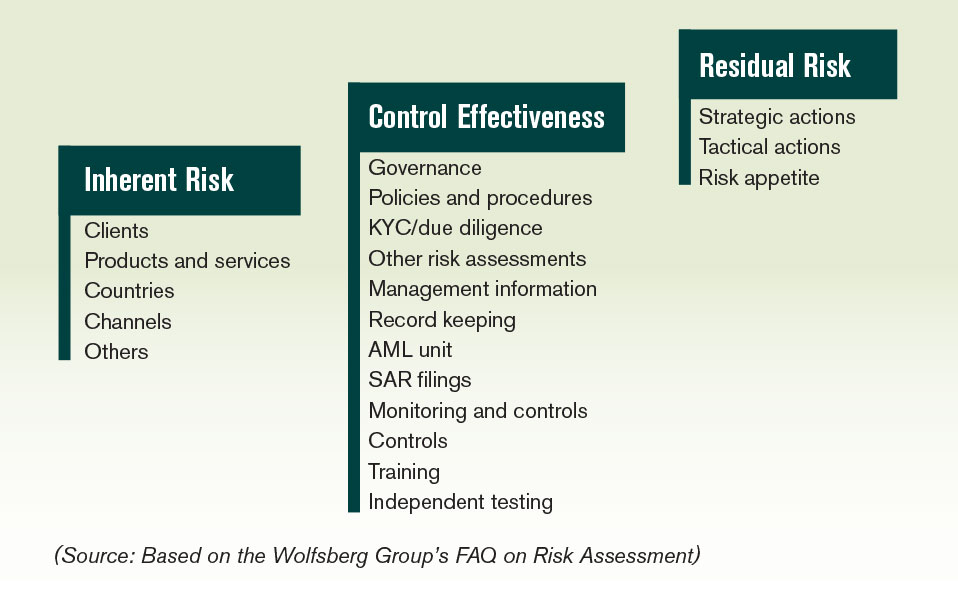

Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. We found high levels of non-compliance with the money laundering regulations with 21 not compliant. The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. Carrying out AML and KYC checks is only part of your money laundering obligations. Importantly you must properly identify and assess the risk of money laundering or terrorist financing and you must document your assessment.

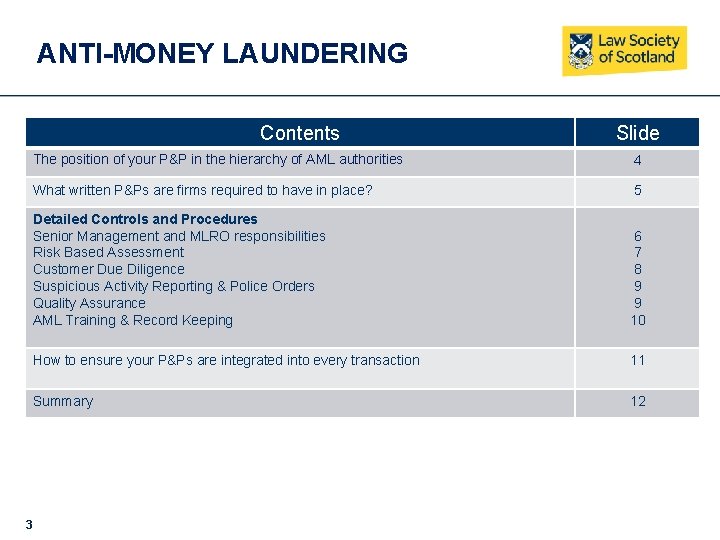

Source: slidetodoc.com

Source: slidetodoc.com

Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. In this column detail the risks your firm may have Mitigating actions. The draft LSAG AML Guidance for. Assessment of risk Every accountancy firm will have risks.

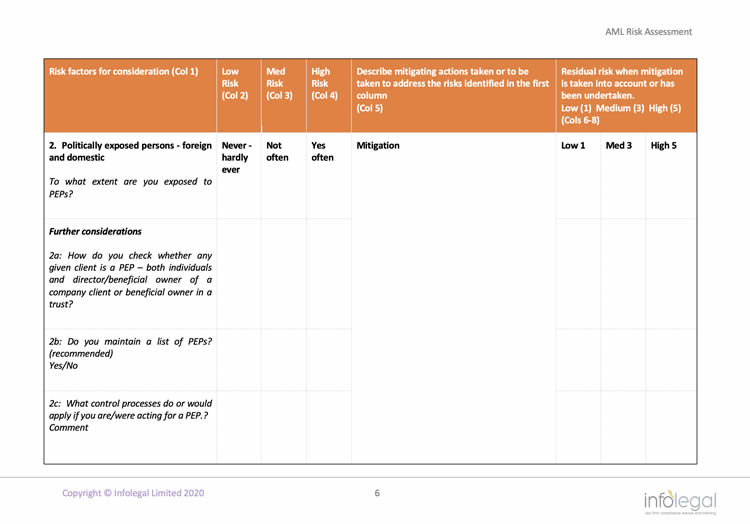

Source: infolegal.co.uk

Source: infolegal.co.uk

Anti-money laundering firm-wide risk assessment Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Below we have created a template with some hints and tips to aid our firms in completing an AML Firm-wide risk assessment. This policy must include but isnt limited to the following. Cover 100 of flood risk in Asia Pacific with RMS models and maps. You must also have a thorough policy in place which details your firms AML policies and procedures.

Source: service.betterregulation.com

Source: service.betterregulation.com

New anti-money laundering risk assessment form available to firms. Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML plan for a small firm. Anti-Money Laundering AML Terrorist Financing TF Compliance Checklist. Carrying out AML and KYC checks is only part of your money laundering obligations.

Source: lexology.com

Source: lexology.com

Ad Most comprehensive Flood Portfolio across Asia Pacific insurance markets. An assessment of risk. New anti-money laundering risk assessment form available to firms. Anti-Money Laundering AML also refers to regulations and procedures implemented to prevent criminals from making illegal funds acquired. Identify the money laundering risks faced by the different areas of your business and the clients and markets you serve.

Source: acamstoday.org

Source: acamstoday.org

An assessment of risk. Assessment of risk Every accountancy firm will have risks. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Money laundering is the process and activities aimed at showing the values of the assets they obtained from the crime in a different way to hide the crimes of the people or bring a legal image to the crime income. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low.

Source: slidetodoc.com

Source: slidetodoc.com

CHECKLIST FOR COMPLIANCE WITH MONEY LAUNDERING REGULATIONS 2017 MLR17 Contents 1. There are three key steps to performing and effective risk assessment as follows. You are best placed to. Reporting Procedures Tipping-Off 7. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low.

Source: advisoryhq.com

Source: advisoryhq.com

The sources of the money in actual are legal and the money is invested in a approach that makes it appear like clear cash and. Again this is scored from 0 5. The firm wide risk assessment should be reviewed and updated on an annual basis. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. We found high levels of non-compliance with the money laundering regulations with 21 not compliant.

Source: pdfprof.com

Source: pdfprof.com

We found high levels of non-compliance with the money laundering regulations with 21 not compliant. Cover 100 of flood risk in Asia Pacific with RMS models and maps. Anti-money laundering firm-wide risk assessment Under the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Nominated Officer of the firm. New anti-money laundering risk assessment form available to firms.

Source: slidetodoc.com

Source: slidetodoc.com

The firm wide risk assessment should be reviewed and updated on an annual basis. The draft LSAG AML Guidance for the legal sector 2021 describes this high level risk assessment as the cornerstone of anti-money laundering compliance. 1 Very limited sums of money could be laundered and the reputational damage to the firm would be low. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms.

Source: service.betterregulation.com

Source: service.betterregulation.com

Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. Not only does it demonstrate that you have been through the required analysis but it informs all of your firm. Reporting Procedures Tipping-Off 7. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms. Again this is scored from 0 5.

Source: jonathonbray.com

Source: jonathonbray.com

In this column detail the risks your firm may have Mitigating actions. FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. Regulation 18 of the Money Laundering Regulations 2017 requires all law firms subject to the Regulations to have in place an AML firm-wide risk assessment. The concept of cash laundering is essential to be understood for those working in the financial sector. The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML plan for a small firm.

Source: slideplayer.com

Source: slideplayer.com

Carrying out AML and KYC checks is only part of your money laundering obligations. An assessment of risk. Of the 400 firms we contacted. You must also have a thorough policy in place which details your firms AML policies and procedures. As part of our ongoing work to refresh the anti-money laundering AML resources we make available to the profession we have recently added an example AML Risk Assessment Form which can be downloaded and used by member firms.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti money laundering firm risk assessment checklist by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 13++ Bank negara malaysia ditubuhkan pada info

- 13+ Different meaning of money laundering ideas

- 20++ Anti money laundering training games ideas in 2021

- 20++ Federal money laundering statute information

- 10+ Def of money laundering ideas

- 10++ Banking secrecy in singapore info

- 20+ Financial crime risk layering information

- 15+ Bank secrecy act high risk businesses information

- 13+ Fca authorisation application forms info

- 13++ Certified anti money laundering specialist certification information